Currencies 2009: Policies of INSOLVENCY, aka Falling Dominoes!

Currencies / Fiat Currency Feb 14, 2009 - 03:26 PM GMTBy: Ty_Andros

In 2008, the currency markets offered some of the greatest opportunities of all markets. Every currency had substantial moves ‘up and down' and many times BOTH ways, as deleveraging and stampedes of panic swept through the markets at different times. 2009 will be no different, only now we are going to look for sharp differences in two in particular. Those that exist in REAL MONEY will skyrocket and pretenders to that moniker will decline regardless of the country that issues them.

In 2008, the currency markets offered some of the greatest opportunities of all markets. Every currency had substantial moves ‘up and down' and many times BOTH ways, as deleveraging and stampedes of panic swept through the markets at different times. 2009 will be no different, only now we are going to look for sharp differences in two in particular. Those that exist in REAL MONEY will skyrocket and pretenders to that moniker will decline regardless of the country that issues them.

“The greatest transfer of wealth from those that store their wealth in paper to those that don't is underway.” The Crack-Up Boom approaches….

“Volatility is opportunity” and it will be with us in SPADES during 2009. As the “mediums of exchange” that most people mistake as money GYRATE up and down, investors will run all over the place trying to ESCAPE the maelstrom, driving values of stocks, commodities, bonds, energy, and all markets up and down. These are huge opportunities for the prepared investor and will be the demise of others. It will separate the men from the boys and there are a lot of boys out there pretending to be men. Absolute return investments are where you should focus, as well as on professional traders who have the potential and track records to illustrate their ability to THRIVE in all market conditions… (P.S.: this is what I do; I am a manager of managers and asset allocator for investors).

This past week really put a face on the coming destruction of the G7 currencies. Second rounds of bank rescues are being prepared as the first have FAILED to put a dent in the cascading losses in the over-the-counter derivatives, such as CLO's, CDO's, CMO's, (Collateralized Loan, Debt, Mortgage Obligations), and are deteriorating in an ever-increasing manner as income and asset values collapse.

Every day the growing number of debtors without the ability to repay grows and grows. Insolvency spreads in widening circles as INCOMES collapse. Governments are implementing stimulus plans that don't stimulate, they just CONSUME precious capital. The OBAMINATION $920 Billion stimulus bill is NOTHING of the sort. It is an 88% PERMANENT expansion of government (new and permanent baseline budget increases and expanded entitlements without the revenues to pay for them) and a 12% token of real investment that will pay itself back from productivity gains. Of course, the $900 Billion understates ALL the costs. Have you EVER heard of a spending item of government which comes in for LESS than projected?

For those of you looking for common sense solutions to the problems of energy production, environmental rules, economic stimulus and job creation, it is a DISASTER. Recent reports put the cost per job created at over $600,000; of course, the private sector would do this for $60,000. Sounds about right … $1 into government (borrowing, taxing, or printing), 90¢ public serpent, er … servant processing fee to support their waste, permanent expansion of government, campaign paybacks, fraud and abuse, and 10 ¢ to the public who pays for it all.

The Congressional budget office states 80% of the spending hits the economy in 2009-2011; this is immediate stimulus? Obama is no longer a new way of doing things, but the old. Change is more of the same as it always is when it is spoken during a campaign. Can you imagine that an $800 STIMULUS Bill can be crafted in a couple of weeks by a bunch of LAWYERS calling themselves KEYNESIAN economists? ABSURD! Like children with crayons in the basement, it is a complete waste. Nothing is planned and thoroughly thought through. Nothing is done to revive the PRIVATE sector where wealth is created. The only thing created is new borrowing that CROWDS out the private sector.

To see the ugly details of the bill click here (look closely at this bill; it is a fraud to call it stimulus, is only PORK and corruption from the left side of the aisle; it is VILE BETRAYAL of the American People by their public serpents, er … servants). Looking at the details, you will notice that the public serpents, er … servants are WHOLLY unconcerned about stimulating the economy and focused only on BUILDING government programs, pork barrel and campaign paybacks. Like usual, the public servants put a pretty label on the legislation, and then the bill is completely different than the title: FOOLING the broad public which cannot see past a headline and mainstream media spin. This is stimulus in NAME only; nothing of the sort will result, only bigger government, higher baseline budgets and business for crony capitalist campaign supporters.

It is guaranteeing a failure to revive the economy and it is setting the table for STIMULUS #2 sometime in the FALL of 2009.

Look for a BIG bang bank rescue bill that will mask over the problems, putting INSURANCE wraps on TRILLIONS of dollars of toxic securities worth virtually ZERO (see Roach Motels in Ted bits Archives) and suspend market to market requirements so they can PRETEND these holdings will recover, just as they did during the Latin American debt crisis in the early 1990's. Then they will create smoke and mirror rules in which to try to dupe private sector investors into buying common equity in bankrupt commercial and investment banks and worthless securities and then leave them HOLDING the EMPTY BAG! This will be a BAD bank plan, followed by a really bad bank plan, and when that fails, the REALLY terrible bank plan!

As I mentioned in a previous missive, they are also reviving the SIV and conduit business model (aka shadow banking system). This model bought loans of all stripes (in CDO's, CLO's CMBS, etc.), then borrowed cheap in the overnight market and earned the spread or carry between the long term payouts on the Securities and the low rate provided by the markets. The Fed is going to allow HEDGEFUNDS to buy the long term STUFF and loan to them CHEAPLY short term. This is what caused the credit crisis to unfold initially as the money market LENDERS quit lending against the diminishing quality, long term securities . The Fed doesn't care about the quality of the long term lending; they just want the lending to take place.

Look no further than today's announcement by Fannie Mae that they are RESURRECTING “Liar Loans”, also known as NINJA (no income, no job or assets). People are not getting approved using conventional qualifications, they just LOWER them again, so now people with good credit scores but unverifiable income can REFINANCE. There is no end to the lies; they will just get bigger and bigger as public servants try to dodge the bullet of insolvency and just enlarge it further. Both of these REVIVED techniques are similar to reviving these FRANKENSTEINS.

Currencies: Policies of INSOLVENCY, aka Dominoes!

When looking at currencies, it is important to note that most masquerade as MONEY but are actually IOU's from morally and fiscally bankrupt public servants and their monopolist companions in the central banks and banking systems. In order to differentiate currency from MONEY, we must first define which is which. So first, let's look at the functions of money:

- Medium of Exchange

- Store of Value

- Standard of Value

- Measure of Value

- No one else's liability

There are only two currencies which meet this definition and functions as such, and they are the longest running currencies in history: they are Gold and Silver . There are also techniques you can use to restore this definition to G7 currencies, but I won't go into them here. In today's world, currencies only live up to one of the definitions above and one other:

*Medium of Exchange

*Someone else's liability: in effect, that of the government that issues them, such as the US Dollar, UK Pound, Swiss Franc, Euro, etc.; these are actually IOU's.

Functionally, they are a type of BOND and thus are only as good as the creditworthiness of the respective government, the solvency of their respective citizens, tax revenues and most of all, the ability of the respective economies to create wealth by producing more than they consume. They are also known as FAITH BASED or FIAT currency because you place your faith in the government and it's economies and private sectors to pay. When a society no longer creates wealth, its ability to pay is always declining. As wealth creation subsides, they first turn to the credit markets to sustain and expand spending. Then when that avenue becomes closed, they turn to the printing press. The G7 approaches this final destination in a big way this year.

To know where the US and ultimately the G7 are headed, look at this article from Bloomberg:

Feb. 5 (Bloomberg) -- Bill Gross, co-chief investment officer of Pacific Investment Management Co. Said the U.S. may slump into a “mini depression” unless policy makers spend trillions of dollars to spur growth.

“This economy needs support from the government, a check from the government in the trillions,” Gross said today in a Bloomberg Television interview from Pimco's headquarters in Newport Beach, California. “There is a potential catastrophe if the U.S. government continues to focus on billions of dollars.”

President Barack Obama has proposed a stimulus package intended to spur growth estimated at as much as $900 billion. The U.S. economy shrank by 3.8 percent in the fourth quarter, the most since 1982 as consumer spending recorded the worst slide in the postwar era, the Commerce Department said last week.

Pimco won a Federal Reserve contract in December as one of the four managers of a $500 billion program to purchase mortgage-backed securities. The company was also one of the managers selected to run the Commercial Paper Funding Facility in October.

The Fed will have to step in and buy Treasuries, Gross said, to keep long-term interest rates low as the U.S. increases its debt sales to finance a growing budget deficit and stimulus programs. Central bank officials said Jan. 28 they were “prepared” to buy longer-term Treasuries.

Government borrowing will probably reach $2.5 trillion during the fiscal year ending Sept. 30, according to Goldman Sachs Group Inc.

Speculation has risen that China, which holds $681.9 billion of Treasuries as the single largest investor in U.S. debt, may stop or slow the purchases of U.S. debt as its own economic growth slows.

“To the extent that the Chinese and others do not have the necessary funds, someone has to buy them,” Gross said. “It is incumbent upon the Fed to step in. If they do, that will be a significant day in the bond market and the credit markets.”

Yes, he is right; foreigners WILL NOT take down this ultimately worthless paper, but the Fed stepping up its purchases won't be a significant positive as he believes. Instead, it will be one more step toward these areas of the bond markets' demise and a short term rally to be sold into, but the long term trend will still be down. One by one, mainstream voices will chorus this TUNE, on top of what has been spent or guaranteed. As you may recall from my last missive, Bill is sitting on a HUGE pile of BOMBS, er … bonds, and evidently sees his demise approaching, thus he says to the government ‘throw everything at it and SAVE me.' He and his fellows at P*mco see the writing on the wall (you could see the fear in Bill's eyes when he was interviewed and calling for TRILLIONS), then he said he is staying in government guaranteed issuance.

Look no further than the NEWLY ANNOUNCED economy commission headed by Paul Volker and Christina Romer to see from where the justifications for further STIMULUS ‘money printing' will come. Then, the mainstream media will SCARE the public and the politicians will turn this FEAR (false evidence appearing real) into foolish action over and over again -- the printing press, borrowing and spending as SALVATION, rather than raising incomes and economies through the PRIVATE SECTOR. More and more government interference and saving the insolvent-- this is an impossible task.

The G7 central banks will increasingly step across the line and expand lending to more and more of their economies, and the new Fed lending facility originally earmarked at $200 billion will be expanded far in excess of previous estimates, maybe even quadruple. Since PRUDENT savers won't lend to unqualified borrowers, the government will (this is moral and fiscal bankruptcy). The latest TRAUNCH of the auto industry bailout number is another $25 billion. The bank bailout ultimately will be 5 to 10 times its current size before it is solved. Postponement of nationalization and extinction for insolvent firms will massively INFLATE its ultimate costs as public servants attempt to save their biggest campaign supporters and fellow MONEY monopolists.

As more and more debt comes due this year, INTERNATIONALLY the Dollar will catch a bid due to a SHORTAGE of Dollars . As most currencies decline relative tothe dollar, the cost of meeting their ‘dollar denominated' obligations SKYROCKETS, and that includes foreign central banks involved in those massive swaps made last fall. At some point, this will trigger a call for a devaluation of the dollar. Ben Bernanke DOES NOT WANT A STRONG DOLLAR. Don't miss out of the corner of your eye that the dollar can rally and so does GOLD. Decoupling has begun. Gold is at or near all-time highs ad opposed to all currencies, and central bankers worldwide are determined to keep it so. They want to inflate away debts aggressively.

Last week, a senior official at the Swiss National Bank announced their intention to keep the Swiss Franc from rising by any means necessary. HE WAS NOT KIDDING. Unfortunately, the Swiss Franc is a currency used in the carry trade and as those positions are unwound, the Swiss Franc catches a bid as those borrowings are repaid. Huge portions of the New EU, borrowed in Swiss for homes and business investments, are now on the hook for 20, 30 or 40% more to repay as the currency in which the borrower lives and operates has fallen by that much against the Swiss franc.

Look for the Swiss, US Dollar and Japanese Yen to BE STRONG as borrowers scramble to get them to pay off their debts and convert the home currency into the currency in which they originally borrowed (Yen, Dollars, Swiss Francs). Once this is done, look for the dollar to then reverse probably mid-year and head radically lower. The Swiss will stay stronger as will the Yen; they do not face the money printing requirements in which the US will indulge .

China's Yuan is a FIAT currency but produces wealth, and not only does China produce more than it consumes, but it holds enormous SAVINGS. Thus, you can expect it to decline in purchasing power MORE SLOWLY than the US Dollar or much of the G7, where wealth creation is a distant memory. In relation to the G7, it should soar.

This crisis will not end until a new economic, global financial order is in place. A recent interview with Paul Keating, ex-Prime Minister of Australia, lays the truth of the matter open in this interview: http://www.abc.net.au/reslib/200902/r335492_1519593.asx . Watch it; he is absolutely correct in his conclusions (worth every minute to watch as it is the BLUNT truth).

People that hold G7 currencies are lenders and creditors to the various countries, having yet to be repaid, this is called REPATRIATION. Ultimately, they NEVER WILL be repaid . They will get nothing but the intrinsic value of them (the value of the paper) because the rescue of the G7 financial systems are the seed and ultimate cause of the currencies' inability to hold their own “purchasing power.”

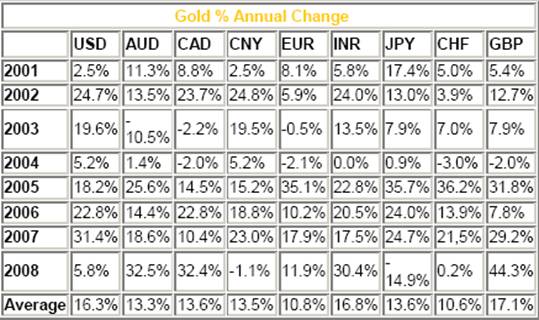

Now we must introduce the MODERN day currency concept (from my good friend Clyde Harrison) of “CURRENCIES DON'T FLOAT, THEY JUST SINK AT DIFFERENT RATES”! To illustrate this, we will use a recent chart by James Turk (at http://www.fgmr.com , Freemarket Gold & Money Report; I subscribe and recommend you do too)

This is the picture of FIAT currency and credit creation and the theft of the purchasing power of the MONEY YOU HOLD WHILE IT SITS IN YOUR BANK. Gold and silver ARE NOT rising in value (they are holding their value steady); it is the purchasing power of your money SHRINKING through DEBASEMENT. It is gold REPRICING higher to reflect the lost purchasing power of the currency in which it is DENOMINATED . It is a stealth tax courtesy of YOU KNOW WHO! And the mainstream media says there is NO INFLATION. Wanna bet? THIS IS SET TO ACCELERATE WITH THE INEVITABLE PRINTING PRESS SOLUTIONS of the G7.

The gold chart is basically what you have seen in stocks until the last year. Stocks WERE NOT increasing at a rate faster than GDP; the additional gain in stocks was ACTUALLY the stocks repricing higher to reflect the debasement of the currency in which they were priced. Your stockbroker could always confidently predict higher prices as inflation would ALWAYS give the illusion of nominally higher prices. Let's take a peek at the S&P 500 priced in Dollars and then priced in gold (real money):

S&P 500 Priced in PAPER FIAT Dollars

Notice how the market has surrendered ALL its gains since 1998. Ugly, but this is actually the good news version of REALITY. Now let's look at the S&P 500 priced in REAL money -gold:

S&P 500 Priced in REAL Money - Gold

Wow. Look carefully. The S&P priced in REAL TERMS,GOLD has surrendered all its gains going back to 1989 (the rally seen since the 2002-2003 low was an inflationary illusion), and a 20 % move higher in gold or lower in stocks will put us back at the lows of 1980. That 1980 low is the next stop for this chart, you can bet on it . It's all an illusion, courtesy of MISTATED inflation numbers. What do you think the American people would do if they understood this picture of the fraud perpetrated on them by unsound monetary practices, failure to grow the private sector (other than the financial sector) and dereliction of duty by public servants and banking systems?

We are about to find out as these illusions are being UNWOUND as we speak. There is ‘no such thing as a free lunch' and the bill is now coming due. The US does not have the money to pay and neither do many other countries in the G7, so they will print it. Debtor countries are now at the end of the proverbial rope; they may roll current holding but can be expected to buy no more. As Dennis Gartman has said “it takes buying. and lots of it, to put any market up; it takes a mere lack of buying to put a market down”, and this is where we are rapidly approaching in the sovereign debt markets. Their next avenue of escape is the printing press as the debt market increasingly REJECTS their offerings.

As Richard Russell recently quipped about FIAT currencies:

They create fiat money and pretend it's wealth. We work for this phony paper and pretend it's money. A sick illusion on the part of the central banks and the people. Scary.

This fabulous missive ‘ Monetary Policy and the US Dollar ,” from Mike Hewitt just hit my inbox and it puts the money creation into perspective with GREAT graphics. When you look at it, think of the trillions of Dollars that are going to be created through debt issuance and PRINTING and what they will do to the illustrations he presents:

Multi-trillion Dollar, Euro, Pound Sterling and Aussie Dollar stimulus programs and BANK bailouts are creating MOUNTAINS of inextinguishable debt and NO PLAN on how to pay it back, as well as rising entitlements, pension obligations and exploding government programs in economies which no longer produce wealth to service their debts. How much longer until lenders figure this out and quit buying the ultimately worthless paper? The answer is - SOON! Both the bonds and the IOU'S, known as G7 money, are actually DEBT IN DISGUISE. As the programs expand, the ability to repay becomes more and more DISTANT. All currencies will loose purchasing power this year and decline against the “barbarous relics” known as gold and silver, which are timeless currencies.

Conclusion: The Black Swans just keep on rolling in as January was the worst January ON RECORD in global stock indexes. On a monthly basis, the S&P 500 is the most oversold in history.

In his latest missive, John Mauldin outlines the situation for Earnings, which is a proxy for INCOME for everybody in the G7. It now appears earnings for 2008 have declined to $29.57 (S&P 500 at 865 divided by $29.57 = 29.25 as today's P/E ratio and rally predicated on earnings rise is false); and if earnings decline as they have in previous recessions, they project to $15.90 as of the end of the 2 nd quarter. At today's S&P level of 865, that translates into a P/E ratio of 54.

This PE level is higher than what was seen AT THE PEAK of the 2000 stock market highs while we are currently sitting near the lows of today's markets. No matter how long and far the current rally may extend due to oversold conditions and fairy tail projections by banks and brokers, when it is done, you can expect a HUGE decline.

How many corporations can meet their bond obligations while their earnings are in FREEFALL? Whenever you see monthly job losses of almost 600,000 people, that is 600,000 people who can no longer pay their car, credit card and mortgage debts or pay taxes to insolvent governments on the state, municipal or federal levels. Private sector capital spending is in freefall globally, as are the GDP's of exporters on the Pacific Rim.

Yesterday, Treasury Secretary Geithner, after much bally hoo, unveiled that the next part of the bank BAILOUT is going to cost in EXCESS of another $2 trillion dollars; then he said the plans were still in the design stage. Once again no details, opaque and unaccountability was the message. It was a disaster and is the continuation of the disaster; another $6,700 plus for every man woman and child in the US. Of course, nothing has been solved; there will be much more MONEY before the financial system is rescued, trillions more and this solution avoids the pain required to FIX the problem. This is called Crony Capitalism.

The G7 is DETERMINED to get people to spend rather than save, punish investment rather then encourage it. Prevent insolvency rather than allow it to cleanse the system. Enlarge government rather than reform it, reward poor decisions rather than let people be punished for them. Discourage entrepreneurs and reward failing ones. These are RECIPES for insolvency, immorality, government corruption and moral and fiscal bankruptcy.

These are HUGE opportunities, as the debt defaults both this year and next are INESCAPABLE. The money printing is INESCAPABLE. The final destination for the G7 stock markets is INESCAPABLE (the greatest buying opportunity in a century will be presented to you in the next year or two). The greatest transfer of wealth from those that hold their wealth in paper to those that don't is INESCAPABLE. Stocks, bonds, commodities, currencies, precious metals and all markets will ZOOM all over the place as the public is ping ponged about in FEAR. You must learn to “ turn volatility into opportunity ” in absolute return alternative investments for a portion of your portfolio and make money in RISING and falling markets. (P.S.: This is what I do.)

Over the weekend, the IMF admitted the G7 is in a depression; politically incorrect language, but true. It is IMPOSSIBLE for me to describe how fast things are FALLING. Short term OPTIMISM about the Federal bailouts of the banks will succumb to the reality that they are woefully too small. And avoid doing what must be done: NATIONALIZE the banks, wipe out the shareholders and bondholders, remove the toxic waste and dispose of it, and sell the CLEANSED bank back to the private sector.

They CANNOT buy the bad assets; it is a fool's errand and a corrupt one, thus, they will do this. It's interesting to watch Barney Frank talk about the banks as he is CULPRIT number one for government meddling and creating BAD lending decisions. There is no that way the savers of the world are going to take these bond issuances, so hi ho, hi ho, it's off to the printing press we go. ALL paper forms of wealth are going to get increasingly toxic and the CON game of FIAT G7 currencies is nearing its WATERLOO….

Don't miss the next edition of the Ted bits 2009 Outlook on Commodities…..

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.