European Banks $25 Trillion Financial Black Hole Hitting Euro-zone Economy

Economics / Recession 2008 - 2010 Feb 18, 2009 - 09:00 AM GMTBy: Oxbury_Research

Happy that Oxbury now allows for immediate online feedback on its revamped website; I rather enjoy the opportunity to deal with the lesser lights among my readers. With respect to those who offered suggestions and reasonable criticisms, I'll suffice here with a nod of thanks. It's more to the fools that I address the following.

Happy that Oxbury now allows for immediate online feedback on its revamped website; I rather enjoy the opportunity to deal with the lesser lights among my readers. With respect to those who offered suggestions and reasonable criticisms, I'll suffice here with a nod of thanks. It's more to the fools that I address the following.

There's a lot of confusion about markets and their relationship to the economy. It's a confusion that arises directly from one's sense of self. What do I mean by that? Let me explain.

I am an investor. I also am paid to find investment opportunities for a large and growing readership. If my suggestions are followed and they make money, my readership grows, and I'm rewarded with more pay. If the opposite, the opposite.

I assume that you, too, are an investor, and that's why you're reading these lines. But if you are not an investor, I suggest that you go away now and find something better to do with your time and your liver and your loins because there's nothing I can say here that will be of any use to you.

Why the harsh tone? Because we're here to make money, not to ***** and whine about the future of America (a sinking ship), or to come up with prescriptions for the long term health of the national or international economy, or to sling mud at this arse-hall or that arseness or his high arseitude or the very arsing king of Arsington! Nor do we care to derive who's to blame for this mess, or how it might have been averted, or how we might avenge the death of Pere Prevost, the saintly French Priest who performed hundreds of miracles on the icy roads of North Shore Quebec in the 1940's. I could not give a bleeding rat's arse about any of these. But for those of you who are preoccupied with them: good luck to you. You've been sidetracked and diverted from the principal cause of making money.

If you want morality, go to church. If you want to assign blame, go speak to your shrink. But while you're here with me, pull your thumbs out yer arse and get with the program.

That aside, we now address the issue:

To begin, bailouts do work, and so do stimulus programs. Yes, there is often a price to be paid down the road by taxpayers, and, yes, that may be unsightly to many, but those are separate issues. I happen to believe that the income tax should be scrapped altogether and replaced by a national sales tax that would force the pimps and drug dealers (and others who operate underground) to pay their fair share while those of us who choose to save and invest are rewarded with less tax to pay. But, alas, this is not reality. Nor will it help either of us make money in the markets right now. There is a confiscatory tax regimen in place, and it won't likely be gotten rid of anytime soon. Therefore, life sucks and you eat your arse.

And, yes, we may end up paying through the nose – or declaring bankruptcy as a nation – sometime down the road for all this profligacy. But that has nothing to do with the stimulus package and tax rebates and “job creation” and other forms of vote buying. Because they work. In the short term. When enough money is put in people's hands and general prices for goods and services are not falling , people spend and prices continue to rise.

Again, we can debate the virtues of the thing endlessly, but we cannot debate that it works. It works. End of story. If enough money is thrown at banks and homeowners we'll pull out of this thing. That's the reality right now. The only question open to debate is whether enough money has or will be thrown. That's it. No more. The whole enchilada.

The European Contribution

Europe is circling the drain. Nowhere in the world, to our knowledge, is there a continental mass of nations so in despair. Is it any wonder that last week major Neo-Nazi rallies took place in Budapest and Dresden ?

The chart below shows the latest quarter over quarter GDP growth rates for the entire Eurozone.

The continent's economic growth rate has chilled to levels not seen in over a decade. As we outlined last week, European industrial production was off in December at a greater rate than any time since statistics have been kept.

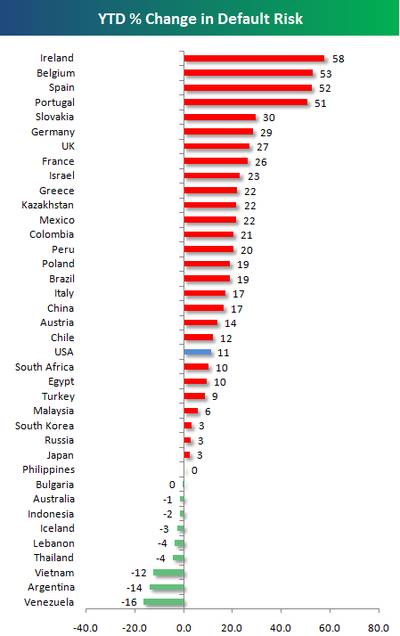

The European Central Bank has been tortoise-like in its willingness to drop interest rates, though it appears they now have to do something at their next get-together. And none too soon: Europe currently holds nine of the first ten spots for countries in increased danger of sovereign debt default.

Rumor has it that European banks still have in the neighborhood of (sit down for this, please) $25 trillion to write down before they're above water ( UK Telegraph ). The reason? To much leveraged lending to Eastern European borrowers who've since had their oversize heads handed to them on a platter. Currency dislocations between Eastern Europe and the Euro have further exacerbated borrowers ability to service debts.

Compare that to Nouriel Roubini's assessment of US bank losses at $1.7 trillion and you have some perspective on the relative dangers posed to the world financial system by US and Eurozone banks. And remember, too, Roubini has never been accused of optimism.

We could go on here, but the long and the skinny of the issue is that if Europe doesn't wake up and smell the cappuccino and lightly buttered baguette, we on this side of the pond may find ourselves hanged on a hoist that was none of our making.

Which reminds:

Disclosure: no positions

Matt McAbby

Analyst, Oxbury Research

After graduating from Harvard University in 1989, Matt worked as a Financial Advisor at Wood Gundy Private Client Investments (now CIBC World Markets). After several successful years, he moved over to the analysis side of the business and has written extensively for some of corporate Canada's largest financial institutions.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

Copyright © 2009 Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.