Stock Market and Commodities Base Building Considerations

Stock-Markets / Investing 2009 Feb 17, 2009 - 06:14 AM GMTBy: Clif_Droke

The most salient feature of the markets at this juncture is the number of interim bases that have been building in several major sectors, including copper and other economically sensitive groups. In this commentary we’ll examine the bottoms currently being established for stocks and one of the key supports for the continued recovery in the precious metals mining sector, namely copper and copper mining shares.

The most salient feature of the markets at this juncture is the number of interim bases that have been building in several major sectors, including copper and other economically sensitive groups. In this commentary we’ll examine the bottoms currently being established for stocks and one of the key supports for the continued recovery in the precious metals mining sector, namely copper and copper mining shares.

The first observation concerns the U.S. broad market as represented by the S&P 500 index (SPX). After the Kress 6-year cycle bottomed last October and the bear market bottom was established in the S&P, the market is now into the fourth month the bottoming process. The duration of the period from when the market first finds bottom and when it finally ends the botoming process and turns up is variable and isn’t the subject of our discussion. What interests us is the observation that a benchmark low is usually tested at least four times by the S&P before the market turns up decisively.

The benchmark support for the SPX since the November low is the area immediately surrounding the 800 level, although the entire range between 800-825 could also be considered the benchmark support zone. This zone has been established as a supporting floor at least four times since November. In the every major bear market since 1974 the S&P’s benchmark support following the final low was tested at least four times before the market launched a cyclical recovery rally. This was true following the 1974 bear market low (40-year cycle bottom), the 1982 bottom (8-year cycle bottom), the 2002 bottom (12-year cycle bottom) and the 2008 bottom (6-year cycle bottom).

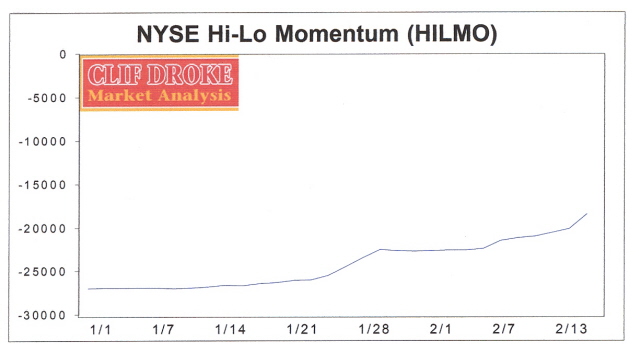

One of the reasons for believing the S&P’s base will remain firm is that since last year’s 6-year cycle bottom, the dominant internal momentum for the NYSE broad market (HILMO) has never broken its November lows. The indicators turned up in November and hasn’t looked back since as you can see here. It would take a major reversal in market internal momentum for the S&P’s November bear market low to be seriously challenged and that isn’t likely at this point.

Stock market bottom building is sometimes a drawn-out affair. The bigger the underlying issues behind the bear market, the longer the bottoming process often takes. The late credit crisis is a case in point and goes a long way in explaining the length of time between the bottoming of the 6-year cycle in October (followed by the composite interim cycle bottom in December) and the market’s current position. The SPX has tested its benchmark support zone several times over the intervening months and based on historical comparisons, in keeping with Kress cycle considerations, a solid base has been built from which a new cyclical recovery will be launched.

Stocks aren’t the only thing that will benefit from the government’s bailout initiative. With trillions in rescue money being vigorously pumped into a liquidity-starved economy and financial market, among the first to historically benefit from the infusion of monetary lifeblood is mining stocks. We’ve already seen the evidence of this in the latest round of pump-ins and other commodities will soon follow. Investors at some point grow weary of receiving practically no return on their safe haven investments. Instead of just handing money to the government for a guarantee of its future return, they start to demand return on capital. Extreme fear causes investors to seek shelter in low-yielding (or no-yielding) safe havens….but only for so long. When the typical investor realizes that the storm clouds have disappeared and the financial storm has ended, he’s going to slowly emerge from his bunker and look for growth potential. Equities in general, and mining stocks in particular, will accordingly be the proverbial “only game in town” during the first half of this year.

Here’s what one observer said recently about the prospects for a commodities recovery in the year ahead: “Fed Chairman Bernanke’s aggressive actions prove that he will do ‘whatever it takes’ to end the credit freeze and stabilize the global banking system. Bernanke’s numerous programs to inject liquidity into the banking system are beyond unprecedented. Multi-trillions of dollars will be created by the global central banks to prevent a global financial meltdown. The Federal Reserve has become both the lender of last resort and the lender of first resort. I will not list all of these liquidity programs, except to say I believe they will eventually end the banking panic and avoid the feared meltdown––at least temporarily. Since we are still printing money to solve problems that were caused by printing too much money, the inevitable meltdown has been pushed forward….Between now and then, it is highly likely that trillions of newly created dollars will reflate the economy and create the last bubble in the commodity sector. Gold prices will rise during this reinflation period because of inflationary fears…” [Donald Rowe, The Wall Street Digest, November 2008]

While skeptics continue to openly doubt that the rescue efforts of the feds will meet with success, one observer has made an interesting statement about the bailouts and monetary pump-ins of the past few months: “Yes, it is possible to inflate an asset without changing the fundamental reality of an economic situation. The stock market went up in the 1930s, yet the Depression continued. Those few brave enough to chance the larger stock market in this day and age may make some money. For the rest of us, there are, perhaps, mining stocks. Mining stocks did indeed do very well during the Depression, and unlike housing stocks or pharma stocks, there was a reason why. People are investing heavily in gold and silver these days, and once the market gets going again….mining stocks will be among the prime beneficiaries because they are providing the true value inherent in money metals.”

Mining stocks have indeed already benefited from the massive infusions of liquidity, much as they did in 2002-2003 following the previous 6-year cycle bottom and economic recession. Meanwhile the gold and silver stocks still have the benefit of upside price momentum as well as internal momentum. This is a rare breed among stocks of any major sector right now.

Only one ingredient has been missing from the precious metals bull market and that’s the leadership (or at least the strong participation) of the copper shares. For instance, our favorite leading indicator in this regard, Freeport Copper & Gold (FCX), has been building a potentially strong technical base since last fall but until recently has lagged the gold stocks in the recovery effort. The copper component of FCX is the obvious culprit as most copper and base metal stocks have lagged the gold shares in the recovery for obvious (economic) reasons. Yet base metals are expected to follow in the gold recovery at some point as they always do historically whenever there’s a concerted effort among the world’s central governments to revitalize the global economy.

Copper and copper stocks will come back and it appears that FCX is catching the scent of the recovery money being forcefully injected into capital markets the world over. In his in-depth research report on the gold price and the probability for a gold-led metals recovery, Larry W. Reaugh of the Reaugh Group, a veteran of 45 years in the mining industry, gives as one reason for believing a commodities rebound is on the way the $600 billion economic stimulus China is conducting over the next three years. “I believe the first beneficiary will be the steel industry which will lead the way out of the recession in base metals,” writes Reaugh. He adds that the Yunnan province in China has announced a one million ton purchase of commodities for stockpiling, namely copper, aluminum, lead, zinc and tin to the tune of $3 billion as the central government stockpiles all metals as a result of low prices.

Mr. Reaugh observes, “The reaction to [last year’s] sudden market downturn by producers has been to shut down, curtail and reduce operations of copper [and other metals]. This has been immediate and I believe it will result in a faster recovery for the prices of these commodities.”

With gold and silver leading the way, both equities and commodities, along with the economically sensitive copper price, will soon recover in response to the worldwide monetary stimulus efforts. The base building process has been an elongated one and fraught with frustrations to be sure. Like most prolonged bottoms, however, a launching pad for a meaningful recovery can be seen in the technical bases under discussion here.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.