Toxic Cocktails and Series of Stock Market Crashes Outlook 2009

Stock-Markets / Stocks Bear Market Mar 10, 2009 - 01:30 PM GMTBy: Ty_Andros

I must apologize for the delay in getting this missive out, but I am just now emerging from the fetal crouch I have been in as I have watched the events of the last two weeks unfold. My plan was to cover the commodity markets this week, but instead I am going to go into a fundamental analysis because the marketplace tells me to do so.

I must apologize for the delay in getting this missive out, but I am just now emerging from the fetal crouch I have been in as I have watched the events of the last two weeks unfold. My plan was to cover the commodity markets this week, but instead I am going to go into a fundamental analysis because the marketplace tells me to do so.

A lot of wonderful work by many people (make sure you review the work on the links in this newsletter) has been published in the last three weeks and I am going to touch on a lot of it; when it is woven into a broad canvass it offers a lot of thoughts which we must consider as we maneuver through what I believe will ultimately become the end of the line for the public servants, crony capitalists and their handmaidens and partners in crime in the banking and financial systems.

I have bad news and good news. Whenever someone says that to me I ask for the bad news first: The world economy is firmly in the grips of a DEPRESSION, as defined by a peak to valley fall in world GDP of at least 10%. Do not look for a recovery for at least a year, and possibly up to 2-3 years of contractions interrupted by occasional blips higher (dead cat bounces). Everybody expects things to bounce back as the have since WWII, but this time IT'S DIFFERENT. HOPE is not a strategy and anyone who supports the President and his 535 partners in corruption is about to learn this.

A hyperinflationary outcome is INEVITABLE because the “something for nothing” public will DEMAND they do something about the collapsing incomes and economies -- and they will. As one government program after another fails, as THEY ALWAYS DO, they will just create more programs WHICH WILL AMPLIFY previous failures. As my friend Clyde Harrison says: “ there will be deflation in everything you own and inflation in everything you use ”, and I believe he is right.

My new number for losses in the G7 banking systems over the next 2-4 years is now 25 trillion Dollars on top of the 15 trillion Dollars already implemented. This DOES NOT include all the government social programs and deficit spending for KEYNESIAN stimulus, which will entail more deficit spending in the next 20 months than we saw in the last 8 years. Furthermore, we will see bigger budget deficits in the next 4 years than all budget deficits since the beginning of America, over 200 years ago COMBINED. Since, eventually, no one in their right mind would loan the G7 governments this money, of course they will “print the money”!!! Ob@ma says his second, Joe Bid@n, will make sure waste fraud and abuse never happen. How much time do you think he spends on this each day -- 10 minutes (his attention span), 1 hour? We can rest assured our trillions of Dollars is well spent with this guy at the wheel! I think not…

The Good news: EVERYTHING is mispriced for what is unfolding. Stocks, Bonds, currencies, natural resources, precious metals, real estate are ALL set for massive VOLATILITY and “volatility is opportunity” for the prepared investor. Markets are going to ZOOM up and down and provide you with EXCELLENT investment opportunities if you are properly prepared. Buy and hold is DEAD except for the precious metals. Absolute Return Alternative Investments are the way to approach this.

The flocks of BLACK swans just keep on emerging in market after market since the last newsletter: the Eastern European currency and credit crisis, 50-year lows in industrial production and exports in Japan, and the Pacific Rim for that matter. We have seen the worst February in history in many stock markets in the world.

The US government now owns or supports the biggest insurer in the world AIG ($150 billion bailout, headed to $450 billion, and a disguised bailout of BIG BANKS), it supports ZOMBIE auto makers GM and Chrysler ($25 billion bailout asking for another $25 billion WITHOUT any plans for profitability), the largest mortgage companies Fannie Mae and Freddie Mac ($100 billion so far and headed for $800 billion from prior bad lending, and this amount is set to skyrocket as these POLITICALLY directed bad practices are to be expanded into FUTURE bad lending to rescue the unrescueable and irresponsible homeowners who are now in trouble), Citigroup (now under $1 a share, soon to be joined by Wells Fargo, Bank of America and JPMorgan Chase and many others). Note: For the entire hullabaloo surrounding corporate jet use by insolvent companies, Speaker of the house Nancy P@losi is jetting back and forth from San Francisco on a private Jet, the cost of which exceeds $400,000 a MONTH on average. Of course the government is more fiscally and morally bankrupt, just as the rescued companies are!

All combined, these ZOMBIE companies ( and many more will join them in the future) will cost US taxpayers trillions of Dollars as NONE of them produce more than they consume (black holes of capital and business models which are FATALLY flawed) and have trillions of Dollars of losses yet to be realized and accounted for. Why is this being done by the US government? These are the epitome of crony capitalist, politically-supported oligarch industrial companies, and not to mention huge campaign contributors!!! Taxpayer be damned! Do you realize that a trillion Dollars is: it i a million million? An inconceivable sum to you and me… $11.6 trillion Dollars is the tally so far and the main bank recapitalizations are still left in the future.

In Europe the story is no better, in fact for the financial and banking systems it is WORSE than the US , and therefore the nascent EURO currency is now FATALLY flawed. In an excellent piece on the state of the Euro Zone banking system by Gary North entitled: “The Looming Collapse of European Banking” at http://www.lewrockwell.com/north/north689.html we learn about the true state of European banking, and it is as MUCH worse than expected with $25 Billion of BAD paper of one sort or another.-- Hi ho hi ho, it's off to the printing press they will go. The Euro zone banking system is also DEAD men walking, just as the US and UK.

I spoke of a potential for a crash several weeks ago and it has materialized, signaling the nightmare economy into which we are descending. My short-term target for the S&P 500 is now 550. Here is the weekly chart of the S&P 500 illustrating the current breakdown and short-term projections:

I spoke of a potential for a crash several weeks ago and it has materialized, signaling the nightmare economy into which we are descending. My short-term target for the S&P 500 is now 550. Here is the weekly chart of the S&P 500 illustrating the current breakdown and short-term projections:

This market is breaking down and out of a pattern built since the initial crash in September and October 2008; this is a HIGH energy break down after a consolidation which lasted 5 months. The most frightening thing about this technical pattern is EVERY major stock index in the world is a CLONE or MIRROR of this: FTSE. CAC, DAX, HANGSENG, NIKKEI, Dow Jones Eurostox 50 and others are signaling the economic destruction unfolding. This is a deadly chorus.

This is a powerful picture of the economic future because these patterns represent MILLIONS of investor's' collective beliefs about the future of these economies. And they are PUTTING their money where their collective thoughtsare directed; it is a collectively BLEAK picture of the economies and the collective actions of public serpents', er servants'.

Longer term targets for the S&P 500 have now gone to 200 to 300. In the 4 th quarter of 2008 the S&P 500 had NO EARNINGS for the first time since the mid 1930's, can you say “another black swan?” The 1 st quarter of 2009 will be no better; we can see the Wolfe Wave of COLLAPSING income at work (see Tedbits Archives about the Wolf Wave). Excellent fundamental earnings research has been made by John Mauldin and I urge you to read it at this link: www.frontlinethoughts.com/pdf/mwo022709 , showing a PE of over 50 signals and a decline of at least 60 to 80% FROM here. OUCH. As I said weeks ago: Sell into rallies andif it's a big rally get short for ANOTHER crash.

When you see his numbers, think about all the G7 and the ability to REPAY bondholders and lenders of all stripes. Huge blood is on the horizon for corporate bondholders and lenders, the bomb, er, bond market IS NOT A PLACE TO HIDE, GET OUT! Don't let your broker FOOL YOU! GET OUT of Municipal and State Bonds as well as they have borrowed for CONSUMPTION and have FREEFALLING receipts to pay them. Sell any rally.

In one fell swoop the democratic supermajority is totally remaking the economy in the US, back to the BAD old days of the Carter Administration, and going even farther, in effect: High unemployment, high inflation, runaway regulation, no incentives to produce/innovate or invest, confiscatory tax rates and collapsing income from reduced business activity and inflation. These people are ECONOMIC IGNORAMUSES and they are in the process of NATIONALIZING the DOMESTIC energy, insurance, mortgage, banking, automobile and healthcare sectors for starters. Not much left after that is there?

The taxman in disguise is appearing in the fight to combat CLIMATE change (so the PUBLIC SERPENTS and non-governmental organizations are correct either way the wind blows, no longer is it global warming as it has been definitively DEBUNKED but the media WILL NOT report it). Cap and trade is nothing more than a TAX on an imaginary BOOGEYMAN, to save you and give politicians the cover to nationalize and terrorize broad swathes of the economies which still produce profits.

This amounts to $640 billion of profits from the oil and energy sectors and their PRIVATE shareholders (your neighbors, pension funds, institutions, endowments and charities) and their transferring it to themselves and their CAMPAIGN contributors/special interests in the BELTWAY. They know how to spend it better than YOU ! The energy proposals -- rather than FUND research to make environmentally-friendly energy AFFORDABLE, -- tax the affordable and practical energy to unaffordable levels to make environmental, politically correct sources practical. This is exactly backwards of what must be done and it is capital destruction on a grand scale. ECONOMIC ignoramuses!

First off, let's start with comments on the new Barack “Pinocchio” Ob@ma Administration and the public servants inside the beltway of WASHINGTON DC. Several words and comments come to mind: Morally and fiscally bankrupt and absolutely corrupt. Their betrayal of doing what is good for their constituents/country and creating the conditions for economic growth versus doing what is good for their political ambitions and power over the economy is on PLAIN display in their activities and proposals.

Contrary to their words, their actions can only lead to one conclusion: They are PURPOSELY driving the economy off a cliff to gather power in the UNFOLDING crisis by destroying every corner of what is still working at the public's expense and MISERY. Please notice how they IMMEDIATELY jump on any public figure who murmurs anything contrary to the headline illusions.

The only reason they are reducing the deduction for charity for those earning over $250,000 dollars, at a time when we need charity more than in the last 70 years, is so the people relying on charity will have to rely on government.

The more the public servants take over broad swathes of the economy, the more opportunities there are for them to collect rents from campaign supporters in exchange for FAVORS; expanding opportunities for corruption, as if we did not already have enough. They now and in the future have a lot more inventory to SELL so the corruption is only set to skyrocket. It is sooooo much easier for crony capitalists to buy markets through legislation than to build and compete for market share. Mal Investments are set to explode. If you think CORN based ethanol was a nightmare, think of it multiplied by 10 as new energy, global climate change (tax man in disguise) and health care initiatives bury capital in unproductive but politically correct BOONDOGGLES!

As I mentioned in previous newsletters, the stage is set for the emergence of a new dictator, and my bet is that we shall see Ob@ma and the gang of 535 morph into it over the next two years. Two recent articles have caught my eye, both are about Narcissism; one is by Dr.Ali Sina entitled “Understanding Ob@ma: The Making of a Fuehrer at http://www.faithfreedom.org/obama.html (here's a video from you tube http://www.youtube.com/watch?v=tVnRzn4rjbY ) and another is by Dr Sam Vaknin at http://www.snopes.com/politics/soapbox/vaknin.asp . I STRONGLY urge you to watch/read these articles. They are absolutely FRIGHTENING when you think about the consequences for us all. Unfortunately, the whole US government and much of the G7 is in the hands of these monsters, the GANG of 535 known as the US Congress, Judicial and Executive Branches and many in Europe are undoubtedly cats of the same stripe.

Why do you think that many of the appointees of the OB@MA Administration are being called Czars? Do you know the definition of CZAR? Look it up. It is a dictator and that is what they will be, not public servants as they swear to be. Public servants in the G7 have been CZARS for quite some time, only now are they brazen enough to call themselves this in the MEDIA for all to see.

Wait until you see what is in the cards at the EPA (Environmental Protection Agency). Carol Browner (Al Gore protégé) is going to TOTALLY rock your world? For the worse… to SAVE you…no, it's to destroy YOU! This is a new Pandora's Box wrapped with a bow on it. Wait until you open it and see all the gifts from the PUBLIC SERPENTS that comes from it…

There is no containing the corruption that can be implemented with the near supermajority democrats (they only have to bribe 2 Republican senators with EARMARKS and then we are all DONE). There is an old saying that power corrupts, and absolute power corrupts absolutely; tthis is where we have arrived inside the beltway, and once passed into law and implemented, never to be repealed. With one stroke, The United States is being transformed into the equivalent of the worker's paradise of FRANCE or WORSE, where anyone making over 4,000 Euros a month is rich. France is the epitome of what the US is set to become. As you look at the basket-case economies of New York, New Jersey, Michigan, Ohio and Illinois just know that this is the destination the rest of the country.

I have commented on the stimulus package which is an undisguised expansion of the government of about 8%, as a percentage of GDP, and a permanent baseline expansion in the government budget of over 25%. This is only the beginning; in one fell swoop they are nationalizing the energy and healthcare industries either through taxation or new programs, expanding not only the federal government but also the state and municipal governments. The rest of us have to cut back while our new rulers raise their pay and increase their take for redistribution to their special interest CAMPAIGN supporters from us all.

I am a small business operator, I have two employees and in February added a 3 rd , as I try to expand. I learned last week that for my efforts in creating jobs for myself and 3 others I will be rewarded for this. My reward from Ob@ma unveiled his omnibus budget proposal for this year -- 8,700 earmarks (is this the change we expected?) and budgets DEFICITS for the next several years, and if carefully added up, my taxes will be going from a rate of 35% to over 60% by the end of next year. I am by no means RICH.

I started in my profession over 25 years ago and gradually worked myself to my present level. I have not accumulated a large retirement account as I am now entering my peak earning years, but these new tax proposals transfer my future savings to the government to support people who have not worked hard, studied, taken the risk of starting a business, etc. I have worked 60 to 70 hours a week for as long as I can remember, I did not buy a house I could not afford, I have paid my taxes in full, I support charities and lead a lawful existence; for this I am a bad man and I am being punished to save people who have not lead responsible lives. I am an evil RICH guy, or a patriot as Jumpin Joe Bid@n says.

Why are they doing this? Michael Boskin, economic professor at Stanford University sums it up quite nicely in a recent article in the www.wsj.com :

“New and expanded refundable tax credits would raise the fraction of taxpayers paying no income taxes to almost 50% from 38%. This is potentially the most pernicious feature of the president's budget, because it would cement a permanent voting majority with no stake in controlling the cost of general government.

From the poorly designed stimulus bill and vague new financial rescue plan, to the enormous expansion of government spending, taxes and debt somehow permanently strengthening economic growth, the assumptions underlying the president's economic program seem bereft of rigorous analysis and a careful reading of history.

Unfortunately, our history suggests new government programs, however noble the intent, more often wind up delivering less, more slowly, at far higher cost than projected, with potentially damaging unintended consequences. The most recent case, of course, was the government's meddling in the housing market to bring home ownership to low-income families, which became a prime cause of the current economic and financial disaster.

On the growth effects of a large expansion of government, the European social welfare states present a window on our potential future: standards of living permanently 30% lower than ours. Rounding off perceived rough edges of our economic system may well be called for, but a major, perhaps irreversible, step toward a European-style social welfare state with its concomitant long-run economic stagnation is not.”

The public serpents now have the MOB behind them. The mob is impoverished from the public servants' policies and DO NOT understand that it is the public servants, nanking systems, crony capitalists and governments they are supporting who are actually the cause and perpetrators of their MISERY!

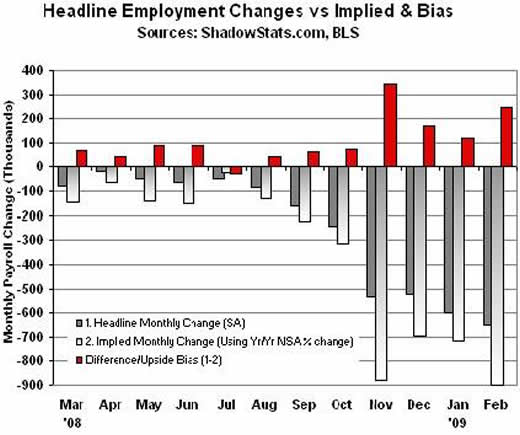

John Williams at www.shadowstats.com (I urge you to subscribe to this excellent source of truth and honest economic reporting) is reporting that unemployment levels, as measured before the government defined away the definitions of the true measure, are now over 19%. NON massaged numbers put it at 812,000. Question: What was the only sector to GAIN jobs? Government, what else. Take a look at the true picture of unfolding unemployment and weep:

If the American public ever finds out about the enormity of the lies that the government (GDP, unemployment, inflation, etc.) and the main stream media has published without QUESTIONING as TRUTH, there would and will be wide scale RIOTING! The problem for the main stream media and their public servant masters is that the lies just keep on getting BIGGER and BIGGER and sooner or later even the dumbest among us will FIGURE it out. I am surprised their noses are not a mile long. Pinocchio where are YOU?

Economic activity throughout the US is in FREEFALL. John also reports the false nature of the budget projections which are based on PHONY GDP growth projections of negative 1.2 % this year, +3.2 percent next year and higher after that. BALD lies to fool the American sheep into supporting NEW spending and government expansion upon which there is no ability to PAY for them.

The unemployment report came out and it claims wages are up 3.6% over the last year? Do you believe this? If falsity is on plain display, ask any one of the 3 million newly unemployed. What's wrong with this picture?

Once they pass the programs based on these PHONY projections they will just PRINT the money as they are VITAL government services after that point. Do you believe in the tooth fairy? Washington DC does, as do all the G7 public servants. They think they can write a check, guarantee a loan, give away free ENTITLEMENTS without LIMITS and their creditors, taxpayers and the printing press will PAY FOR IT ALL. The patsy's are quickly WAKING UP! They shall soon find out what I learned in Econ 101:

“There ain't no such thing as a free lunch” and the tab is about to come due….

In conclusion: The policy prescriptions of the G7 are combining into a potent toxic cocktail for the private sector. It is clear that many of the crony capitalists who have leaned on public servants and the banksters for decades are now failing as their business models are not providing more for less (as would be in a capitalist economy), but now rely on government for their lofty perches. As we watch one big company after another fall, even mighty GE is about to be humbled, it is the entrepreneurs who will be needed to create economic salvation. The oligarchs are falling and the G7 governments are doing everything in their power to kill their successors.

What we see happening is the collapse of the American dream. America as we know it and its constitution are now a corpses. Weasel words and ORWELLIAN doublespeak are the norm. Contrary to the broad belief of the dumbed down, “functionally illiterate” citizens of the G7, their economies are now the poorest in the world and their debts are increasing not in a compounded manner, but geometrically. Truth about what's unfolding is SCARCE. Leaders are only increasingly becoming dictators and ignoramuses. The attacks on competitive tax areas (they are not tax havens, this capital has left because it is mistreated, subject to confiscation, overtaxed and regulated). That sucking sound you hear is CAPITAL flight from the G7 as it is in peril; the talk about tax-competitive regions is just the bankrupt politicians getting ready to chase it.

There are many web links in this newsletter and it is important that you review them to PREPARE yourself and your families. It will be a lot of GOOD work.

Eastern Europe and the PIGS (Portugal, Italy, Greece and Spain) are in absolute meltdown mode. Currency, credit and a funding crisis are IMMINENT and unfolding RAPIDLY.

Governments in the G7 have now grown faster than the respective economies for DECADES. The G7 ability to create wealth, savings and produce more than it consumes is now very small and in freefall. The government and elite parasites have now outgrown the wealth creating private sectors, or “host”, and are rapidly KILLING what profitable sectors are left, so collapse is set to unfold in an increasingly UGLY manner. The G7 are the most MASSIVE debtor nations in history and their currencies have now inflated to the point of collapse as ASSET backed economies and wealth creation through falsely stated inflation has now GONE INTO REVERSE. As Von Mises stated:

The latter is where we are today. The future money printing on a simultaneous basis will turn Dollars, Euros, and Pounds into dimes first, then worthlessness soon after. The maximum time to FINAL meltdown in my estimation is less than 5 years. There is only one bit of good news and I laid it out at the beginning of this missive:

Don't miss the next edition of the Ted bits 2009 Outlook on Commodities…..

Please remember that subscribers generally receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.