Inflation Returns Whilst Stocks Deflate Towards Bear Market Lows

Stock-Markets / Financial Markets 2009 Feb 21, 2009 - 08:54 AM GMT

The Consumer Price Index still reveals inflation... The cost of living in the U.S. rose in January for the first time in six months as gasoline stopped sliding and retailers tried to push through start-of-year increases even as sales slumped.

The Consumer Price Index still reveals inflation... The cost of living in the U.S. rose in January for the first time in six months as gasoline stopped sliding and retailers tried to push through start-of-year increases even as sales slumped.

The consumer price index rose 0.3 percent, as forecast, after dropping 0.8 percent in December, Labor Department figures showed today in Washington. Excluding food and fuel, the so- called core rate climbed 0.2 percent, more than anticipated, reflecting gains in autos, clothing, and medical care.

…but businesses see even more.

The Producer Price Index (PPI) was released yesterday. In it businesses saw their costs go up .8% last month. That means profit margins are being squeezed, since businesses are having a hard time passing along price increases. The PPI measures wholesale costs for unfinished goods.

Sen. Dodd says that banks may be nationalized.

Senate Banking Committee Chairman Christopher Dodd said banks may have to be nationalized for “a short time” to help lenders such as Citigroup Inc. and Bank of America Corp. survive the worst economic slump in 75 years. “I don't welcome that at all, but I could see how it's possible it may happen. I'm concerned that we may end up having to do that, at least for a short time.” The camel's nose is in the tent again.

Will the November low hold?

-- The S&P 500 is less than 30 points from its November low. Dow Theory Guru Richard Russell wrote in his newsletter two days ago that a close in the Dow Jones Industrials below 7552 reconfirms the bear market. It closed yesterday at 7465.95. The Primary Trend is now reconfirmed as bearish, according to Dow Theory.

-- The S&P 500 is less than 30 points from its November low. Dow Theory Guru Richard Russell wrote in his newsletter two days ago that a close in the Dow Jones Industrials below 7552 reconfirms the bear market. It closed yesterday at 7465.95. The Primary Trend is now reconfirmed as bearish, according to Dow Theory.

After the Dow held, closing at 7,556, Russell wrote grudgingly: "If the Fed was ever motivated to manipulate, this would be the perfect time ... I continue to believe the path of least resistance is down. Another day passes with the bear held at bay. "Question -- Do I think manipulation is going on? As far as the Fed is concerned, this is economic war. 'All's fair in love and war.'"

Treasuries are in a tug-of-war.

-- Treasuries rose Friday, pushing yields lower for the first day in three as investors feared government efforts to rescue the financial system may fall short and renewed their appetite for the relative safety of U.S. government debt. Concerns about the deepening global recession and the speculation that a major U.S. bank may be nationalized pushed money back into government bonds.

-- Treasuries rose Friday, pushing yields lower for the first day in three as investors feared government efforts to rescue the financial system may fall short and renewed their appetite for the relative safety of U.S. government debt. Concerns about the deepening global recession and the speculation that a major U.S. bank may be nationalized pushed money back into government bonds.

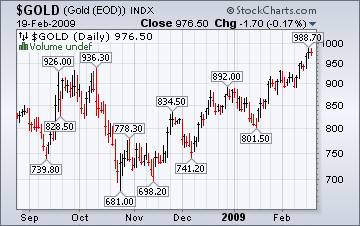

Gold tops $1,000 due to fears of stimulus and inflation.

( Bloomberg ) -- Gold rose to more than $1,000 an ounce in New York for the first time in almost a year as investors, spooked by plunging stocks and a deepening recession, sought to protect their wealth. “One camp of investors is buying gold because of fear the fiscal stimulus packages are insufficient to bring the economy out of recession,” said Peter Fertig , owner of Quantitative Commodity Research Ltd. in Hainburg, Germany. “The other camp fears the stimulus packages will lead to inflation.”

( Bloomberg ) -- Gold rose to more than $1,000 an ounce in New York for the first time in almost a year as investors, spooked by plunging stocks and a deepening recession, sought to protect their wealth. “One camp of investors is buying gold because of fear the fiscal stimulus packages are insufficient to bring the economy out of recession,” said Peter Fertig , owner of Quantitative Commodity Research Ltd. in Hainburg, Germany. “The other camp fears the stimulus packages will lead to inflation.”

The Nikkei slumps even more.

Japanese stocks slumped, sending the Topix index to its lowest close in a quarter century, as Bridgestone Corp.'s forecast rekindled concern the slump in corporate earnings will deepen. The Nikkei has slumped 16 percent this year as government and central bank measures to revive growth failed to quell concerns about the recession and eroding company earnings. Gross domestic product shrank an annualized 12.7 percent last quarter, the sharpest since the 1974 oil crisis.

Japanese stocks slumped, sending the Topix index to its lowest close in a quarter century, as Bridgestone Corp.'s forecast rekindled concern the slump in corporate earnings will deepen. The Nikkei has slumped 16 percent this year as government and central bank measures to revive growth failed to quell concerns about the recession and eroding company earnings. Gross domestic product shrank an annualized 12.7 percent last quarter, the sharpest since the 1974 oil crisis.

Is the Shanghai Index an accident waiting to happen?

-- China's stocks surged 24% this year, fuelling concerns that companies may be using borrowed money to speculate in their own stocks.

-- China's stocks surged 24% this year, fuelling concerns that companies may be using borrowed money to speculate in their own stocks.

As much as 660 billion yuan of new lending may have been converted by companies into term deposits or used to buy equities, Li Huiyong , Shanghai-based analyst at Shenyin Wanguo, said in a phone interview this week. “The reason stocks have rallied in China is because of money supply and loans have grown,” Faber said. “This money hadn't gone into production but into the stock market.”

Strong Dollar driving down commodity prices,

-- Sugar fell, heading for the biggest weekly decline since December, as a deepening recession erodes demand for commodities and investors seek havens in gold and the dollar . Orange juice also declined.

-- Sugar fell, heading for the biggest weekly decline since December, as a deepening recession erodes demand for commodities and investors seek havens in gold and the dollar . Orange juice also declined.

“People are selling pretty much everything today except gold,” said Jack Scoville , a vice president at Price Futures Group in Chicago. “Sugar really can't escape that. Crude oil is down pretty hard, the dollar's pretty strong and people are in fear of the entire world economic system.”

Who are these people, anyway?

In his speech , Obama said his plan "will not help speculators who took risky bets on a rising market and bought homes not to live in but to sell. And it will not reward folks who bought homes they knew from the beginning they would never be able to afford."

In his speech , Obama said his plan "will not help speculators who took risky bets on a rising market and bought homes not to live in but to sell. And it will not reward folks who bought homes they knew from the beginning they would never be able to afford."

It should be fairly easy to identify speculators who bought homes to rent or flip. But how do you prove someone bought a home they knew they couldn't afford? Do people who refinanced several times to pull out equity also qualify?

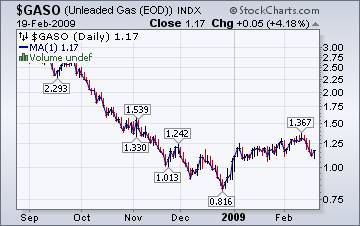

My stats don't agree with the EIA.

The Energy Information Administration reports that, “For the third week in a row, the national average price for regular gasoline increased. The average price rose 3.8 cents to 196.4 cents per gallon. Over the past three weeks, the national average price has increased 12.6 cents, but remains 107.8 cents below the price a year ago and 215 cents below the all-time high set on July 7, 2008.” Apparently their data doesn't agree with ours.

The Energy Information Administration reports that, “For the third week in a row, the national average price for regular gasoline increased. The average price rose 3.8 cents to 196.4 cents per gallon. Over the past three weeks, the national average price has increased 12.6 cents, but remains 107.8 cents below the price a year ago and 215 cents below the all-time high set on July 7, 2008.” Apparently their data doesn't agree with ours.

A surplus of Natural gas in storage keeps prices down.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Natural gas spot prices continue to show considerable weakness, decreasing at all market locations in the Lower 48 States, since Wednesday, February 11. Easing heating demand due to moderating temperatures and declining crude oil prices likely contributed to price declines posted since Wednesday, February 11. However, pricing patterns in the Lower 48 States during the current heating season suggest that natural gas markets are sufficiently supplied to meet consumer demand and have considerable slack at the margin, as prices appear somewhat less responsive to changes in space heating demand compared with recent heating seasons. ”

The Energy Information Agency's Natural Gas Weekly Update reports, “ Natural gas spot prices continue to show considerable weakness, decreasing at all market locations in the Lower 48 States, since Wednesday, February 11. Easing heating demand due to moderating temperatures and declining crude oil prices likely contributed to price declines posted since Wednesday, February 11. However, pricing patterns in the Lower 48 States during the current heating season suggest that natural gas markets are sufficiently supplied to meet consumer demand and have considerable slack at the margin, as prices appear somewhat less responsive to changes in space heating demand compared with recent heating seasons. ”

Rick Santelli rants about the mortgage bailout bill!

I don't know how long the video will stay on the net, but Rick Santelli's rant on CNBC really hit a nerve with a lot of folks. This is a must see. We may see a Chicago Tea Party this summer as a protest against all the antics of the government in an attempt to look like they are doing something to solve the problem when they are creating an even larger monster.

New foreclosure defense: “Prove I owe you.” Homeowners demand lenders produce original documents — some can't. This is the latest stall to buy time when facing foreclosure. In the land of securitized mortgages, the original paperwork is often lost or destroyed. This makes it more difficult for mortgage holders to foreclose. Ultimately, it may only be a delay, since judges will accept copies of the documents which are often stored in electronic files.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.