The Canadian Currency Faces Deepening Damage Ahead

Currencies / Canadian $ Mar 02, 2009 - 10:18 AM GMTBy: Ashraf_Laidi

While the dollar and the yen continue to prove being the strongest currencies during falling equities, let's focus on the currency with the combination of past sell-off as well as prolonged downside ahead. The latest Canadian GDP report accentuates our recent notes highlighting the case against the Canadian dollar as the country produces deteriorating figures on growth, jobs and industrial production. Q4 GDP fell 3.4% annualized (first decline since 91) from +0.9% on Q3, while 2008 GDP rose 0.5% from 2.7% in 2007.

While the dollar and the yen continue to prove being the strongest currencies during falling equities, let's focus on the currency with the combination of past sell-off as well as prolonged downside ahead. The latest Canadian GDP report accentuates our recent notes highlighting the case against the Canadian dollar as the country produces deteriorating figures on growth, jobs and industrial production. Q4 GDP fell 3.4% annualized (first decline since 91) from +0.9% on Q3, while 2008 GDP rose 0.5% from 2.7% in 2007.

The report leaves little doubt as to the outcome of tomorrows Bank of Canada rate announcement (50-bp rate cut to record low of 0.50%). Markets are currently in debate as to whether central banks readiness (BoE and BoC) to launch credit easing will avoid taking rates down to zero. In mid-February, Bank of Canada Governor Carney hinted at quantitative easing, indicating that the Bank retains considerable policy flexibility, which [it] will use if required." With Canadian interest rates at 1.0% and inflation dipping to 1.1% y/y, well below the banks preferred target of 2.0%, the outlook for further rate cuts looms large, especially considering plummeting oil prices and the drag from the US contraction. The onslaught of record job losses (-129K decline in Jan) and the 6.4% unemployment rate at 5-year highs paves the way for prolonged dislocation, allowing for a 7.0% print to emerge before year-end.

Canada' s eroding budget and trade imbalances are highlighted by the fact that the nation is slipping into its first budget deficit in 12 years and its first trade deficit in 33 years 1976 as falling oil prices and plummeting exports from the US eroded its external account. Since currency markets focus on relative values, the deepening deterioration in Canadas finances as well as the prolonged onslaught from the US recession is the key to the increased positive correlation between the Canadian dollar and the US equity indices. Those who argue that Canada's budget and trade imbalances remain far superior to those in the G-3 economies, a reminder suggests that FX markets focus on the relative changes rather than absolute levels in these macroeconomic variables.

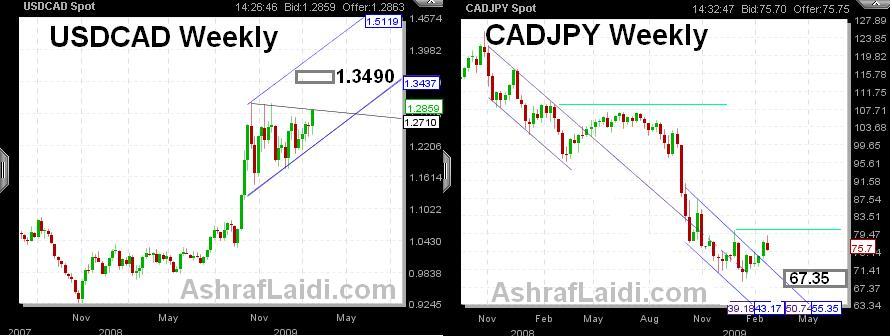

The Canadian dollar is increasingly correlated with shifts in risk appetite as the currencys heightened vulnerability to the US contraction and plummeting oil prices rendered it a high profile victim of rising risk aversion and a beneficiary of market bounces. Correlations in USDCAD (Canadian dollars per 1 US dollar) against the S&P500 and the DJIA edged up to -0.69 since the start of February, compared to -0.66 since year-to-date. The increase in correlation was similar for CADJPY, which is a stark manifestation of risk appetite as the loonie is gauged against the low yielding Japanese currency. Additional downside in equities (-15% from current levels) is likely to see USDCAD head beyond $1.30 and onto $1.3490s, while CADJPY is likely to breach below 72 and onto the 69.70s.

The Australian dollar fared as the best performing currency in February, followed by the pound and the US dollar, while the yen and Canadian dollar were the worst performers amid a group of 10 currencies. Year-to-date, the dollar retains the lead in FX returns, followed by the pound and the Norwegian krone, while the New Zealand dollar and the euro trail at the bottom.

Fundamentally speaking, the Australian dollar represents an economy that has fared better than most of its G10 counterparts, with a growth outlook far exceeding that of the G10 nations. Australias 2009 GDP growth is expected to reach +1.0% y/y, compared to -2.0%, -2.20%, -5.0%, -2.7% and -2.2% in the US, Eurozone, Japan, UK and Canada respectively. From a structural perspective, Australias current account deficit is seen at 4.4% of GDP in 2009, its lowest level since 2002. Its budget surplus is expected to hover at 1.0% of GDP--a far superior display than the deepening deficits of the US, Eurozone, Japan and the UK.

Norway , the other commodity currency, whose structural situation is boosted by a hefty current account surplus standing at 5% of GDP (biggest in industrialized world) and a budget deficit of less than 2.0% of GDP. Chapter 8 of my book highlights the Norwegian Krone's outperformance relative to other energy currencies (Canadian dollar, Russian ruble & Mexican peso) during the following periods Jan 2000-May 2008, Jan 2002-May 2008 and Jan 2007-May 2008.

I have argued the case for for 5,500 in the Dow and 550-60 in the S&P500 before end of Q3 based on the interaction with interest rates, gold and oil. The economic and banking case is also supportive. The FX implications for such an outlook are likely to carry prolonged gains in the yen and the dollar (despite weak Japanese fundamentals) but CAD weakness will be here to stay.

For more on the market and economic implications of gold ratios with oil, equity and commodity indices, see Chapters 1, 8 and 9 of my book Currency Trading & Intermarket Anlaysis.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.