Stocks Bear Market Rally at Cross Roads

Stock-Markets / Stocks Bear Market Mar 19, 2009 - 03:56 PM GMTBy: Chris_Ciovacco

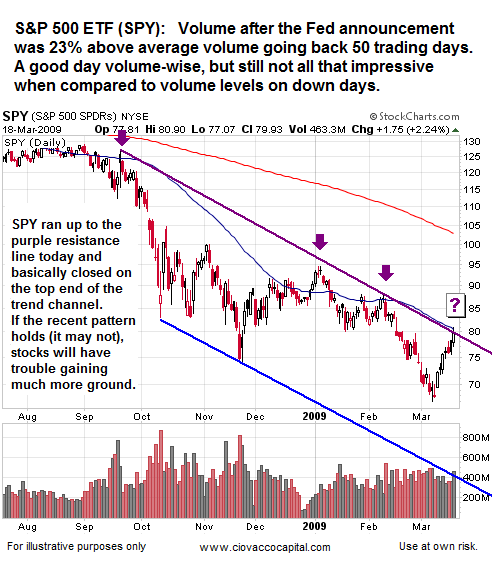

Even after the current "powerful rally", the S&P 500 is still down over 12% YTD , something to keep in mind if you feel we are missing something. All we have missed year-to-date is a 12% loss. Bear markets always give people a reason to stick around. Yesterday , we commented, ...rather than signaling the end of the bear market, the more probable outcome for the current rally in the S&P 500 is for it to fail somewhere between current levels and 806. This rally may have further to run, but Wednesday's high on the S&P 500 was 803.

Even after the current "powerful rally", the S&P 500 is still down over 12% YTD , something to keep in mind if you feel we are missing something. All we have missed year-to-date is a 12% loss. Bear markets always give people a reason to stick around. Yesterday , we commented, ...rather than signaling the end of the bear market, the more probable outcome for the current rally in the S&P 500 is for it to fail somewhere between current levels and 806. This rally may have further to run, but Wednesday's high on the S&P 500 was 803.

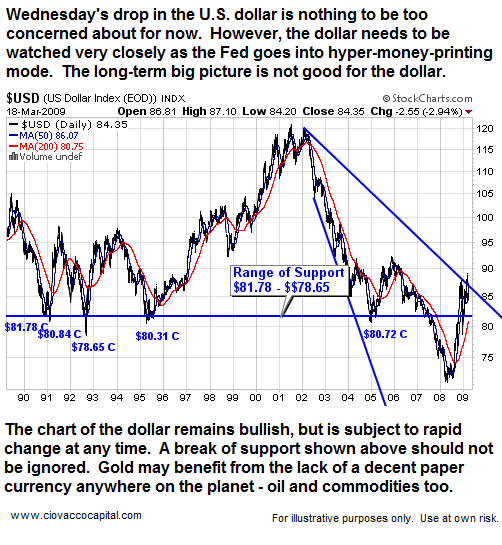

Fed Throws Gasoline on the Inflation/Deflation Fire: In our view, the most important fundamental factor in investing today is managing the shift from principal protection (as asset prices fall) to purchasing power protection (as the Fed eventually will produce positive inflation). As the average American's 401(k) statement has shown in recent months, a principal protection strategy is more important than a purchasing power protection strategy. As cited by yesterday's WSJ article below, The Fed threw gasoline on the inflation/deflation debate with Wednesday's announcement. At some point in the future, purchasing power protection will be more important than principal protection – we are not there yet, but it we have to pay close attention.

From the Wall Street Journal (03/18/09) - notice the choice of words:

WASHINGTON -- The Federal Reserve ramped up its effort to revive the economy, declaring it would buy as much as $300 billion of long-term U.S. Treasury securities in the next few months and hundreds of billions of dollars more in mortgage-backed securities. The Fed had already cut its benchmark interest-rate target to near zero. Unable to go lower, the central bank now is essentially printing money to raise the supply of credit and thus push down the longer-term rates paid by families and companies on mortgages and other key loans.

Hyper-Money–Printing Mode: What Now? Americans should be concerned that we are now openly talk about our government printing money. When the Fed prints money and increases the number dollars in circulation, they are setting the table for an inflationary dinner, which will make every dollar in our pockets worth less. In the final analysis, the government is indirectly taxing all of us by eroding the purchasing power of the dollars we hold. We may not be hurt by the money printing right now, but it will be virtually impossible for the Fed to withdraw the liquidity from the system in a way to avoid inflation. Eventually investors are going to have to trade mattresses and coffee cans for gold, oil, and stocks.

The chart below is as of Wednesday's close ["today" refers to Wednesday].

Timing A Surprise: Months ago the Fed signaled they were considering the option of buying Treasuries. The market believed such a radical policy shift would only be used "if things get really, really bad.” Apparently, from the Fed's perspective, things must already be “really, really bad”. If the Fed felt the economy was in the process of bottoming, they would not be taking this radical step now.

College Days: Like in calculus, where tending to infinity is a common term, we can learn about the Fed's desired policy effects with an extreme example. If Chairman Bernanke and Secretary Geithner dropped $100 bills from helicopters for a few weeks, all Americans would have more money to spend. In this example, it is easy to see how a rapid increase in the money supply can drive up the prices of everything from milk to mortgage-backed securities. Despite the economic problems of the day, we have to be open to the possible "reflation" effect of a virtual helicopter drop. If the Fed's policies are effective, they may be able to reflate the value of stocks, homes, oil, etc.

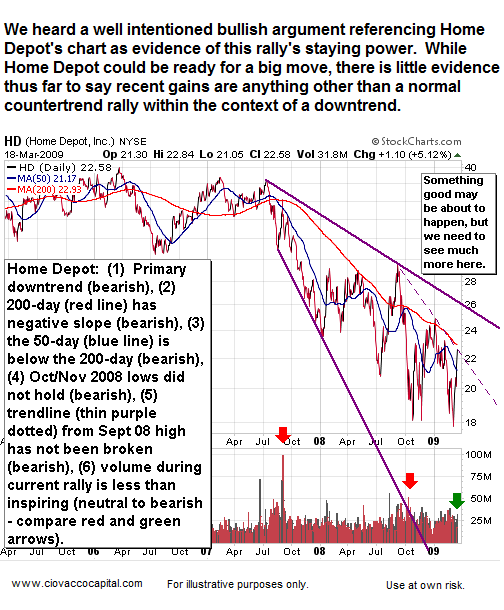

Especially after Wednesday's "crank up the printing presses" announcement, we have to be open to a surprising rise in assets prices. It may be starting now, or it may come much, much later. The helicopter story (i.e. the infusion of printed money) is a real fundamental factor which cannot be ignored. However, the charts (or technicals) need to confirm or align with the helicopter story before it is prudent to jump back with both feet into risk assets. The following ETFs can be used as a reflation gauge – we can expect to see them begin to make meaningful new highs (not bear market rallies) when the Fed's helicopters begin to have their desired effect:

- Gold (GLD)

- Gold Stocks (GDX)

- Treasury Inflation Protected Securities (an oxymoron? – TIP)

- Crude Oil (USO, USL)

- Physical Commodities (DBC)

- Emerging Market Stocks (EEM)

Pay Attention: Concerning the ETFs above, the markets will give us numerous clues when the real shift starts to take place from falling asset prices to rising asset prices. There is no need to guess, forecast, or predict.

Short covering big part of stock rally: When you sell short you must buy shares to cover or close out your short position. As the market rose off the recent November low, many shorts were covered, which increased buying demand for stocks. The vast majority of shorts have now been covered. Therefore, the stock market has lost some buying power.

Range traders – buy low – sell high: Range traders trade between market extremes of oversold and overbought . Range traders are not long-term investors. Range traders will be quick to take profits if the S&P 500 fails to clear 806. They will also be quick to sell if we reverse from current levels (locking gains from the "trade").

New shorts: Range-traders are happy to go short too. They sell high and buy back low. We are “high” now. New shorts are licking their chops looking for a sign of a reversal. New shorts will add to any selling pressure. The new shorts are waiting to see what happens below 806 on the S&P 500 before pulling the trigger. If we break 806 for a time, the new shorts will gladly go long instead.

Remaining shorts: There is a group of "long-term" shorts who have not covered yet because stocks clearly remain in a primary downtrend. If stocks can break 806, we may see one more round of short covering, which means it pays to be patient even if we trade above 806 for a few hours or few days.

Break of support says new lows still probable: It is dangerous to push aside the recent break of long-term support above 741 on the S&P 500. After a break of support, it is not unusual to move back above the lower end of support before reversing to make a new low. If the S&P 500 cannot hold above 806 for a few days, the odds continue to favor new lows for the stock market. Buyers of this rally should be very careful - some patience is prudent.

Markets tend to retest lows: Even if we have started a new bull market (not probable, but possible), we will not go up in a straight line (just as we have not gone down in a straight line). As we covered in a previous article , bear market bottoms tend to be retested, which means, at a minimum, a retest of the 667-741 range on the S&P 500 is likely. A retest may not come for weeks or even months, but we need to be aware the possibility exists. We failed on the retest of the November 2008 lows. It is doubtful this market will bottom before a successful retest.

Human beings can do anything: There are people behind all these charts. People are capable of doing anything at anytime, which means there is nothing sacred about a trendline or technical indicator. Technical analysis can help us with probable outcomes and trends. Trends can, do, and will change. Probable outcomes are not certain outcomes. We have numerous moving parts in the current market, many of them extremely rare (Fed printing massive amounts of money). The ongoing battle between economic weakness and the printing press is very difficult to wrap our arms around. Keeping an open mind and paying attention will serve us well. If a new bull market has started, countless signals will appear over the coming days and weeks.

About making money: There are ways to make money in bear markets and ways to make money in bull markets. Our objective is not to be right or to prove we are smarter than the market. Our purpose is to make a profit while at the same time protecting hard-earned principal. Ego, pride, and emotion rarely, if ever, play a role in making prudent investment decisions. The charts help us with probabilities in a manner similar to a good blackjack player. A good blackjack player plays and bets according to the odds. A good blackjack player does not expect to win every hand even when the odds are in their favor, nor should we expect the higher probability outcome to always occur in the financial markets. If we did, there would be no need for a stop-loss and money management discipline. In our estimation, cutting losses is the single biggest difference between consistent pros and the typical investor. As money managers, we respect that investing is not a form of gambling, but the analogies related to probabilities and protecting capital are sound. Probabilities are probabilities – nothing more nothing less. However, over the long haul, if we play the probabilities, cut losses when we are wrong, and let winners ride when we are right, we will find it difficult to go too far off the path to desirable long-term outcomes.

Using Our Hands: In closing, it may be best to sit on our hands in the morning during the next few days. How the market finishes is much more important than how we start each day. Many will be making what could be short-lived, kneejerk reactions to the Fed. We prefer to see what the market tells us late in the day and over the next few days. Buying or selling in a fast market can backfire. The economy remains weak, which can get lost with all the external noise.

The charts and commentary above are for illustrative purposes only and are not recommendations to buy or sell any security. Inverse ETFs or short positions are not suitable for many investors.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.