Super Over Sold Stock Market That Still Refuses to Rally

Stock-Markets / Stocks Bear Market Mar 01, 2009 - 09:49 AM GMT

Battle-weary investors remained skeptical of a banking quick fix and endured more grim economic fodder during the past week, causing US stocks to hit their lowest level since 1997. After the worst January (-8.8%) on record, the Dow Jones Industrial Average closed February (-11.7%) in the third worst position, after 1933 (-15.6%) and 1920 (-12.5%).

Battle-weary investors remained skeptical of a banking quick fix and endured more grim economic fodder during the past week, causing US stocks to hit their lowest level since 1997. After the worst January (-8.8%) on record, the Dow Jones Industrial Average closed February (-11.7%) in the third worst position, after 1933 (-15.6%) and 1920 (-12.5%).

As if the recent declines are not bad enough, Chart of the Day points out that in inflation-adjusted terms the Dow has gained only 55% since its 1929 peak and a mere 10% since the 1966 high.

Global stock markets were generally down on the week as summarized by the week's movements of the MSCI Global Index (-2.8%, YTD -18.4%) and the MSCI Emerging Markets Index (-0.6%, YTD -11.9%). In US dollar terms the Russian Trading System Index (+5.3%) and the Hang Seng Index (+0.9%) were two of the markets to record positive returns.

Although still the top performer for the year to date (+14.0%), the Shanghai Composite Index (-8.0%) came under strong selling pressure last week. (Click here to access a complete list of global stock market index movements, in local currency terms, as supplied by Emerginvest .)

Of the major markets the Japanese Nikkei 225 Average closed higher in local currency terms (+2.1%), but failed to do so in US dollar terms (-2.9%) as a result of the sharp decline (-4.7%) of the Japanese yen against the greenback. Japan experienced record capital outflows over the past three months on the back of the country's economy suffering a sharp slowdown, resulting in the yen's worst monthly performance in 13 years.

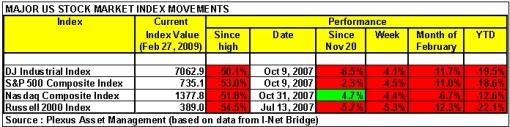

As shown in the table below, the major US indices suffered another torrid week, recording seven losing weeks out of eight in 2009. Also, the Dow's decline marked its sixth consecutive month in the red. Bespoke pointed out that losses during this period (-38.8%) were much larger than in any of the other seven losing streaks of six months or longer.

Click on the table below for a larger image.

US banking regulators last week launched a new Treasury rescue program, known as the Capital Assistance Program. Federal Reserve Chairman Bernanke told lawmakers that, following a stress test of the 19 largest US banks, the Treasury will buy convertible preferred stock in financial institutions that are deemed to be undercapitalized in a “worst-case” economic scenario. He explained that the shares would be converted to common equity only as and when “extraordinary” losses occurred.

A real-world example followed only a few days later in the form of the third attempt to prop up Citigroup (C) in the past five months, with the government converting as much as $25 billion in preferred shares to common stock for an interest of up to 36%.

Bernanke played down the need for the nationalization of banks. However, it remains unclear whether the latest initiatives can avert a nationalization of select beleaguered US banks. BCA Research said: “We are skeptical, given that the private sector appears unwilling to inject further capital, especially at a point when the economy and underlying bank loan collateral values continue to erode rapidly.”

President Obama unveiled his 2010 budget proposal, including another $750 billion in aid to the financial system and $635 billion in spending on an overhaul of the US health-care system, bringing the budget deficit to an unprecedented $1.75 trillion by September 30, 2009. The proposal, which goes to Congress on Thursday, would bring budget spending to 12% of GDP.

“President Obama's desperate plan to float or spend us out of this bear market is not impressing Wall Street,” said Richard Russell ( Dow Theory Letters ). “The Street is not thinking about job creation, it's thinking about trillion-dollar deficits - and whether the banks can remain solvent, and whether the dollar is viable.”

Supply concerns - $94 billion in the case of Treasuries last week - pushed government bond yields higher in the US, UK and Germany. Yields of 10-year Treasuries (see graph below), Bunds and Gilts were up by 25, 11 and 20 basis points respectively. “There is no conceivable way to pay for the [US government's] coming debt. That's why the Chinese are angry and weary,” said Bill King .

Source: StockCharts.com

Commenting on the federal government's actions to resolve the economic crisis, MarketWatch reported Warren Buffett telling Berkshire Hathaway (BRKA, BRKB) shareholders on Saturday: “Economic medicine that was previously meted out by the cupful has recently been dispensed by the barrel. These once-unthinkable dosages will almost certainly bring on unwelcome aftereffects.”

On the Exchange Traded Fund (ETF) front, John Nyaradi ( Wall Street Sector Selector ) reports that US Oil (USO) (+11.1%) led the way last week, followed by all things “short” like ProShares Short QQQ (PSQ) (+4.5%) and Short S&P 500 (SH) (+4.5%). The biggest loser was Silver (SLV), giving back 9.6%. Gold (GLD) (-5.8%) also retreated, but remained above its 50- and 200-day moving averages.

The “ETF of the Month”, the top-performing non-leveraged exchange-traded fund for February was Short Dow30 ProShares (DOG), gaining 11.6%.

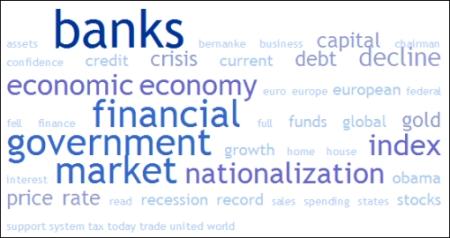

Next, a tag cloud of all the articles I have read during the past week. This is a way of visualizing word frequencies at a glance. One could summarize the image in three words: “Banks ad nauseam”!

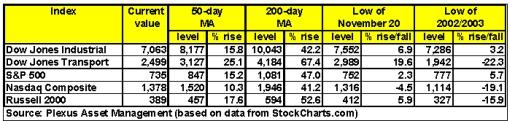

As mentioned above, the Dow and S&P 500 are at 12-year lows, having breached the November 20, 2008 and October 2002 lows, as shown in the columns on the right-hand side of the table below. Interestingly, Bob Farrell, retired Merrill Lynch strategist, said that many market bottoms have been made when the major market indices have violated previously “well-advertised” lows. He called such occurrences “undercut lows” and thought they had a pretty good chance of holding most of the time. (Hat tip: Jeff Saut .)

The number of S&P 500 stocks trading above their respective 50-day moving averages has declined to 11% from 81% at the beginning of 2009, as shown in the chart below. In order to be bullish about the secondary trend, one would expect the majority of stocks to be above the 50-day line. For a primary uptrend to manifest itself, the bulk of the index constituents also need to trade above their 200-day averages. This is a slow indicator, but the number at the moment is still a very low 2.2%.

Source: StockCharts.com

Commenting on the fact that most indicators seem to signal an oversold condition, Richard Russell said: “Technically, if the market isn't poised to rally now, when will it ever rally? Despite the depressing newspaper headlines, the technical picture of the Dow now is one of being super-oversold. Investor sentiment is on the verge of being demoralized. The weakest kind of market is a severely oversold market that refuses to rally. Sad to say, that's what we have now.”

John Mauldin, in his latest Thoughts from the Frontline newsletter entitled “Buy and Hope Investing”, said: “Given the nature of what could be a negative environment for earnings in the second quarter, there could be one more leg to this bear market. Though I must admit that I am surprised we haven't seen some type of tradable rally. I thought the money coming back into the market from hedge fund redemptions might have been a boost, but evidently it has not been. Caution is the word today.”

For those of you not familiar with Mauldin's latest project, it is called “Conversations with John Mauldin”. The first Conversation was with Ed Easterling and Lacy Hunt, the current one is with Nouriel Roubini, and the one after that with Chris Whalen and some real bank people. Audios and transcripts of the conversations are being produced. Although an annual subscription for a dozen Conversations retail at $199, I have negotiated a special price of $109 (-45%) for readers of Investment Postcards . To find out more, just click here and put in code JM55 (at the end of the form), which will give you the discounted price.

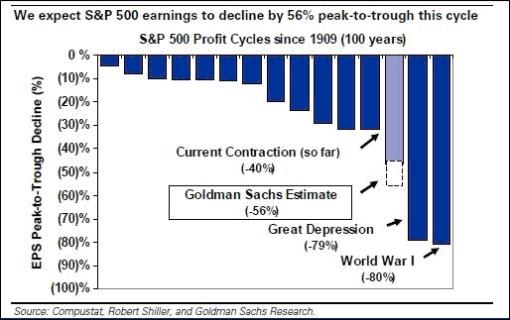

On the topic of earnings, the cheery chart below is from David Kostin of Goldman Sachs (via FT Alphaville ), who has just slashed his S&P earnings forecast.

Standard & Poor's estimated GAAP (or “as reported”) earnings of 32.4 cents for the S&P 500 for calendar year 2009 (2008: 26.2 cents) implies a ten-month prospective P/E ratio of 22.7.

Another way of looking at valuation levels, and cutting through the uncertainty of having to forecast earnings, is by means of Robert Shiller 's cyclically adjusted price-earnings ratio (CAPE), effectively muting the impact of the business cycle by averaging ten years of earnings. According to Tech Ticker, Yahoo Finance , Shiller's P/E is now under 14 (compared to a long-term average of about 15), but is has dropped to below 10 at major market lows in the past. That could happen either through an additional severe drop in prices or a long period in which the market moves sideways and earnings grow again.

And finally on the stock market, in an interview with CNN Money , Jeremy Grantham draws comparisons to 1974 and 1982, when the S&P 500 lost roughly half its value. Since he estimates the current S&P 500 fair value at 900, Grantham puts his worst-case bottom at a hair-raising 450. Still, he is on a strict, slow schedule to invest as valuations dip even lower. “If you don't have a schedule for investing, you will not do it,” he says. “When the market goes down, it reinforces the hoarding of cash. By the bottom, you suffer what we called in 1974 terminal paralysis - you cannot pull the trigger. Almost everyone who avoids the great pain is very slow to get back.”

For more discussion about the direction of stock markets, also see my recent posts “ Jeremy Grantham: Beware of terminal paralysis ” and “ Video-o-rama: Let's move beyond the ‘N' word “. (And do make a point of listening to Donald Coxe's weekly webcast, which can be accessed from the sidebar of the Investment Postcards site.)

Reminder

Back to Richard Russell, octogenarian author of the 52-year-old Dow Theory Letters . John Mauldin ( Thoughts from the Frontline ) is organizing a “Richard Russell Tribute Dinner” for April 4 in San Diego. This will be a night of memories and good fun with fellow writers and long-time readers of Richard's newsletter. I will be making the 34-hour trip from Cape Town and would encourage you, if at all possible, also to attend this very special event. You can register here .

Economy

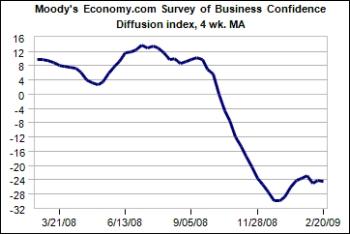

“There is no respite from the dark pessimism overhanging global businesses. Sentiment regarding sales, hiring and investment remains extraordinarily poor,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . “Most worrisome is the recent collapse in pricing power; a record over one-third of respondents now say they are cutting prices for their goods and services.”

“I don't remember any time, maybe even in the Great Depression, when things went down quite so fast, quite so uniformly around the world,” Volcker told a group of economists and investors during a luncheon at Columbia University. Volcker noted that industrial production across the globe was declining even more rapidly than in the United States, according to Reuters .

In interviews with Business New Europe and Bloomberg , Nouriel Roubini ( RGE Monitor ) turned his attention to trouble at European banks that are too big to fail but too big to be saved by their home country. Foreign bank ownership exposed large European banks to Central and Eastern Europe (the CEE), where Latvia, Estonia, Lithuania, Hungary, Belarus and Ukraine pose major weak spots.

Roubini believes the European banking system may need a region-wide rescue effort to contain and resolve the financial turmoil. A “European Stabilization and Integration Program” will be discussed on March 1 at a European Union summit, reported Bloomberg .

A snapshot of the week's US economic data is provided below. (Click on the dates to see Northern Trust 's assessment of the various data releases.)

February 27

• Decline in economic activity larger than advance GDP estimate

February 26

• New home sales point to deepening economic malaise

• Orders of durable goods plunge

• Jobless claims paint bleak picture

February 25

• Existing home sales maintain downward trend

February 24

• Chairman Bernanke places emphasis on financial stability

• Loan delinquency and charge-offs rise in Q4 2008

• S&P/Case-Shiller - home prices continue to decline as inventories of unsold homes remain at elevated level

• Consumer Confidence Index records new low

As far as Chairman Bernanke's testimony on monetary policy before the US Senate Banking Committee is concerned, he noted that the “outlook is subject to uncertainty” and the “downside risks probably outweigh those on the upside”. Bernanke pointed out that “a full recovery of the economy from the current recession is likely to take more than two or three years.” He emphasized that continued support from the Fed to complement fiscal stimulus is necessary to “stabilize financial institutions and financial markets”.

Negative economic news has been looming over markets to such an extent in recent times that the few rays of light are easily overlooked. US Global Investors highlighted the two positives below.

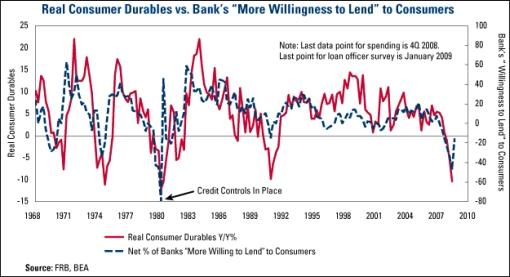

(1) A sign that credit markets are loosening up: Through late February, $229 billion in corporate bonds had been issued this year, up from $150 billion over the same period last year and $172 billion in the first seven weeks of 2007. Credit conditions are also showing incremental improvement as the percentage of banks more willing to lend to consumers continues to improve, as the chart below shows.

(2) The Citi Financial Conditions Index is also showing marked improvement, which tends to lead economic activity such as auto sales, as indicated in the chart below. (The Index is a weighted composite of corporate credit spreads, mortgage rates, equities, money growth, the US dollar's exchange rate and retail energy costs expressed as standard deviations from trend values.)

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Feb 24 | 9:00 AM | S&P/Case Shiller Home Price Index | Dec | -18.55% | NA | -18.25% | -18.20% |

| Feb 24 | 10:00 AM | Consumer Confidence | Feb | 25.0 | 35.0 | 35.0 | 37.4 |

| Feb 24 | 10:00 AM | Bernanke Monetary Policy Report | Semi | - | - | - | - |

| Feb 25 | 10:00 AM | Bernanke Monetary Policy Report | Semi | - | - | - | - |

| Feb 25 | 10:00 AM | Existing Home Sales | Jan | 4.49M | 4.80M | 4.79M | 4.74M |

| Feb 25 | 10:35 AM | Crude Inventories | 02/20 | - | NA | NA | -138K |

| Feb 26 | 8:30 AM | Durable Goods Orders | Jan | -5.2% | -2.5% | -2.5% | -4.6% |

| Feb 26 | 8:30 AM | Durables, Ex-Tran | Jan | -2.5% | -2.2% | -2.2% | -5.5% |

| Feb 26 | 8:30 AM | Initial Claims | 02/21 | 667K | 625K | 625K | 631K |

| Feb 26 | 10:00 AM | New Home Sales | Jan | 309K | 320K | 324K | 344K |

| Feb 27 | 8:30 AM | GDP -Preliminary | Q4 | -6.2% | -5.0% | -5.4% | -3.8% |

| Feb 27 | 8:30 AM | Chain Deflator-Preliminary | Q4 | 0.5% | -0.1% | -0.1% | -0.1% |

| Feb 27 | 9:45 AM | Chicago PMI | Feb | 34.2 | 33.0 | 33.0 | 33.3 |

| Feb 27 | 10:00 AM | Mich Sentiment-Revised | Feb | 56.3 | 56.0 | 56.0 | 56.2 |

Source: Yahoo Finance , February 27, 2009.

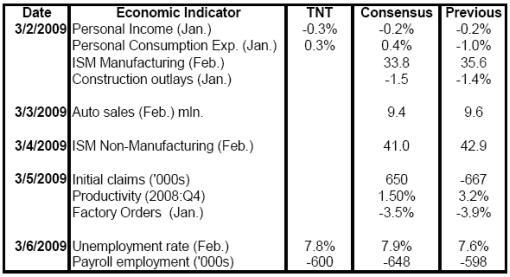

In addition to interest rate announcements by the Bank of England and the European Central Bank (Thursday, March 5), the US economic highlights for the week include the following:

Source: Northern Trust

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

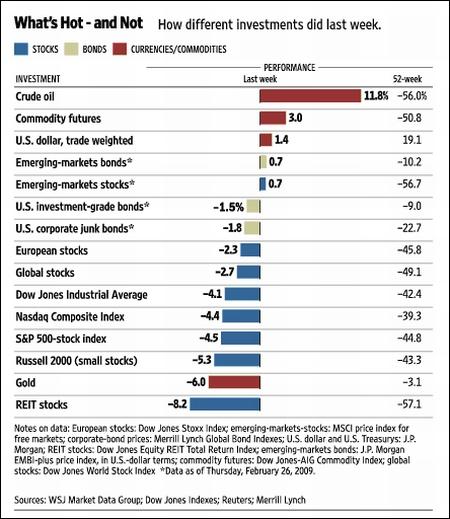

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , February 27, 2009.

“There is no situation so bad that you can't make it worse,” somebody once said. Hopefully the “Words from the Wise” reviews will assist Investment Postcards ‘ readers in preventing their investment returns from going from bad to worse in these troubled times.

That's the way it looks from Cape Town.

Jonathan Jarvis: The crisis of credit visualized

“The goal of giving form to a complex situation like the credit crisis is to quickly supply the essence of the situation to those unfamiliar and uninitiated. This project was completed as part of my thesis work in the Media Design Program , a graduate studio at the Art Center College of Design in Pasadena, California.”

Source: Jonathan Jarvis, Crisisofcredit.com

Reuters: US regulators put big banks to deep recession test

“US banking regulators on Wednesday launched a ‘stress test' program to assess the largest banks' ability cope with the possibility of a deeper recession in which the unemployment rate climbs above 10% next year.

“The stress tests, mandatory for the roughly 20 institutions with over $100 billion in assets, will be used to determine whether the banks need more capital from a new US Treasury program for government preferred stock investments that can be converted into common equity.

“The new Treasury program, known as the Capital Assistance Program, will be placed alongside a previous program that has injected nearly $200 billion into banks since last October. Both will draw from remaining funds in the Treasury's $700 billion financial rescue fund.

“The stress tests, to be conducted by end of April by the Federal Reserve, the Federal Deposit Insurance Corp, the Office of the Comptroller of the Currency and the Office of Thrift Supervision, will measure banks against two economic scenarios.

“The first, or ‘baseline', scenario is based on the consensus of private economic forecasters. The second, or ‘more adverse', outlook anticipates a longer and deeper recession.

“News of the test details, which were not as onerous as some analysts had expected, sparked a brief late rally in financial shares, but many sank back on comments by President Barack Obama calling for sweeping regulatory reform on Wall Street.

“Under the stress test program, regulators will conduct ‘an assessment of all these banks to try and figure out how much capital they need to meet even that weaker scenario,' Federal Reserve Chairman Ben Bernanke told the US House of Representatives Financial Services Committee on Wednesday.

“Bernanke said banks will first have the opportunity to try to raise capital in the private market, but if they cannot do so, the Treasury will offer to buy convertible preferred shares in the bank.

“If losses grow, this can be converted to common equity, giving the government a direct ownership stake and enhancing the bank's ability to absorb write-downs.”

Source: David Lawder, Reuters , February 25, 2009.

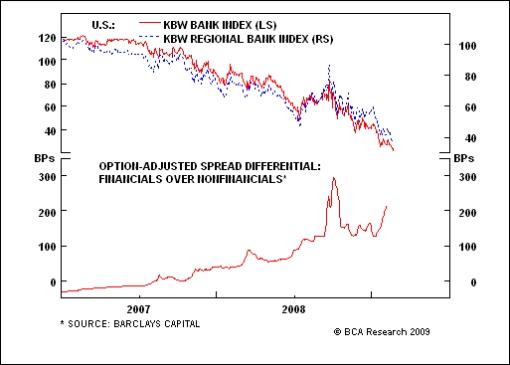

BCA Research: US authorities - trying to avoid bank nationalization

“Monday's statement by the Treasury, FDIC, OCC, OTS and the Federal Reserve underscores authorities' desire to keep major US banks in the hands of the private sector. We remain skeptical they can succeed.

“Policymakers will begin stress testing banks this week. Those that require additional capital, but are unable to raise it from private sources, will receive an injection from a temporary capital buffer made available from the government. This capital injection will be in the form of mandatory convertible preferred shares, which would be converted into common equity as needed over time to keep banks in a well-capitalized position.

“Clearly, the government remains hopeful that banks will be able to source private capital, that any government capital injected will be on a temporary basis, and that wholesale conversion of preferred equity into common can be avoided (by allowing banks to retire the convertible preferred shares before conversion is mandatory).

“We are skeptical, given that the private sector appears unwilling to inject further capital, especially at a point when the economy and underlying bank loan collateral values continue to erode rapidly.

“Moreover, it is yet to be seen if authorities can convince taxpayers why this approach serves their interests better than nationalization. For investors, another critical point is that the statement referred to ‘systemically important financial institutions' which appears to exclude smaller regional banks.

“Bottom line: It remains unclear whether the latest initiatives can avert a nationalization of select beleagured US banks.”

Source: BCA Research , February 24, 2009.

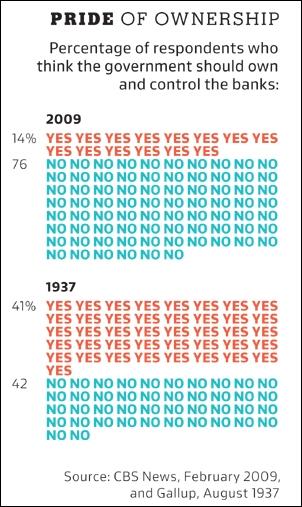

Paul Kedrosky (Infectious Greed): Nationalization - Depression polls versus today

“Comparing polling views on bank nationalization now and back in the Depression, courtesy of a David Leonhardt piece in this weekend's NYT Magazine on various ways to get to the same nationalization place.”

Source: Paul Kedrosky, Infectious Greed , February 26, 2009.

ABS News: Roundtable - Krugman and Roubini discussing nationalization of banks

Source: ABC News , February 22, 2009.

David Reilly (Bloomberg): Bank nationalization is done deal, let's move on

“The nationalization debate is a smoke screen. We've already nationalized the big banks. Let's just accept it and move on.

“Once that happens, the government can give investors clarity on whether nationalization will do more than dilute shareholders' common stock. It can stop wasting time trying to fashion support mechanisms that don't give the appearance of ownership. And it can get about the business of forcing weak banks into the hands of the strong, or the Federal Deposit Insurance Corp.

“Instead, the government is trying to craft a plan that ‘uses nationalization to prevent nationalization,' according to a research note Tuesday from Christopher Low, chief economist at FTN Financial. In other words, the government, if it has to take common equity in banks, wants to avoid owning more than 50% so it can sidestep claims of nationalization.

“In the meantime, officials try to bluff their way past the issue. During congressional testimony Tuesday, Federal Reserve Chairman Ben Bernanke said there was no rush toward nationalization. Senate Majority Leader Harry Reid struck a similar note when asked about nationalization in an interview with Bloomberg television Monday, saying there is ‘no need to even talk about it. It's not necessary'.

“No wonder investors are confused and fleeing markets. Fundamental analysis of banks is now nearly impossible; it is all down to government whim. Investors may as well read chicken entrails to divine prospects for bank stocks.

“The government has guaranteed debt issued by the banks, agreed to absorb losses of some of their toxic assets and taken ownership stakes through preferred stock in exchange for emergency cash.

“The government drew another line under the big banks Monday with a statement from bank regulators, the Treasury Department and the Federal Reserve. ‘We reiterate our determination to preserve the viability of systemically important financial institutions,' the government said.

“In other words, it will not let the Big Four fail. If that's the case, the government is certainly in the driver's seat. And as new accounting rules under consideration for off- balance-sheet vehicles make clear, if you control it, it's yours.

“That is why the government, even if it continues to side- step ownership tests, has already nationalized the banks. Semantic contortions designed to ignore this are a waste of time.”

Source: David Reilly, Bloomberg , February 25, 2009.

Barry Ritholtz (The Big Picture): The new N word - nationalization

“OK, so how do we move beyond the N word?

“Instead, why don't we call it by a more accurate, precise, and less scary name: FDIC mandated, pre-packaged Chapter 11, government funded reorganization.

“That is an accurate description of what occurred with Washington Mutual (WAMU) now part of JPM Chase, and Wachovia, now part of Wells Fargo. The Feds step in, seamlessly transfer control of the assets to a new owner, while simultaneously wiping out the debt, the shareholders, and giving a huge haircut to the bondholders.

“Let's look at each of these in turn:

• FDIC mandated: What does that mean? Well, by law, the FDIC is required to handle the liquidation or reorgs of insolvent banking institutions. We have prevented that normal process thru the application of trillions of dollars in bailout monies;

• pre-packaged: The entire process is mapped out in advance so as to make it fast and seamless. WAMU depositors did not notice a single change over the weekend their FDIC mandated, pre-packaged Chapter 11 workout, government funded reorganization occurred. The only observable difference was that WAMU customers were no longer charged an ATM fee when they went to Chase ATMs, as it was now the same company;

• Chapter 11: The full bankruptcy protection applies - meaning employees still get paid, secured creditors do not suffer, and debtor in possession financing (DiP) is available to the bank;

• government funded: The source of the DiP funding;

• reorganization: Just what it sounds like - new board of directors, management transitions out to a new team, recapitalized, bad debt taken off of the books, toxic assets spun out.

“What emerges is a clean bank, no debt, well capitalized, and free of deadly toxic assets. You can see why so many people would find this state of affairs utterly objectionable.

“In all seriousness, I understand the objection by shareholders - already down 90% - who would be wiped out by this. I fail to see the merit in the save-the-banks-at-any-cost arguments so many are proffering and preferring.

“If the choice is between going Swedish or turning Japanese, you can call me Inga …”

Source: Barry Ritholtz, The Big Picture , February 25, 2009.

Bill King (The King Report): Why is Obama, Ben opposing nationalization?

“Why are Ben and solons trying to convince everyone that the nationalization of banks is not an option even though the government owns large chunks of financial firms and guarantees all their obligations?

“As we keep averring, nationalization best protects taxpayers; non-nationalization best protects insiders and elites. It is no surprise that financial industry executives fear nationalization because their equity and stock options would be lost. But is there another reason the Obama, Ben and solons are strenuously opposing outright nationalization?

“Hillary's trip to China, where she begged China to keep buying and holding US debt, provides a clue. Obviously China has pressured the US about its burgeoning debt. But reports are ubiquitous, but not public, that large US investors [like that big bond fund], foreign investors and SWFs that hold nonsecured debt and large equity stakes in troubled financial companies have warned Obama and Ben that if they lose their equity or non-secured debt holdings via nationalization, they will jettison US debt and similar investments.

“The above is a major reason for the severe stock decline that has appeared in February. Another reason is the steady reports from prominent business leaders that have met with WH and cabinet officials and their staffs that express shock at the lack of biz experience, the surfeit of academics and level of arrogance.”

Source: Bill King, The King Report , February 26, 2008.

CNBC: Roubini & Lutnick - banking's transformation

“Nouriel Roubini, RGE Monitor.com, and Howard Lutnick, BGC Partners, discuss the transformation in the banking sector.”

Source: CNBC , February 27, 2009.

Financial Times: US takes 36% stake in Citi

“The US government agreed to become the biggest single shareholder in Citgroup on Friday, in the latest attempt to save the ailing financial group and to shore up the country's banking system, says FT's Francesco Guerrera.”

Source: Financial Times , February 27, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.