Brazilian Real The Strongest Currency in the World Today

Currencies / Brazil May 08, 2007 - 12:16 PM GMT

When I first went to Brazil, I was six years old.

A new Chevy cost $1,300.

Gasoline was going for 27 cents a gallon.

Harry Truman was still in the White House.

And my father wanted a second home in the tropics.

So he picked a beautiful spot in Brazil's interior state of Goiás — four days' drive from the bustling coastal cities of Rio de Janeiro and São Paulo; 30-odd hours on a Boeing 377 from Idlewild Airport (now JFK).

Dad, who worked for a Wall Street research and advisory firm, said Brazil was the land of the future and said he wanted to introduce the country to U.S. investors someday.

My mother's relatives said he was nuts.

So did most of his associates on Wall Street.

But not far from Wall Street, two of Broadway's most famous leading ladies — Janet Gaynor (in "A Star is Born) and Mary Martin ("A Sound of Music," "South Pacific," and "Peter Pan") — chose the same small town in Brazil that he chose. Mary Martin's son, Larry Hagman ("I Dream of Jeannie" and "Dallas"), also came.

And a few years later, a nearby plateau was chosen as the site of Brazil's new, ultra-modern capital — Brasília.

So one dry winter day in July, we drove out in our Willis jeep to take a look around. But all we saw were vast open fields and a hand-painted, misspelled sign " FUTURE CITE OF BRASÍLIA ."

People said a new city in the wilderness was crazy, too.

They Were Wrong

As it turned out, it wasn't crazy to go to Brazil … to introduce American investors to its amazing opportunities … or to build a modern metropolis on its central highlands.

It was just premature.

Indeed, for half a century, my family and I watched as Brazil struggled — through the most rampant inflation of any major nation in the postwar era … through two decades without democracy … and with some of the most corrupt leaders of its 500-year history.

But today, Brasília is a bustling metropolis with 2.3 million people. And suddenly, with growing momentum, nearly all of Brazil is finally shifting into high gear.

Just recently, Brazil's currency, the real, hit a six-year high against the dollar .

It's also gaining against the euro, the Swiss franc, the British pound, the Japanese yen, and eleven other most actively traded currencies tracked by Bloomberg.

In fact, this year, it's the strongest major currency in the world.

A pivotal driving force: Brazil's huge and fast-growing trade surplus.

Just last week, the surplus expanded to $4.2 billion from a revised $3.36 billion in March. And even if it shrinks a bit in the coming months, the long-term trend is firmly in place — more gushers of black ink and a still-stronger Brazilian real.

Look …

The Folks Who Used to Say We Were Crazy Are No Longer Around

But their descendants are quite vocal …

- William Landers, a fund manager with $4 billion in stocks at Blackrock Inc., says Brazil is now "one of the most attractive countries" in the world for investors, with 20 percent earnings growth ahead.

- Arthur P. Steinmetz, manager of the best-performing international bond fund in the United States, says Brazil is now entering its "golden age." His fund has $6.4 billion in assets. And among all the countries outside the United States, his biggest single stake is in Brazil, the only emerging market in his portfolio.

- Even America's leading credit rating agencies are expected to add their vote of confidence: Sometime in the not-too-distant future, don't be surprised if they upgrade Brazil's debt to investment grade. Reason: Before interest payments, Brazil will probably have a budget surplus amounting to 3.8% of GDP this year.

- Most important, countless investors are voting with their money. That's why …

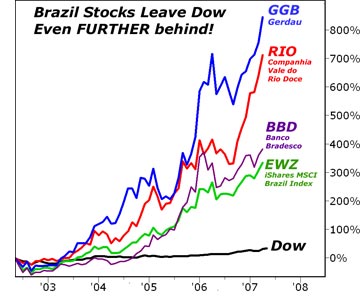

Brazil's Stocks Are Outperforming the U.S. Markets by a Mile

Brazil's leading stock index, Bovespa, has just catapulted above the 50,000 mark.

Brazil's largest resource stocks are going through the roof.

The Brazil ETF is making new all-time highs.

And nearly all of Brazil's stocks are leaving the Dow Jones Industrials further and further behind.

As an illustration, look at some of the Brazilian stocks we've been highlighting in our publications:

- Banco Bradesco, which trades on the New York Stock Exchange with the symbol BBD, is Brazil's largest private bank and has just made new all-time highs.

- Companhia Vale do Rio Doce (RIO) , the world's second-largest miner, is leading Brazil's natural resource boom. And …

- Gerdau S.A. (GGB), Latin America's largest steelmaker, has just issued a stellar first-quarter report, with earnings before interest, taxes, depreciation and amortization, surging over 17 percent.

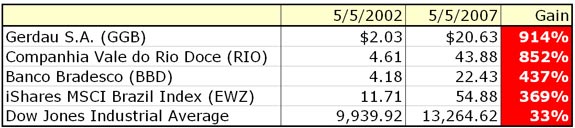

Here's a brief scorecard: Over the past five years, while the Dow is up 33% …

- Banco Bradesco is up 437%, or 13 times more than the Dow …

- Companhia Vale do Rio Doce is up 852%, or 25 times more, and …

- Gerdau is up 914%, or over 27 times more.

Think about it this way: Five years ago, you could have invested $10,000 in the average Dow stock at the close of trading on May 5, 2002. And this past Friday you could have sold it for a gain of $3,300, minus any commissions.

But suppose, instead of the average Dow stock, you invested those same $10,000 in Brazil's Gerdau. This past Friday, instead of $3,300, you'd have over $91,000.

Naturally, with 20-20 hindsight, it's easy to pick out the best-performing stocks. But even if you did no stock picking whatsoever, and even if you invested strictly in EWZ — an exchange-traded fund that holds all three of these stocks plus several others — you'd still have a gain of 369%, or 11 times the Dow's.

And there's more to come …

Ethanol Boom to Help Propel Brazil's Economy

When you mention the word ethanol to most North Americans, the first thing that comes to mind is corn-based ethanol, replete with inefficiencies, supported by subsidies, and now prompting a fierce worldwide debate.

Last month, for example, no sooner had President Bush and Brazil's president Luiz Inácio Lula da Silva signed a deal to expand ethanol production in the Americas than …

- Venezuela's Hugo Chávez launched a series of venemous attacks against both …

- Fidel Castro said it was a "sinister idea of turning foodstuffs into fuel" …

- Many U.S. farmers felt President Bush had betrayed them …

- And at least one U.S. newsletter editor was telling his subscribers that "ethanol is a hoax."

What these critics don't seem to understand, however, is that none of this has anything to do with ethanol made from sugar cane. Instead, the problems they're referring to are strictly related to the ethanol made from corn.

That's why, this Wednesday, at the United Nations headquarters in New York, the representative of the International Federation of Agricultural Producers (IFAP) will set the record straight. She will give a speech before the UN's Commission for Sustainable Development. And she will prove to them that sugar-cane based ethanol is a revolution that's barely begun.

How do I know?

Because she's my wife's sister, and I just helped her finish translating her PowerPoint presentation from Portuguese to English.

Here are the highlights …

First, right now, Brazil has a whopping 260 million acres of land available for cultivation. Plus, it has another 86 million acres that have been used for pastures, are now mostly fallow, and could mostly be converted to sugar cane cultivation. So the capacity to produce more ethanol is almost limitless.

Second, in almost any other situation, environmentalists would seek to block the expansion of cash crops like sugar cane to help protect the rainforests.

But in Brazil, the Amazon is not even a part of the equation. The largest sugar cane producing region is in southern Brazil, thousands of miles from the Amazon basin. And the second largest is in the northeast, also far from the Amazon.

This leaves the door open for massive expansion of ethanol production and an equally massive infusion of international capital into Brazil's ethanol industry.

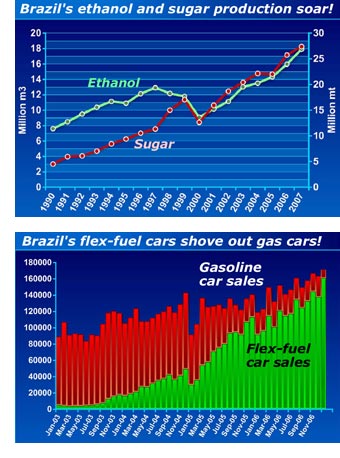

Already, Brazil is the world's number one producer and exporter of sugar and the world's largest exporter of ethanol.

Already, last year, Brazilian ethanol makers produced 4.5 billion gallons of ethanol and exported 900 million gallons.

And already, in the current sugarcane season, Brazil expects to produce a record 5.34 billion gallons of ethanol, up 13.5 percent from last year's harvest.

Third, cars with flex-fuel engines — that run on ethanol, gasoline, or any mix of the two — are rolling off Brazil's assembly lines en masse.

Just four years ago, the overwhelming majority of autos sold in Brazil still ran strictly on gasoline. Now, flex-fuel cars have virtually eliminated gas-only engines from the new-vehicle marketplace.

So as you can see, the ethanol revolution in Brazil is not just a sideshow in a world dominated by fossil fuels. Quite to the contrary, the ethanol industry is quickly becoming the dominant player in Brazil's energy marketplace.

Results:

- A sharp reduction in Brazil's crude oil imports … a substantial increase in energy exports … and an even larger trade surplus.

- A marked reduction in greenhouse gas emissions.

- Far less reliance on oil-producing nations and much reduced vulnerability to geopolitical risks.

- More jobs: Already, with just 6.5% of Brazil's arable land, Brazil's sugar cane farmers provide one million jobs.

So now do you see a key reason Brazil's stock market is soaring? Now do you understand why I've been pounding the tables and shouting from the rooftops about this energy revolution?

Stand by. Because the real fun — and bigger profit potential — is still ahead.

Good luck and God bless!

By Martin Weiss

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.