Global Financial Crisis and the Statue of the Three Lies

Stock-Markets / Credit Crisis 2009 Feb 25, 2009 - 11:17 AM GMTBy: Rob_Kirby

Canada 's Globe and Mail newspaper reporter, Heather Scoffield, interviewed renowned Harvard Economist Niall Ferguson for an article published Feb. 23, 2009 titled, There Will Be Blood . In the interview Ferguson states,

Canada 's Globe and Mail newspaper reporter, Heather Scoffield, interviewed renowned Harvard Economist Niall Ferguson for an article published Feb. 23, 2009 titled, There Will Be Blood . In the interview Ferguson states,

The global crisis is far from over, has only just begun, and Canada is no exception.

While I concur with this assessment, I'm not so sure about some of Ferguson 's remarks on how the U.S. is going to escape this financial tumult much easier than the rest of the world,

While I concur with this assessment, I'm not so sure about some of Ferguson 's remarks on how the U.S. is going to escape this financial tumult much easier than the rest of the world,

“…they can do it at a lower cost than anybody else, because the U.S. retains the safe-haven status, which makes the world so unfair. Here is the world's biggest economy, which gave us subprime mortgages, rampant securitization, the collateralized debt obligation, Lehmann Brothers, Merrill Lynch. It is, in a sense, the fons et origo of this crisis. And yet, because it retains safe-haven status, in a global crisis, investors want to increase their exposure to the U.S. Hence, the dollar rally. Hence 10-year Treasuries down below 3 per cent yields. It's almost paradoxical that an American crisis ... reinforces the status of the United States as a safe haven.”

Mr. Ferguson's comment that investors wanted to increase their exposure to the U.S. is misleading. This was an outcome engineered by the U.S. monetary elites.

Monetary authorities induced highly levered hedge funds, who were long commodities, to liquidate their positions and delever. This forced hedge funds to raise cash U.S. Dollar balances to settle their trades. For example, the engineered collapse in the crude oil complex is chronicled in, Oh Yes They Did!

Hedge fund investment in tangibles – in the face of unprecedented monetary debasement on the part of the U.S. Fed - reached such manic proportions by late 2008 that U.S. Dollar hegemony was threatened.

One should never mistakenly characterize a “forced and engineered” levered long liquidation as a “want” to accumulate a dying fiat currency.

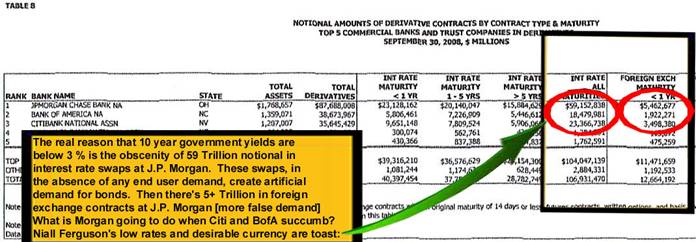

To suggest that 10 yr. bond rates are below 3 % for this “safe haven” reason is misplaced and also false. Sub 3 % ten year interest rates are a product of J.P. Morgan's Interest Rate Derivatives position – 59 Trillion in notional - of their 87 Trillion Overall Derivatives Book:

source: Comptroller of the Currency Q3/08

The nasty details of how interest rate swaps have been utilized by J.P. Morgan [The Federal Reserve in drag] to neuter usury is documented at Kirbyanalytics.com in a paper titled, The Elephant In the Room .

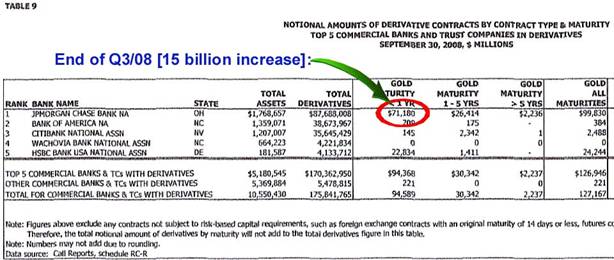

While we're on the topic of J.P. Morgan and their aggregate 87 Trillion Derivatives Book [at Sept. 30, 2008] – we should all remember that our current financial crisis, that slew the likes of AIG, Lehman, Bear Stearns and soon Citi and BofA – these failures were all a direct result of blowups in their OTC derivatives exposure – derivatives exposures which pale in comparison to those held by J.P. Morgan Chase – like their “short” gold position for instance:

source: Comptroller of the Currency Q3/08

So, how is that toxic financial instruments - which have been lethal to so many financial institutions can be held in even greater concentration at J.P. Morgan without the same deleterious, adverse effects????

Likely Answer: It was back in 2006 when Dawn Kopecki reported in BusinessWeek Online in a piece titled, Intelligence Czar Can Waive SEC Rules ,

“President George W. Bush has bestowed on his [then] intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006 , that was opaque to the untrained eye.”

What this means folks, is if J.P. Morgan is deemed to be integral to U.S. National Security – they could be “legally” excused from reporting their true financial condition.

What would you reckon the Vegas odds are on that happening?

The Big Question That No One Dares Ask?

With the walking dead Citibank and BofA both circling the toilet bowl and eying the drain while facing the prospects of impending Fed mandated “stress tests” – is J.P. Morgan now going to “pick up” the cadavers' collective 41+ Trillion in interest rate derivatives and their additional 5+ Trillion in Foreign exchange contracts? That ought to give ole Niall something to ponder even if he doesn't have the cajones to speak or write about it.

Veritas: Plain and Ugly

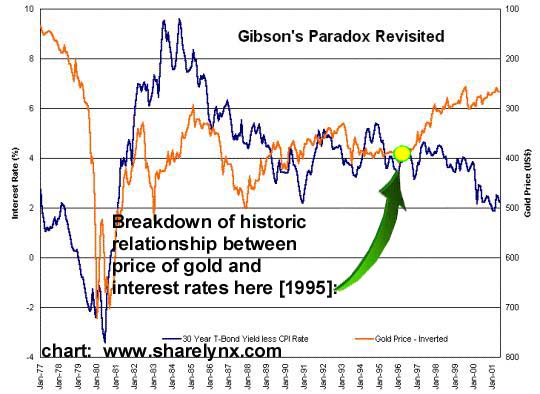

Harvard has been the incubator of other disastrous economic revisionism / chicanery – like Barsky and Summers work / observations on Gibson's Paradox. It was this body of economic work which formed the basis of former Treasury Secretary Robert Rubin's “sham” Strong Dollar Policy and the cornerstone of the U.S. government / Fed gold price rigging scheme:

Gibson's Paradox and the Gold Standard" was published in June 1988 in the Journal of Political Economy. In this article, the two Professors observe that in a "truly free market... gold prices will move inversely to real long-term rates, falling when rates rise and rising when they fall." Most interesting is the failure of this relationship to persist post 1995 during Summers' tenure at the Treasury. "During this period, as real rates (30 year T-bond less CPI rate) have declined from the 4% level to near 2%, gold prices have fallen from $400/oz. to around $270 rather than rising toward the $500 level as Gibson's paradox and the model of it constructed by Barsky and Summers indicates they should have."

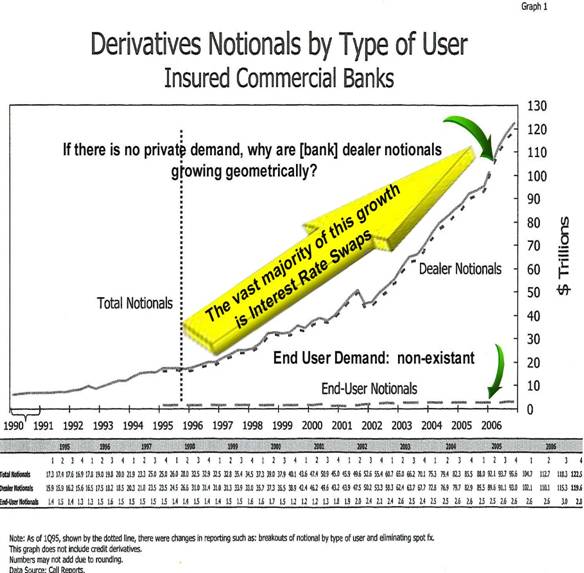

Understand that the decline in “real rates” was largely accomplished with falsified inflation data and just as J.P. Morgan began building their monolithic interest rate swap derivatives position depicted below. Note the timeframe [ 1995 ] cited above with the proliferation of derivatives:

source: Comptroller of the Currency

Like a Bad Smell That Never Goes Away

Before anyone suggests that I'm unjustly berating Harvard, consider the following:

Harvard Watch , in case you don't know, is [was] a group of academics who were formed ostensibly to be the conscience of the ultra secretive Harvard Corporation, whose 7 members have included the likes of Lawrence Summers, Robert Rubin and Dyn Corp.'s Mr. Pug Winokur.

The Harvard Corporation administers the ‘not for profit' [now] 28 billion dollar Harvard Endowment Fund. The largest such pool of capital this side of the Roman Catholic Church. This fund has been intimately linked to such financial fiascos as Bush/Harken Energy and Enron/California energy debacle.

When the Harvard Watch did their own investigations back in 2003 / 2004, here are a few snippets of what they found. In addition to giving guidance, such as choosing outside money managers, to Harvard's 21 billion [at the time] dollar Endowment fund, Pug Winokur was the Chairman of Enron's audit committee.

At the same time one of the Endowment Fund's biggest outside money managers was Highfields Capital. This is a hedge fund run by John Jacobson – a former member of the seven-man Harvard Corp. He left the Corp. in 1996 with 500 million of Harvard money to start his own financial advisory/absolute return fund.

According to Harvard University 1999 tax returns Highfields topped the pay list of advisories at 30 million in management fees for the year. In fact Highfields did so well making money for Harvard, the Harvard Magazine was crowing about the job they did and they were reportedly awarded additional billions of Harvard money to manage.

Now, I'll bet none of you will ever guess how Highfields made their astonishing returns for Harvard in 1999? This long/short fund only had 3 equity shorts (put options). Enron just happened to be the biggest – and the Enron short was 47 times the size of the next biggest short.

Of course, no guilt was ever found implicating Mr. Winokur or Highfields – because the SEC was on the job!! Highfields' 5000 foot grand salami of a homerun simply got chalked up to “pure brilliance”.

Now, for those of you who are not aware; Enron funded research centers at Harvard. This allegedly objective research – incubated at Harvard - was instrumental in legitimizing energy deregulation in California and defending energy industry monoliths against assertions of price manipulation.

Nothing stinky here, eh?

Well, apparently something didn't exactly smell quite right; because it was soon after these facts came to light that Mr. Winokur had sufficiently spread an aroma of his doings about Harvard that his presence was no longer required and he resigned his post to make room for none other than Mr. Robert Rubin. Here's a snippet of the statement the Harvard Watch published at the time regarding the changing of the guard.

“Winokur's departure from the Corporation, however, represents only a first step in cutting Harvard's ties to Enron. There remain multiple Harvard research initiatives funded by and effectively functioning for Enron and its executives. Notable examples include the Harvard Electric Policy Group, the Belfer Center , and the Winokur Public Policy Fund. Moreover, the Harvard Corporation's remaining members include several Enron insiders. D. Ronald Daniel, for instance, was Jeffrey Skilling's boss at McKinsey during the 1980s, when Skilling consulted with Enron to design the energy giant's unsustainable business model. Because of the work of Daniel and Skilling, McKinsey is now a defendant in the largest suit against Enron. Moreover, it is remarkably telling that just as the university prepares to bid farewell to one of the Enron club, it has already announced the entry of another one. Robert Rubin, the Corporation's latest addition, is a director of Citigroup, Enron's largest creditor. Rubin attempted to obtain a Federal bailout for Enron as it approached collapse-while its top executives cashed in on Enron's falling stock and drained the pension funds of thousands of their employees”

Admittedly, the Enron / Gibson's Paradox Harvard guffaws occurred before Niall Ferguson's tenure at Harvard [began in 2004]; but with him being such a sharp economic historian – he probably knew all this stuff anyway.

From Harvard Ironies : The Statue of the Three Lies :

So, the statue [above] supposedly of John Harvard, who founded Harvard College in 1638, is actually a statue of an unknown Harvard student, who represents the real John Harvard, who did not found a college in 1638, but who died in 1638, leaving money for a school that had been founded two years earlier. Rev. Harvard, who was known to be a passionate preacher, intended his gift to support the training of Christian ministers.

Given the current religious state of Harvard University – not exactly a paragon of Christian faith – there's much irony here. But I want to focus for a moment on the deceptions of this statue. Surely they aren't the sorts of lies that ruin lives or nations. Yet I find this statue to be a symbol for the reality of our culture. Whether we recognize it or not, we're swimming in a sea of deceptions.

Sometimes truth is stranger than fiction. You just can't make this stuff up.

Got physical gold yet?

Much more precious metals specific content is contained in the same article for subscribers. Subscribers to Kirbyanalytics.com are educating themselves; not only about the merits of ownership of gold and precious metals – but valuable know-how on the merits of different forms of ownership as well as tips and guidance on the acquisition of physical precious metal.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietary Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.