U.S. Treasury Bonds and Gold Soars Whilst Stocks Correct Following Quantitive Easing

Stock-Markets / Financial Markets 2009 Mar 21, 2009 - 01:42 AM GMT

It's a circus in Washington. - Denouncing a "squandering of the people's money," lawmakers voted decisively Thursday to impose a 90 percent tax on millions of dollars in employee bonuses paid by troubled insurance giant AIG and other bailed-out companies. In some cases the bonuses might be taxed 100 percent leaving the recipients with nothing.

It's a circus in Washington. - Denouncing a "squandering of the people's money," lawmakers voted decisively Thursday to impose a 90 percent tax on millions of dollars in employee bonuses paid by troubled insurance giant AIG and other bailed-out companies. In some cases the bonuses might be taxed 100 percent leaving the recipients with nothing.

It was only this past weekend that the bailed-out insurance giant paid bonuses totaling $165 million to employees, including traders in the Financial Products unit that nearly brought about AIG's collapse. AIG has received $182.5 billion in federal bailout money and is now 80 percent government owned.

Topic No. 1 raised by Republicans during the House debate was the last-minute altering of a provision in President Barack Obama's $787 billion stimulus law to cap executive compensation for firms receiving government bailouts. The measure might have forestalled payment of the AIG bonuses.

But Senate Banking Committee Chairman Chris Dodd, a Connecticut Democrat and the author of the provision, says the administration insisted that he modify his proposal so that it would only apply to payments agreed to in the future. That, critics claim, cleared the way for the AIG pay-outs.

"The idea came from the administration," Dodd said Thursday. Hmmm.

The Senate plans to vote on the bill next week. Here is just one commentary on this week's events.

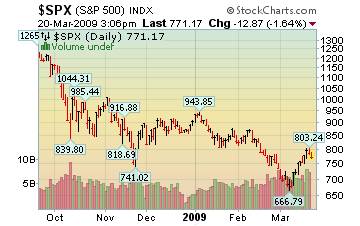

Stocks trading cautiously after gains.

-- U.S. stocks fell, trimming gains in the market's first back-to-back weekly advance of the year, as analysts cut earnings estimates for General Electric Co. and Congress moved toward raising taxes on bank employees' bonuses. The S&P 500 rebounded as much as 17 percent from a 12-year low on March 9 as banking shares surged. The S&P 500 Financials Index gained as much as 50 percent, lifted by speculation the worst of the financial crisis is over after Citigroup Inc., Bank of America Corp. and JPMorgan Chase & Co. said they were profitable in January and February.

-- U.S. stocks fell, trimming gains in the market's first back-to-back weekly advance of the year, as analysts cut earnings estimates for General Electric Co. and Congress moved toward raising taxes on bank employees' bonuses. The S&P 500 rebounded as much as 17 percent from a 12-year low on March 9 as banking shares surged. The S&P 500 Financials Index gained as much as 50 percent, lifted by speculation the worst of the financial crisis is over after Citigroup Inc., Bank of America Corp. and JPMorgan Chase & Co. said they were profitable in January and February.

Treasuries seeing a “buyback” revival.

-- Treasury prices rose on Friday and were set for big gains in a a week that saw yields plunge after the Federal Reserve on Wednesday announced extraordinary steps to lower borrowing costs, including massive purchases of government bonds.

-- Treasury prices rose on Friday and were set for big gains in a a week that saw yields plunge after the Federal Reserve on Wednesday announced extraordinary steps to lower borrowing costs, including massive purchases of government bonds.

The Fed said Wednesday it would buy $300 billion in Treasuries from the market to help support the economy and spur lending. Following the Fed's announcement Wednesday, 10-year yields plunged about half of a percentage point, the biggest drop since the 1987 stock market crash.

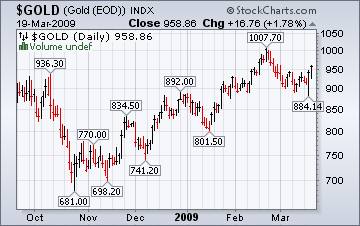

Gold rallied on the Fed announcement, too.

( MarketWatch ) -- Gold futures fell Friday to trade around $950 an ounce, after rallying nearly 8% in the previous session, as a rebounding U.S. dollar reduced the metal's investment appeal.

( MarketWatch ) -- Gold futures fell Friday to trade around $950 an ounce, after rallying nearly 8% in the previous session, as a rebounding U.S. dollar reduced the metal's investment appeal.

But the metal is set to end the week up about 2% after the Federal Reserve's decision to buy long-term Treasurys pushed up gold prices sharply Thursday. The Fed's plans also had led to a slump in the U.S. dollar. The greenback rebounded slightly Friday, adding downward pressure to gold prices.

Japanese in a bear market rally?

( Bloomberg ) -- The Bank of Japan said today the nation's economy is worsening “significantly.” The central bank this week decided to increase purchases of government bonds from banks and offer subordinated loans to lenders in an effort to revive an economy headed for its worst contraction in the postwar period. Traders are caught between optimism that the Federal Reserve will be able to revive the credit markets and fear that the U.S. Dollar might collapse.

( Bloomberg ) -- The Bank of Japan said today the nation's economy is worsening “significantly.” The central bank this week decided to increase purchases of government bonds from banks and offer subordinated loans to lenders in an effort to revive an economy headed for its worst contraction in the postwar period. Traders are caught between optimism that the Federal Reserve will be able to revive the credit markets and fear that the U.S. Dollar might collapse.

Chinese investors holding their gains.

-- The Shanghai Composite has advanced 7.2 percent this week, the biggest since the five days to Feb. 6, on speculation demand for metals will pick up and the central bank will cut interest rates for a sixth time since September. The index has risen 25 percent this year, the best performer among 89 benchmark measures worldwide tracked by Bloomberg. Stocks have rallied on optimism record new lending and the government's 4 trillion ($585 billion) stimulus plan will reverse a slump in the world's third-largest economy, where fourth-quarter growth slowed to the weakest pace in seven years.

-- The Shanghai Composite has advanced 7.2 percent this week, the biggest since the five days to Feb. 6, on speculation demand for metals will pick up and the central bank will cut interest rates for a sixth time since September. The index has risen 25 percent this year, the best performer among 89 benchmark measures worldwide tracked by Bloomberg. Stocks have rallied on optimism record new lending and the government's 4 trillion ($585 billion) stimulus plan will reverse a slump in the world's third-largest economy, where fourth-quarter growth slowed to the weakest pace in seven years.

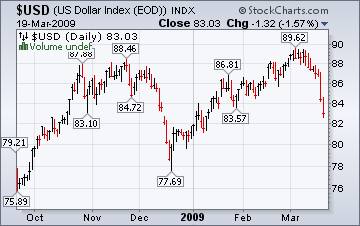

Is the dollar at risk?.

-- The dollar fell to the lowest since Jan. 8 against the euro, and was headed for a record weekly drop after the Federal Reserve said it may buy $300 billion of government debt and more mortgage bonds, increasing the supply of dollars.

-- The dollar fell to the lowest since Jan. 8 against the euro, and was headed for a record weekly drop after the Federal Reserve said it may buy $300 billion of government debt and more mortgage bonds, increasing the supply of dollars.

This brings us to the ultimate cause of inflation. It is not the increase in prices. Instead, it is the increase in the money supply that makes holding currency-denominated assets worth less and tangible items worth more.

Owners skulking away from "underwater" U.S. homes .

Ron Barnard is throwing in the towel. Like a growing number of the 8.3 million American homeowners who owe more on mortgages than their homes are worth, he's ready to just walk away .

Ron Barnard is throwing in the towel. Like a growing number of the 8.3 million American homeowners who owe more on mortgages than their homes are worth, he's ready to just walk away .

Barnard and others like him are starting to worry market experts and economists, who fret that the growing trend may deal a blow to an economy on its knees while swelling an already ample pool of bad loans.

A turn ahead in gasoline prices.

U.S. crude oil stocks rose more than expected last week and gasoline posted a surprise build as refiners seasonally boosted motor fuel production, Energy Information Administration weekly data showed on Wednesday. In reaction to the bearish builds, NYMEX crude oil futures fell $2, or 4 percent, to $47.16 a barrel and gasoline futures fell 5 percent.

U.S. crude oil stocks rose more than expected last week and gasoline posted a surprise build as refiners seasonally boosted motor fuel production, Energy Information Administration weekly data showed on Wednesday. In reaction to the bearish builds, NYMEX crude oil futures fell $2, or 4 percent, to $47.16 a barrel and gasoline futures fell 5 percent.

"It's the build in gasoline that was most dramatically bearish since the market was looking for a decline," said Tim Evans, oil analyst at Citi Futures in New York.

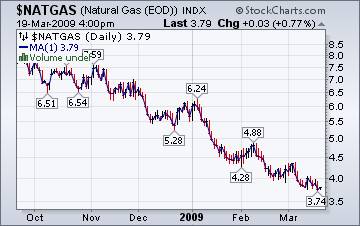

A lack of drawdown is keeping gas supplies high.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Price changes in the spot market this week reflected seasonal natural gas consumption, as temperatures warmed in most of the country. Decreased space-heating demand in consuming regions reduced the need for storage withdrawals during week, adding to a perception of adequate supplies in the marketplace.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Price changes in the spot market this week reflected seasonal natural gas consumption, as temperatures warmed in most of the country. Decreased space-heating demand in consuming regions reduced the need for storage withdrawals during week, adding to a perception of adequate supplies in the marketplace.

Most significantly, the economic downturn has resulted in a decline in consumption, particularly in the industrial sector, with many companies announcing layoffs and closures of manufacturing plants around the country.”

Trillions now, worry later.

The Federal Reserve made it clearer than ever Wednesday that it's willing to go for short-term gain at the risk of future pain.

Chairman Ben S. Bernanke and his peers at the central bank stunned financial markets by announcing two huge steps aimed at driving down long-term interest rates, including mortgage rates: The Fed said it would buy up to $300 billion of longer-term Treasury securities for its own portfolio and that it would expand its purchases of mortgage-backed bonds to $1.25 trillion from the previously announced $500 billion.

The announcements drove the yield on the benchmark 10-year Treasury note down by nearly a half-percentage-point, to 2.53%. That put it back to where it was in late January. The stock market was thrilled. The Standard & Poor's 500 index rallied 2.1% to 794.35. It's now up 17.4% from its 12-year closing low reached March 9.

So, what's the risk? As the Fed effectively pumps another $1 trillion-plus into the financial system, critics say it's setting a time bomb for a future surge in inflation -- the classic case of too much money chasing a limited supply of goods and services.

Our Investment Advisor Registration is on the Web .

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.