Will Keynesian Tax Cuts Deepen The Recession?

Economics / Economic Theory Feb 19, 2009 - 01:07 AM GMTBy: Mike_Shedlock

In one of the more ridiculous Keynesian theories to date, Gauti B. Eggertsson at the New York Fed comes to the conclusion Tax Cuts Will Deepen The Recession . Simple logic would dictate that letting people and businesses keep more of their money would be a good thing but amazingly Eggertsson comes to the opposite conclusion.

In one of the more ridiculous Keynesian theories to date, Gauti B. Eggertsson at the New York Fed comes to the conclusion Tax Cuts Will Deepen The Recession . Simple logic would dictate that letting people and businesses keep more of their money would be a good thing but amazingly Eggertsson comes to the opposite conclusion.

The belief is based on a bunch of incomprehensible (to the non-economist) equations such as this one.

I am not going to bother to explain what each symbol means because it is all nonsense. The theory in English suggests

1) Tax cuts will increase aggregate supply

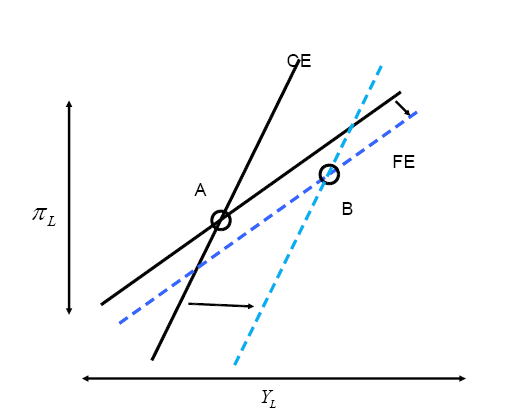

2) Tax cuts will reduce wages according to this chart

I am not going to bother explaining that chart either because the number of assumptions that go into the charts and formulas is staggering. Instead let's skip to the conclusion of the paper.

The main problem facing the model economy I have studied in this paper is insufficient demand. In this light, the emphasis should be on policies that stimulate spending. Payroll tax cuts may not be the best way to get there. The model shows that they can even be contractionary. What should be done according to the model? Traditional government spending is one approach. Another is a commitment to inflate. Ideally the two should be put together.

We are in this mess precisely because consumers spent every cent they had and then some. Now Eggertsson wants consumers to spend more. If they don't spend, then Eggertsson wants government to spend on their behalf. Excuse me but common sense alone would suggest that is spending got us into this mess so spending is not going to get us out of it.

Furthermore, never do any of these Keynesian clowns tell us what is going to happen as soon as the stimulus is taken away. Somehow they believe in a free lunch perpetual motion theory of the economy where spending feeds on itself and we all live happily ever after.

In practice Japan tried that for a decade and it did not work and it did not work in the Great Depression either. A more recent example of the idiocy of fiscal stimulus can be found in 2003 when Greenspan slashed interest rates to 1% fueling the biggest property bubble in the history of the world. That bubble has now imploded and the Keynesian clowns did not learn a damn thing from it.

And as soon as the bridges are fixed and the potholes patched and nothing happens, the Keynesian clowns will be back at it wanting government to spend still more taxpayer money. Not one Keynesian ever has said what happens once the stimulus stops.

Triumph Of Faith Over Reason

Caroline Baum takes the Keynesian clowns to task in Fiscal Stimulus Is a Ruse Absent Fed Pixie Dust

It's a jobs-creation program. No, it's investment in our future.

It's a tax-relief plan. Wait, it provides assistance to consumers hardest hit by the economic recession.

It's legislation to jump-start the economy. No, it's a recovery program. It's a life raft for state and local governments. It's a spending bill.

Which is it? Fiscal stimulus is all things to all people. In other words, it represents the triumph of faith over reason.

When I first learned about fiscal stimulus according to John Maynard Keynes in an introductory economics course, it made a modicum of sense. The idea was that at times when the private sector isn't pulling its weight, the government can step in and spend instead.

It doesn't take an inquiring mind very long to find the flaw in the argument. How exactly does the government get the money to pay for its spending? Neither borrowing (today) nor taxing (tomorrow) increases aggregate demand. All they do is transfer the ability to spend from one entity to another and the timing of that spending from the future to today.

“Empirically, nobody can point to a single Keynesian episode that worked,” says Dan Mitchell, senior fellow at the Cato Institute, a libertarian think tank in Washington.

Attempts to spend their way out of a slump by Herbert Hoover, Franklin Roosevelt, George W. Bush, Japan (in the 1990s) and Europe yielded little in the way of results, Mitchell says. “The only thing Keynesians have ever been able to point to that worked was World War II,” which isn't something we want to repeat.

Left to its own devices, the economy's natural tendency is to grow. That may sound like a cliche, but it's true.

Eggertsson proposes tax cuts will reduce wages. I propose tax cuts will keep people employed. Eggertsson proposes rising prices are a good thing. I propose they are not. The more money people have and get to keep, the more money they will eventually spend. That is logic that any eight grader can understand.

The problem with most economists is they put their belief in ridiculous theories and formulas that have failed time and time again. Instead economists might try using one ounce of common sense. Is that too much to ask?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

PeterMontee

02 Jul 09, 17:10 |

I like it topic

Quite good question |