Stocks Bear Market Rally About to Begin

Stock-Markets / Stocks Bear Market Feb 23, 2009 - 02:46 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend -

Down! The very-long-term cycles have taken over and if they make their lows when expected, the bear market which started in October 2007 should continue until 2012-2014. This would imply that much lower prices lie ahead.

SPX: Intermediate trend - A short-term rally is about to begin, but it will probably take a little longer for the start of one of intermediate trend. Technical signs are becoming favorable in diverse areas of the market.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which determines the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview:

The last newsletter started with "Are the bulls, after a short set-back, regaining dominance? ... The market may be motivated by the potentially bullish news reports which will take place next week, and traders may "sell on the news" and abort the advance before it gets under way." Indeed, this is what happened, and the markets went on to make another down-leg. I mentioned at the time, that the indicators of the hourly SPX chart were overbought and needed to correct, and a clue would be given by the manner in which they corrected. The answer came very quickly and decisively.

On Friday, we again had signs that another short-term low may have been reached, or is about to be reached. And then what? Will it develop into anything significant? If you ask 3 different Elliott Wave analysts, you get 3 different answers about the intermediate position of the market. So let's not rely solely on this analytical method, and look elsewhere as well. My opinion is that we are not quite there yet, and another low in the SPX is probable before we find an intermediate bottom.

Last week, the index came within 13 points of its November low. The Dow Jones Industrials, Transportation, Composite, Financials, and the OEX went beyond theirs. But the Nasdaq -- especially the Nasdaq 100 -- and the Russell 2000 have built up some positive divergence to the large-cap indices by remaining higher, which is a hopeful sign for the bulls that an important low is near.

In market analysis, there is one thing that seems to work fairly consistently in predicting a reversal in the market trend, and that is when divergence occurs between certain indices (such as the positive divergence existing currently between the NDX and SPX) and the divergence between oscillators and price. On Friday, the hourly oscillators showed positive divergence, an indication that we should expect a short-term low.

Also bullish -- as we will see later -- is the fact that there is positive divergence built up in the breadth summation index, and the longer-term sentiment index is giving an increasingly positive reading. Therefore, the bears need to be put on notice that their moment in the sun is not going to last forever and that it is about to be interrupted -- perhaps for quite some time -- before too long.

However, my daily oscillators are simply oversold without divergence. This is why I am not yet convinced that we have started an important up-move.

Let's look at some charts.

What's ahead?

Chart Pattern and Momentum

Since we spoke of the divergence showing up in the hourly chart, let's start with that one. We are looking at a large channel constructed from the 943 high of early January. The dotted lines are parallels drawn from the previous short-term tops in the first rally from Jan. 20. They represent support and resistance lines for the downtrend from 875. As you can see, all supports have been broken except the last one, which was touched on Friday. It produced a rally that has been stopped by the one above it.

There is another (blue) channel within the larger channel. It is divided in two approximately equal parts. Notice how the middle line, so far, has stopped all attempts at going through it in the past 5 days.

Now look at the indicators below. The middle one (o/b-o/s oscillator) was oversold, and the one above (price momentum) showed positive divergence, as well as the one below, which is the A/D oscillator. This gave an indication that we might be coming into a short-term low on Friday. We did get a reversal, but it was stopped by the middle blue line and the dotted line above -- two resistance lines. If we continue going up, we will be faced with the same situation higher, where another blue line and dotted line intersect. Continuing the rally would be an indication that the market is developing strength, and we would look for a challenge: first to the upper blue trend line, and then, to the upper trend line of the larger channel.

But we could make a new low first because of the following reasons:

1. The A/D was still very negative at the end of the day on Friday.

2. Since the index went all the way to the bottom of its blue channel, it is not showing any sign of deceleration, yet!

3. We are in the bottoming window of a short-term cycle which extends into Wednesday, and it may not have bottomed, yet!

4. The structure of the decline from 875 is ambiguous. We may have completed five waves on Friday, or only three with the fifth yet to come.

Clearly, we need some confirmation that a short-term rally has already started. Let's look at the daily chart and see if it shows signs of something more than a short-term move coming.

Here, you can see how insignificant the two channels mentioned above really are within the context of the longer trend. The price action has moved below a long-term (red) trend line to form a channel in which prices have been trading. The channel trend, like the blue channel in the hourly chart above, is divided in two distinct portions and the SPX has been trading in the lower portion since October. There have been several attempts at going through that mid-channel line, all unsuccessful.

Until an intermediate-term low has been made, we will not be able to penetrate that mid-channel line, and the indicators do not show a readiness to do this immediately. We only have the faintest sign of divergence in the histogram (above), but the two lower indicators are only oversold, ready to rebound, but probably not ready for a follow-through. If we do keep on going and move through the dashed line and the former shortterm tops, we would, of course, have to reconsider. Right now, this does not seem likely without more preparation.

Cycles

There is a short-term cycle which was due at some time between Friday and early this week. If it has not yet bottomed, we could see more retracement before we move up to challenge the top of the short-term blue channel.

Where is the 18-mo Hurst cycle? This is not one of my favorites for clarity, and the 9-mo even less. I'm beginning to wonder if they are worth following, or if they really exist at all.

Something else which makes me wonder how much of a rally we can have at this time, is that I believe that the 20-wk cycle is due to make its low in the first few days of March. But this will have to be confirmed by the market.

Projections:

I gave my subscribers step ladder projections for this decline. All have held the SPX back for a little while before it went on to the next one. The last two were 768 and 751. It looks as if the index paused only briefly around 768, and then went on to test 751 before rallying to 770 at the close on Friday. If the cycle makes its low Monday or Tuesday, we could retrace back to 751. If we try to go up, there is severe resistance between 785 and 800 which will need to be overcome, along with the upper trend line of the blue channel.

It is not possible to make anymore valid short-term projections until the short-term low is confirmed, but breaking decisively below 741 could eventually lead to about 650.

Breadth

In spite of the current market weakness, the McClellan Summation Index (courtesy of StockCharts) continues to show a good pattern which could be interpreted as positive relative strength and preparation for an intermediate low. The timing could be when the RSI is oversold.

The daily NYSE A/D MACD is oversold

The hourly A/D is attempting to begin an uptrend.

Market Leaders and Sentiment

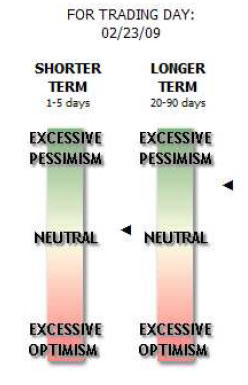

Investor sentiment, as you can see on the graph above (courtesy of Sentimentrader), is neutral short-term and getting more and more bullish longer-term. The long-term reading, in conjunction with other indicators, is saying that we may now be close to an intermediate low.

As mentioned before, the NDX is resisting the decline more and more relative to other market indices, and this is bullish. The Russell 2000 is beginning to do the same, which is also bullish. We will now need to see better action from the banking and financial indices to confirm that we have a low in place.

Summary

There is some ambiguity concerning whether or not a short-term low was made last Friday, or if it will come early this week.

Signs are growing that we are approaching an intermediate low.

The following are examples of unsolicited subscriber comments:

Awesome calls on the market lately. Thank you. D M

Your daily updates have taken my trading to the next level. D

… your service has been invaluable! It's like having a good technical analyst helping me in my trading. SH

I appreciate your spot on work more than you know! M

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.