No Sign of an Economic Recovery Yet? Look Again at BDI, Copper and Homebuilders

Stock-Markets / Financial Markets 2009 Feb 17, 2009 - 06:26 AM GMTBy: Donald_W_Dony

There are a number of early economic signals that are beginning to slowly surface that has not yet caught the attention of financial media. These slight changes to the commodity, bond and equity markets are the early indicators and building blocks of the next economic recovery. Throughout 2009 additional evidence is expected to gradually surface. Here are some of the most recent pieces of the recovery puzzle

There are a number of early economic signals that are beginning to slowly surface that has not yet caught the attention of financial media. These slight changes to the commodity, bond and equity markets are the early indicators and building blocks of the next economic recovery. Throughout 2009 additional evidence is expected to gradually surface. Here are some of the most recent pieces of the recovery puzzle

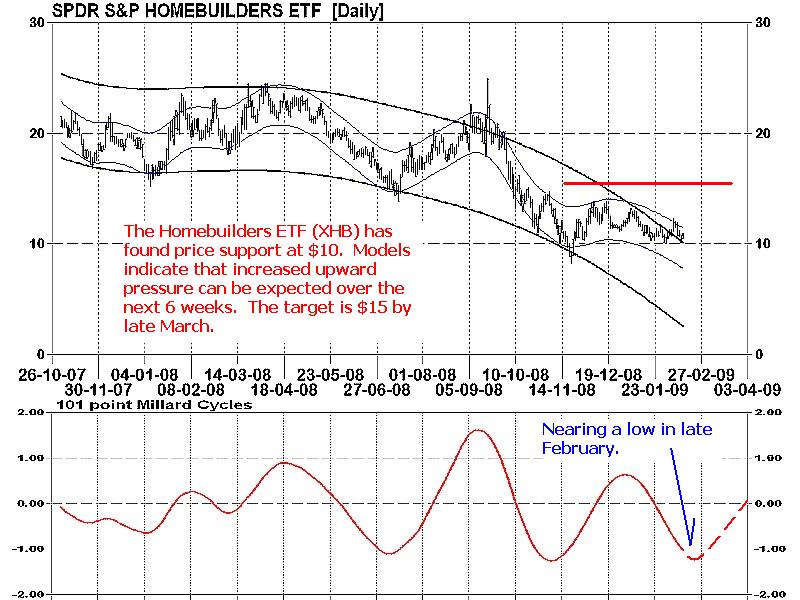

The home builders sector (Chart 1) represents a parallel to leading indicator to the U.S. housing market. As this market was the root cause of the financial crises, any stability in the home builders sector would provide an important clue to a possible bottom in the deeply depressed American housing market. More than three years since the market began correcting, inventories are now flattening, prices are coming back down to earth, and sales are approaching stability. The peak in the U.S. housing market occurred in the second half of 2005, whereas the top in the home builders sector developed in May 2005.

Technical models indicate that renewed upward pressure should develop over the next six weeks. This is encouraging especially since the sector has already found stable price support since November.

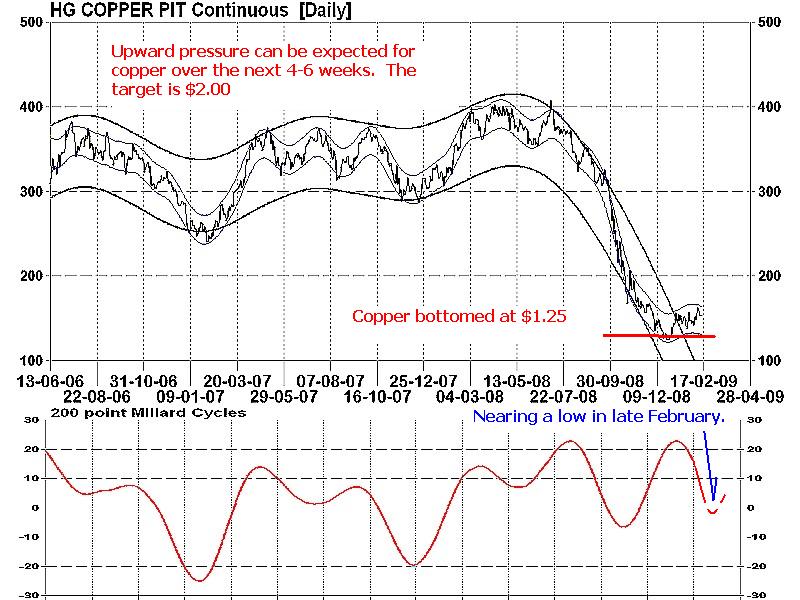

The price movement of Copper (Chart 2) is a vital indicator to the economy for this metal moves with the business cycle. After the waterfall collapse in the second half of 2008 from $4.00 to $1.25, copper appears to be finding a floor and good price support at the $1.40 to $1.60 range. With the enormously wide application use of copper in areas such as consumer electronics, plumbing, computers, industry and homes building, price firmness for this metal indicates building strength in the global economy.

The Baltic Dry Index (Chart 3) is another economic gauge that is displaying some returning life. The BDI is a number issued daily by the London-based Baltic Exchange. The index provides an assessment of the price of moving the major raw materials by sea.

The index covers dry bulk carriers carrying a range of commodities including coal, iron ore and grain. This index fell from over 11,000 at its peak in early 2008 to a dismal 700 in December. Some of the reasons for the advance are the slow unfreezing of credit and the decline of the iron ore stockpiles in China.

Technically, the index still remains down but is currently establishing a base. Only an advance over the 2000-3000 resistance level would suggest a reversal has begun.

The growing stability in base metals is another early sign of the recovery. Zinc, nickel and lead are all forming solid price bases for the first time since early 2008. Zinc, in particular, began to recover back in September, over five months ago.

There is also a slow but gradual shift out of consumer staples and into select consumer cyclicals. For the first time in over a year, the relative performance of both sectors is now equal. Bull markets require the consumer to move their funds out of the safety of staples and into discretionaries. Models are suggesting that this transfer is starting.

Other pieces of evidence include the calming of the Volatility Index (VIX), the narrowing of the TED spread and changing yield curve in the bond market.

Though many of these elements are relatively minor in their context, they are the silent building blocks for the next economic recovery and bull market.

Additional research can be found in the February newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.