Euro Currency Fractures as European Bond Markets Diverge on Default Risks

Currencies / Euro Feb 17, 2009 - 04:48 PM GMTBy: Gary_Dorsch

For almost a decade, yields on bonds issued by different Euro-zone governments moved close together. By joining the Euro-bloc currency regime, every member state could suddenly reap the benefits of “free-riding” in the Euro-zone bond market, or borrowing at almost the same interest rates as Germany , irrespective of whether the country's economic fundamentals justified the lower rate.

For almost a decade, yields on bonds issued by different Euro-zone governments moved close together. By joining the Euro-bloc currency regime, every member state could suddenly reap the benefits of “free-riding” in the Euro-zone bond market, or borrowing at almost the same interest rates as Germany , irrespective of whether the country's economic fundamentals justified the lower rate.

But as the global financial crisis gathered in intensity last September, yields in the 16-member Euro-zone bond market started to diverge. Global investors became more selective, and started demanding higher interest rates from member states with large budget and external trade deficits. Euro-zone yield spreads diverged more widely than at any time since the introduction of the Euro, with Germany enjoying the lowest interest rates and Greece and Ireland offering the highest.

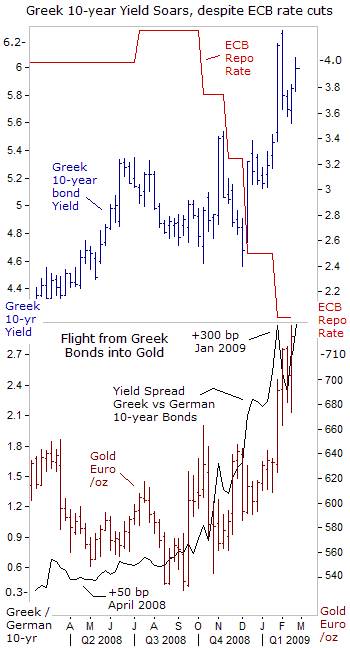

But the vision of Euro-zone economies and interest rates converging behind the shield of a shared currency, pulling Europe together economically and politically to rival the United States, has begun to unravel, raising skepticism about the long-term viability of the Euro itself, and sparking a flight into gold as a safe-haven. Already, three Euro zone economies, - Spain, Greece, and Ireland, are under heavy attack from the global banking crisis and credit rating downgrades, and there are concerns that Portugal and Belgium, may be under fire next.

Currency union may have narrowed the wide-gap between the richer and poorer nations of Western Europe , but the good times also masked the underlying structural differences between the various economies, which are now becoming more visible as the global recession deepens. On January 29 th , the Die Zeit newspaper wrote, “The global banking crisis is widening the interest rate gap between the Euro countries. Serious economists are wondering when the first state will go bankrupt. After that it's only a short step to catastrophe - the collapse of the currency union.”

Membership in the Euro-currency was originally tied to strict budgetary discipline. The annual deficit of a member country was to be limited to a maximum of 3% and its total debt to 60% of the country's gross domestic product (GDP). But for many years, Greece , Spain , and Italy took advantage of the easy money that came their way, borrowing beyond their treaty-set limits, while their trade deficits remained wide. But S&P downgraded Greek debt to A- in January, citing a current account deficit of 14% of its gross domestic product - the highest in Europe .

Membership in the Euro-currency was originally tied to strict budgetary discipline. The annual deficit of a member country was to be limited to a maximum of 3% and its total debt to 60% of the country's gross domestic product (GDP). But for many years, Greece , Spain , and Italy took advantage of the easy money that came their way, borrowing beyond their treaty-set limits, while their trade deficits remained wide. But S&P downgraded Greek debt to A- in January, citing a current account deficit of 14% of its gross domestic product - the highest in Europe .

A year ago, Greece could issue 10-year bonds priced to yield �basis points higher than Germany 's Bund. But trade surpluses from countries like Germany are no longer being recycled back to Greece and other less prosperous Euro-zone countries. Instead, Greece has become a favorite target for the European bond vigilantes. Greece expects to borrow 43.7-billion euros this year, pushing its debt-to-GDP ratio to almost equal to the country's 250-billion euro annual output.

Without the crutch of Euro membership, Greece could not have attracted foreign investors at interest rates that were nearly equal to those of German bunds, while its economy ran a trade deficit of -36.5-billion euro, compared to Germany , the world's biggest exporter for the past six-years, which earned a surplus of +178-billion euros in foreign trade last year. Standing alone, the Greek drachma would have plunged, and sending Greek bond yields even higher.

The European Central Bank has slashed its key repo-rate by 225-basis points since October to 2.00%, unwinding a tightening cycle that spanned over the previous 2-½-years. Yet despite the drive towards sharply lower ECB rates, yields on Greece 's 10-year bond have begun to move in the opposite direction, climbing 125-basis points higher, while at the same time, yields on Germany 's 10-year Bund have tumbled by 75-basis points. In lockstep, the price of gold has risen from 540-euros /ounce in September to above 720-euros /oz today, tracking the widening interest differential between the German Bund and the weakest link in the Euro- bloc .

One of the drawbacks to membership in the Euro-bloc is the lack of sovereignty over one's own money supply. The electronic printing press, often utilized by central banks to monetize the government's debt, is largely controlled in the Euro-zone by the Bundesbank hawks, united with ECB chief Jean Claude Trichet. The ECB hawks reject the increasingly popular embrace of “Quantitative Easing,” which is being adopted by central banks in England , Israel , Japan , the United States , and even Switzerland , in order to combat the destructive force of deflation. The Euro-bloc also precludes member states from unilaterally devaluing their currencies, in a beggar thy neighbor strategy, to boost overseas exports.

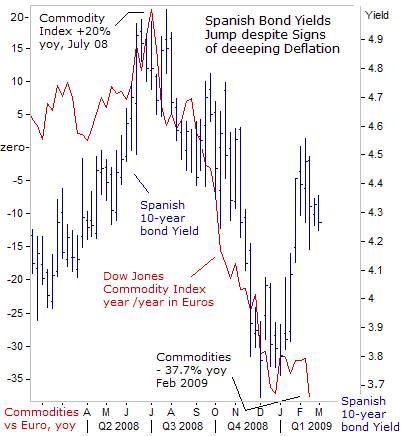

Interest rates for Spain 's 10-year note have jumped a half-percent since the beginning of this year, which might not seem unusually large on the surface, but is actually quite destructive, considering that an underlying trend of deflation is seeping deeper into the Euro-zone economy. Measured in Euros, the Dow Jones Commodity Index is 38% lower than a year ago, and it's only a matter of a few months, before EuroStat begins to report consumer inflation turning sharply negative.

Interest rates for Spain 's 10-year note have jumped a half-percent since the beginning of this year, which might not seem unusually large on the surface, but is actually quite destructive, considering that an underlying trend of deflation is seeping deeper into the Euro-zone economy. Measured in Euros, the Dow Jones Commodity Index is 38% lower than a year ago, and it's only a matter of a few months, before EuroStat begins to report consumer inflation turning sharply negative.

While government and media commentators are still attempting to assure the public that there could be no repeat of the 1930's, - a deflationary spiral leading to global depression, the commodity markets are telling a different story. Deflation is seen as a precursor to depression, because falling prices generate less cash flow to companies, reducing their ability to pay-off debts, which in turn, can lead to a vicious cycle of mass layoffs, production cutbacks, and weaker consumer spending.

For Spain, higher bond yields and mortgage rates are especially worrisome, since the number of Spanish jobless has risen by 1-million workers in the past 12-months, as thousands of small businesses, which employ around 80% of the workforce, lose access to easy credit and can't roll-over debts. The Spanish jobless rate rose to 14.4% in December, twice the average of the European Union, while industrial production has plunged by 20% from a year ago.

Bundesbank chief Axel Weber is telegraphing a half-point ECB rate cut to 1.50% next month, “We should not avoid lowering interest rates aggressively, because we understand at this current juncture, all indicators look like the Euro-zone economy is in free-fall,” Weber warned. But Bundesbank hawk Juergen Stark is warning that the ECB should not adopt “Quantitative Easing” or printing money to lower Euro-zone bond yields. “Overly aggressive reductions in our policy rate when we cannot see any risk of deflation would exacerbate and not resolve uncertainty. Those who advise us to go to zero interest rates and then experiment at the zero level are not those who are responsible for the possible consequences,” Stark said.

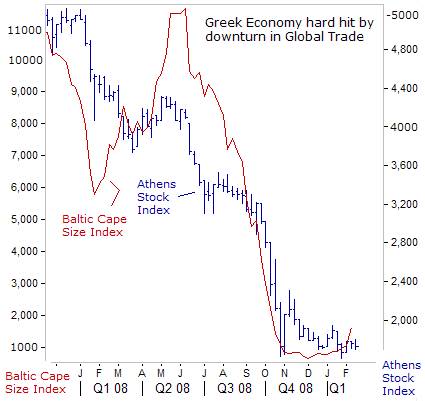

But Greek central banker George Provopoulos sees the situation very differently, - the worst since the Great Depression of the 1930's. “The outlook for the global and the Euro-area economy in 2009 appears dismal. The current crisis is the biggest since the 1930's and exiting from it will not be easy or quick,” he warned. Foreign direct investment into Greece has fallen from 31.3-billion euros in 2006 to just 4.6-billion euros last year. The Athens stock market index, ASE General, which was trading at 5,000-points a year ago, has tumbled to 1,800-points, hard hit by a sharp drop in tourism and ship building, which accounts for 25% of its economy.

But Greek central banker George Provopoulos sees the situation very differently, - the worst since the Great Depression of the 1930's. “The outlook for the global and the Euro-area economy in 2009 appears dismal. The current crisis is the biggest since the 1930's and exiting from it will not be easy or quick,” he warned. Foreign direct investment into Greece has fallen from 31.3-billion euros in 2006 to just 4.6-billion euros last year. The Athens stock market index, ASE General, which was trading at 5,000-points a year ago, has tumbled to 1,800-points, hard hit by a sharp drop in tourism and ship building, which accounts for 25% of its economy.

Greek central banker Lucas Papademos has gone a step further, saying he would support the use of unconventional tools at any time, such as “Quantitative Easing,” or printing money in order to buy corporate or government bonds. Papademos indicated that the ECB wouldn't necessarily have to cut rates to zero before expanding its monetary policy toolkit. “Any measures that may be deemed appropriate to improve the functioning of markets and help stabilize the financial system may be taken independently of the level of policy rates,” he said.

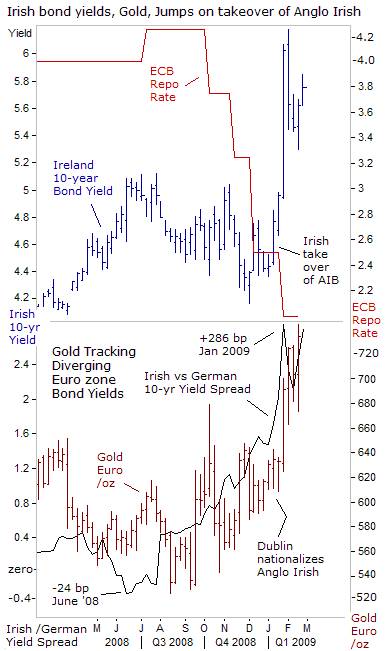

The Luck of the Irish runs out

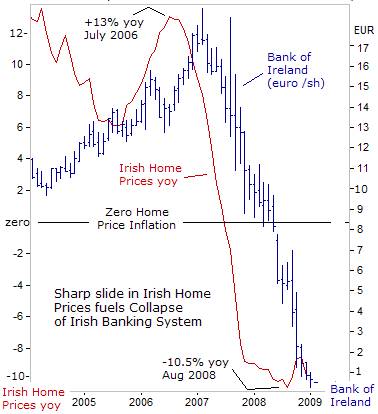

A year ago, Ireland 's debt to GDP ratio was among the lowest in the Euro-zone at 41%, and at one juncture, Ireland 's 10-year bond was yielding 25-basis points less than Germany 's. Ireland enjoyed an economic boom since the late 1990's, expanding at more than double the average growth rate across the 13-nation Euro-zone, with high-tech multinationals arriving to take advantage of its 12.5% corporate tax rate, one of the lowest in Europe, earning it the nickname of the “Celtic Tiger.”

But the Irish Republic 's economy was the first to slide into a recession in the Euro zone last year, its first setback since 1983. Irish house prices fell 9.1% during 2008, compared with a fall of 7.3% in 2007, and are expected to fall 10% in the year ahead. The average home price in Ireland was 261,600-euros in December, down from 287,900-euros at the end of 2007, and 310,600-euros at the end of 2006.

The global credit crunch was a key factor behind the collapse of a decade-long bonanza in Ireland 's housing market, culminating in a move by the Irish government on January 15 th , to take Anglo Irish Bank into full state ownership. The move came as fears that a collapse of the bank, from toxic mortgages and other bad debts, would bring down the entire economy. The decision reversed a previous move to pour €1.5 billion into the bank while leaving it independent.

The global credit crunch was a key factor behind the collapse of a decade-long bonanza in Ireland 's housing market, culminating in a move by the Irish government on January 15 th , to take Anglo Irish Bank into full state ownership. The move came as fears that a collapse of the bank, from toxic mortgages and other bad debts, would bring down the entire economy. The decision reversed a previous move to pour €1.5 billion into the bank while leaving it independent.

This was part of a €5.5 billion package to prop-up the three major Irish banks, - Allied Irish, AIB, and the Bank of Ireland, as agreed in December. Ireland 's Finance chief Brian Lenihan made clear that full state control was the only way to prevent a catastrophic run on the bank, with 80-billion euros of customer deposits outweighing assets. “The damage to the country's reputation in trashing deposits and refusing to honor obligations will be enormous,” Lenihan said. Ireland is a key financial hub in Europe , administering 1.7 trillion euros of funds.

At its peak in 2007, AIB was worth €21-billion. It is now worth €528 million. Over the same period, the Bank of Ireland's market value has fallen from €18 billion to €340 million. In 2007, total Irish financial stocks together were worth €59.4-billion. Now they are worth €1.65 billion. Both AIB and the Bank of Ireland are reported to have large volumes of bad debt similar to Anglo Irish. For the moment these banks remain outside full state control, but are in dire need of additional cash infusions.

Ireland 's government debt has now become the riskiest in the Euro-zone, surpassing Greece 's sovereign bonds, according to credit-default swap (CDS) rates. Part of the reason is Dublin 's guarantee scheme for the debts held by Irish banks is more than 11-times the size of the Irish economy. CDS traders are betting that the possibility of widespread bank bailouts will drive up government borrowing, at a time when the worst economic slump since the Great Depression curbs tax revenue.

Credit-default swaps on Irish government bonds jumped 95-basis points to a record 355 basis points last week, the most of any Euro-zone country. This rate compares to 265 basis points insuring against a default by Greece . A basis point on a credit-default swap contract insuring €10 million of debt from default for five years is equivalent to €1,000 a year. Iceland retains the riskiest debt ratings with contracts on its government debt at 995-basis points.

The transfer of credit risk from the private sector to the public sector, in bailing out the banks, is exposing Anglo Irish's property portfolio to the government's expanding debt, putting its strained public finances under even more pressure. Ireland 's Treasury is set to borrow some €15-billion this year, taking the total national debt towards the €70-billion mark, but that number can climb far higher. The European Commission predicts the budget shortfall in Ireland will reach 11% of GDP this year.

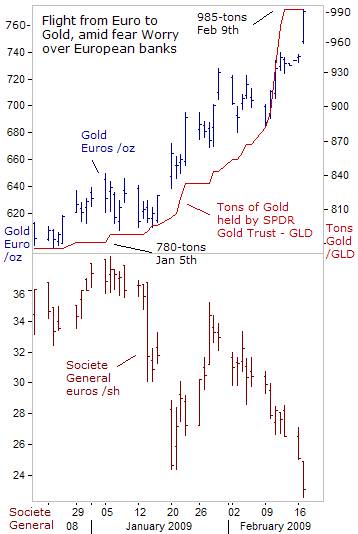

The recent run-up in gold prices versus the Euro, up nearly 20% so far this year, is tracking the widening yield spread between Irish and German bonds, mirroring the same pattern seen with Greek bond spreads. While the current yields on Euro-zone bonds do not suggest that any member state is in danger of defaulting on its debt, the divergence in yields represents the first cracks in the Euro currency regime.

If the Euro zone's economic downturn morphs into a 1930's style Great Depression, the temptation for weaker member states to opt-out of the Euro regime, in favor of currency devaluation, such as recently engineered by the Bank of England for the British pound, or central bank monetization of government debt might become unavoidable. That's the message of gold's rally versus the Euro coinciding with diverging Euro zone bond yields versus the benchmark German Bund.

Gold hit a record 765-euros /ounce on Feb 17 th , after a report by ratings agency Moody's sparked fresh fears about the deteriorating health of Western European banks, with big loan exposure to Emerging European countries. The global financial crisis has forced Hungary , Ukraine , Belarus , Latvia and Serbia to seek more than $35 billion in emergency loans from the IMF to stave off default on their bonds.

Gold hit a record 765-euros /ounce on Feb 17 th , after a report by ratings agency Moody's sparked fresh fears about the deteriorating health of Western European banks, with big loan exposure to Emerging European countries. The global financial crisis has forced Hungary , Ukraine , Belarus , Latvia and Serbia to seek more than $35 billion in emergency loans from the IMF to stave off default on their bonds.

Ukraine led a rise in borrowing costs across the region, with the extra yield offered by Ukrainian bonds compared to US Treasuries rising to a record high 32.25% this week. At the same time, investment in the SPDR Gold Trust, (GLD) an exchange-traded fund backed by gold, rose 14% last week to a record 985-tons, mirroring a flight from the Euro into the yellow metal.

Western European banks have bought up most of emerging Europe 's banks. But as emerging European currencies weaken by the day, the rising cost of loans taken out in foreign currencies such as the Swiss franc, the Euro and the yen is pushing many borrowers into default. Since August, Hungary 's forint has dropped about 28% versus the Swiss franc, and 23% versus the Euro. Hungary 's total stock of foreign currency mortgages rose to 2,374 billion forints ($10.2-billion), or about 9% of the country's entire GDP in December.

The banks with the greatest exposure are primarily located in six countries, Austria , Italy , France , Belgium , Germany and Sweden which account for 84% of the claims on Emerging Europe. The BIS indicated last week, that Austrian bank claims on emerging European clients totaled $277-billion, or nearly 75% of Austria 's GDP. For Sweden , claims mostly on clients in the Baltic countries of Estonia , Lithuania and Latvia represent 23% of GDP and for the Netherlands , exposed mostly to Polish, Russian and Romanian borrowers, this is just under 16 percent.

“A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him,” - John Maynard Keynes.

This article is just the Tip-of-the-Iceberg of what's available in the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2009 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.