ECB Dithers as Eastern Europe Bad Debts to Bankrupt European Banks

Economics / Credit Crisis 2009 Feb 21, 2009 - 09:12 AM GMTBy: John_Mauldin

The Risk in Europe

The Risk in Europe- While Rome Burns

- The Euro Back to Parity? Really?

- Back to the Basics

- Living in Paradise

- The 20-Year Horizon

- If I Had a Hammer

When I sit down each week to write, I essentially do what I did nine years ago when I started writing this letter. I write to you, as an individual. I don't think of a large group of people, just a simple letter to a friend. It is only half a joke that this letter is written to my one million closest friends. That is the way I think of it.

This week's letter is likely to lose me a few friends, though. I am going to start a series on money management, portfolio construction, and money managers. It will be back to the basics for both new and long-time readers. I am not sure how long it will take (in terms of weeks), but it is likely to make a few people upset and provoke some strong disagreements. Let's just say this is not stocks for the long run.

And because many of you want some continuing analysis of the current crisis, each week I will throw in a few pages of commentary at the beginning of the letter.

But first, and quickly, I just wanted to take a moment and remind you to sign up for the Richard Russell Tribute Dinner, all set for Saturday, April 4 at the Manchester Grand Hyatt in San Diego -- if you haven't already. This is sure to be an extraordinary evening honoring a great friend and associate of mine, and yours as well. I do hope that you can join us for a night of memories, laughs, and good fun with fellow admirers and long-time readers of Richard's Dow Theory Letter.

A significant number of my fellow writers and publishers have committed to attend. It is going to be an investment-writer, Richard-reader, star-studded event. If you are a fellow writer, you should make plans to attend or send me a note that I can put in a tribute book we are preparing for Richard. And feel free to mention this event in your letter as well. We want to make this night a special event for Richard and his family of readers and friends. So, if you haven't, go ahead and log on to https://www.johnmauldin.com/russell-tribute.html and sign up today. I wouldn't want any of you to miss out on this tribute. I look forward to sharing this evening with all of you.

And now, let's turn our eyes to Europe.

The Risk in Europe

I mentioned last week that European banks are at significant risk. I want to follow up on that point, as it is very important. Eastern Europe has borrowed an estimated $1.7 trillion, primarily from Western European banks. And much of Eastern Europe is already in a deep recession bordering on depression. A great deal of that $1.7 trillion is at risk, especially the portion that is in Swiss francs. It is a story that could easily be as big as the US subprime problem.

In Poland, as an example, 60% of mortgages are in Swiss francs. When times are good and currencies are stable, it is nice to have a low-interest Swiss mortgage. And as a requirement for joining the euro currency union, Poland has been required to keep its currency stable against the euro. This gave borrowers comfort that they could borrow at low interest in francs or euros, rather than at much higher local rates.

But in an echo of teaser-rate subprimes here in the US, there is a problem. Along came the synchronized global recession and large Polish current-account trade deficits, which were three times those of the US in terms of GDP, just to give us some perspective. Of course, if you are not a reserve currency this is going to bring some pressure to bear. And it did. The Polish zloty has basically dropped in half compared to the Swiss franc. That means if you are a mortgage holder, your house payment just doubled. That same story is repeated all over the Baltics and Eastern Europe.

Austrian banks have lent $289 billion (230 billion euros) to Eastern Europe. That is 70% of Austrian GDP. Much of it is in Swiss francs they borrowed from Swiss banks. Even a 10% impairment (highly optimistic) would bankrupt the Austrian financial system, says the Austrian finance minister, Joseph Proll. In the US we speak of banks that are too big to be allowed to fail. But the reality is that we could nationalize them if we needed to do so. (And for the record, I favor nationalization and swift privatization. We cannot afford a repeat of Japan's zombie banks.)

The problem is that in Europe there are many banks that are simply too big to save. The size of the banks in terms of the GDP of the country in which they are domiciled is all out of proportion. For my American readers, it would be as if the bank bailout package were in excess of $14 trillion (give or take a few trillion). In essence, there are small countries which have very large banks (relatively speaking) that have gone outside their own borders to make loans and have done so at levels of leverage which are far in excess of the most leveraged US banks. The ability of the "host" countries to nationalize their banks is simply not there. They are going to have to have help from larger countries. But as we will see below, that help is problematical.

Western European banks have been very aggressive in lending to emerging market countries worldwide. Almost 75% of an estimated $4.9 trillion of loans outstanding are to countries that are in deep recessions. Plus, according to the IMF, they are 50% more leveraged than US banks.

Today the euro rallied back to $1.26 based upon statements from German authorities that were interpreted as a potential willingness to help out non-German (in particular, Austrian) banks.

However, this more sobering note from Strategic Energy was sent to me by a reader. It nicely sums up my concerns:

"It is East Europe that is blowing up right now. Erik Berglof, EBRD's chief economist, told me the region may need €400bn in help to cover loans and prop up the credit system. Europe's governments are making matters worse. Some are pressuring their banks to pull back, undercutting subsidiaries in East Europe. Athens has ordered Greek banks to pull out of the Balkans.

"The sums needed are beyond the limits of the IMF, which has already bailed out Hungary, Ukraine, Latvia, Belarus, Iceland, and Pakistan -- and Turkey next -- and is fast exhausting its own $200bn (€155bn) reserve. We are nearing the point where the IMF may have to print money for the world, using arcane powers to issue Special Drawing Rights. Its $16bn rescue of Ukraine has unravelled. The country -- facing a 12% contraction in GDP after the collapse of steel prices -- is hurtling towards default, leaving Unicredit, Raffeisen and ING in the lurch. Pakistan wants another $7.6bn. Latvia's central bank governor has declared his economy "clinically dead" after it shrank 10.5% in the fourth quarter. Protesters have smashed the treasury and stormed parliament.

"'This is much worse than the East Asia crisis in the 1990s,' said Lars Christensen, at Danske Bank. 'There are accidents waiting to happen across the region, but the EU institutions don't have any framework for dealing with this. The day they decide not to save one of these one countries will be the trigger for a massive crisis with contagion spreading into the EU.' Europe is already in deeper trouble than the ECB or EU leaders ever expected. Germany contracted at an annual rate of 8.4% in the fourth quarter. If Deutsche Bank is correct, the economy will have shrunk by nearly 9% before the end of this year. This is the sort of level that stokes popular revolt.

"The implications are obvious. Berlin is not going to rescue Ireland, Spain, Greece and Portugal as the collapse of their credit bubbles leads to rising defaults, or rescue Italy by accepting plans for EU "union bonds" should the debt markets take fright at the rocketing trajectory of Italy's public debt (hitting 112pc of GDP next year, just revised up from 101pc -- big change), or rescue Austria from its Habsburg adventurism. So we watch and wait as the lethal brush fires move closer. If one spark jumps across the eurozone line, we will have global systemic crisis within days. Are the firemen ready?"

While Rome Burns

I hope the writer is wrong. But the ECB is dithering while Rome burns. (Or at least their banking system is -- Italy's banks have large exposure to Eastern Europe through Austrian subsidiaries.) They need to bring rates down and figure out how to move into quantitative easing. Europe is at far greater risk than the US.

Great Britain and Europe as a whole are down about 6% in GDP on an annualized basis. The Bank Credit Analyst sent the next graph out to their public list, and I reproduce it here. (www.bcaresearch.com) In another longer report, they note that the UK, Ireland, Denmark, and Switzerland have the greatest risk of widespread bank nationalization (outside of Iceland). The full report is quite sobering. The countries on the bottom of the list are also in danger of having their credit ratings downgraded.

This has the potential to be a real crisis, far worse than in the US. Without concerted action on the part of the ECB and the European countries that are relatively strong, much of Europe could fall further into what would feel like a depression. There is a problem, though. Imagine being a politician in Germany, for instance. Your GDP is down by 8% last quarter. Unemployment is rising. Budgets are under pressure, as tax collections are down. And you are going to be asked to vote in favor of bailing out (pick a small country)? What will the voters who put you into office think?

We are going to find out this year whether the European Union is like the Three Musketeers. Are they "all for one and one for all?" or is it every country for itself? My bet (or hope) is that it is the former. Dissolution at this point would be devastating for all concerned, and for the world economy at large. Many of us in the US don't think much about Europe or the rest of the world, but without a healthy Europe, much of our world trade would vanish.

However, getting all the parties to agree on what to do will take some serious leadership, which does not seem to be in evidence at this point. The US almost waited too long to respond to our crisis, but we had the "luxury" of only needing to get a few people to agree as to the nature of the problems (whether they were wrong or right is beside the point). And we have a central bank that could act decisively.

As I understand the European agreement, that situation does not exist in Europe. For the ECB to print money as the US and the UK (and much of the non-EU developed world) will do, takes agreement from all the member countries, and right now it appears the German and Dutch governments are resisting such an idea.

As I write this (on a plane on my way to Orlando) German finance minister Peer Steinbruck has said it would be intolerable to let fellow EMU members fall victim to the global financial crisis. "We have a number of countries in the eurozone that are clearly getting into trouble on their payments," he said. "Ireland is in a very difficult situation.

"The euro-region treaties don't foresee any help for insolvent states, but in reality the others would have to rescue those running into difficulty."

That is a hopeful sign. Ireland is indeed in dire straits, and is particularly vulnerable as it is going to have to spend a serious percentage of its GDP on bailing out its banks.

It is not clear how it will all play out. But there is real risk of Europe dragging the world into a longer, darker night. Their banks not only have exposure to our US foibles, much of which has already been written off, but now many banks will have to contend with massive losses from emerging-market loans, which could be even larger than the losses stemming from US problems. Plus, they are more leveraged. (This was definitely a topic of "Conversation" this morning when I chatted with Nouriel Roubini. See more below.)

The Euro Back to Parity? Really?

I wrote over six years ago, when the euro was below $1, that I thought the euro would rise to over $1.50 (it went even higher) and then back to parity in the middle of the next decade. I thought the decline would be due to large European government deficits brought about by pension and health care promises to retirees, and those problems do still loom.

It may be that the current problems will push the euro to parity much sooner, possibly this year. While that will be nice if you want to vacation in Europe, it will have serious side effects on international trade. It clearly makes European exporters more competitive with the rest of the world, and especially the US. It also means that goods coming from Asia will cost more in Europe, unless Asian countries decide to devalue their currencies to maintain an ability to sell into Europe, which of course will bring howls from the US about currency manipulation. It is going to put pressure on governments to enact some form of trade protectionism, which would be devastating to the world economy.

Large and swift currency swings are inherently disruptive. We are seeing volatility in the currency markets unlike anything I have witnessed. I hope we do not see a precipitous fall in value of the euro. It will be good for no one. It is a strange world indeed when the US is having such a deep series of problems, the Fed and Treasury are talking about printing a few trillion here and a few trillion there, and at the very same time we see the dollar AND gold rising in value. Which all serves as a good set-up to the next section.

Back to the Basics

"Stocks for the long run" has been weighed in the balance in Baby Boomers' retirement accounts all over the world and has been found wanting. The S&P 500 is now roughly where it was 12 years ago, although earnings in 1997 were higher than those projected for 2009. The Dow closed at 7466 on Thursday, a six-year low, giving all those who follow Dow Theory a clear bear market signal, suggesting there is more pain ahead.

In 1997 I was a young 49. For me to make the advertised 8% average annual returns in my equity portfolio, the Dow would have had to go on a tear for the next 8 years. 8% compound from 1997 would have the Dow well over 30,000 now. Remember those silly books which predicted such nonsense? (Seriously, what statistically flawed analysis, yet people bought it.) Now the market would have to do 18% a year for the next 8 years to get to 30,000. Anyone want to make that bet? Let's look at a few paragraphs I wrote in Bull's Eye Investing.

Living in Paradise

Would you like to live in paradise? There's a place where the average daily temperature is 66 degrees, rainy days only occur on average every five days, and the sun shines most of the time.

Welcome to Dallas, Texas. As most know, however, the weather in Dallas doesn't qualify as climate paradise. The summers begin their ascent almost before spring arrives. On some days the buds almost wilt before turning into blooms. During the lazy days of summer, the sun frequently stokes the thermometer into triple digits, often for days on end. There are numerous jokes about the Devil, hell, and Texas summers.

Once winter arrives, some days are mild -- perfect golf weather. Yet the next day might be frigid, with snow or the occasional ice storm. That's good for business at the local auto body shops, though it makes for sleepless nights for the insurance companies. Certainly the winters don't match the chilly winds of Chicago or the blizzards of Buffalo, but Dallas is far from paradise as its seasons ebb and flow.

For the year though, the average temperature is paradisical.

Contrary to the studies that show investors they can expect 7% or 9% or 10% by staying in the market for the long run, the stock market isn't paradise either. Like Texas summers, the stock market often seems like the anteroom to investment hell.

Historically, average investment returns over the very long term (we're talking 40-50-70 years) have been some of the best available, but the seasons of the stock market tend to cycle with as much variability as Texas weather. The extremes and the inconstancies are far greater than most realize. Let's examine the range of variability to truly appreciate the strength of the storms.

In the 103 years from 1900 through 2002, the annual change for the Dow Jones Industrial Average reflects a simple average gain of 7.2% per year. During that time, 63% of the years reflect positive returns, and 37% were negative. Only five of the years ended with changes between +5% and +10% -- that's less than 5% of the time. Most of the years were far from average -- many were sufficiently dramatic to drive an investor's pulse into lethal territory!

Almost 70% of the years were "double-digit years," when the stock market either rose or fell by more than 10%. To move out of "most" territory, the threshold increases to 16% -- half of the past 103 years end with the stock market index either up or down more than 16%!

Read those last two paragraphs again. The simple fact is that the stock market rarely gives you an average year. The wild ride makes for those emotional investment experiences which are a primary cause of investment pain.

The stock market can be a very risky place to invest. The returns are highly erratic; the gains and losses are often inconsistent and unpredictable. The emotional responses to stock market volatility mean that most investors do not achieve the average stock market gains, as numerous studies clearly illustrate.

Not understanding how to manage the risk of the stock market, or even what the risks actually are, investors too often buy high and sell low, based upon raw emotion. They read the words in the account-opening forms that say the stock market presents significant opportunities for losses, and that the magnitude of the losses can be quite significant. But they focus on the research that says, "Over the long run, history has overcome interim setbacks and has delivered an average return of 10% including dividends" (or whatever the number du jour is. and ignoring bad stuff like inflation, taxes, and transaction costs).

The 20-Year Horizon

But how long is the "long run"? Investors have been bombarded for years with the nostrum that one should invest for the "long run." This has indoctrinated investors into thinking they could ignore the realities of stock market investing because of the "certain" expectation of ultimate gains.

This faulty line of reasoning has spawned a number of pithy principles, including: "No pain, no gain," "You can't participate in the profits if you are not in the game," and my personal favorite, "It's not a loss until you take it."

These and other platitudes are often brought up as reasons to leave your money with the current management which has just incurred large losses. Cynically restated: why worry about the swings in your life savings from year to year if you're supposed to be rewarded in the "long run"? But what if history does not repeat itself, or if you don't live long enough for the long run to occur?

For many, the "long run" is about 20 years. We work hard to accumulate assets during the formative years of our careers, yet the accumulation for the large majority of us seems to become meaningful somewhere after midlife. We seek to have a confident and comfortable nest egg in time for retirement. For many, this will represent roughly a 20-year period.

We can divide the 20th century into 88 twenty-year periods. Though most periods generated positive returns before dividends and transaction costs, half produced compounded returns of less than 4%. Less than 10% generated gains of more than 10%. The P/E ratio is the measure of valuation reflected in the relationship between the price paid per share and the earnings per share ("EPS"). The table below reflects that higher returns are associated with periods during which the P/E ratio increased, and lower or negative returns resulted from periods when the P/E declined.

Look at the table above. There were only nine periods from 1900-2002 when 20-year returns were above 9.6%, and this chart shows all nine. What you will notice is that eight out of the nine times were associated with the stock market bubble of the late 1990s, and during all eight periods there was a doubling, tripling, or even quadrupling of P/E ratios. Prior to the bubble, there was no 20-year period which delivered 10% annual returns.

Why is that important? If the P/E ratio doubles, then you are paying twice as much for the same level of earnings. The difference in price is simply the perception that a given level of earnings is more valuable today than it was 10 years ago. The main driver of the last stock market bubble, and every bull market, is an increase in the P/E ratio. Not earnings growth. Not anything fundamental. Just a willingness on the part of investors to pay more for a given level of earnings.

Every period of above-9.6% market returns started with low P/E ratios. EVERY ONE. And while not a consistent line, you will note that as 20-year returns increase, there is a general decline in the initial P/E ratios. If we wanted to do some in-depth analysis, we could begin to explain the variation from this trend quite readily. For instance, the period beginning in 1983 had the lowest initial P/E, but was also associated with a two-year-old secular bear, which was beginning to lower 20-year return levels.

Look at the following table from my friend Ed Easterling's web site at www.crestmontresearch.com (which is a wealth of statistical data like this!). You can find many 20-year periods where returns were less than 2-3%. And if you take into account inflation, you can find many 20-year periods where returns were negative!

Look at the 20-year average returns in the table above. The higher the P/E ratio, the lower (in general) the subsequent 20-year average return. Where are we today? As I have made clear in my last two letters, we are well above 20. Today we are over 30, on our way to 45. In a nod to bulls, I agree you should look back over a number of years to average earnings and take out the highs and lows of a cycle. However, even "normalizing" earnings to an average over multiple years, we are still well above the long-term P/E average. Further, earnings as a percentage of GDP went to highs well above what one would expect from growth, which is usually GDP plus inflation. Earnings, as I have documented in earlier letters, revert to the mean. Next week, I will expand on that thought.

And given my thesis that we are in for a deep recession and a multi-year Muddle Through Recovery, it is unlikely that corporate earnings are going to rebound robustly. This would suggest that earnings over the next 20 years could be constrained (to say the least).

In all cases, throughout the years, the level of returns correlates very highly to the trend in the market's price/earnings (P/E) ratio.

This may be the single most important investment insight you can have from today's letter. When P/E ratios were rising, the saying that "a rising tide lifts all boats" has been historically true. When they were dropping, stock market investing was tricky. Index investing is an experiment in futility.

You can see the returns for any given period of time by going to http://www.crestmontresearch.com/content/Matrix%20Options.htm .

Now let's visit a very basic concept that I discussed at length in Bull's Eye Investing. Very simply, stock markets go from periods of high valuations to low valuations and back to high. As we will see from the graphs below, these periods have lasted an average of 17 years. And we have not witnessed a period where the stock market started at high valuations, went halfway down, and then went back up. So far, there has always been a bottom with low valuations.

My contention is that we should not look at price, but at valuations. That is the true measure of the probability of success if we are talking long-term investing.

Now, let me make a few people upset. When someone comes to you and starts showing you charts that tell you to invest for the long run, look at their assumptions. Usually they are simplistic. And misleading. I agree that if the long run for you is 70 years, you can afford to ride out the ups and downs. But for those of us in the Baby Boomer world, the long term may be buying green bananas.

If you start in a period of high valuations, you are NOT going to get 8-9-10% a year for the next 30 years; I don't care what their "scientific studies" say. And yet there are salespeople (I will not grace them with the title of investment advisors) who suggest that if you buy their product and hold for the long term you will get your 10%, regardless of valuations. Again, go to the Crestmont web site, mentioned above. Spend some time really studying it. And then decide what your long-term horizon is.

If I Had a Hammer

Let me be very candid. As the saying goes, if you only have a hammer, the whole world looks like a nail. Many investment professionals only have one tool. They live in a long-only world. If the markets don't go up, they don't make a profit. So, for them the markets are always ready to enter a new bull phase, or stocks are always a good value. That is what they sell, and that's how they make their money. What mutual fund manager would keep his job if he said you should sell his fund? Frankly, it is a tough world.

About half the time they are right. The wind is at their backs and they look very, very good. Genius is a riding market. And then there are those times when it is just no fun to be them OR their clients. Driving to the airport today, I had CNBC on. They had a mutual fund manager on who was talking about why you should ignore the down periods and invest today. He used every hackneyed bromide I have heard and a few new ones. "You have to do it for the long run." "If you aren't invested, you miss the bull when it comes." (Which is SO statistically misleading! Maybe next week I will go at that one!) "Long-term valuations are very good." "The economy looks to turn around in the latter half of the year, so now is the time to buy, as the market anticipates the rebound by six months." Etc. He was selling his book.

Again, back to basics. In terms of valuations, markets cycle up and down over long periods of time. These are called secular cycles. You have bull and bear secular cycles. In a period of a secular bull, the best style of investing is relative value. You are trying to beat the market. These periods start with low valuations, and you can ride the ups and downs with little real worry. Think of 1982 though 1999.

But in secular bear cycles, the best style of investing is absolute returns. Your benchmark is zero. You want positive numbers. It is much harder, and the longer-term returns are probably not going to be as good. But you are growing your capital against the day the secular bull returns. And, as bleak as it looks right now, I can assure you that bull will be back. Some time in the middle of the next decade, maybe a little sooner, we will see the launch of a new secular bull.

Why? Because low valuations act just like a coiled spring. The tighter it gets wound, the more explosive the result. You just have to have patience.

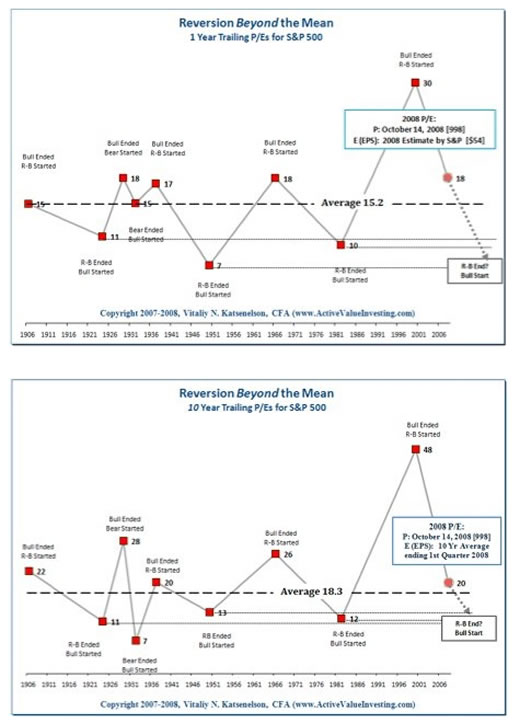

Now let's look at two charts from Vitaliy Katsenelson. They illustrate my basic point: markets go from high valuations to low valuations and then back. The first uses one-year trailing earnings and the second uses a smoothed 10-year trailing earnings stream. But however you look at them, you see a very clear cycle. By the way, the one-year chart is a few months old, so the numbers would look even worse after the horrific earnings from the 4th quarter of last year.

It is time to hit the send button. Next week, we will look at a very simple method for timing the markets within the cycles, which can help you avoid the real downturns. While it may seem obvious that avoiding bear markets will do wonders for your portfolio, a lot of investment professionals say you can't do it. To that I politely say, garbage.

The tables above clearly lay out how you can time the markets in broad patterns. You can't pick the absolute highs and lows, but you don't need to. You just need to know the direction of the wind and where you want to sail.

New York, Las Vegas, and La Jolla

I will be in New York in mid-March. Details are firming up. Then it's Doug Casey's "Crisis & Opportunity Summit," March 20-22 in Las Vegas, where I get to be the resident bull! Click to learn more about the Summit.

I will then go to La Jolla for my own Strategic Investment Conference, April 2-4. It is sold out, but as I mentioned at the top of the letter, you can still get tickets to the Richard Russell Tribute Dinner.

And allow me a quick commercial. Not all money managers and funds have had losses last year, though it may seem like it. My partners around the world can introduce you to some alternative funds, commodity funds, and managers that you may find of interest as you rebalance your portfolio this year. You owe it to yourself to check them out.

If you are an accredited investor (net worth roughly $1.5 million), you should check out my partners in the US, Altegris Investments (based in La Jolla) and my London partners (covering Europe), Absolute Return Partners. If you are in South Africa, my partner there is Plexus Asset Management. You can go to www.accreditedinvestor.ws and fill out the form, and someone from their firms will be in touch. All three shops specialize in alternative investments like hedge funds and commodity funds, on a very selective basis. We will soon be announcing new partners in other parts of the world. And if you are an advisor or broker, you should call them (or fill out the form) and find out how you can plug your clients into their network of managers.

If your net worth is less than $1.5 million, I work with Steve Blumenthal and his team at CMG. I suggest you go to his website, register, and then let them show you what the blend of active managers on his platform would have done over the past few months and years. These are primarily managers who will trade a managed account (using various proprietary styles) in your name, and they are quite liquid. Again, if you are an advisor or broker and would like to see the managers on the CMG platform and how you can access them for your clients, sign up and let Steve and his team know you are in the business. The link is http://www.cmgfunds.net/public/mauldin_questionnaire.asp.

If you are still here, I assume that you are still one of my one million closest friends. Have a great week, and take some time to enjoy life.

Your worried about Europe analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2009 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.