Stock Market Battles Between Bullish and Bearish Signals

Stock-Markets / Investing 2009 Feb 15, 2009 - 06:55 PM GMT

Peter Schiff (Seeking Alpha): This is just the beginning

Peter Schiff (Seeking Alpha): This is just the beginning

“The intense scrutiny recently paid to my investment strategy in the immediate wake of the financial crisis of the last six months has unfortunately obscured the central element of my larger economic forecast. The standard line has been that although I was able to predict the crash, in the form of the housing collapse and the credit crunch, my expected fallout of a weaker dollar and global decoupling has been proven false. However, this assumes that the crash has fully played out. In reality, all we have heard thus far is the overture.

“In 2008, the bubble economy that I had meticulously described years ago finally hit the pin that I knew was out there. The corporate losses, frozen credit markets and plunging home prices were the opening salvo in the unfolding economic crisis. However, the vast majority of air has yet to leak out of the bubble. As it does, the US economic crisis will kick into a much higher gear. I have positioned my clients to withstand the full fury of the gale, and when it finally comes, the question ‘was Peter Schiff right?' will finally be answered.

“Thus far, our economy has actually been spared the worst due to the temporary strength in the dollar and the recent desirability of our Government's debt. These movements derailed the short-term performance of many of my investment recommendations (though clearly not to the extent alleged by my critics) and threw a life-line to the downing US economy. The demand for US Treasuries has led to one of the sharpest dollar rallies on record, which has helped bring about just as pronounced a decline in commodity prices. As a result, although consumer income has fallen, so too have prices and interest rates.”

Click here for the full article.

Source: Peter Schiff, Seeking Alpha , February 8, 2009.

Google Video: Peter Schiff's presentation at the Global Competitiveness Forum

Source: Google Video , February 9, 2009.

Chales Munger (The Washington Post): How we can restore confidence

“Our situation is dire. Moderate booms and busts are inevitable in free-market capitalism. But a boom-bust cycle as gross as the one that caused our present misery is dangerous, and recurrences should be prevented. The country is understandably depressed - mired in issues involving fiscal stimulus, which is needed, and improvements in bank strength. A key question: Should we opt for even more pain now to gain a better future? For instance, should we create new controls to stamp out much sin and folly and thus dampen future booms? The answer is yes.

“Sensible reform cannot avoid causing significant pain, which is worth enduring to gain extra safety and more exemplary conduct. And only when there is strong public revulsion, such as exists today, can legislators minimize the influence of powerful special interests enough to bring about needed revisions in law.

“Many contributors to our over-the-top boom, which led to the gross bust, are known. They include insufficient controls over morality and prudence in banks and investment banks; undesirable conduct among investment banks; greatly expanded financial leverage, aided by direct or implied use of government credit; and extreme excess, sometimes amounting to fraud, in the promotion of consumer credit. Unsound accounting was widespread.

Click here for the full article.

Source: Charles Munger, The Washington Post , February 11, 2009.

CNN: Vanguard founder blames banks

“John Bogle, the founder of the Vanguard Group, says Wall Street's risky business resulted in the worst recession he's ever seen.”

Source: CNN , February 11, 2009.

Financial Times: Sales of PCs to fall for first time in eight years

“Problems in the personal computer business have increased the likelihood that 2009 will bring the first decline in PC sales since 2001, according to industry analysts.

“Evidence has been accumulating since the start of the year that the deterioration has reached unexpected parts of the market, with trouble appearing even in some emerging markets, which had previously been seen as the main source of growth.

“‘We're definitely more pessimistic,' said Loren Loverde at IDC, the technology research group.

“He said IDC's latest official forecast, for 4 per cent growth in the number of PCs sold this year, was unlikely to hold: ‘As things sink in, it could easily be in negative territory.'

“Weak earnings reported last week by Lenovo, the world's fourth-biggest PC maker, showed that corporate buyers in particular have been cutting back.

“That, and softening sales in emerging countries, suggests that the pain has spread beyond consumers in the developed world, who had been expected to be the main source of industry weakness.

“Last month Microsoft warned that the first half of this year at least could see even weaker conditions than the final quarter of last year, when an expected 10-12% increase in the PC market completely evaporated.”

Source: Richard Watersin, Financial Times , February 8, 2009.

CNBC: Marc Faber: “US will default on debt or enter hyperinflation”

Source: CNBC (via YouTube ), February 5, 2009.

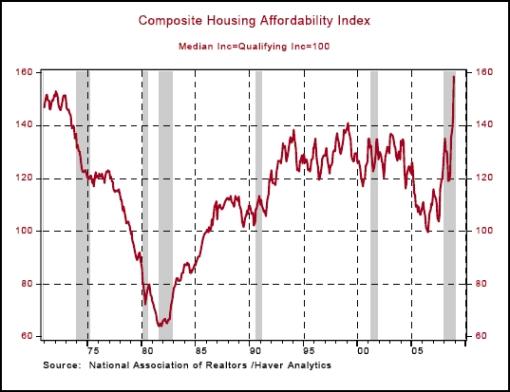

Asha Bangalore (Northern Trust): Housing market update - applications for both purchase and refinance decline

“The Purchase Index of the Mortgage Bankers Association fell to 235.9 during the week ended February 6 from 261.4 in the prior week. The Purchase Index is at its lowest level since the end of 2000.

“The Refinance Index fell sharply to 2722.7 from 3906.3 in the prior week. The 30-year fixed rate mortgage has risen to 5.19% during the week ended February 6 from a low of 4.89% in the week ended January 9. Although the Housing Affordability Index is at a record high, demand for homes will gather momentum only after employment conditions have improved.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , February 11, 2009.

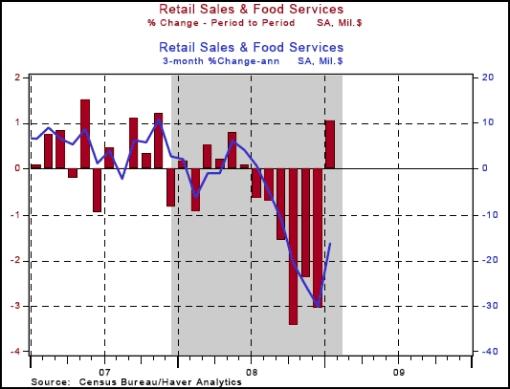

Asha Bangalore (Northern Trust): Retail sales stabilized in January, future remains gloomy

“Retail sales moved up 1.0% in January, after a revised 3.0% drop in December. The gain in retail sales in January was a surprise. But, the good news does not imply that the weakness in consumer spending is behind us. Unemployment claims numbers were also published in addition to retail sales this morning. Jobless claims remain at elevated levels and reinforce expectations of a continued gloomy outlook. The bottom line is that consumer spending will be weak again in the first quarter, but by a considerably smaller degree. The weakness in the fourth quarter is most likely the worst performance of retail sales in the current downturn.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , February 12, 2009.

Asha Bangalore (Northern Trust): Consumer sentiment remains gloomy

“The University of Michigan Consumer Sentiment Index fell to 56.2 in the early-February survey from 61.2 in January. The Current Economic Conditions Index moved up slightly (67.1 versus 66.5). The Expectations Index dropped to 49.1 from 57.8 in January. The gloomy outlook should not be surprising given the nature of economic reports and financial market conditions. The level of the index is second only to the low readings seen in 1980.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , February 13, 2009.

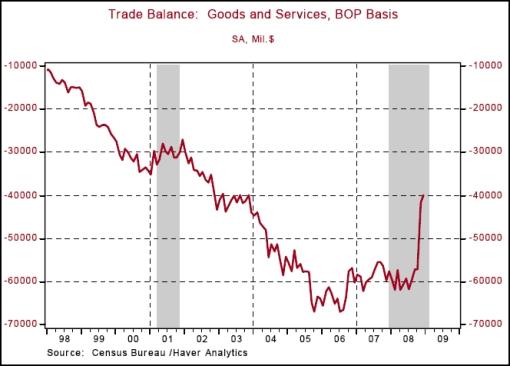

Asha Bangalore (Northern Trust): Sharp drop in exports and imports reflects global recession

“The trade deficit of the US economy narrowed slightly to $39.9 billion in December. Both exports (-6.0%) and imports (-5.5%) of goods and services fell in December. The trade deficit of goods, after adjusting for inflation, was wider in December compared with November ($43.3 billion versus $40.1 billion in November). The headline GDP estimate is most likely to be revised down to a nearly 5.0% drop to reflect this discrepancy and that of inventories and construction outlays (net impact of both these components is also a weaker GDP), assuming insignificant revisions of retail sales during November and December.”

The Wall Street Journal: $100 bills as toilet tissue?

“Efforts to avoid a deflationary depression will probably produce the opposite - a nasty bout of inflation, says John Williams of Shadow Government Statistics, who advises hoarding gold and even Scotch to barter. Alistair Barr reports.”

Source: The Wall Street Journal , February 12, 2009.

Telegraph: GM and Chrysler “Chapter 11″ to protect US taxpayers

“The US government is exploring the possibility of placing General Motors and Chrysler in Chapter 11 bankruptcy protection in an effort to safeguard the $17.4 billion in loans extended to the two ailing car manufacturers.

“The move, which is one of a range of options understood to be being considered by government advisers, would ensure that taxpayers would be paid out first in the event that either company actually collapsed.

“Chapter 11 is designed to allow a company to undertake drastic restructuring measures while protecting it from its creditors. However both companies have in the past said that a move into Chapter 11 would destroy them, as customers would lose confidence and many suppliers would cease working with them.

“As the current loan agreements stand, the US Treasury's loans stand behind those from other creditors, including banks such as Goldman Sachs and Citigroup, as those lenders have, according to Bloomberg News, first position on some assets.

“It is thought that Treasury officials are aiming to renegotiate their position in the debt chain ahead of a March 31 deadline. By then, both car manufacturers must show that they have begun to restructure their operations to such an extent that they will be able to return to profitability. If not, the government can demand return of the loans.”

Source: James Quinn, Telegraph , February 9, 2009.

Dealbreaker: CDS death bill introduced in the house

“H.R. 977 (The Derivatives Markets Transparency and Accountability Act of 2009), from the brilliant mind of Rep. Collin Peterson (D-MN), puts restrictions on OTC contracts and would ‘deny the Federal Reserve the authority to establish regulations or rules with regard to clearing OTC transactions.'

“Instead, OTC contracts must either be cleared centrally or reported to the CFTC. Ouch. This would pretty much end the custom options and swap business, making it very difficult to tailor specific instruments for specific risk.

“The bill also gives ‘the CFTC the authority to suspend credit default swap trading, with the concurrence of the president.'”

Source: Dealbreaker , February 12, 2009.

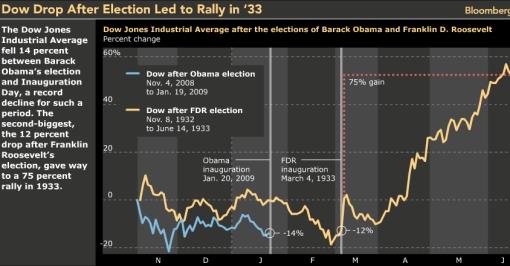

Bloomberg: Post-election movements of Dow

Source: Bloomberg (via Fullermoney) , February 12, 2009.

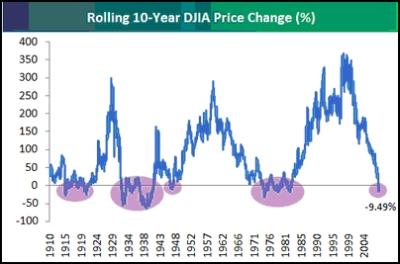

Bespoke: A look at 10-year market returns

“The New York Times published an article this weekend highlighting that the current 10-year stretch that ended last month was the worst for the S&P 500 in at least the last 82 years. The Times looked at total returns for the S&P 500, and below we provide a similar analysis of the 10-year rolling price change of the Dow Jones Industrial Average going back to 1910.

“As shown, there have only been four other periods where the 10-year return has been negative, and three of the four periods saw returns float around the negative to flat line for quite some time. While it may have taken ‘buy-and-holders' a few years to end up making money if they got in early when the 10-year returns went negative, they did end up making money.

“When looking at 10-year returns, however, where the market was 10 years ago is just as big of a factor as where it is now. Ten years ago, the market was just about to hit the peak of the Internet bubble, and once it burst, the 10-year return was destined to take a big hit right about now.”

Source: Bespoke , February 9, 2009.

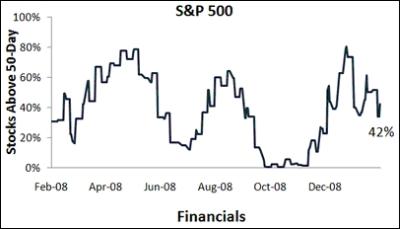

Bespoke: Percentage of stocks above 50-day moving averages

“Below we highlight the percentage of stocks in the S&P 500 that is currently trading above their 50-day moving averages. As shown, even though the S&P 500 has been getting close to touching its November lows recently, 42% of stocks in the index are above their 50-days. This means breadth within the index is still strong even though the index itself has been struggling.

“On a sector basis, Financials have the weakest breadth with just 16% of stocks above their 50-days. Health Care, Energy, and Technology are the three sectors that currently have more than 50% of stocks above their 50-days.”

Source: Bespoke , February 13, 2009.

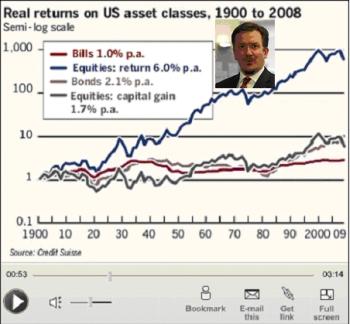

John Authers (Financial Times): The importance of dividends

“John Authers explains why dividends are the key to finding long-term value in equities.”

Click here for the article.

Source: John Authers, Financial Times , February 10, 2009.

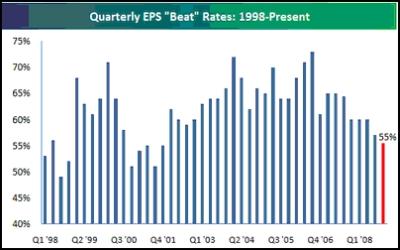

Bespoke: Earnings season “beat rate” at 55%

“Along with guidance and a multitude of other indicators, we track the ‘beat rate', which is the quarterly percentage of companies that report earnings that are better than analyst expectations. As shown in the chart below, this earnings season, 55% of US companies have reported better than expected earnings.

“Nearly 1,000 US companies have already reported, and there is only a week or so left of earnings season, so this number is definitely starting to firm up. The current ‘beat rate' of 55% is the weakest reading in about 8 years, but it still hasn't gotten as low as it got during the ‘00-'02 bear market. Bears will argue that the ‘beat rate' needs to get down to the ‘00-'02 levels before a bottom can be put in, while bulls will argue that it's an indication that things aren't as bad as people think. Only the market will eventually tell us who is right.”

Source: Bespoke , February 9, 2009.

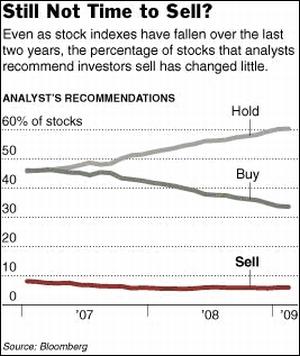

The New York Times: Why analysts keep telling investors to buy

“Even now, with the recession deepening and markets on edge, Wall Street analysts say it is a good time to buy. Still.

“At the top of the market, they urged investors to buy or hold onto stocks about 95% of the time. When stocks stumbled, they stayed optimistic. Even in November, when credit froze, the economy stalled and financial markets tumbled to their lowest levels in a decade, analysts as a group rarely said sell.

“And last month, as the Dow and Standard & Poor's 500-stock index suffered their worst January ever, analysts put a sell rating on a mere 5.9% of stocks, according to Bloomberg data. Many companies have taken such a beating in the downturn, analysts argue, that their shares are bound to bounce back.

“Maybe. But after so many bad calls on so many companies, why should investors believe them this time?”

Source: David Ranson, The New York Times , February 8, 2009.

David Fuller (Fullermoney): Where should we look for global stock market leadership?

“Most analysts, not to mention those who are Americans, will inevitably hover over US stock market's data, given the size and influence of that market. However, this mother ship seldom leads the global equity armada either north or south, although none will significantly diverge from Wall Street's course for long.

“So where should we look for global leadership and what is Wall Street doing at present?

“Taken in reverse order, US stock market indices are ranging in potential base formation development. However, the Dow and S&P 500 are uncomfortably close to their November lows. Both need to sustain moves above this week's highs to remain consistent with base development. While this may seem like a ‘big ask' to some, the Nasdaq 100 is considerably firmer.

“However the largest capitalisation market seldom leads. With the US economy remaining the epicentre of global economic risk, there is no chance that it will lead on the upside, although it could still drag other stock markets lower.

“If the S&P and Dow stay within their current trading ranges, let alone move higher, markets with better fundamentals such as China and Brazil will do considerably better, as we are already seeing. Fortunately, they remain highly favoured Fullermoney investment themes.”

Source: David Fuller, Fullermoney , February 11, 2009.

Charles Dumas (Lombard Street Research): A bleak outlook for Asia

“The recent crash in Chinese imports augurs ill for the region - and Asian stocks are less likely to recover than their north American counterparts, says Charles Dumas, economist at Lombard Street Research.

“‘China's imports are down 40% over six months, as are the exports of South Korea and Taiwan, and almost certainly Japan,' he says.

“‘By contrast, the drop in Chinese exports has been a ‘mere' 20%. This suggests that Chinese final assemblers of goods for export are lowering their sales expectations.'

“Mr Dumas acknowledges that the highly disruptive new year period means the position cannot be fully judged until March data are released. ‘But the scale of these trade declines means that in any scenario the outlook for this particular set of mercantilist ‘savings gluttons' is for a much worse recession than in the deficit economies with currency and monetary flexibility - i.e. the Anglo-Saxons.'

“He suggests the fall in exports will wipe out more than half of China's 10% trend growth - leading to a significant knock-on to consumer spending, he says.

“‘Of course, Beijing will strive to offset the collapse of private demand - but the chance of actual Chinese recession looks major.'

“In Japan, Mr Dumas says a fall of 30-40% in exports implies a fierce recession - and much the same applies to Korea and Taiwan.

“‘This Asian recession could be worse than the Asian crisis of 1997-98.'”

Source: Charles Dumas, Lombard Street Research (via Financial Times ), February 11, 2009.

Moneywise: Could you profit from new frontiers?

“As developing countries appear to defy the global gloom, Liam Tarry looks at the opportunities - and risks - of investing these new frontier markets.

“Countries such as Vietnam, Nigeria and Kazakhstan are often associated with images of political unrest and corruption - few of us imagine that they could offer a sound investment opportunity. Yet these countries belong to a relatively unknown sector called ‘frontier markets', which has performed very well in recent years. Although highly volatile, this sector may hold hidden treasures for those investors willing to take the risk.

“Frontier markets are, in essence, very small emerging markets. Just 15 years ago, the BRIC markets (Brazil, Russia, India and China) were classed as frontier markets, but they now form a part of many investors' portfolios. Today's frontier markets, however, are virgin territory for most of us. They can be found across the globe, from Bulgaria to Bangladesh and from Kazahkstan to Kenya.

“According to Morgan Stanley Capital International, which launched the MSCI Frontier Market Index in November 2007, there are about 20 frontier market countries vying to become tomorrow's emerging markets.

“‘Frontier market economies are generally much smaller and less developed than emerging markets, but investors understand their potential to grow and become tomorrow's success stories,' says Mark Mobius, executive chairman of Templeton Asset Management and manager of its range of emerging market funds.

“So, if you dare to step into the unknown, you could find that high returns are there for the taking.”

Source: Liam Tarry, Moneywise , February 9, 2009.

Steven Lewis (Monument Securities): A yield too high?

“The Federal Reserve must tread carefully in regard to the sharp rise in Treasury bond yields over the past couple of months, warns Stephen Lewis, economist at Monument Securities.

“He says rising yields risk nullifying the actions being taken by the Fed and the Treasury in other policy areas to stimulate the economy. The authorities need to assess the impact of their fiscal and Tarp-related (troubled asset relief programme) measures on Treasury yields, he says, and balance the loss to demand from higher yields against the gains to demand expected from their actions.

“‘It is entirely possible that a point might be reached where the loss would exceed the gains. This would, in effect, set a limit to what the US authorities could do to support the economy.

“‘Any attempt to reflate the economy beyond that point would be as futile as an attempt to travel faster than the speed of light.'

“Mr Lewis says the Fed may believe it can circumvent this constraint by holding down yields in the marketplace.

“‘If they initiate a strategy of buying Treasuries in such circumstances, they will very likely find plenty of willing sellers.

“‘But to keep yields steady, the Fed might have to progressively increase the scale of its purchases, and eventually wind up holding most of the Treasury debt in issuance. This looks like a route-map to the destruction of financial markets and the establishment of a command economy.'”

Source: Steven Lewis, Monument Securities (via Financial Times ), February 9, 2009.

Neil Mellor (Bank of New York Mellon): Why the ruble still looks risky

“The recent appreciation of the ruble by no means indicates that Russia has yet secured stability for the currency - particularly if oil prices continue to suffer from declining optimism about the global economy, says Neil Mellor, currency strategist at Bank of New York Mellon.

“He notes that the ruble's jump on Wednesday was the biggest since the current composition of its euro/dollar trading basket was established two years ago. ‘On the face of it, the central bank's efforts to steer the ruble away from the lower boundary of its trading band appear to be working,' he says.

“‘But in doing so, the Bank has been obliged to draw upon its full arsenal; it has hiked interest rates, limited the money on offer at its liquidity operations, cautioned investors against depreciation bets and put its money where its mouth is by using up around one third of its reserves to defend the currency. Yet it remains to be seen whether this will be enough.'

“Mr Mellor says that for the week to February 6, the central bank spent a further $4.6 billion defending the ruble; and that if weakening optimism indeed bodes ill for the oil price, this might be at the lower end of the expenditure scale.

“‘The ruble might have enjoyed a degree of respite, but, at the very least until the price of oil shows greater signs of life, pressure on the currency is unlikely to desist - resulting in central bank intervention that can only further undermine confidence in Russia's current credit ratings.'”

Source: Neil Mellor, Bank of New York Mellon (via Financial Times ), February 12, 2009.

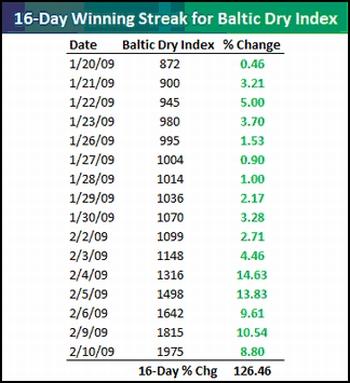

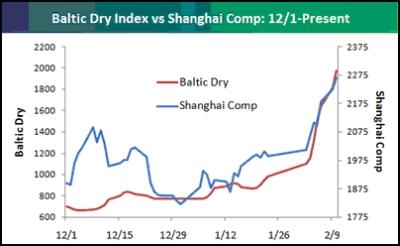

Bespoke: Baltic Dry, winning streaks, and China

“The Baltic Dry Index (BDI) has been making news lately after its impressive performance over the last few weeks. For those unfamiliar with the BDI, it measures the cost to transport raw materials by sea, and it is currently on a 16-day winning streak in which it has risen 126%. The last five trading days have seen the index rise 14.63%, 13.83%, 9.61%, 10.54%, and 8.80% - talk about a rally!

“And while the Baltic Dry doesn't have much correlation with US stocks, it does follow China's equity market pretty closely. Over the Baltic Dry's 16-day winning streak, China's Shanghai Composite index is up 14% as well, and it really looks like it's beginning to turn a corner. Below we provide a chart of the Baltic Dry Index compared to China's Shanghai Composite. While the percentage changes are more extreme for the Baltic Dry, the direction of its move is very similar to China. Given the fact that China is such an export based economy, it's no surprise that this trend exists.

“Finally, it's important to note a few things regarding the Baltic Dry. First, the index declined more than 94% from its peak to trough over the last two years. While it has made a nice move upward in the past few weeks, it is still way, way down from its highs.”

Source: Bespoke , February 10, 2009.

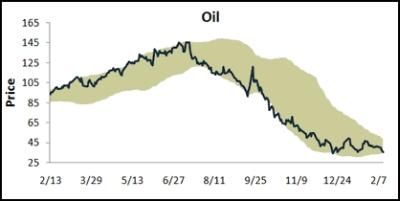

Bespoke: Commodity snapshot

“Below we provide our trading range charts of commodities. The green shading represents two standard deviations above and below the commodity's 50-day moving average. Moves above or below this green shading are considered overbought or oversold.

“As shown, oil has once again taken a turn for the worse, and it is currently testing support at its prior lows over the past couple of months. Metals, on the other hand, continue to surge. Gold, silver, and platinum are all trading at the very top of their trading ranges. They've rallied nicely over the past few weeks, and a further move of 1% to 2% higher will put them at overbought levels.”

Source: Bespoke , February 12, 2009.

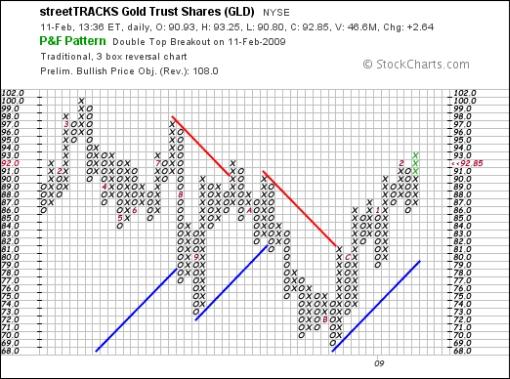

Richard Russell (Dow Theory Letters): Gold frenzy lies ahead

“There's only one item that is bought through both fear and greed. That item is gold. Are you worried about the viability of the dollar? Then buy gold - (fear). Are you afraid that the gold market is getting away from you? Then don't wait - buy gold (greed).

“Those subscribers who have heeded my advice - ‘buy gold'. They are doing OK today. Of course, for years I advocated buying gold coins and hiding them away and never looking at them or thinking of selling those little beauties. Now if you want gold, you have to buy ‘paper gold' in the form of GLD. Which is probably OK. Below we see an up-dated chart of GLD. And we see the breakout today at 92.29. This completes a huge base, which started at the 69 box and since has been building and building.

“Today, with the upside breakout at the 93 box on the P&F chart, we're forced to buy gold in the 944 (April futures) area. For those who missed out on gold when it was in the 700s and 800s, this is a scary proposition. So question - is it too late to buy GLD or high-premium coins if you can find them? As I see it, the frenzy, the speculative phase of gold, the rush of a frightened public lies ahead.

“Big bull markets always find a way to keep you frightened and OUT. Big bull markets are devils with no conscience - to get in you have to ‘close your eyes, and just do it'. Not easy, but in this business nothing is easy except losing money. ‘There's no fever like gold fever.' And I'm beginning, just beginning, to feel the fever now. When I look at the chart below, I can sense the fever rising.”

Source: Richard Russell, Dow Theory Letters , February 11, 2009.

Business Intelligence: Merrill Lynch - $1,500 target for gold

“Gold prices may hit US$1,500 an ounce in the next 12 to 15 months, Gary Dugan, the Chief Investment Officer of Merrill Lynch, said yesterday.

“Dugan termed his apprehensions of gold striking such a high as a ‘fear' that may come true. He reasoned that such a price would mean the other commodities and streams of investments have been shunned by investors.

“With confidence in currencies shaken to the core, the yellow metal is increasingly assuming the role of ‘the most trusted currency', Dugan said. ‘We have never seen such a rush to buy gold. It's bringing in security and it's still affordable.'

“Merrill Lynch commodity price forecast authored by Dugan showed that gold prices can rise from the currently prevailing US$913 per ounce to US$1,100 in the first quarter of 2009 and to US$1,150 in the second quarter. ‘While demand for gold has been rising production has been declining. South Africa, which accounts for the major share of global gold production, is facing political issues and has energy problems,' Dugan said.

“With reports of declining returns from other investment options, ‘cash' - keeping money safe in banks and investing in government bonds - is the option in front of investors, Dugan said.

“‘Fear' and eventual decline of the greenback are the two factors that will drive gold prices, he said. While commodity markets could also bounce back in the first half of the year, a rebound is likely to be short-lived in the absence of strong US consumer demand.”

Source: Business Intelligence , February 8, 2009.

Financial Times: Bullion sales hit record in rush to safety

“Investors are buying record amounts of gold bars and coins, shunning risky assets for the relative safety of bullion amid renewed fears about the health of the global financial system.

“The US Mint sold 92,000 ounces of its popular American Eagle coin last month, almost four times that which it sold a year ago and more than it shipped during the whole of the first half of 2007.

“Other countries' mints have also reported strong sales. ‘Large purchases of coins are perhaps the ultimate sign of safe-haven gold buying,' said John Reade, a precious metals strategist at UBS.

“Inflows into gold-backed exchange traded funds surged in January, pushing their bullion holdings to an all-time high of 1,317 tonnes. Last month's flows of 105 tonnes were above September's previous record of 104 tonnes, and absorbed about half the world's gold mine output for January, said Barclays Capital.

“‘We estimate that investment demand [into gold] could double in 2009 compared to 2007,' said Mr Reade. ‘Purchases of physical gold have jumped over the past six months as investors' fears about the current financial crisis … have intensified.'

“The move into gold is being driven by the very rich, with bankers saying that some clients are hoarding gold in their vaults. UBS and Goldman Sachs said last week that investor hoarding would drive prices back above $1,000 an ounce.

“Traders and analysts said jewellery demand, historically the backbone of gold consumption, had collapsed under the weight of the high prices. Sharp falls in demand in the key markets of India, Turkey and the Middle East have capped the potential of any price rally. But the lack of jewellery demand has not discouraged investors.

“GFMS, the precious metal consultancy, estimated bullion coin demand last year reached its highest level in 21 years.”

Source: Javier Blas, Financial Times , February 9, 2009.

CEP News: Euro Zone GDP contracts at record pace in fourth quarter

“The euro zone economy shrank at a record pace to end off 2008, suggesting that the current recession in the monetary union will be both deep and prolonged.

“According to advance estimates from Eurostat, the euro zone economy contracted by a record 1.5% in the fourth quarter of 2008 compared to the previous quarter. Economists had expected a more modest fall of 1.3% following Q3's 0.2% decline.

“Germany led the way in declines, contracting 2.1% in the fourth quarter. Conversely, Slovakia was one of the few economies to show any gains over the period, rising 2.1% according to preliminary estimates.

“Year-over-year, overall output in the monetary union shrank by 1.2%, its sharpest pace in series history and down from both the 1.1% contraction expected and Q3's annualized gain of 0.6%. Looking at 2008 as a whole, GDP growth slowed to 0.7%, down two percentage points from the rate in 2007.”

Source: CEP News , February 13, 2009.

David Fuller (Fullermoney): China has the money

“Every country faces the most serious economic problems in decades but you can be reasonably certain that US Treasury Secretary Tim Geithner and UK Chancellor of the Exchequer Allistar Darling would love to have China's problems. China is a creditor nation with enviable amounts of cash.

“Yes, the export sector is in a mess and the PRC had been overly reliant on it for two decades. Nevertheless, by being the world's manufacturer of first resort, China gained enormous technological know how. This will be invaluable as they move their manufacturing base to a more sophisticated level.

“China will not worry about lots of toy manufacturers going out of business. However consider these comments mentioned to me last weekend by a friend visiting from Hong Kong. China is making huge efforts to improve the economic wellbeing of its rural poor. For instance, he said the government has told manufacturers of refrigerators not to lay off workers or slash prices. Instead, it is buying surplus refrigerators at market prices and selling them to the rural poor at half price. There are plenty more rural poor who need looking after than unemployed factory workers in the Southern provinces, although China's population statistics are astronomical for Western observers.

“The point is, China has the money to do that and does not need to borrow. However, the PRC is not just subsidising the poor with its vast surplus.

“For over a year it has been fashionable to say once again that: ‘Cash is king.' To the extent that this is a truism, it means that anyone with cash can buy cheap assets when others are forced sellers. From Russia to Australia, China is buying cheap industrial resources for its long-term development.”

Source: David Fuller, Fullermoney , February 12, 2009.

Financial Times: Alarming times for China as exports fall

“Jung Ulrich, chairman, China equities at JP Morgan says the exports drop is a real cause of concern for the Chinese leadership. She tells FT's capital markets correspondent David Oakley that there is little prospect of a return to 8% growth until world economy recovers.”

Source: Financial Times , February 11, 2009.

Bloomberg: China's new loans rise by record on stimulus efforts

“China's new loans rose by a record in January and money supply expanded at the fastest pace in more than a year as the government pressured banks to support a 4 trillion yuan ($585 billion) stimulus package.

“Banks extended 1.62 trillion yuan of new local-currency loans and M2, the broadest measure of money supply, climbed 18.8% from a year earlier, the People's Bank of China said today on its website.

“The jump in new loans to twice the record set a year earlier shows China may succeed in reviving growth even as credit markets around the world remained locked and after developed economies slumped into what the International Monetary Fund calls a ‘depression'. Loan default risk is rising and represents the biggest single threat to Chinese lenders this year, Fitch Ratings said last month.

“‘We believe China is the only economy in the world to see significant growth in credit to corporate and household sectors after September 2008, when the financial crisis worsened to a near collapse,' said Lu Ting and T.J. Bond, Merrill Lynch economists in Hong Kong. Soaring credit growth ‘might be at the cost of the future health of the banking system'.”

Source: Kevin Hamlin and Luo Jun, Bloomberg , February 12, 2009.

Financial Times: Economists warn of Chinese deflation

“China faces a bout of deflation, economists warned on Tuesday as data revealed that inflation dropped to its lowest in 2½ years in January and that the price of goods leaving factory gates fell 3.3% in January.

“In the latest sign of economic weakness in the country, consumer price inflation fell for the ninth month in a row to 1% in January from 1.2% the previous month as prices for clothing, transport and housing tumbled.

“Several economists forecast that consumer prices in China would begin to fall from this month.

“However, most analysts say that China will avoid a prolonged period of deflation, which could lead to a sharp drop in output as consumers and companies delay spending, because of the aggressive monetary and fiscal stimulus policies introduced by the Chinese authorities.”

Source: Geoff Dye, Financial Times , February 10, 2009.

Financial Times: Japan faces “unimaginable” contraction

“Japan's economy faces an ‘unimaginable' contraction, the chief economist of its central bank warned on Monday, as figures revealed surging bankruptcies and a big fall in machinery orders.

“The warning from Kazuo Momma, head of the Bank of Japan's research and statistics department, underscored the gloom surrounding the world's second-largest economy as export orders dry up, companies shut down production lines and consumers stop spending.

“Japan, where industrial output plunged a record 9.6% month on month in December, is due to announce fourth-quarter gross domestic product data next week. Polls of economists suggest GDP will have fallen more than 3% compared with the previous quarter - an annualised decline of more than 10%.

“‘From October to December the scale of negative growth [in GDP] may have been unimaginable - and we have to consider the possibility that there could be even greater decline between January and March,' Mr Momma said in a speech on Monday.

“His remarks came as a private research company reported a 16% year-on-year rise in the number of bankruptcies among Japanese companies to 1,360 in January, the highest level for six years. Total debts left by failed companies rose 44% from a year earlier to Y839 billion ($9.2 billion), Tokyo Shoko Research said.”

Source: Mure Dickie, Financial Times , February 9, 2009.

Financial Times: Australian Senate passes A$42 billion stimulus plan

“Australia's Senate on Friday passed a A$42 billion ($27.4 billion) economic stimulus package it had blocked the day before after frantic overnight negotiations won a vital extra vote allowing the government to over-ride opposition from conservative parties.

“Independent South Australian senator Nick Xenophon switched sides after winning a commitment from Wayne Swan, Australia's Treasurer, that the Labor government would commit almost A$1 billion to help improve water flow in the ailing Murray-Darling river system.

“The unexpected second vote, in which senators backed the amended package by 30 votes to 28, boosted the Australian dollar on hopes the stimulus payments would reach households in time to avert recession in an economy badly hit by the global slowdown.

“‘I'm not sure whether this package is going to save this country from recession,' Xenophon told parliament. ‘I'm pleased to say I believe we have been able to reach a compromise, which while not giving everybody what they want, may give everyone what they need.'”

Source: Kevin Brown, Financial Times , February 12, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.