SMEs set to benefit – business bank current account sector springs to life

Personal_Finance / SME May 09, 2007 - 11:09 AM GMTBy: MoneyFacts

Lee Tillcock, Editor of Business Moneyfacts comments:“According to recent research by Standard Life Bank, British SMEs are missing out on just over a billion pounds a year by keeping their money in low-paying business current accounts, with 60 per cent unhappy with the level of interest they are paid.

Lee Tillcock, Editor of Business Moneyfacts comments:“According to recent research by Standard Life Bank, British SMEs are missing out on just over a billion pounds a year by keeping their money in low-paying business current accounts, with 60 per cent unhappy with the level of interest they are paid.

“However the last few months have seen increased activity in the sector, with three of the so-called ‘challenger banks,’ Abbey, Alliance & Leicester Commercial Bank and Bank of Scotland, all recently announcing new offers.”

Alliance & Leicester New Account

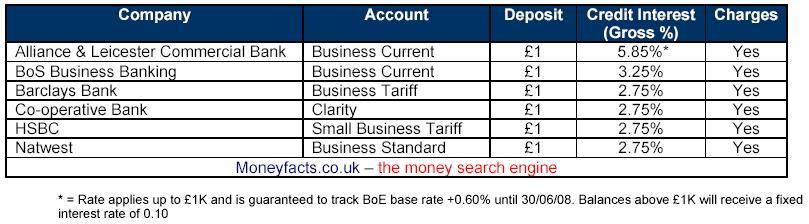

Alliance & Leicester Commercial Bank’s (A&LCB) new Free Business Current Account is available to all businesses with an annual turnover of less than £1million. It offers 6.00% AER credit interest rate for balances up to £1,000, with a guarantee that customers will receive 0.60% above the Bank of England base rate until 30 June 2008. Balances above £1,000 will receive a fixed interest rate of 0.10% gross. The Free Business Current Account requires customers to credit their account with £1,000 per month or a £5 fee is charged for that month only.

Abbeys entices switchers

For those switching to Abbey, a six per cent interest rate awaits. The applicable tiered in-credit rate will be paid monthly on the whole balance, with the remainder of 6% gross p.a./AER (fixed) paid on balances up to £1,000 paid after 12 months. Customers must switch to an Abbey business bank account using their account transfer service and make transactions on their account each month.

Bank of Scotland sets a challenge

Bank of Scotland Business Banking is offering a slightly different proposition. For customers currently banking with Barclays, HSBC, Lloyds TSB or NatWest, with a turnover of £50K or more and who are on a published tariff, it guarantees to beat the existing overall package. If it can’t demonstrate that it will save you money over the next 12 months, it will give switchers £500. The offer is not available to those in Scotland.

Lee continues: “Reports by Cruickshank and the Competition Commission have seen levels of public concern increase regarding the lack of competition in the supply of business banking services. With the latest report from The Federation of Small Businesses (FSB) showing a declining market share of the big four, down from 83% in 2000 to 70%, is a positive sign that businesses are prepared to switch and that competitive deals are available outside the big four.

“But worryingly, the switching process seems flawed. Of those businesses that tried to switch providers, 45% said the experience was difficult and a further 20% failed to complete the switch. The successful running of an SME’s current account can be the lifeblood of a business: if errors occur creditors and wages may not be paid or debtors’ monies not received. The transfer process must be seamless to earn the trust of your new customer.

“It still remains the case that any small business looking for a new bank needs to weigh the price on offer against the level of service, but if the last few weeks are the beginning of a trend, then SMEs surely stand to benefit in the long term.”

By Lee Tillcock,

http://www.Moneyfacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.