Financial Markets React Badly to Obama Economic Stimulus Plan

Stock-Markets / Financial Markets 2009 Feb 13, 2009 - 12:26 PM GMT

“Stimulus Bill” up for a final vote today... After a 24-hour delay caused by late, lingering controversy, Democratic congressional leaders say President Barack Obama's economic stimulus bill -- a massive, $790 billion package of tax cuts and federal spending -- is on track for a Friday vote in the House.

“Stimulus Bill” up for a final vote today... After a 24-hour delay caused by late, lingering controversy, Democratic congressional leaders say President Barack Obama's economic stimulus bill -- a massive, $790 billion package of tax cuts and federal spending -- is on track for a Friday vote in the House.

The Senate could vote on the bill later in the day or over the weekend, sending the measure to Obama's desk and awarding him a crucial victory. He says the measure will create or save 3.5 million jobs, while critics contend the bill is filled with wasteful spending and provisions that won't boost the economy.

…but will it do the job?

The compromise economic stimulus plan agreed to by negotiators from the House of Representatives and the Senate is short on incentives to get consumers spending again and long on social goals that won't stimulate economic activity, according to a range of respected economists.

"I think (doing) nothing would have been better," said Ed Yardeni, an investment analyst who's usually an optimist, in an interview with McClatchy. He argued that the plan fails to provide the right incentives to spur spending. For once, I think Ed has it right.

When will stock investors look at the fundamentals?

-- Confidence among U.S. consumers fell in February as job losses and declining prices for stocks and homes undermined Americans' view of their financial well-being.

-- Confidence among U.S. consumers fell in February as job losses and declining prices for stocks and homes undermined Americans' view of their financial well-being.

The Reuters/University of Michigan preliminary index of consumer sentiment fell to 56.2, from 61.2 in January. The drop is the first in three months and puts the index near a 28-year- low reached in November.

Treasuries set for first weekly gain since December.

-- Treasuries headed for a weekly gain, trimming their worst start to a year in more than two decades, on speculation President Barack Obama's $789 billion stimulus plan won't revive consumer spending and the world's biggest economy.

-- Treasuries headed for a weekly gain, trimming their worst start to a year in more than two decades, on speculation President Barack Obama's $789 billion stimulus plan won't revive consumer spending and the world's biggest economy.

Traders reduced bets on inflation as Treasury Secretary Timothy Geithner said he needs time to work out the details of his strategy to shore up the financial industry.

Gold investors taking profits.

( Bloomberg ) -- Gold declined for the first time in four days in London as some investors sold the commodity to lock in gains from its rally to a six-month high.

( Bloomberg ) -- Gold declined for the first time in four days in London as some investors sold the commodity to lock in gains from its rally to a six-month high.

“We have run up too fast and too high,” Bernard Sin , currency and metals trading chief at Swiss refiner MKS Finance SA, said today by phone from Geneva. “We should see a correction down to the $920-an-ounce level.”

The Japanese market looks a lot like ours.

Japanese stocks rose the first time this week on optimism a U.S. plan to aid homeowners will ease global credit markets and as earnings downgrades prompted investors to favor companies with stable profits.

Japanese stocks rose the first time this week on optimism a U.S. plan to aid homeowners will ease global credit markets and as earnings downgrades prompted investors to favor companies with stable profits.

The Nikkei 225 has fallen 12 percent this year, building on a record slump in 2008 as the world's largest economies slipped into recession. Companies are currently forecasting an 84 percent decline in net income for the year ending March, according to Shinko Research Institute Co., only a year after aggregate profits climbed to a record.

Chinese market too reliant on politics.

-- China's stocks advanced, driving the benchmark index higher for a fifth week, on optimism government spending plans will revive growth and bolster corporate earnings. Trading surged to the highest in at least three years.

-- China's stocks advanced, driving the benchmark index higher for a fifth week, on optimism government spending plans will revive growth and bolster corporate earnings. Trading surged to the highest in at least three years.

Has the Shanghai Index risen too far? China was cut to “neutral” from “overweight” by Niall MacLeod , a Hong Kong-based strategist at UBS, as the market will “take a breather” after rallying since November.

Strong Dollar not helping exporters,

-- The strong Dollar has resulted in decreased competitiveness in the eyes of foreign consumers, and consequently, lower exports. For this reason, the US trade deficit has not shrunk significantly, despite a slight down-tick in imports. One must also look at the overseas earnings of American multinational corporations, which are frequently repatriated to the US and booked in Dollar-terms. In fact, as much as 50% of S&P 500 member company profits now come from overseas.

-- The strong Dollar has resulted in decreased competitiveness in the eyes of foreign consumers, and consequently, lower exports. For this reason, the US trade deficit has not shrunk significantly, despite a slight down-tick in imports. One must also look at the overseas earnings of American multinational corporations, which are frequently repatriated to the US and booked in Dollar-terms. In fact, as much as 50% of S&P 500 member company profits now come from overseas.

Do we need subsidies to homeowners?

The Obama administration is hammering out a program to subsidize mortgages in a new front to fight the credit crisis, sources familiar with the plan told Reuters on Thursday, boosting financial markets.

The Obama administration is hammering out a program to subsidize mortgages in a new front to fight the credit crisis, sources familiar with the plan told Reuters on Thursday, boosting financial markets.

In a major break from existing aid programs, the plan under consideration would seek to help homeowners before they fall into arrears on their loans. Current programs only assist borrowers that are already delinquent.

Gasoline prices may be done rising.

The Energy Information Administration reports that, “The national average price for regular gasoline increased 3.4 cents to 192.6 cents per gallon. Over the past six weeks, the national average price has increased 31.3 cents; however, the price remains 103.4 cents below the price a year ago and 218.8 cents below the all-time high set on July 7, 2008. The East Coast price increased 3.6 cents to 191.2 cents per gallon. The Midwest was the only region where the price did not increase, but instead fell just six-tenths of a cent to reach 186.4 cents per gallon.”

The Energy Information Administration reports that, “The national average price for regular gasoline increased 3.4 cents to 192.6 cents per gallon. Over the past six weeks, the national average price has increased 31.3 cents; however, the price remains 103.4 cents below the price a year ago and 218.8 cents below the all-time high set on July 7, 2008. The East Coast price increased 3.6 cents to 191.2 cents per gallon. The Midwest was the only region where the price did not increase, but instead fell just six-tenths of a cent to reach 186.4 cents per gallon.”

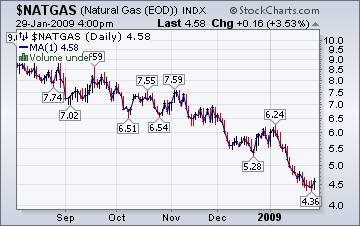

The bitter cold winter is finally affecting Natural gas prices...a little.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Recent market trends reflect a number of altered fundamental conditions. The economic downturn has resulted in a decline in consumption, particularly in the industrial sector, with many companies announcing layoffs and closures of manufacturing plants around the country. Reduced prices for natural gas in recent months also relate to growing productive capacity in the Lower 48 States, particularly because of reported developmental activity at shale fields such as the prolific Barnett shale in Northeast Texas. ”

The Energy Information Agency's Natural Gas Weekly Update reports, “ Recent market trends reflect a number of altered fundamental conditions. The economic downturn has resulted in a decline in consumption, particularly in the industrial sector, with many companies announcing layoffs and closures of manufacturing plants around the country. Reduced prices for natural gas in recent months also relate to growing productive capacity in the Lower 48 States, particularly because of reported developmental activity at shale fields such as the prolific Barnett shale in Northeast Texas. ”

Do nothing? How audacious!

I just found Philip Greenspun's Weblog . We hear so much in the news about how government is the only solution to the problem that it is refreshing to see another point of view.

I spent a few days recently in the company of some money managers with a total of about $2 trillion to invest, precisely the sort of folks whose confidence the government is currently trying to win. How did they feel about all of the rule and policy changes coming out of Washington and the new more muscular government? Terrified.

The “real money” investors didn't want to invest alongside the government. Their concern is that if things go south, the government will take 100% of the value left in the bank or whatever and leave private investors, including recent ones, with nothing. This is precisely what happened to recent investors in Fannie Mae.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.