Stock Market Cycle Turning Points Analysis 7th May 2007

Stock-Markets / Cycles Analysis May 07, 2007 - 10:14 AM GMTBy: Andre_Gratian

A 3-dimensional approach to technical analysis

Cycles - Breadth - Price projections

Current Position of the Market

SPX: Long-Term Trend - The 12-year and 10-year cycles are still in their up-phases but their influence will be reduced in the weeks ahead as intermediate and long term cycles bear down into year-end.

SPX: Intermediate Trend - With the price reaching the preferred target area, the rally from 3/14 should be coming to an end.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which determines the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview

The past two weeks saw a brief but sharp correction caused by the bottoming action of some shortterm cycles, but the market came roaring back with most indices making new bull market highs. Two did not: the Russell 2000 and the Dow Jones Transportation index. By contrast, the strongest performance came from the blue chips with the Dow Jones industrials and the SPX 100 clearly outperforming others. The NDX kept pace with the SPX, displaying little divergence. Even GE was a strong performer, gaining over 2 points last week.

The market recently had to deal with a mixed bag of economic statistics, but chose to focus on those that were positive while ignoring the negative ones.

An event that could have a potential long-term economic impact and which has received little attention is the French presidential election that was held Sunday. The favorite candidate for the presidency, Nicolas Sarkosy, an admirer of American capitalism, is in favor of major reforms designed to bring France out of the economic doldrums in which it has been for many years. Speculation that he will be elected could be one of the drivers behind the strong performance of European indices which, in turn, is influencing our own markets.

What's Ahead?

Cycles

More short-term cycles made their lows early last week. At first, it looked as if the weakness associated with that low was disproportionate to the cycles involved, suggesting that a declining 10- week cycle was beginning to influence the trend from 3/14. However, the rebound after Tuesday demonstrated that there is still plenty of strength in the uptrend and calls into question how much of a factor the 10-week cycle will be in putting a stop to the prevailing bullishness.

The 10-week cycle is due to bottom in the middle of this month and so far, there has been little price deceleration. It is true that market moves are influenced by more than cycles. Economic news probably has the most effect on the market. But cycles do influence the mood of investors and determine their reaction to the news. As an example, there have been plenty of negative economic news concerning housing and strong evidence of slower economic growth in the past couple of weeks, but these were ignored by the stock market. I believe that is a sign that longer term cycles are still in charge.

In the past, the 10-week cycle has had a mixed influence on the market, ranging from a few days up to 3 weeks of decline into its low. As we will see in "projections", the SPX has now entered its preferred target zone and if that target is valid, it means that a top is imminent. Perhaps it will coincide with the FOMC meeting which is due to take place next Wednesday.

If we measure from the low of the 20-wk cycle which occurred on 3/14, 10 weeks from that date falls in the week of 5/21. However, the 5-week cycle made its low a little early, on 4/12, which means that we should be prepared for the possibility that the10-week low will take place a week earlier.

The question is whether or not the bottoming of the 10-week cycle will break the upward momentum of the intermediate trend. This will depend on how much weakness it generates and, even more importantly, how much strength there is in the subsequent rally. The 4.5-year cycle and the 18-mo cycle will combine with the next 20-week to form a nest of lows in late July, early August. It's only a matter of time before their influence begins to shift the market momentum from up to down.

Technical Indicators:

If we compare the current daily chart of the SPX with the one which was presented two weeks ago, we can see that the two momentum oscillators are still overbought and have started to flatten out. This can be interpreted as the beginning of a loss of upward momentum. The pattern that was made going into the February top shows a long drawn-out process of deceleration with the oscillators peaking four months before the SPX started declining, but we should not expect the same pattern to repeat itself today. Oscillators are dependent on price, and price structure is dependent on cycles. The cyclical configuration which exists today is completely different from the one which existed prior to the last top.

Momentum indicators have two functions: first to demonstrate an overbought/oversold condition, and then the loss of up/down momentum which leads to a reversal. On the following chart (courtesy of Stockcharts) the RSI and STO are currently overbought and are beginning to show a loss of momentum. These are preliminary warning signs that a market turn may be near; in this case, caused by the bottoming of the 10-week cycle. At the same time, the SPX is approaching the top of its up-channel where it will most likely find resistance.

Projections

We can already project that the next intermediate-term high for the SPX -- which could also prove to be the bull market high -- will be between 1498 and 1520. These are levels to keep in mind as we approach them. They have been determined by Fibonacci measurements, but there is at least one Point & Figure count from the base which projects to 1498.

I am repeating this quote from a month ago because we have now reached the preferred projection zone in which we should be looking for the current trend to come to an end. As mentioned above, Fibonacci ratios were used to make this projection. But because of the current market strength it is entirely possible that this level will be exceeded.

The above projection was made for the intermediate trend which started on 3/14. As we enter the intermediate target zone, short-term projections can be used to fine-tune the longer term one. Last week, after the SPX pulled back to 1477, it was possible to project that the next move would carry to about 1510 if the uptrend resumed. In fact, 1510 was reached in the opening surge Friday, and the index immediately retraced to 1502.

If the SPX cannot move beyond 1510, we can begin to suspect that this might be the high of the move. Confirming signs will come from other areas, such as the A/D. As of Friday, there was no confirmation that a top was in place, so we need to wait and see what Monday will bring.

Breadth

This aspect of the stock market is showing the most deceleration. Whether you look at the McClellan oscillator or the summation index, both have stopped going up and started to move sideways, seemingly waiting for the price to stop advancing. This is true of both the NYSE and the Nasdaq statistics.

However, the NH/NL figures (a longer term indicator) are not showing serious deterioration at this time.

Market leaders

The Rusell 2000 has replaced the NDX as the index exhibiting relative weakness to the SPX. After the last short-term low last week, the Russell failed to overcome its previous highs. If this persists, it will become a negative for the market. At tops, it is normal for small cap stocks to under-perform large caps.

GE made a strong showing last week, but it has yet to overcome its January high. The XBD also made its high in January, ahead of the other major indices. On Friday, it just made it back to those highs. Both of these indices have to be considered laggards on an intermediate basis.

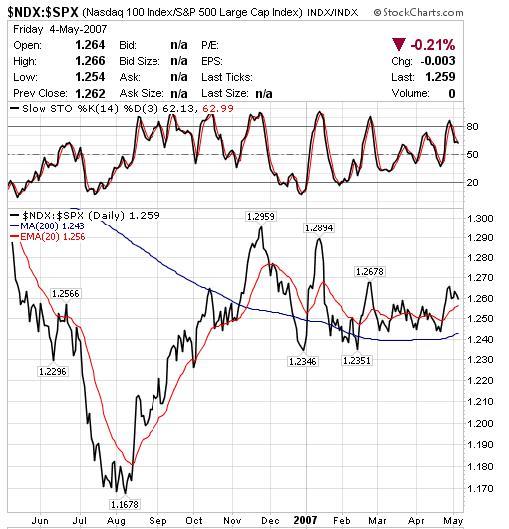

The NDX is currently keeping pace with the SPX but its ratio is not doing as well, as you can see in the next chart.

Summary

Identifying the intermediate high is our immediate concern. At this point, even though the SPX has essentially reached its preferred target, there are few signs of weakness. Sentiment indicators are not at a level indicative of a major top, and the last COT report is bullish. The SPX is still trading in the upper portion of its up-channel, and the NDX is not under-performing.

Many cyclical and technical considerations are coming together to indicate that we are very close to some sort of a top which could occur as early as next week, but we need more time to determine how important a top it is going to be.

By Andre Gratian

MarketTurningPoints.com

If this information is of value to you, you should consider our trial subscription offer (above). Daily updates consist of a

Morning Comment, Closing Comment (which occasionally includes an updated hourly chart of the SPX to illustrate the

analysis), and at least one or more updates during the trading session whenever it is warranted by market action. These

updates discuss phase completions, give projections, potential reversal points, and whatever else may be pertinent to the

short-term trend.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again,

and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and

each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature

which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.