Equities Endure Another Bumpy Month End

Stock-Markets / Financial Markets 2009 Mar 02, 2009 - 04:48 AM GMTBy: PaddyPowerTrader

There simply is no respite for long suffering stocks as fears of nationalisation creep closer. The seemingly endless need to drip feed financials more and more public money (Citibank and AIG) and news of slashed dividends at GE (and pared payouts elsewhere) was just too much for the market to take. The Dow Jones finished a horrible week at only 7063. Sorry but it looks like another tough week ahead is in store.

There simply is no respite for long suffering stocks as fears of nationalisation creep closer. The seemingly endless need to drip feed financials more and more public money (Citibank and AIG) and news of slashed dividends at GE (and pared payouts elsewhere) was just too much for the market to take. The Dow Jones finished a horrible week at only 7063. Sorry but it looks like another tough week ahead is in store.

Today's Market Moving Stories

- House prices in the UK fall 0.8% in Feb (down 10% year on year) according to Hometrack. The number of house completions is also down 60% year on year while non-conforming mortgages hit record delinquency levels of 28.6% of all such loans outstanding.

- Merkel says no. A fractious EU summit has rejected calls (from Hungary) for €180bn aid programme / bailout the recapitalise banks and reschedule foreign currency debt of Central and eastern European countries. EUR/USD has pushed below 1.25 in response. Think globally, act locally!

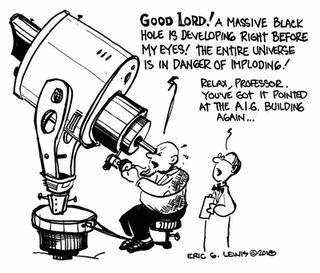

- US “insurance” black hole AIG is set to unveil a $60bn loss forcing it to get its begging bowl for yet another $30bn lifeline from the sucker taxpayer. TARPed and feathered indeed.

- HSBC has announced a record rights issue of £12.5bn (5m new shares at 254p) and a 30% dividend cut. They are also to exit all new business in US consumer banking. European banking stocks in general are unsurprisingly under pressure this morning on this bombshell. HSBC is off 7% while the likes of Deutsche, UBS and BNP are also struggling.

- Staying with the banks, Allied Irish Bank full year net income, following an unsurprising profit warning on 19th Feb, came in positive at €767m. This is down 61% year on year but in line with the guided EPS of 66c. Results include loan loss provisions of €1.8bn (vs €106m in 07) and €106m gain on disposal of merchant business. As guided, core Tier 1 is low at 5.8% and Tier 1 at 7.4% but following government recap €3.5bn, these will be 8.4% and 10% respectively. Final dividend has been scrapped.

- Berkshire Hathaway reports its worst annual performance on record. Buffett says the economy is a “shambles”.

- Stocks bucking gravity today are Dutch grocer Ahold, who beat estimates handily and French media giant Vivendi, who are even increasing their dividend . Kingspan released results which were slightly ahead of expectations.

Meanwhile Davy's stockbrokers have further downgraded their economic outlook for Ireland in 2010 to a 4.4% drop in GNP (previously –0.5%) due to the alarmingly rapid deterioration in the labour market.

Meanwhile Davy's stockbrokers have further downgraded their economic outlook for Ireland in 2010 to a 4.4% drop in GNP (previously –0.5%) due to the alarmingly rapid deterioration in the labour market.

- Maybe Rick Santelli's rant was not as off the cuff as it first appeared? This is one instance where we did read the articles and interviews !

- So we've all heard the phrase “re-owned” as the Americanism for “second hand” but over the weekend I heard one pundit speak of “ nationalisation ” of the banking system as “preprivatisation”!

- While Ryanair may soon charge you for them, bankers seem to always get golden parachutes.

Data Today

There is a plethora of manufacturing PMI data scheduled for release today including data from the Eurozone (consensus 33.6), UK (35) and the US (34). The collapse in global trade has dealt a severe blow to this beleaguered sector which has already been suffering from the drop in domestic demand. Today's releases will reveal across the board weakness as manufacturing continues to contract. The only good news is that such bad news should not come as a surprise any more. Nonetheless, it will only add to the evidence pointing to an extremely severe recession globally, one that is being led by the developed economies but quickly spreading into the emerging markets.

Thursday will bring rates cuts from the Bank of England 's MPC (0.50%) and the ECB (between 0.50% - 1%). It will be back to the bunker with the hard hat on as we brace ourselves for another blowout monthly jobless number for the US on Friday.

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.