Dead Bankrupt Banks Stock Prices Diluted Into Oblivion

Companies / Credit Crisis 2009 Feb 13, 2009 - 03:02 AM GMTBy: Jim_Willie_CB

A hard time came when deciding upon a title today. “Dead Banks Walking” or “Insolvent & Motionless Yet Standing” or “Much Ado About No Credit” or “The Bank Vampires” or “The Primary Dark Syndicates” made sense. But what came to mind when a comment made by the Jackass in June 2008 on the Vancouver stage at a Cambridge House Metals & Mining Conference. My words to close a panel discussion on the banks were “Just wait, in several months you will see the entire US banking system go insolvent, its stock prices dwindle to nothing, as it will be diluted into oblivion!” It happened.

A hard time came when deciding upon a title today. “Dead Banks Walking” or “Insolvent & Motionless Yet Standing” or “Much Ado About No Credit” or “The Bank Vampires” or “The Primary Dark Syndicates” made sense. But what came to mind when a comment made by the Jackass in June 2008 on the Vancouver stage at a Cambridge House Metals & Mining Conference. My words to close a panel discussion on the banks were “Just wait, in several months you will see the entire US banking system go insolvent, its stock prices dwindle to nothing, as it will be diluted into oblivion!” It happened.

The response by the USGovt, the USFed, Wall Street banks, and the USCongress will result in very little remedy since their first objective is to keep in place the cover-up to their gigantic fraud, much of which still eludes the financial press. By the time conditions worsen, rescues will not be the primary objective any longer. Rather, prevention of collapse will become the urgent priority. Desperate official actions will result in turning the corner on inflation, from the so-called deflation toward hyper-inflation. The gold & silver price will find release. Already, their prices are disconnected from the USDollar. Gold & silver serve as panic meters, systemic breakdown meters, monetary meters, and official desperation meters. The USEconomy has entered an acceleration phase in its breakdown. Gold & silver are poised to make new highs and not look back. They have responded to growing monetary disasters. Incredibly powerful events are in the works, to be unleashed within the next several months. What an exciting yet tragic time! The Hat Trick Letter analyzes the events, both public and hidden, in detail.

The USCongressional display of big bankers this week was a pathetic spectacle. They admitted fault. They should have genuflected and thanked the USGovt and legal authorities for not being directed to prison quarters with orange jumpsuits. The spectacle was reminiscent of the ‘Godfather' movies when the Corleone family had the spotlight shined on them for involvement in organized crime. Even the London bankers had their more pathetic public apology session. Their failure was marred by ineptitude and purchase of fraudulent Wall Street bonds, more than criminal activity. See the video clip for a truly pathetic glimpse (CLICK HERE ).

The tragic reality is that both New York City and London are in the process of morphing into financial rust belts (not my original line). The Wall Street syndicates are not yet recognized as such criminal entities, but they are far more dangerous and deadly. Most syndicates do not kill their hosts. They killed the USEconomy. Heck, even the United Nations drug watchdog group has let the cat out of the bag, announcing that Western banks have been dependent upon narcotics trafficking money, but did not mention Afghanistan or New York City.

In fairness, the dispatch of a large portion of the US manufacturing sector to China was the final blow that guaranteed the death of the USEconomy. That move left the national economy dependent upon a queer housing & mortgage bubble for capital and consumption. The dissipation of those two major bubbles has left the Untied States on the verge of national failure. If such words seem like hyperbole, watch in horror at the next few months. The industrial, retail, shipping, housing, and banking sectors are dying horrible deaths. Next come the vicious cycles that deliver heavy blows in feedback loops, amply described in earlier articles. Such momentum cannot be arrested by adding more funny money into the system, setting up more federal debt, putting some cash into people's hands, and just hitting the gas pedal harder on a jalopy that has serious engine and locomotive problems. Almost no new ideas have come forth.

Martial law looks inevitable, not due to other attacks on our cities, but rather from economic disintegration and breakdown. Momentum has become powerful enough to send the national economy into powerful acceleration toward the abyss. Merely opening a newspaper testifies to this claim. Just this week, Treasury Secy Geithner mentioned the word ‘collapse' in his eloquent yet vacant speech. My forecasts over the last three years on economic breakdown, banking system insolvency, endless housing recession, and failed state are all aligned and in progress, tragically. A special Hat Trick Letter Crisis Update report for February provides more information on the gnarly subject of martial law, even a few anecdotes from the field. Many states are rumbling in federal defiance, citing the Tenth Amendment.

This week, focus on the banks, the foundation for capital creation, the lubrication for commerce, the source of most credit, the home for unwanted toxic assets. They are the cancer that doctors refuse to remove, since the death of the patience seems certain. It was once said that as the transportation and steel industries go, so goes the nation. Well, they are shells falling of their own weight nowadays. It was also once said that as the banking industry goes, so goes the nation. That covers the core of commerce and finance. Interesting how the US Federal Reserve is being sued by both Bloomberg News and Fox Business News. The USFed claims they are protecting trade secrets. Yeah right! The trade secrets pertain to money laundering, fraudulent bond issuance, influence peddling of debt ratings agencies, collusion with regulatory bodies, maintenance of double book accounting, insider trading with JPMorgan & Goldman Sachs, and financial genocide of hedge funds. Those are trade secrets worthy of keeping secret and protecting.

DEAD BANKS WALKING

A few weeks ago, a forecast call was made that the BKX bank stock index was on the verge of breaking down again. It happened exactly as forecasted, even hit my target. That makes three such forecasts that occurred. Instead of a detailed chart to notice the exact steps in the bounce, notice how the BKX index is threatening to break down below its 1994 low that could be called a generational low. The index began on its tracking back then. Insolvency of the banks cannot be remedied with 0% rates anymore than a dead body can be resuscitated by ample blood supply. The breakdown in the USEconomy will next take a toll on the banks, for the umpteenth time. If proper accounting were used, instead of the mickey mouse approved lunacy today, the BKX stock index would be closer to its actual true value, zero. As measures are imposed and policies are ordered to prop up the dead banks, money will flee the banks and go to GOLD & SILVER.

For many months, an incorrect notion had been put forth, that the regional banks were in good health, and mainly the big money center banks were in the death throes. Not so! The regional bank stock index strongly resembles the BKX, as the economic distress has hit the entire nation. What is its true value? Who knows? Bring out book value, which for the big banks is irrelevant. Why? Since the big banks of the BKX index have a negative worth in the trillion$ from their caved-in credit derivatives. The regional banks in the RKH index (stock chart shown below) at least have some salvage value, but not much.

Bank failures might reach 1000 on bad loans, according to RBC Capital Markets. This could easily happen in the next three to five years, almost double the one-year tally at the height of the Saving & Loan collapse, as losses mount on commercial property loans next. Most of the bank failures will probably occur at banks with less than $2 billion in assets as their commercial customers default, stated in their research report. Gerard Cassidy, an analyst at RBC, said “There are billions of dollars of losses embedded in the system, and the system has to flush them out. The people that are going to take the losses are the taxpayers and bank stockholders, and if regulators say there will not be much loss to taxpayers, they will be lying… The sooner the bank regulators can shut down the troubled banks, the faster the industry will get back on its feet. We are nowhere near the end of this down leg in the current credit cycle.” The Federal Deposit Insurance Corp has taken additional steps, hiking its ‘tax' to member banks and lifting its borrowing limit from the USCongress.

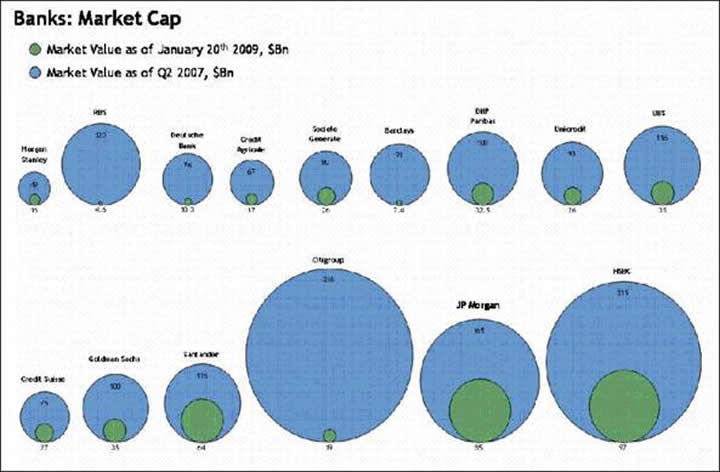

Check out the following graphic, which shows market bubbles of valuation for major banks according to diameters for each circle tied to a big bank. This is a little misleading, since people will easily deduce value is associated with area of each disk. The area is proportional to the square of the diameter. Regardless, notice the colossal reduction in the giants, whose size is now miniscule, especially Citigroup and Royal Bank of Scotland. Ouch! Too big to fail soon gives way to not that big at all!

REALITY CHECK

The attempts to revive the banks will lead to desperate measures. The Obama Stimulus plan is not a good start. It is much more of the same failed junk tossed into a hasty package, founded on desperation, called urgent expedience. Little is designed to rebuild the US industrial base, which would provide a strong legitimate income source. Most economists fail to recognize this missing piece. The tax cuts are not permanent, thus will change little in spending propensity. The tax credit for home buyers will lift mainly the homebuilders, who need to go out of business. The pork amounts to 11% to 13% of the total spending bill. Little is done to alleviate the high corporate tax burden, where the US is not competitive. Sorry, but this is just another spending bill loaded with garbage and a few half-baked ideas that seem constructive.

By the way, the Aggregator (aka Bad Bank) concept was a very bad idea and was unceremoniously scrapped, an embarrassment to Geithner. The entire concept is insane and shows the high degree of desperation by the USFed. He is already looking like a green kid who cannot operate without the strings attached to Robert Rubin. The proposed idea was recognized as stupidity put to paper almost immediately, as described two weeks ago. The ultimate problem with the vacuum cleaner miracle worker Bad Bank is that its proper implementation would have destroyed the balance sheet of the majority of large US banks. So scrap the idea! Meredith Whitney of Oppenheimer believes “Simply removing ‘toxic' assets from bank balance sheets will not directly cause banks to increase lending.” She favors having banks sell their ‘crown jewel' assets to cover their own losses. That amounts to liquidation in my book.

Next we have a bizarre notion put forth by Treasury Secy Geithner that all banks must submit to a Stress Test on a mandatory basis. That sounds promising, except that the results probably will not be made public any more than the disbursal of the TARP funds. Why? Because the Stress Test will reveal the insolvency of the banks, and vulnerability to bankruptcy if proper accounting is inflicted upon their assets. That is what a stress test reveals. See the article on how regulators have invaded the big US banks (CLICK HERE ).

Nearly 100 federal banking regulators descended on Citigroup in New York on Wednesday morning. Dozens more entered Bank of America, JPMorgan Chase, and other big banks across the nation. These regulators could become the arbiters of American finance, as the Geithner Stress Test empowers them to decide which banks are strong enough to survive, and which must accept new bailouts from Washington with strings. These are not prosecutors or investigators, but rather accountants and analysts. The financial sector was anticipating far more than the rookie Geithner delivered last week. The original investments under the Troubled Asset Relief Program, or TARP, might soon be converted into bank common equity. Such a move will end the graft, private payoffs, and satisfaction of foreigner bondholders who (rumored) threatened Wall Street officials with violence last September. The litmus test might well be a Dow Jones and S&P500 stock response, as in new multi-year lows. The forward guidance from 80% of major companies is dreadful.

Karl Marx was an annoying man with some brilliant thoughts, whose work was like a football that Vladimir Lenin ran with. If his words prove correct, and the first few tenets seem right on the mark, then what follows in the Untied States will be anything but continued freedom. Calling it socialism might be a stretch. He wrote in “Das Kapital” the words:

“Owners of capital will stimulate the working class to buy more and more expensive goods, houses and technology, pushing them to take on more and more expensive debt, until their debt becomes unbearable. The unpaid debt will lead to the bankruptcy of all banks, which will have to be nationalized, and the State will have to take the road which will eventually lead to communism.”

Nobel laureate Joseph Stiglitz hated the Bad Bank concept designed to rid financial companies of toxic assets risks, since it would vastly expand the national debt. That amounts to swapping taxpayer money, as in cash for trash, in the words of Stiglitz. He spoke in a panel discussion at the World Economic Forum in Davos, Switzerland. He said “You should not chase good money after bad. We are talking about a national debt that is very hard to manage.” Stiglitz serves as a professor at Columbia University in New York. The Davos Forum was one of the gloomiest ever, but it did feature a big spotlight on Vladimir Putin. The blueprint put forth by Putin should be regarded as the ‘Post-US Blueprint' and is built atop a energy foundation with many workable rules. The Untied States and Untied Kingdom are going to soon find themselves outside looking in concerning global commerce and banking. The Hat Trick Letter Crisis Update addresses and analyzes the Putin plan.

JPMORGAN EXPLOITS USGOVT AID

Nothing new here! But details need some exposure. JPMorgan received its first bailout funding from the New York Fed of $55 Billion, guaranteed by worthless assets from Bear Stearns, to prop up its own liquidity position and to buy Bear Stearns stock. JPMorgan also recently received another $25 billion in TARP payments from the Dept Treasury. That does not count the $138 billion received from highly suspicious fresh funds from the USFed in what has been called a RELOAD, from a decision made by a bankruptcy judge on a Saturday morning before dawn, to satisfy private Bear Stearns accounts. Focus on JPMorgan executives. Instead of receiving cash bonuses more easily detected, they received very large bonuses in the form of Stock Appreciation Rights (SARs) and Restricted Stock Units. These equity compensation securities are hard to value except by expert analysts. SARs are very similar to employee stock options, whereas Restricted Stock Units are very similar to Restricted Stock. These SARs were granted on 20 January 2009, the day that the JPMorgan stock reached its lowest in five years. The stock quickly rebounded.

Total value (2/6/2009) of SARs Granted = $81,405,000

Total value (2/6/2009) of RSUs Granted = $30,500,000

Total value (2/6/2009)of Grants to top 15 executives= $111,905,000

These totals greatly exceed those for the top Merrill executives as yearend bonuses in cash and equity. The New York Attorney General has begun investigation of Merrill's executives for criminal wrongdoing. Merrill CEO John Thain has granted himself a mere $10 million while at least three JPMorgan executives exceeded that in equity compensation alone. JPMORGAN IS BEYOND REPROACH, AND SEEMS NEVER TO BE THE SUBJECT OF SCRUTINY. Why is JPMorgan immune from investigation? See the probing article with graphs (CLICK HERE ).

CITIGROUP & BANK OF AMERICA ARE DEAD

The charade continues. Both big banks are too important to the syndicates to fail. They hold up the highly fallacious fractured foundation to the US banking system, complete with credit derivative ramparts and illicit gold & silver suppression latticework. The bizarre props to Citigroup cannot stand any test of scrutiny. The reorganization into a commercial bank on one side and an investment bank on the other side is likely soon to result in a pair of bankruptcies. Without USGovt props, it would be dead. Without influence by Robert Rubin, it would be let go. Then we have the Citi naming rights up in air and its $400 million cost associated with the new New York Met Stadium. Bad timing!

In a maneuver possibly more to deflect public outrage, under public pressure to increase its lending, Citigroup says it will release $36.5 billion to issue mortgages, to make credit card loans, and to buy distressed assets from the credit markets. The decision arrives after the bank received $45 billion in capital from the USGovt in two installments late last year, not yet used in any visible manner. In highly dubious promises, CEO Vikram Pandit said, “Our responsibility is to put these funds to work quickly, prudently and transparently to increase available lending and liquidity. TARP capital will not be used for compensation and bonuses, dividend payments, lobbying, or government relations activities, or any activities related to market, advertising and corporate sponsorship.” My belief is that funds are fungible, and Pandit gave a complete list of precisely what TARP funds have enabled and will continue to enable. After considering $51.2 billion worth of proposals within its business segments, the bank said it approved $36.5 billion in total. That includes $25.7 billion in residential mortgages, $5.8 billion in credit card lending, $2.5 billion in personal and business loans, $1.5 billion in corporate loans, and $1 billion in student loans.

The Federal bailout has not fixed Bank of America, according to several industry analysts like David Henry, Matthew Goldstein, and Roben Farzad. My viewpoint is that BOA was bailed out in order to shore up a potential explosion in credit derivatives, no more, no less. They have become a gigantic tank to house toxic assets owned previously by Merrill Lynch and Countrywide. The entire merger was hastily cobbled in a time of desperation. The USGovt $138 billion rescue package of Bank of America is already failing. The bailout has amounted to little more than temporary medicine to help BOA digest its acquisition of brokerage giant Merrill Lynch, amidst great controversy. They could not permit Merrill to fail, so a clumsy merger was arranged that puts the larger BOA at heightened risk of failure. Worse, the USGovt approach to rescuing the big banks has been called a Band-Aid, even camouflage, as opposed to a real solution. My view is that many mergers were ordered by the USFed and higher powers who remain hidden. BOA will need another $80 billion to cover imminent losses and to rebuild its capital, estimates Paul J. Miller Jr., an analyst at research firm FBR Capital Markets. The ultimate costs to keep BOA afloat will be an order of magnitude greater.

The USGovt, complete with Dept Treasury henchmen from Goldman Sachs, and compromised USCongress committee wonks, still has not addressed the underlying problem: Billions of dollars of toxic securities and loans languish on banks balance sheets. The big banks are flailing, reluctant to make sharp writedowns, urging accounting boards to exclude mark to market methods, hiding assets off the balance sheets, anything to buy another day. In the meantime, the USEconomy suffers from credit seizures and basic deprivation. Much of the funds authorized for rescues, bailouts, and nationalizations have been squandered, not by waste, but in fighting credit derivative fires. These activities are not publicized for many reasons. Attention is not wanted on the flimsy foundation to the US banks. Attention is not wanted to reveal the location of financial nuclear bombs of great potential destructive force. One informed contact to the Hat Trick Letter expects at least $30 trillion and perhaps over $50 trillion to blow up eventually in credit derivatives, with uncertain consequences. Much has been discussed of the Credit Default Swaps that insure asset backed bond like mortgages and corporates. However, given the extreme pressures from near 0% rates, the Interest Rate Swaps have begun to blow up. The JPMorgan machine has abused the leverage of IRSwaps to force long-term interest rates down for a decade. The Bond Vigilantes pulled a disappearing act over that decade. With fresh fires in the IRSwap Laboratories, the same Bond Vigilantes might reappear, as rumor has indicated in just the last couple weeks.

The Institutional Risk Analyst follows such developments like a well-trained hawk. He writes, “By failing to enforce margin limits on CDS leverage while investing new capital in Citigroup, Bank of America, and other large banks via the TARP, the Fed and Treasury are essentially trying to fill up a bucket with a hole in the bottom … To fix the systemic risk issues with the CDS market permanently and also provide a much need additional buttress to the bank rescue efforts by the Fed and Treasury, here is what we would suggest. First, the Fed and Treasury should prohibit the writing of new CDS on any financial institutions that is participating in the TARP. Instead, the Fed and Treasury should interpose themselves as counter-parties for these names, writing CDS for any and all counter-parties and capturing the revenue for the US Treasury.” They make other suggestions regarding the legal configuration of CDS contracts themselves. They claim in summary, more like an urgent warning, that “Unless and until Chairman Bernanke and the other regulator are willing to tame the CDS tiger, there will be no success in bringing stability to the US banking system or foreign banking markets. And the longer Bernanke & Co refuse to say an emphatic NO to Goldman Sachs, JPMorganChase, and the other CDS dealers, the financial crisis affecting global banking institutions will continue to worsen.” See the analyst summary (CLICK HERE ).

MANY HAVE WRITTEN WHEN THE USTREASURY BOND LOSES ITS SAFE HAVEN STATUS, THAT GOLD WILL RISE IN TURN. FEW ARE FACTORING IN HOW THE CREDIT DERIVATIVE GRADUAL MELTDOWN WILL LIFT GOLD. IT IS OCCURRING IN HIDDEN FASHION, AND WILL SURELY AMPLIFY.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” (ShawnU in Ontario)

“Your analysis is of outstanding quality, the best I have read. In particular, as a person on the spot, I can confirm the accuracy of your bleak assessment of our prospects in the UK.” (JanB in England)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces' approach into an awesome intellectual tool.” (RobertN in Texas)

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street.” (GeorgeC in Minnesota)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.