Stock Markets Stage Late Comeback on Mortgage Bailout Plan

Stock-Markets / Financial Markets 2009 Feb 13, 2009 - 04:35 AM GMTBy: PaddyPowerTrader

JFK once inspired a generation of young Americans with the immortal line “think not what your country can do for you, but what you can do for your country”. How ironic, in the era of bailout nation, does that sound now! And with an hour to go to the New York close last night it was more of what your country may do for you that helped the market claw back heavy early losses.

JFK once inspired a generation of young Americans with the immortal line “think not what your country can do for you, but what you can do for your country”. How ironic, in the era of bailout nation, does that sound now! And with an hour to go to the New York close last night it was more of what your country may do for you that helped the market claw back heavy early losses.

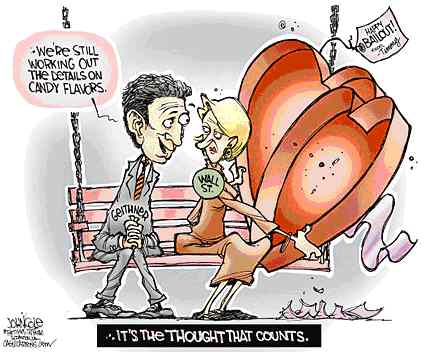

A hazy Reuters report was enough, which suggested that the Government would soon (perhaps within a week) announce further measures to help struggling mortgage holders meet their hefty repayments possibly in the form of a Federal payment subsidy. But on Friday the 13th, to paraphrase Macbeth, it's full of sound and fury stimulating nothing.

Today's Market Moving Stories

- Writing in FT Deutschland, Sebastian Dullien and Daniela Schwarzer argue that euro area member states would not allow any individual country to declare default. The no-bail out clause in the Maastricht Treaty would lose all relevance in a crisis. The most likely scenario would be the setup of a joint fund.

- What is horrific is the hypocrisy once again from the UK authorities. So while Gordon Brown is “angry” about bank bonuses while they are being bailed out, we sit here stunned by the news that the FSA, the regulatory watchdog, is to pay out £33mil in bonuses to staff! These are the same people that sat and watched as those UK banks imploded.

- European stocks have started on a positive footing for the first time in four sessions with banks and oil stocks bid after the latest hints on a mortgage bailout plan and a small uptick in crude futures prices.

- Meanwhile CRH, which is the biggest supplier of raw materials for the US highway market, should get a fillip from the $27.5bn highway stimulus package which is front loaded with half the funds to be spent within four months.

- Pernod-Ricard is up sharply after reporting profits up 5% and confidently confirming full year guidance.

- The misery in the airline sector was highlighted by news from Air France-KLM who said they are to cull 2k jobs as a result of a collapse in air cargo volumes and falling ticket sales even at reduced prices.

- Swedish car maker Saab is getting pummelled this morning (down 21%) after reporting a Q4 loss of $85m.

Irish Banking Recapitalisation Starts Badly

Timing is everything in financial markets and it was back to amateur hour yesterday when, after all the false starts and leaks, the Irish banks recapitalisation scheme ended up being overshadowed by Bank of Ireland's impairment loss provisions and the bungling of the Anglo Irish / Irish Life & Permanent issue. The accountancy scandal surrounding IL&P has already led to two high profile resignations.

As with the announcement of the unilateral guarantee last September the Irish government ended up getting no bang for considerable taxpayers buck they have committed a generation to. This led to a very hairy day for Irish Government bond spreads and the pesky Credit Default swap spread, both of which ballooned out. Good work lads. I see the governments approval rating has fallen to 14%. One wonders who these 14% are!

Data And Earnings Today

The main focus this morning will be the release of a dire Euro area GDP number which will perhaps copper fasten the reticent ECB into a ½% rate cut at their March rendezvous.

The US data highlight is the Michigan consumer “confidence” survey (consensus 60.2).

Earnings highlights (or indeed lowlights) due from Pepsi (expected EPS $0.88) and Abercrombie and Fitch ($1.00).

Roses are red,

Balance sheets too,

Bank bosses are scary

They haven't a clue….

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.