Stock Market Bears Continue To Feast On Bulls

Stock-Markets / Stocks Bear Market Feb 23, 2009 - 04:33 PM GMT

Monday's market action was not much of a surprise. The DJIA has already closed below the November low last week. While the S&P 500 bounced off its low on Friday, it did not seem like the impetus to start looking for stocks to buy. The one positive for the S&P 500 was that the intraday November low was not breached. That fact does not instill me with a great sense of confidence.

Monday's market action was not much of a surprise. The DJIA has already closed below the November low last week. While the S&P 500 bounced off its low on Friday, it did not seem like the impetus to start looking for stocks to buy. The one positive for the S&P 500 was that the intraday November low was not breached. That fact does not instill me with a great sense of confidence.

The one index still above its November low is the Nasdaq . Compared to the Dow and S&P 500, it has indeed been hanging tough. The Nasdaq currently sits at support in the 1400 area. However, considering recent conditions, all this negativity may be enough to drag it back down.

As can be expected gold is thriving in this environment. I mentioned back in January that Gold was possibly setting up for a big move . GLD should be retesting 100.44 sometime soon. If this move occurs on good volume, expect the run to continue.

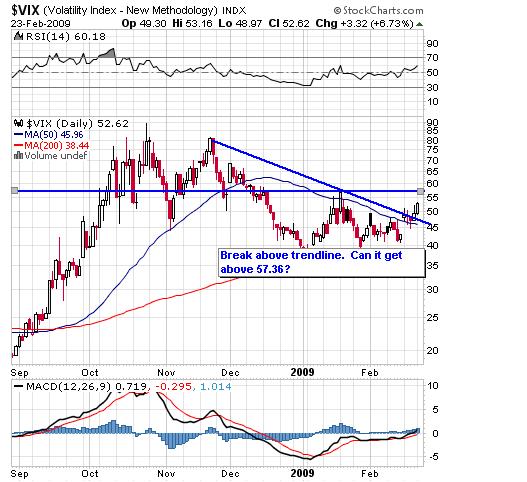

The VIX has been also making some headway. While it has been making lower highs, it recently broke above a trendline and seems poised to keep moving. If it can breach the 55 area and the recent high of 57.36, things could get very ugly.

Is Tuesday going to turn into a “Turnaround Tuesday?” The market is without a doubt oversold at this point. Assuming a rally does kick off, keep in mind that it is a bear market rally until proven otherwise. Having said that, it is still fun to watch!

Positions: None

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

Copyright © 2009 Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.