World Trade Collapsing, Over-leveraged Bankrupt European Banks

Economics / Global Economy Feb 14, 2009 - 05:03 PM GMTBy: John_Mauldin

Time for a Reality Check

Time for a Reality Check- World Trade Is Falling Off a Cliff

- European Bank Losses Dwarf Those in the US

- Geithner: "You Can't Handle the Truth"

- Earnings Will Get Even Worse

It is not just the US that is in recession. The world is slowing down, and rapidly. This week we quickly survey the rest of the world, and then come back to the US. We follow up with the implications for corporate earnings worldwide, and specifically address my speculations about earnings forecasts for 2009.

World Trade Is Falling Off a Cliff

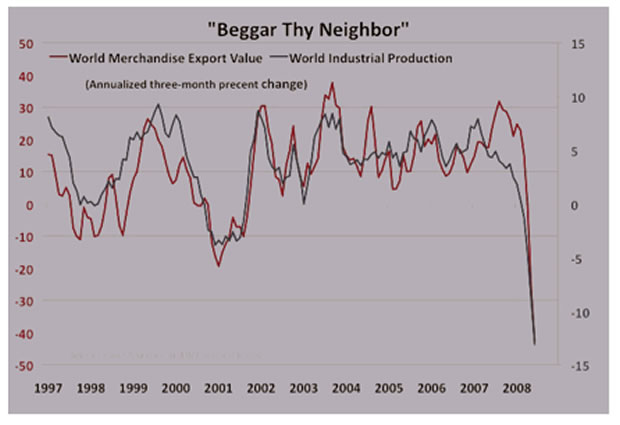

Let's start with some charts from my friend Simon Hunt, out of London. The following chart shows World Merchandise Export Values and World Industrial Production falling off a cliff. This is the worst such period since the end of World War II. And as the data we will examine next indicates, it is likely to get worse. Simon notes that consumer spending is about 60% of world GDP, and it is not just in the US that spending is slowing down. Consumers all over the developed world are in shock, as assets such as stocks and houses, real estate, and commodities fall in value. Unemployment is rising.

We think that almost 2,000,000 lost jobs in the last three months in the US is a catastrophe. China lost a reported 20,000,000 jobs in the last quarter, and migrant workers came back to the cities after Chinese New Year to find factories and jobs simply gone. Unemployment is rising rapidly in Europe, as the demand for goods has clearly been falling since last October.

This means that inventories are too high, not just in the US but in factories all over the world, and that production is slowing down. Look at the recent US trade deficit. Many market analysts rejoiced that it dropped to a six-year low, just below $40 billion. But the internal numbers were not as positive. Exports are dropping faster than imports, as seen below. "After growing in every quarter during the last three years, real goods exports fell 34.9% at an annual rate, the worst performance in more than three decades." (www.dismal.com) And a falling deficit means that US consumers have to save more to balance out less foreign buying of US debt. There is no free lunch.

Let's look at a little bit of insider economics trivia. The US government first estimated that GDP last quarter was a negative 3.8%. I wrote when that number first came out that it would be revised downward.

When the government makes its initial forecast of GDP one month following the end of a quarter, it has to estimate what exports and imports were for the last month of the quarter. There is simply no data. For the 4th quarter of 2008, they estimated that the trade deficit would be about $34.5 billion, in line with what most economists thought. As it turns out, each $1 billion represents about 0.1% of GDP. So being off about $5 billion from the actual total of $40 billion subtracts another 0.5% of GDP from the previous estimate of -3.8%, taking it to a -4.3%.

Further, the government makes estimates about inventories which also affect GDP. When final numbers on real inventories come in, it will also add to the negative GDP estimate. Expect GDP to be in the range of a negative 5% for the 4th quarter, and the current quarter is likely to be almost as weak.

In the US, the leading economic indicators (LEI) continued to decline, but the leading indicators in the rest of the world were often much worse. (The chart below is again from Simon Hunt.) These are results from the OECD's analysis of the leading economic indicators for a variety of countries. Notice in particular how poorly Russia and China are doing! Also remember that the LEI is about how the economy is expected to be doing in six months, not what is going on right now. This argues that there is no real global turnaround in the picture before the end of the third quarter, at the earliest.

China has seen its year-over-year exports drop by 17.5% and imports by 43%. These are not signs of a healthy economy. That being said, China is massively increasing bank loans and other stimulus-type spending to try and offset the effects of the global downturn. But putting 20 million people back to work in a short time is a daunting task.

Japanese GDP was down by 9% (!) last quarter. Many of the largest corporations are seeing exports drop by 20-30% and are engaged in massive layoffs, larger proportionally than in the US. The euro area economy dropped by 6% in the 4th quarter, led by an 8.2% contraction in Germany (JP Morgan). I could go on and on, but the news is the same. The global economy is in a deep and worsening recession.

European Bank Losses Dwarf Those in the US

In a few paragraphs I am going to put up a chart from Nouriel Roubini's RGE Monitor on the size of US bank losses, and in a few pages I'll comment on the Geithner "plan" for rescuing US banks. We have indeed dug ourselves a very deep hole here in the US.

But European banks may be in far worse shape. Bruno Waterfield of the London Daily Telegraph reports to have seen an eyes-only document prepared by the European Commission for the finance ministers of the various EU member countries. The problem revealed in the report is an estimated write-down by European banks in the range of 16 trillion pounds, or about $25 trillion dollars! The concern is that bailing out the various national banks for such an unbelievable amount would push the cost of government borrowing to much higher levels than we see today.

As my kids would say, "Really, Dad, you think so?" Europe is somewhat larger than the US, so think what my gold-bug friends would say if the US decided to borrow $25 trillion to bail out US banks. The dollar would be crucified! The euro is going to get a lot weaker if bank problems are even half of what the report says they are. The British pound sterling is already off almost 30% and, depending on what the real damage is to their banking system, it could get worse.

Waterfield reports, "National leaders and EU officials share fears that a second bank bail-out in Europe will raise government borrowing at a time when investors -- particularly those who lend money to European governments -- have growing doubts over the ability of countries such as Spain, Greece, Portugal, Ireland, Italy and Britain to pay it back.

"The Commission figure is significant because of the role EU officials will play in devising rules to evaluate 'toxic' bank assets later this month. New moves to bail out banks will be discussed at an emergency EU summit at the end of February. The EU is deeply worried at widening spreads on bonds sold by different European countries."

Part of the problem is that European banks were far more highly leveraged than US banks. Some banks were reportedly leveraged 50:1. And they lent money to Eastern European projects and businesses which are now facing severe financial strain and plummeting local currencies.

Let that number rattle around in your head for a moment: $25 trillion. Even $5 trillion would be daunting. But the problem is that Europe does not have a central bank that can step in and selectively save banks from one country without taking on all euro zone member-country banks. Yet, as noted above, some countries may not have the wherewithal to save their own banks. It is reported that some Austrian banks are hoping that Germany will step in and help them. Given Germany's problems, they may have a long wait.

Now, let's look at what Nouriel Roubini (www.RGEmonitor.com and professor at NYU) estimates for US banks losses. He puts the figure at some $1.7-1.8 trillion out of a total of about $3 trillion (I think) in total financial system losses. And Nouriel's base assumptions are not all that bearish, given what we know: a 5% GDP contraction and 9% unemployment, with housing prices down another 20%. All those estimates are quite plausible.

And a quick promotional plug: my next recorded "Conversation" will be with Nouriel and his staff in a few weeks. See the link at the end of the letter to make sure you get your copy.

Geithner: "You Can't Handle the Truth"

The critics were quick to pan Treasury Secretary Tim Geithner's bank bailout plan as being weak on details. Which was true. There wasn't much substance in his speech. But let me offer a contrarian view. Geithner and the team around him may not be entirely tone deaf. They are very smart people and are surely in contact with major Wall Street figures, and would know that the lack of detail would disappoint.

Pretty much everyone knows the scene from A Few Good Men, where Jack Nicholson tells Tom Cruise, "You can't handle the truth!" (www.youtube.com/watch?v=8hGvQtumNAY)

What if the number that the Treasury and the Fed are looking at is a lot more than the remaining $350 billion in the TARP program? As in another $1 trillion more, or even the $1.5 trillion that Roubini says may be out there (and other independent analysts, like David Rosenberg of Merrill, say there may be another $2 trillion in losses). Can you imagine what the market reaction would have been if they had announced that this week? The Dow down 400 points would have seemed like a Sunday walk in the park. Congress would be screaming, and the chances for the stimulus package to pass would have materially diminished.

I don't think we know the real extent of what it is going to cost to shore up the banking system. But the consensus among the financial leadership is that we have to fix the credit system no matter what the costs, or risk a repeat of the Great Depression. That is the essence of what Irving Fisher taught us some 75 years ago, when faced with a deflationary debt crisis.

Time for a Reality Check

Reality check: The "stimulus" that President Obama will sign Monday is a band-aid. If Irving Fisher, who by some accounts was our finest American economist, was right, such a stimulus is useful in that it helps those who are unemployed and replaces some lost consumer spending; but the real work that must be done is to get the credit system flowing again. I don't have the space to go into that economic debate tonight, but it is at the core of the problem. It is Keynes vs. Fisher, von Mises vs. Friedman. It is, as Lacy Hunt says, "The Grand Experiment." After 70 years, we are going to see who is right. My money is on Fisher. It is not an experiment that is going to be fun to live through; but when we have the next debt deflation in 70 years or so, our grandchildren may know what to do.

We will see another stimulus package, probably by the end of the year. This time it will hopefully provide real stimulus. Much of the current version is simply an increase in federal spending that will be hard to rein in. And please, I am not being partisan. That is the analysis of many of Obama's advisors. And it goes back to the debate I mentioned. Keynes would argue that it is in fact stimulus. The other three economists would have differing views. And like I said, in a few years we are going to know who was right.

But the heavy lifting is going to be done by the Fed. Watch their balance sheet expand. And watch Treasury and the FDIC come back and ask for massive amounts of money to take over very large insolvent banks. Stay tuned.

Earnings Will Get Even Worse

Last week I said that 2009 as-reported earnings estimates for the S&P 500 would be dropping. 2008 earnings had dropped to $29.57 as I wrote the letter. They are now down to $28.60. One of my favorite analysts is David Rosenberg of Merrill Lynch. His forecast for reported earnings for 2009 is now down to $28. That puts the P/E for the S&P 500 at 30.

He also projects "operating" earnings to be $55 for 2010. And, as he writes today:

"For those looking for a silver lining, at least we are going to have a deeper bottom to bounce off. Applying a classic recession-trough multiple of 12x against a forward EPS estimate of $55 would imply an ultimate low of 666 on the S&P 500, likely by October if our estimate of the timing for the end of the official downturn is accurate."

That is a 20% drop from today's close of 829. That is not what you will hear from "sell-side" managers who want you to invest in their mutual funds and long-only management programs.

I noted the problem with the rest of the world earlier. 40% of the earnings for the S&P 500 are from outside the US. It is hard to see how those earnings are not going to be deeply affected. Let me reiterate my continued warning: this is not a market you want to buy and hold from today's level. This is just far too precarious an economic and earnings environment.

Given the probable ongoing bad news from financial and consumer stocks, plus the depressing news on bank losses coming down the road, why take the risk?

Orlando, Colorado Springs, New York, and Las Vegas

This Monday I fly out to Colorado Springs to look at a very intriguing high-tech start-up. As gloomy as this letter was, there are so many cool opportunities to get involved with new companies with truly world-changing technologies. Maybe it is just serendipitous, but I am seeing more exciting possibilities than I ever have.

On Friday I am off to Florida for a conference sponsored by Cain, Watters & Associates, and then back home for a few weeks (maybe) before I head to New York in mid-March and then to Las Vegas to be with Doug Casey and friends at his "Crisis & Opportunity Summit," March 20-22. Doug and his associate David Galland have really put together a great line-up. If you are interested in gold and natural resources, this may be a conference you want to attend. I always enjoy being with Doug and David, as they are old friends. And it is interesting to be at a conference where I am the "bull." Click to learn more about the Summit.

I mentioned the edition of "Conversations with John Mauldin" I will be doing with Nouriel Roubini. And the one I did with Lacy Hunt and Ed Easterling, where we talked about the economics "Great Experiment," is up! We recorded it two weeks ago, and I thought it went very well for an inaugural talk. The complete audio and transcript are already in the Membership Library. We are getting very favorable reviews. Multiple readers have let us know that the first Conversation was worth their entire year's membership. I am quite pleased with the first transcript and the response to it. After the release of banking data in early March, I will do a Conversation with good buddy Chris Whalen and a few real banking experts, on where the US banking system really is. I will offer it as a bonus to those who have already subscribed, as it will be more me asking questions than a real Conversation. I expect it to be very informative.

The regular price for a yearly subscription is $199, but you can subscribe now for $109 and still get access to the timely Conversation with Ed and Lacy. Don't wait, as I am sure my staff will only keep raising the price. To find out more, just click on the link and put in code JM77, which will give you the discounted price. https://www.johnmauldin.com/newsletters2.html

And for organizations that would like to purchase a discounted multiple subscription for all their brokers or partners, just drop Tiffani a note at conversations@2000wave.com and she will get back to you.

It is late and time to hit the send button. Have a great week, and enjoy the holiday weekend in the US!

Your on the lookout for more opportunities analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2009 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.