Global Stock Markets Rallies, Buoyed by Stimulus Packages

Stock-Markets / Financial Markets 2009 Mar 13, 2009 - 03:08 PM GMT

Consumer confidence is still in the pits. - Confidence among U.S. consumers in March held near a 28-year low, reflecting mounting job losses and a deepening recession. The Reuters/University of Michigan preliminary index of consumer sentiment climbed to 56.6 from 56.3 in February. The gauge reached a 28-year low of 55.3 in November.

Consumer confidence is still in the pits. - Confidence among U.S. consumers in March held near a 28-year low, reflecting mounting job losses and a deepening recession. The Reuters/University of Michigan preliminary index of consumer sentiment climbed to 56.6 from 56.3 in February. The gauge reached a 28-year low of 55.3 in November.

The highest rate of unemployment in 25 years and the biggest drop in wealth on record as home and stock values plunge have shaken Americans, raising the risk spending will again tumble after stabilizing the last couple of months. The figures indicate the Obama administration's plans to cut taxes, boost spending and stem foreclosures have yet to soothe household anxiety.

Confidence and employment go hand-in-hand,

Unemployment climbed in January in every U.S. state except Louisiana, and the decline there, to 5.1 percent from 5.5 percent in December, was due to rebuilding from Hurricane Katrina, the Labor Department said.

The jobless rate topped 10 percent in four states, led by Michigan, where at 11.6 percent it was the highest since May 1984, according to data compiled by Bloomberg.

South Carolina at 10.4 percent and California with 10.1 percent also saw their steepest rates in a quarter-century. Unemployment in Rhode Island was 10.3 percent, greater than since at least 1976 according to the data. Wyoming's was the lowest in January at 3.7 percent.

A G-20 meeting this weekend may mean buy the rumor, sell the news.

-- World stock markets rallied again Friday as confidence remained buoyed by positive U.S. economic data, hopes of further stimulus measures from Japan and China and upbeat comments from U.S. bank executives. However, investors are wary of calling the end to the bear market and remain on guard for any news that may knock the stuffing out of the buyers. A failure by the G-20 finance ministers and central bankers to provide a united front at this weekend's meeting in southern England could be one catalyst for a renewed bout of selling pressure.

-- World stock markets rallied again Friday as confidence remained buoyed by positive U.S. economic data, hopes of further stimulus measures from Japan and China and upbeat comments from U.S. bank executives. However, investors are wary of calling the end to the bear market and remain on guard for any news that may knock the stuffing out of the buyers. A failure by the G-20 finance ministers and central bankers to provide a united front at this weekend's meeting in southern England could be one catalyst for a renewed bout of selling pressure.

Treasuries also post a weekly gain.

-- China is the largest holder of Treasuries and has been increasingly vocal in recent times about how the U.S. is dealing with its economy and deficits.

-- China is the largest holder of Treasuries and has been increasingly vocal in recent times about how the U.S. is dealing with its economy and deficits.

China's Premier wants the U.S. to "maintain its credibility, honor its commitments and guarantee the security of Chinese assets," according to the Wall Street Journal. Bond traders fear that China's Treasury stockpile is so large that any divestiture could send rates sharply higher.

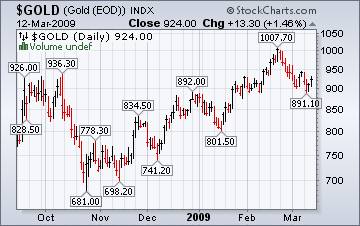

Gold is giving back hard-earned gains.

( Bloomberg ) -- Investors are seeking to protect their wealth by buying gold as economies slump and central banks spend trillions of dollars in response to the worst financial crisis since the Great Depression. More than $30 trillion has been erased from the value of global equities in a year. Some investors are betting that the stimulus spending will devalue currencies and spur inflation. SPDR Gold Trust , the biggest exchange-traded fund backed by bullion, expanded to a record, overtaking Switzerland's central bank holdings as the world's sixth-largest stockpile.

( Bloomberg ) -- Investors are seeking to protect their wealth by buying gold as economies slump and central banks spend trillions of dollars in response to the worst financial crisis since the Great Depression. More than $30 trillion has been erased from the value of global equities in a year. Some investors are betting that the stimulus spending will devalue currencies and spur inflation. SPDR Gold Trust , the biggest exchange-traded fund backed by bullion, expanded to a record, overtaking Switzerland's central bank holdings as the world's sixth-largest stockpile.

Japanese in a bear market rally?

( Bloomberg ) -- Japan's stocks rose, giving the Nikkei 225 Stock Average its biggest gain this year, on optimism the government will buy shares and as a better-than-expected U.S. retail sales report eased concern of a deepening global slowdown. Mitsubishi UFJ Financial Group Inc., Japan's No. 1 listed bank, gained 5.8 percent after the Nikkei newspaper said the government is considering purchasing equities to prop up share prices.

( Bloomberg ) -- Japan's stocks rose, giving the Nikkei 225 Stock Average its biggest gain this year, on optimism the government will buy shares and as a better-than-expected U.S. retail sales report eased concern of a deepening global slowdown. Mitsubishi UFJ Financial Group Inc., Japan's No. 1 listed bank, gained 5.8 percent after the Nikkei newspaper said the government is considering purchasing equities to prop up share prices.

Chinese investors are not confident.

-- China's benchmark stock index fell for a third day, extending the weekly decline, as the government failed to announce specific new stimulus measures after exports and retail sales plunged. “The economic data are still not good enough to convince investors to buy aggressively,” said Lu Yizhen , who oversees the equivalent of $732 million as chief investment officer at Tianhong Asset Management Co. in Beijing.

-- China's benchmark stock index fell for a third day, extending the weekly decline, as the government failed to announce specific new stimulus measures after exports and retail sales plunged. “The economic data are still not good enough to convince investors to buy aggressively,” said Lu Yizhen , who oversees the equivalent of $732 million as chief investment officer at Tianhong Asset Management Co. in Beijing.

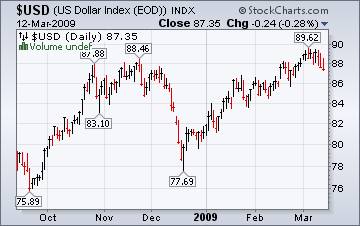

The dollar pullback is in play.

-- De-leveraging and "risk aversion" are the buzzwords cited by many currency analysts to explain the puzzling strength of the US Dollar since mid-2008, writes Gary Dorsch of Global Money Trends .

-- De-leveraging and "risk aversion" are the buzzwords cited by many currency analysts to explain the puzzling strength of the US Dollar since mid-2008, writes Gary Dorsch of Global Money Trends .

The greenback has climbed by more than 20% since last July, despite the widely held view that top Wall Street banks are insolvent and only surviving on artificial life support. With the flow of credit badly constrained, the US economy is spiraling towards a "Great Depression" – yet the Dollar has risen against all major currencies.

“Phantom Supply” of foreclosed homes make it impossible to call a bottom.

According to RealtyTrac, a firm that sells default data, foreclosure filings rose in February to nearly 300,000, up 6% from the month before. This figure is the third highest for any month since the housing market turned south in 2005. And while President Obama's hotly debated $275 billion housing-relief package is barely a month old, it is becoming clear that no cleverly worded press release or inspiring oratory can reverse the trend that's firmly in place: Housing supply remains elevated, with buyers sitting on the sidelines awaiting better deals. Prices, as a result, will keep falling for the foreseeable future.

According to RealtyTrac, a firm that sells default data, foreclosure filings rose in February to nearly 300,000, up 6% from the month before. This figure is the third highest for any month since the housing market turned south in 2005. And while President Obama's hotly debated $275 billion housing-relief package is barely a month old, it is becoming clear that no cleverly worded press release or inspiring oratory can reverse the trend that's firmly in place: Housing supply remains elevated, with buyers sitting on the sidelines awaiting better deals. Prices, as a result, will keep falling for the foreseeable future.

Lower prices may be ahead!

The Energy Information Administration tells us, “Our current forecast assumes that a recovery in global economic activity begins sometime in the second half of 2009. If this timing assumption proves to be correct, then world oil prices should begin to rise gradually later this year. The onset of a price increase is dependent upon this assumption, and a slower or later recovery would delay it.” A safe assumption. Look for lower prices soon.

The Energy Information Administration tells us, “Our current forecast assumes that a recovery in global economic activity begins sometime in the second half of 2009. If this timing assumption proves to be correct, then world oil prices should begin to rise gradually later this year. The onset of a price increase is dependent upon this assumption, and a slower or later recovery would delay it.” A safe assumption. Look for lower prices soon.

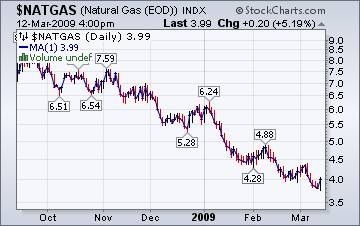

A lack of drawdown is keeping gas supplies high.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Natural gas spot prices continue to show considerable weakness, decreasing at most market locations in the Lower 48 States since Wednesday, March 4. Robust supplies and relatively weak demand continue to characterize natural gas markets. Moderating temperatures since Wednesday, March 4, eased heating demand, and a lower level of industrial demand for natural gas as a result of the ongoing economic downturn has been a key characteristic of the natural gas market during the 2008-2009 heating season.”

The Energy Information Agency's Natural Gas Weekly Update reports, “ Natural gas spot prices continue to show considerable weakness, decreasing at most market locations in the Lower 48 States since Wednesday, March 4. Robust supplies and relatively weak demand continue to characterize natural gas markets. Moderating temperatures since Wednesday, March 4, eased heating demand, and a lower level of industrial demand for natural gas as a result of the ongoing economic downturn has been a key characteristic of the natural gas market during the 2008-2009 heating season.”

Greenspan still denying responsibility.

After a long period of relative silence since the wheels fell off the global economy last fall and as his critics grew in number, Alan Greenspan is often cited in public opinion polls as "the one individual" most responsible for the current mess (this term, admittedly, now failing to adequately describe the extent of the problems the world now faces), his defense has become defiant, if not desperate, the most recent example being provided today: ( Click here for Greenspan's article.)

Not surprisingly, the "easy money" thesis is dismissed out of hand - there is nothing further about fostering a culture of debt or being overly accommodating to the slightest of financial market stumbles over a period of almost two decades, all of which surely contributed to the prevailing attitudes and conventional wisdom of just a few years ago.

Having dispensed with that, it is on to the now-familiar, "I was powerless to do anything about long-term rates" retort, as if long-term rates really played a key role in the housing bubble during its bubbliest years. Read Tim Iacono's The Mess That Greenspan Made for more commentary.

Our Investment Advisor Registration is on the Web .

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.