Stock Market Will Not Bottom Without the Banking Index

Stock-Markets / Stocks Bear Market Mar 17, 2009 - 07:31 PM GMTBy: Marty_Chenard

Some investors were excited last week with a nice market move on oversold conditions.

Some investors were excited last week with a nice market move on oversold conditions.

Is it real, or is it part of a market attempt to find a bottom?

Think about it ... who or what got us into this whole trouble? The answer is the Banks.

So, it makes imminent sense that the banks are going to have to show that they are out of trouble and trending up before the stock market can find its way to a new Bull Market. This is important, because over 13% of the S&P 500 is made up of Financial stocks.

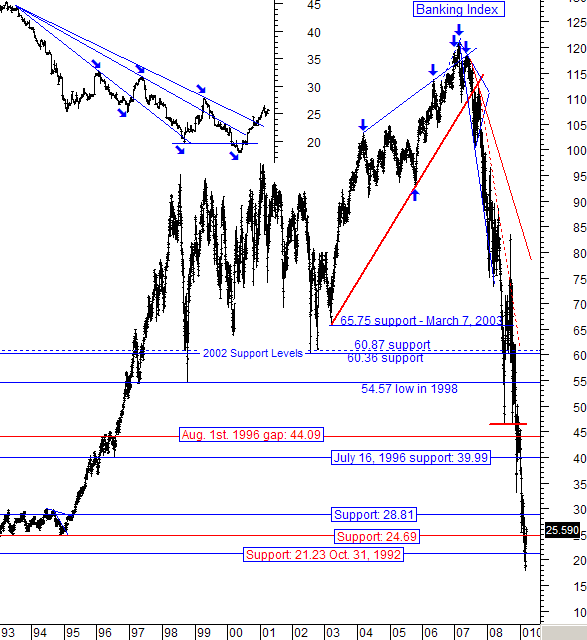

Therefore, let us look at Banking Index today (symbol: $BKX).

This daily chart goes back to 1993, 17 years ago.

On Friday, the Banking Index closed at 25.59 . That was a level just above the 1993 and 1994 support levels. As you can see on today's chart, the drop after the Banking Index's 2007 peak has been precipitous .

In fact, the down movement in the past two and a half years erased 14.5 years of up movement . The fall in the Banking Index depicts the seriousness of the the financial troubles this country is in.

So, what is the Banking Index telling us now?

The daily chart looks pretty depressing. But, take a look at the close-up insert in the upper left hand corner. That is a picture of the Index's movement since January of this year.

First, note the fan lines. We have had rising fan lines which is a sign that the Banking Index is trying to stabilize.

Sounds good? Not quite yet ... note the arrows I drew in the close-up. They still show lower/highs and lower/lows ... a classic definition of a down trend. Until that changes , the Banking Index will remain in a technical down trend.

So, what we are seeing is a mixture of two conditions ... one negative and one positive. This could be a basing attempt which would translate into the Banking Index trying to establish a hold-able bottom . While that would be good news, it hasn't happened yet . Such an event is a process , not an instantaneous happening.

So, be patient. The Banking Index is showing some progress ... it now has to show a trend reversal and that will take some work.

________________________________________________

*** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.