The Nationalization Train Has Left The Station

Politics / Nationalization Feb 18, 2009 - 06:54 AM GMTBy: Mike_Shedlock

The Financial Times is reporting Alan Greenspan Hops On Board The Nationalization Express and is sitting in the bar car next to Nouriel Roubini. The next stop is D.C.

The Financial Times is reporting Alan Greenspan Hops On Board The Nationalization Express and is sitting in the bar car next to Nouriel Roubini. The next stop is D.C.

The US government may have to nationalise some banks on a temporary basis to fix the financial system and restore the flow of credit, Alan Greenspan, the former Federal Reserve chairman has told the Financial Times.

In an interview with the FT Mr Greenspan, who for decades was regarded as the high priest of laissez-faire capitalism, said nationalisation could be the least bad option left for policymakers.

”It may be necessary to temporarily nationalise some banks in order to facilitate a swift and orderly restructuring,” he said. “I understand that once in a hundred years this is what you do.”

Those who think Greenspan is the "high priest of laissez-faire capitalism" have holes in their heads. The very existence of the Fed and its micro-mismanagement of interest rates is in direct conflict with capitalism.

The Fed directly setting interest rates is more like the failed policies of the Soviet Central Planners than anything remotely to do with capitalism.

Greenspan's stance on free trade was the only major thing he got right in his entire tenure. So it's ironically fitting that free trade is one of the biggest things he is criticized about.

Nationalize the Banks! We're all Swedes Now

Matthew Richardson and Nouriel Roubini are arguing Nationalize the Banks! We're all Swedes Now .

The U.S. banking system is close to being insolvent, and unless we want to become like Japan in the 1990s -- or the United States in the 1930s -- the only way to save it is to nationalize it.

As free-market economists teaching at a business school in the heart of the world's financial capital, we feel downright blasphemous proposing an all-out government takeover of the banking system. But the U.S. financial system has reached such a dangerous tipping point that little choice remains. And while Treasury Secretary Timothy Geithner's recent plan to save it has many of the right elements, it's basically too late.

Nationalization is the only option that would permit us to solve the problem of toxic assets in an orderly fashion and finally allow lending to resume. Of course, the economy would still stink, but the death spiral we are in would end.

Nationalization -- call it "receivership" if that sounds more palatable -- won't be easy, but here is a set of principles for the government to go by ....

Nationalizing banks is not without precedent. In 1992, the Swedish government took over its insolvent banks, cleaned them up and reprivatized them. Obviously, the Swedish system was much smaller than the U.S. system. Moreover, some of the current U.S. financial institutions are significantly larger and more complex, making analysis difficult. And today's global capital markets make gaming the system easier than in 1992. But we believe that, if applied correctly, the Swedish solution will work here.

Sweden's restructuring agency was not an out-of-control bureaucracy; it delegated all the details of the cleanup to private bankers and managers hired by the government. The process was remarkably smooth.

Basically, we're all Swedes now. We have used all our bullets, and the boogeyman is still coming. Let's pull out the bazooka and be done with it.

Bến Tre Logic

" As free-market economists teaching at a business school in the heart of the world's financial capital, we feel downright blasphemous proposing an all-out government takeover of the banking system. "

Roubini, Richardson, and Greenspan are using Bến Tre Logic .

One of the most famous quotes of the Vietnam War was a statement attributed to an unnamed U.S. Air Force Major by AP correspondent Peter Arnett. Writing about the provincial capital, Ben Tre, on February 7, 1968, Arnett said: "'it became necessary to destroy the town to save it,' a U.S. major says."

To this day, "Ben Tre logic" is a common saying for whenever a "logical" conclusion is to destroy something out of the perceived best interests of everyone involved.

Roubini is a fantastic economist when it comes to analyzing current data and seeing the problems coming down the road. I hold him in high regard. However, Roubini is simply not a free market economist. Please read Roubini Misses the Boat on Regulation for more evidence.

Roubini blames lack of regulation for the problems we face when the real problem is misguided regulation, micromanagement of interest rates by the Fed, and indeed the very existent of the Fed itself.

It is impossible to save a free market by abandoning it. Unfortunately, many try.

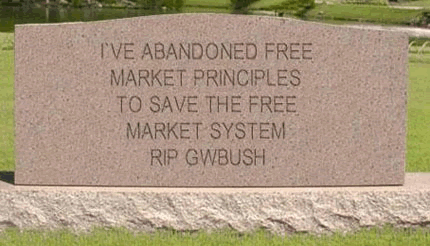

Bush Abandons Free Market Principles To Save Free Market

Dec 16, 2008

George W. Bush's political epitaph

This picture from Michelle Malkin sums up how I feel.

What Roubnini, Greenspan or any other proponent of bail-outs, nationalization, etc. fails to explain, or even mention is this: Why can we not just let them fail? Let them go bankrupt! Why not?

This is not the first time in history that banks are keeling over, and won't be the last time, especially if we have a Fed attempting to micromanage the economy. Sure, it's going to be painful, but it's only going to be painful ONCE.

Banks who were prudent and foresaw the collapse are waiting in the wings to take over already. Why should they be forced to compete with state-owned zombies? The argument that we cannot afford to let the big banks fail is nonsense. In Russia in 1998, 95% of all banks failed. What happened afterwards? A big economic boom.

When Russia had the opportunity to start with a clean slate , things quickly came right again. Of course, the Russian government also instituted a 13% flat tax, an important contributor to the economy's rebirth.

Everyone proclaims the Swedish nationalization "worked". However, correlation is not causation. The miracle Swedish recovery is more likely to have stemmed from a global economy that was starting to boom and strengthened by an internet and productivity revolution in its early stages, than a brilliantly executed nationalization plan.

Here's the deal....

1. You cannot save a village by destroying it.

2. You cannot save capitalism by destroying it.

3. You cannot save a free market when you don't have one in the first place.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.