The End of the Consumer Credit Empire: Stairway to Retail Heaven

Economics / US Economy Mar 03, 2009 - 08:35 AM GMTBy: James_Quinn

There's a lady who's sure

There's a lady who's sure

All that glitters is gold

And she's buying a stairway to heaven

When she gets there she knows

If the stores are all closed

With a word she can get what she came for

Ooh, ooh, ooh, ooh, ooh

And she's buying a stairway to heaven

Led Zeppelin – Stairway to Heaven

She was buying the stairway to heaven using her home equity line, but now that she is underwater on her mortgage she tried to pay using her Amex card, but her credit score had dropped to 600 and they cut her credit line in half. The stairway to heaven isn't as easy to achieve as it used to be. Barney Frank and Nancy Pelosi feel bad for the lady. They are going to borrow against your children's future tax dollars and give them to the lady, so she can buy that stairway to heaven. By making this deal with the devil, the corrupt politicians running this country have put us on an escalator to hell. A straight shooting blunt President from last century described what would destroy America .

“The things that will destroy America are prosperity-at-any-price, peace-at-any-price, safety-first instead of duty-first, the love of soft living, and the get rich quick theory of life.” - Theodore Roosevelt

Over the last 30 years Americans have learned to love soft living and fallen for the lie of prosperity at any price. In the last 10 years a significant number of delusional citizens have tested the get rich quick theory of life, twice. First, the internet bubble lured millions to believe that Pets.com was going to change the world and day trading was a road to riches. Once this bubble collapsed and wiped out millions of morons we moved onto the next bubble. Millions of Americans bought into the “fact” that home prices only go up. The National Association of Realtors dealt the propaganda that now was the best time to buy. Alan Greenspan provided the fuel with 1% interest rates and recommending ARMs for everyone. Banks and mortgage brokers provided the mortgage products that would allow someone with annual income of $25,000 to “buy” a $400,000 home. George Bush and Congress stood on the sidelines cheering everyone on. The get rich quick portion of our population (10% to 20%) began to buy multiple houses and flipping them before the ink was dry on the closing papers. Home prices doubled in many places in the space of a few years. This lured a vast amount of the population to borrow against the ever increasing value of their homes. Everyone knew that home prices never fall.

Well on his way, his head in a cloud,

The man of a thousand voices, talking perfectly loud.

But nobody ever hears him,

Or the sound he appears to make.

And he never seems to notice .....

But the fool on the hill

Sees the sun going down.

And the eyes in his head,

See the world spinning around.

The Beatles – Fool on the Hill

During the period of 2000 through 2008, I felt like the fool on the hill. I never bought an internet stock and couldn't understand how people were getting rich buying and selling these stocks. I didn't flip any condos, didn't borrow against the equity of the house I've lived in since 1995, or buy a new BMW. None of the hype and enthusiasm made any sense to me, so I sat on the hill and watched the sun going down. Instead of having the satisfaction of making the right choices, my government is telling me that I should have joined the party. They are taking my money and handing it to the people who made wrong choices. Corrupted politicians, government bureaucrats and lying financial pundits are breathlessly awaiting the return of irrational exuberance. They believe that the American consumer just needs a little confidence to resume their rightful place in the world economic pyramid. I hate to be a wet blanket, but the American consumer isn't coming back and the consequences of this fact have yet to be realized by the financial markets, foreign manufacturers, domestic retailers or politicians. The overhang of debt, continued home price depreciation, lack of savings, and aging of America will change the face of retailing for decades.

Why Worry?

The Consumer Confidence Index in February was 25, the lowest since the index inception in 1967. During the Dot.com bubble it reached an irrationally exuberant 140. It hovered in the 110 level through the housing bubble until late 2007. The good news is that it can't go below zero. The CNBC pundits and Washington politicians think that Americans just need to get their confidence back and everything will be OK. There's only one problem. You can't spend confidence.

The Consumer Confidence Index in February was 25, the lowest since the index inception in 1967. During the Dot.com bubble it reached an irrationally exuberant 140. It hovered in the 110 level through the housing bubble until late 2007. The good news is that it can't go below zero. The CNBC pundits and Washington politicians think that Americans just need to get their confidence back and everything will be OK. There's only one problem. You can't spend confidence.

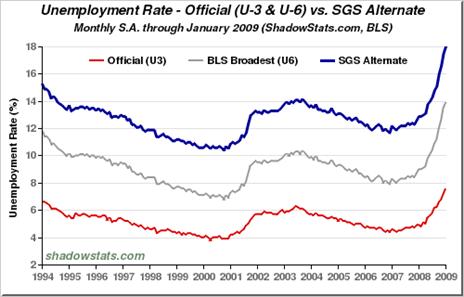

The index shows how fragile the psyches of Americans can be. In retrospect, the extreme confidence in early 2000 and high levels from 2004 through 2007 were completely unwarranted. The American public had a false sense of confidence inflated by our bubble economy. Now the confidence level is at a record low level. This level is rational. With the government reported unemployment rate of 7.6% and the true rate between 14% and 18%, consumers aren't too confident. There are 235 million Americans of working age. Only 154 million are in the work force according to government statistics. Of those, 11.6 million are unemployed. There are 81 million Americans of working age who are not in the workforce. At least 10 million of these people would work if they had an opportunity. With the massive destruction of wealth in the last two years, many more of the 81 million will have to go back into the workforce, whether they like it or not.

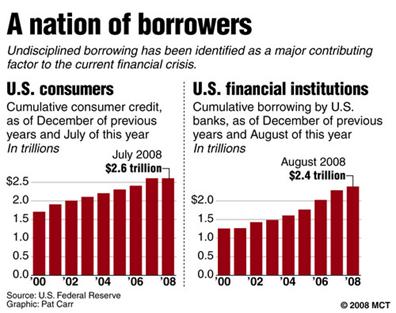

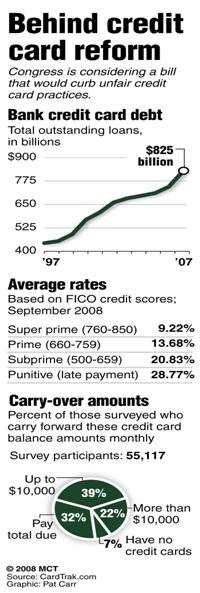

The country has tried to spend its way to prosperity over the last three decades. Total consumer debt is just under $2.6 trillion, or $23,600 per household. This includes credit card debt, auto loans, and personal loans. There are approximately 170 million credit card holders who own 1.5 billion cards, or 9 cards per person. The average household carries nearly $8,700 in credit card debt. The average new car loan is $25,000 with a loan to value ratio of 93%. This means that the average new car owner is underwater on their loan as soon as they pull out of the dealership parking lot.

The credit card wasn't invented until 1967. Americans have adapted quite well to this new fangled American invention. Since 1970 revolving credit debt has increased by 26,000%, from $3.7 billion to $963.5 billion. Over this same time frame GDP grew by 1,430%. These statistics prove to me that America has maintained its standard of living by using credit cards. The always loquacious Alan Greenspan concluded in 2005 that the geniuses at Citicorp, Bank of America, Capital One, among others had done a wonderful service to humanity by giving credit cards to people who could not pay them back. I can picture his hang dog jowls quivering while tears welled up in his lying eyes.

The credit card wasn't invented until 1967. Americans have adapted quite well to this new fangled American invention. Since 1970 revolving credit debt has increased by 26,000%, from $3.7 billion to $963.5 billion. Over this same time frame GDP grew by 1,430%. These statistics prove to me that America has maintained its standard of living by using credit cards. The always loquacious Alan Greenspan concluded in 2005 that the geniuses at Citicorp, Bank of America, Capital One, among others had done a wonderful service to humanity by giving credit cards to people who could not pay them back. I can picture his hang dog jowls quivering while tears welled up in his lying eyes.

"As we reflect on the evolution of consumer credit in the United States, we must conclude that innovation and structural change in the financial services industry have been critical in providing expanded access to credit for the vast majority of consumers, including those of limited means. Without these forces, it would have been impossible for lower-income consumers to have the degree of access to credit markets that they now have. This fact underscores the importance of our roles as policymakers, researchers, bankers, and consumer advocates in fostering constructive innovation that is both responsive to market demand and beneficial to consumers."

Only 23% of the credit cards in the country are in the hands of prime borrowers. Giving out credit cards like candy to people of limited means couldn't possibly end badly. The MBA Wall Street geniuses gazed at their models and concluded that their million dollar bonuses were in the bag. According to Fitch, write-offs are breaching 8% and are headed towards 10%. Auto loan delinquencies are already at 10%. Maybe lending 120% of the value of those Cadillac Escalades to a person with no job or assets was a bad idea.

Only 23% of the credit cards in the country are in the hands of prime borrowers. Giving out credit cards like candy to people of limited means couldn't possibly end badly. The MBA Wall Street geniuses gazed at their models and concluded that their million dollar bonuses were in the bag. According to Fitch, write-offs are breaching 8% and are headed towards 10%. Auto loan delinquencies are already at 10%. Maybe lending 120% of the value of those Cadillac Escalades to a person with no job or assets was a bad idea.

The worst recession since the Great Depression will lead to the unprecedented credit card write-offs. Guess who will step to the plate and cover these losses. Right again. You and I will pay for the noble experiment of giving credit cards to people with little or no income. The bank CEO's walked away with hundreds of millions in pay, Congressmen who pushed for poor people to get the credit were re-elected, Alan Greenspan receives $150,000 per speaking engagement, and the U.S. taxpayer gets screwed.

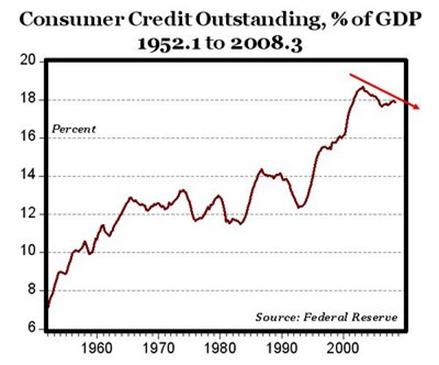

Anyone who thinks the U.S. consumer is close to resuming their spending habits should look at the chart below. Consumer credit outstanding as a % of GDP ranged between 12% and 14% from 1965 through 1995. It currently stands at 18%, with GDP in freefall. With GDP at $14 trillion, the American consumer will have to shed $600 billion of debt to achieve a 14% level. It will take years of debt reduction and GDP growth to rebalance the economy. The brilliant bank analyst Meredith Whitney lays out our bleak future:

I estimate that the mortgage market will shrink for the first time in US history and that the credit card market will be 18 months behind it . While just over 70 per cent of US households have access to credit cards, 90 per cent of these people use credit cards as a cash-flow management vehicle, or revolve payments at least once a year. While the credit card market is small relative to the mortgage market, it has grown to play a key role in consumer liquidity. Declining liquidity here will have disastrous effects on consumer spending and the economy.

It is time to take the advice of John Lennon and stop riding on the merry-go-round of a materialistic society that tries to borrow and spend its way to prosperity.

It is time to take the advice of John Lennon and stop riding on the merry-go-round of a materialistic society that tries to borrow and spend its way to prosperity.

People say I'm crazy doing what I'm doing

Well they give me all kinds of warnings to save me from ruin

When I say that I'm o.k. well they look at me kind of strange

Surely you're not happy now you no longer play the game

I'm just sitting here watching the wheels go round and round,

I really love to watch them roll,

No longer riding on the merry-go-round,

I just had to let it go.

John Lennon - Watching the Wheels

Home Sweet Home Equity

“Consumption doesn't drive an economy - entrepreneurship does that - while savings fuel it.” - Gerard Jackson

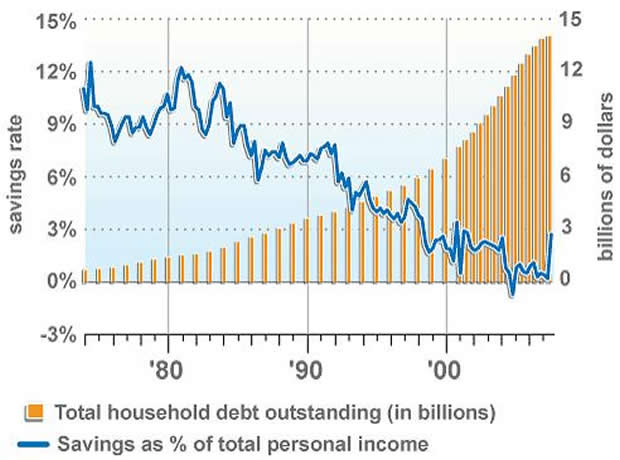

U.S. households accumulated an additional $8 trillion in debt over the past decade. As their home values rose relentlessly, it became passé to save for retirement. Old age would be funded from vast amounts of housing wealth. This made Americans less interested in saving their money as the chart below shows. At the height of housing mania, the savings rate went negative. The dream of a retirement financed by housing wealth has since been shattered.

Source : Carpe Diem

“Now remember, when things look bad and it looks like you're not gonna make it, then you got to get mean. I mean plumb, mad-dog mean! Cause if you lose your head and you give up, then you neither live nor win. That's just the way it is.” - Clint Eastwood in Outlaw Josey Wales

Things do look bad and Americans need to get mad-dog mean. The meanness that I've witnessed so far has been from 35 year old jerks driving leased BMW 525i's who have 3 underwater condos and have lost 70% of their faux wealth in the market. They're the ones who come up behind you at 90 mph, lock onto your bumper and flash their brights at you to get out of their way. I slow down.

Average Americans need to get mean about spending and saving. Between 2002 and 2008, Americans sucked over $3 trillion of equity out of their houses and spent it on gadgets and goodies. That well is dry. There are no more wells. Ignore the crap you are hearing from Paul Krugman about the paradox of thrift. You must become thrifty because you have no choice. The future is approaching at hyper-speed and Americans have saved little. Their choice is to save now or acquire a taste for dog food. The saving rate in January jumped to 5%, the highest level since 1995. This trend will continue up to 10% in the coming years.

Average Americans need to get mean about spending and saving. Between 2002 and 2008, Americans sucked over $3 trillion of equity out of their houses and spent it on gadgets and goodies. That well is dry. There are no more wells. Ignore the crap you are hearing from Paul Krugman about the paradox of thrift. You must become thrifty because you have no choice. The future is approaching at hyper-speed and Americans have saved little. Their choice is to save now or acquire a taste for dog food. The saving rate in January jumped to 5%, the highest level since 1995. This trend will continue up to 10% in the coming years.

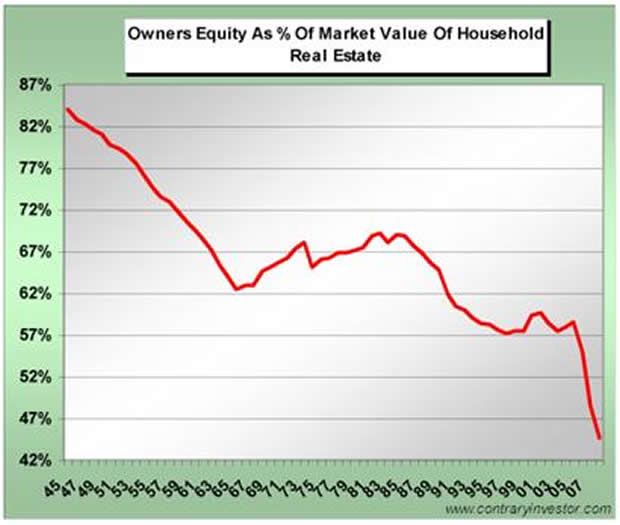

For decades homeowners had a ridiculous notion that they should slowly but surely pay off their mortgages. Why pay off your mortgage when your home value is guaranteed to increase 10% per year for infinity? After the greatest housing boom in history Americans are left with 45% equity in their homes versus 68% in 1985. With home prices destined to fall another 20% to 30%, equity will fall to 35%. One in seven homeowners across the country has negative equity, and of homeowners who bought in the last five years, 29.5% are under water.

Reversion to the mean is a concept that government bureaucrats refuse to accept. They are willing to spend as much of your money as they can get their grubby little hands on to reverse a non-reversible trend. Home prices must fall another 30% to reach the long term mean value. Taking money from prudent homeowners giving it to deadbeat homeowners and allowing politically motivated judges to decide who deserves a lower mortgage will not reverse the downward trajectory of home prices. It will just prolong the pain and create unintended consequences.

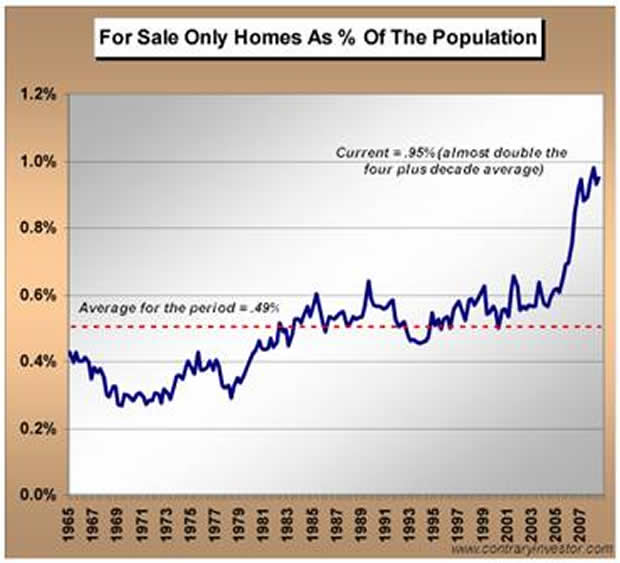

The number of homes for sale is still at record levels. With foreclosures accelerating more houses will come onto the market and prices will fall. Unemployment will reach 10% in the next year. There are 2.1 million vacant homes in the U.S. today. This is 1 million more than the historical trend. No one is going to buy these homes at the current asking prices. If you wait until foreclosure, you may get a house 50% cheaper than today's asking price. This is a rational approach and will lead to lower prices.

A normalized level of homes for sale would be in the range of 2 million. There is 9.5 months supply of homes for sale. A normalized level would be 4 months.

![[EHSInventoryJan09.jpg]](../images/2009/Mar/James_Quinn_clip_image006_0000.jpg)

All the facts point to a significant further decline in home prices. Barney Frank's efforts to mitigate foreclosures and prop up home prices with our tax dollars will fail. With prices falling for another two years and jobs disappearing at 500,000 per month, consumers will stay on the sidelines for years.

Dude, Where's My Retirement?

At the end of 2007 the average 401k balance was $65,500. The median 401k balance was $19,000. This divergence shows there are a few people with huge 401k balances, while the majority has virtually no retirement savings. These balances were at the end of 2007. Balances are likely to be 40% lower today. Almost 20% of 401k participants had borrowed against their 401k at the end of 2007, with an average loan balance of $7,500. With plunging markets and home prices, the number of loans probably soared in 2008. A 45 year old couple with an $11,000 401k balance and an entire net worth of $110,000 and annual income of $62,000 is in a precarious position. They would have to be living in complete denial if they think they will have a comfortable retirement.

At the end of 2007 the average 401k balance was $65,500. The median 401k balance was $19,000. This divergence shows there are a few people with huge 401k balances, while the majority has virtually no retirement savings. These balances were at the end of 2007. Balances are likely to be 40% lower today. Almost 20% of 401k participants had borrowed against their 401k at the end of 2007, with an average loan balance of $7,500. With plunging markets and home prices, the number of loans probably soared in 2008. A 45 year old couple with an $11,000 401k balance and an entire net worth of $110,000 and annual income of $62,000 is in a precarious position. They would have to be living in complete denial if they think they will have a comfortable retirement.

Americans bought into the lie that their homes could fund a glorious retirement of cruises, golf, and travelling the world. That illusion has been shattered. It will likely take 10 years to get back to breakeven on the losses they've experienced in the last 18 months. Anyone who has retired in the last five years or has plans to retire in the next five years has had their plans upended. They will have to go back to work or work longer, if they can find a job. There are 1,000 Americans per day turning 65. Only an insane person, after experiencing the losses of the last few years, would continue to spend on electric gadgets and luxury cars. If they don't start to save at a rapid clip, they will experience a miserable stress filled old age.

Deleveraging and How I Learned to Love It

Men, all this stuff you've heard about America not wanting to fight, wanting to stay out of the war, is a lot of horse dung. Americans traditionally love to fight. All real Americans love the sting of battle. When you were kids, you all admired the champion marble shooter, the fastest runner, big league ball players, the toughest boxers. Americans love a winner and will not tolerate a loser. Americans play to win all the time. I wouldn't give a hoot in hell for a man who lost and laughed. That's why Americans have never lost, and will never lose a war... because the very thought of losing is hateful to Americans. George C. Scott – Patton

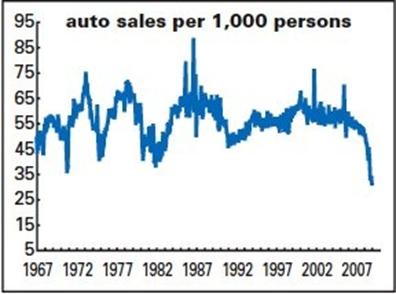

Americans have gotten soft over the last few decades. It is time to fight and prove that we still have a backbone. The next decade will not be pleasant, but it will build character. The priorities of the country must be changed and it will be American consumers who will force the change. They have already begun the long trek back from a losing spending strategy to a saving strategy that could result in being a winner. The drop in retail sales in the last few months is the most dramatic in U.S. history. This is not a momentary blip in a long term uptrend. This is a paradigm shift.

![[RetailDec2008.jpg]](../images/2009/Mar/James_Quinn_clip_image009.jpg)

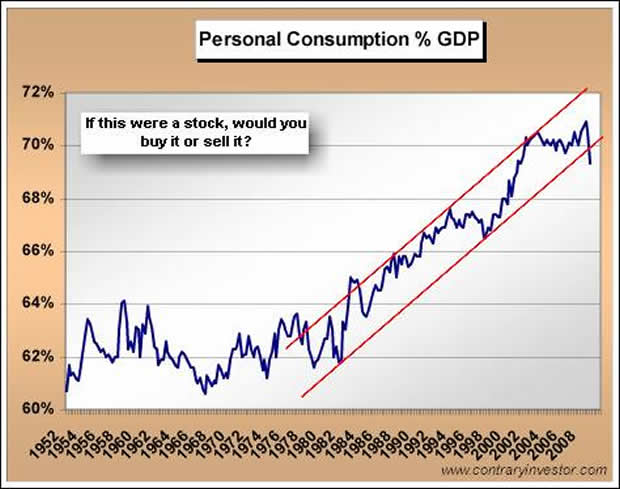

From 1952 through 1982, consumer spending as a percentage of our economy ranged between 60% and 64%. The United States ran trade surpluses and manufactured things that other countries wanted. Since 1982 we've lived above our means, consumed 4% more per year than we produced, and borrowed the money from foreigners to live this way. In 2008, this ratio topped out at close to 71%, or $10 trillion of our $14 trillion economy. Since this was an unsustainable trend it will revert to the mean over the next decade. The reversion to 62% of GDP will reduce consumer spending by $1.3 trillion annually going forward.

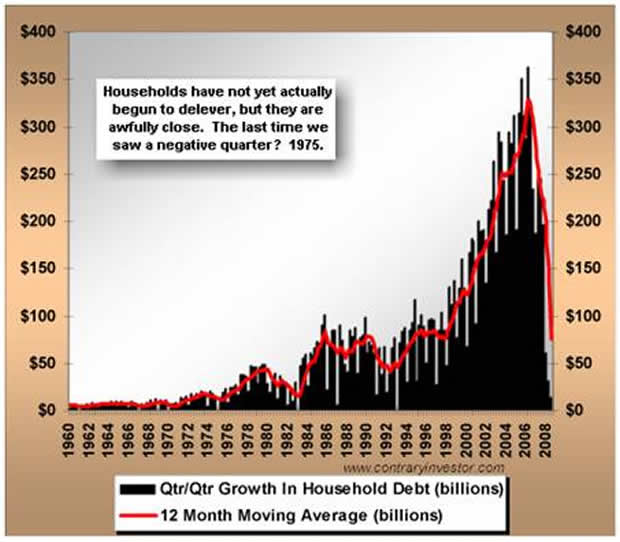

To paraphrase famous American admiral John Paul Jones, we've only just begun to de-lever. When you accumulate debt over three decades, you don't get rid of it in two years. Multi-decade expansions of debt are followed by a multi-decade deleveraging. The last time consumers pulled back for longer than one month was 1975. The consumer is in the process of collapsing. There will be false starts in a positive direction, but the overhang of consumer debt, relentless decrease in housing and stock values, and looming retirement funding will force Americans to dramatically cut their spending for decades. The retail industry will be devastated by this paradigm shift.

Knock, Knock, Knockin on Heaven's Door

The managements of most retailers in the United States are not prepared for $1.3 trillion less consumer spending per year. Their little expansion models were built upon an existing over inflated demand extrapolated at 5% or greater growth for eternity. We know how well bank models worked out. The good news is that retailer expansion models will not bring down the financial system. The bad news is that thousands of retailers will go bankrupt because they planned their businesses based upon false assumptions. Any retailer that used leverage to expand based on faulty pie in the sky assumptions is headed to retail heaven.

Retail top management is notorious for copying the strategy of other successful retailers. Wal-Mart created the concentration strategy of dominating a market with multiple stores. Every retailer in America dreamed of replicating Wal-Mart's success. Home Depot, Bed, Bath & Beyond, Target, Lowes, among others have followed this same strategy. Every retailer does the same thing. They know how many households are in a market and they multiply that number by the expected spending per household. There are three major errors that have been committed by every retailer in America . They failed to recognize that the spending per household was 30% over inflated due to debt financed demand. They then extrapolated the spending per household using a 5% to 10% growth rate. Lastly, they ignored the fact that their competitors had the same strategy.

I consider Lowes to be one of the best run retailers in the U.S. , with beautiful stores and good service. But, their top management was clearly irrationally exuberant regarding their expansion plans. Lowes has annual sales of $45 billion with approximately 1,500 stores. This averages out to $30 million of annual sales per store. Their operating margin has been 10%. They opened a store in Plymouth Meeting, 20 minutes south of my home. Since it was the 1 st store in the market, it likely generated annual sales of $40 million with a $4 million profit. Next they opened a store in Montgomeryville, 20 minutes northeast of my home. This store likely generated $30 million in sales, while reducing the sales of the Plymouth Meeting store by 15%. Next they opened a store in Oaks, 20 minutes west of my home. This store likely generated $25 million in sales, while reducing the sales of the Plymouth Meeting store by 10% and the Montgomeryville store by 10%. Now for the final nail in the coffin. They will open a 4 th store in Hatfield, 5 minutes from my home in April. It will cannibalize the sales of all three other stores. Below is an analysis of the likely profit implications for Lowes.

** Two stores had a profit of $5.5 mil.

*** Three stores had a profit of $5.3 mil.

This chart shows that Lowes likely generated more annual profit with two stores than with four stores. These figures don't take into account that Lowes likely spent $20 million to build each of those stores. They have sunk $40 million into building the 3 rd and 4 th stores, while reducing annual profits. These figures have also not taken into account the future reduction in consumer spending. If Lowes has replicated this error across the country, their future will not be bright. The hubris and overconfidence of top retail executives will result in thousands of store closings and retail layoffs.

I have experienced the incompetence and shortsightedness of retail executives firsthand. It is amazing to me that supposedly intelligent executives could gamble with a $100 million investment based on ridiculous assumptions and blatant lies. Many retailers have a winning concept, but few have top executives who do not get caught up in their own press clippings. When executives are driven by ego and diversity agendas, while disregarding unequivocal facts, that retailer is destined to fall. Understanding your external environment, your competitors and changing trends are essential to long-term success. These executives forget that Montgomery Ward and K-Mart were once premier retailers. The accumulation of bad strategic decisions by management will eventually bankrupt even the best retail concept. Bad decisions by retail executives destroy the lives of long-time employees when they are forced to close stores and fire staff. I've dealt with executives who couldn't spell strategic let alone think strategically. The retailers listed below have either collapsed or scaled back in the last year. The worrisome fact is that the decline in retail spending has only just begun.

A smart retail executive should be analyzing the current situation with a critical eye. Any executive who is planning for an upturn in spending by consumers next year is in for a rude awakening. The environment has changed forever and if they don't adapt immediately, their companies will die. Based on the balance sheets and cash flows of the retailers in the following chart, I've categorized them according to their risk level. Most of the information is prior to the dreadful holiday sales season. Balance sheets and cash flows continue to deteriorate. Some of the retailers on this list will be a surprise. Those with huge short-term debt obligations run the risk of not being able to rollover that debt. Banks in the U.S. no longer lend money they just beg the government for more capital. Many of these retailers will not be in business five years from now. Others will need to close hundreds of stores to survive.

The words of George C. Scott as Patton describe how retailers and nations sometimes have a limited amount of time on top of the world.

For over a thousand years, Roman conquerors returning from the wars enjoyed the honor of a triumph - a tumultuous parade. In the procession came trumpeters and musicians and strange animals from the conquered territories, together with carts laden with treasure and captured armaments. The conqueror rode in a triumphal chariot, the dazed prisoners walking in chains before him. Sometimes his children, robed in white, stood with him in the chariot, or rode the trace horses. A slave stood behind the conqueror, holding a golden crown, and whispering in his ear a warning: that all glory is fleeting.

All glory is fleeting. The American conquerors have returned from the mall wars pulling carts laden with HDTVs, iPods, Rolexes, and other treasures. There is no more ammunition left to fight another war. Retailers and Nations alike can experience fleeting glory. The question is whether it is too late for lessons learned to be implemented in time.

Join me at TheBurningPlatform.com to debate the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.