Stock Sectors Worth Watching: Food, Gold and Healthcare…

Stock-Markets / Investing 2009 Feb 26, 2009 - 10:09 AM GMTBy: Oxbury_Research

In a bear market, we're always keen to spot anything that's outperforming its peers. Even the strongest stocks and sectors can get beaten down when panic selling or forced selling wreaks havoc on prices. It's a bit like boxing: even the toughest boxer can get rocked with a hard swing to the jaw. What sets apart the truly tough boxers is their ability to bounce right back up and continue the fight.

In a bear market, we're always keen to spot anything that's outperforming its peers. Even the strongest stocks and sectors can get beaten down when panic selling or forced selling wreaks havoc on prices. It's a bit like boxing: even the toughest boxer can get rocked with a hard swing to the jaw. What sets apart the truly tough boxers is their ability to bounce right back up and continue the fight.

We've been discussing gold recently, primarily because it's the most proven store of value over time. You typically don't invest in gold to make money - gold's value is in preserving your wealth even as everything else burns around it.

We mentioned the HUI index last week as a possible investment vehicle, but investing in the HUI is rather awkward unless you like buying or selling rather illiquid index options on the NYSE Amex.

However, there are better ways to get into gold:

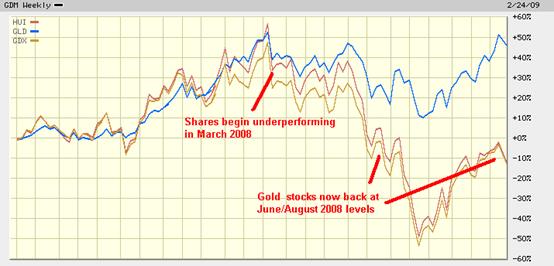

1) GDX: a synthetic HUI options trading vehicle which is actually based on the GDM index (GDM tracks 32 gold and silver stocks, not just the 15 in the HUI, but is to all intents and purposes identical for performance purposes - see the chart below).

2) GLD: a gold-holding fund which tracks the metal itself, rather than gold mining shares.

As you can see, GLD has been outperforming the HUI and GDX for the nearly a year now. That's primarily because equities in general have been getting pounded to one degree or another and even gold stocks were not immune. However, unlike most other sectors, gold stocks have recovered from the worst of the beating and are already back to summertime 2008 levels.

In the face of continued financial chaos (almost a certainty considering government and central banking strategies to solve the ongoing crisis), gold itself (GLD) will definitely rise, as will its associated producers (GDX). In fact, GDX should outperform GLD at some point as miners begin reporting larger profits and more favorable P/E ratios.

But if that doesn't happen immediately, putting a portion of your "wealth preservation" funds into each vehicle would be a prudent hedging strategy. You'll benefit both ways unless the gold bull is truly over, which we don't believe to be the case at all. Even though the price is currently weak, it's a well known bull market strategy to buy the dips.

How long will the weakness last? Who knows? But you can bet that the next government and central bank plan won't do anything to boost the value of the dollar and that will only be good for the yellow metal.

An Appetizing Investment Sector

Some cynics have rightly pointed out that you can't eat gold during a time of crisis, no matter how pretty it looks. That's entirely true, of course. The only gold to pass our lips is the stuff making up the caps on our molars courtesy of the local orthodontist.

So for an investment you can really sink your teeth into, we'd suggest looking at food. In the face of a dire economy and insane monetary policy, it makes sense to buy things that

a) people absolutely have to have, and

b) are tangible products which can't be revalued to zero thanks to government shenanigans

Commodities in general don't look particularly attractive at the moment, although we think they'll be winners for the long term (see other articles on this site for detailed analyses). The fact that the CRB index is continuing to make new lows tells us that we'd like to see some kind of reversal signal before suggesting commodities as a group are destined for an imminent rise.

And we also aren't overwhelmed with the performance of the food industry in general as indicated by the Dynamic Food & Beverage Intellidex Index.

But the 30 companies in the Food and Beverage Index include restaurants and “brand name” companies which we don't anticipate doing well. After all, as this recession/Depression really bites, most people will be looking to cut back on restaurant visits and “expensive” brands in favor of home cooking and generic no-name brands. At least DZF hasn't made a new low recently.

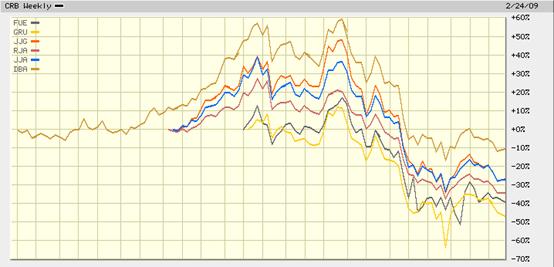

Therefore we did a comparison of several of the best known agricultural ETF's to evaluate their performance over the last while. We realize that “the last while” doesn't sound very precise, but many of these investment vehicles didn't exist even one year ago, as clearly demonstrated by the two year chart below:

The best performer by far is the PowerShares DB Agriculture ETF (DBA) which is equally weighted amongst corn, soybeans, sugar, and wheat.

The worst performer is the MLCX Grains Index ETF (GRU) which is unevenly weighted amongst wheat, corn, soy meal, and soy beans (with the largest holding being wheat).

From these results, it would seem that DBA's equal weighting strategy is superior as a 10% loss over the last two years (including a 60% gain until last summer) is a strong performance amidst the rest of the market carnage. DBA has consistently outperformed all its peers and compares favorably to gold stocks as well.

Good Health In the Biotech Field

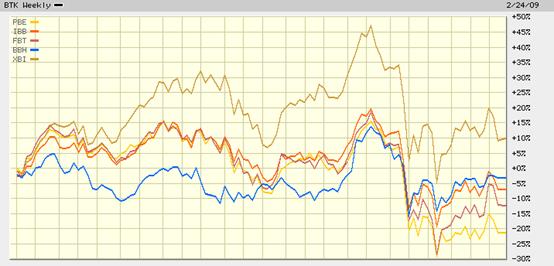

This next sector certainly seems to fly in the face of the ‘back to basics' gold and food theme. But you can't argue with performance and the biotechnology index has been delivering results. Yes, it's still down from where it was, and it failed to break the confluence of its 50-week and 200-week moving averages, but it's up substantially from its lows.

And what's more, the best performing ETF in this sector would still be showing a profit over the last two years. The SPDR Biotech ETF (XBI) is still up 10% and holds healthcare stocks exclusively -- many of them are top performers and the fund's record is clear evidence of an excellent selection strategy.

That's primarily because healthcare is another sector that should do well even in the worst of economic crises. It's simply another basic need we can't live without.

Rather than take the risks of individual biotech stocks, a well-managed ETF such as XBI would be the better investment strategy.

So there you have it: GDX (and/or GLD) for gold, DBA for food and XBI for biotechnology with a healthcare focus.

Good investing,

Disclosure: no positions

Nick Thomas

Analyst, Oxbury Research

Nick Thomas is a seasoned veteran of technical analysis and has mastered all intra-day trading in stocks, options, futures and forex. He prefers to scout investments as one asset class of many and shapes his investment strategies accordingly. He writes extensively about offshore banking and offshore tax havens and is active in the career development field of independent investment research.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.