Fear Pushing Gold to New High this Year

Commodities / Gold & Silver 2009 Feb 11, 2009 - 02:18 PM GMTSean Broderick writes:  I would like to state for the record that what's happening to the U.S. economy is freaking me out. And I think that if you're not scared, you're not paying attention.

I would like to state for the record that what's happening to the U.S. economy is freaking me out. And I think that if you're not scared, you're not paying attention.

That said, there are positive steps you can take to protect yourself and your portfolio — and I'll get to three of those steps in a minute. But just because I'm worried doesn't mean things can't end well. With some luck, maybe President Obama's economic team can stabilize things.

Then again, maybe not.

The Latest Madness Out of Washington …

The Fed will probably let hedge funds borrow from its new, Term Asset-backed Lending Facility (TALF) — a program that is expanding to as much as $1 trillion!

The idea is that securities that have no buyers will be sold to hedge funds for about 5 cents to 20 cents on the dollar. The loans the Fed will make to hedge funds are non-recourse loans. This means that if the fund defaults, its collateral is the securities bought with the borrowed money — securities that will likely be worth nothing.

If you think this scheme sounds like another slick way for hedge funds to get a shot at the roulette wheel with our money … you're probably right.

My question is: If the Fed thinks that some securities are worth just five cents on the dollar, why aren't they forcing the big banks that currently hold these securities to write them off at that price?

Most worrying to me: Considering that hedge funds use tremendous leverage, does that mean we could see $1 trillion worth of securities sucked into this financial meat grinder? $2 trillion? $4 trillion?

Again, U.S. taxpayers — you and me — will be stuck with the bill.

So, my confidence in whether the new administration can free us from financial quicksand is rapidly deteriorating.

However, if it's any consolation, things seem to be a lot worse in Europe, where much of the bad U.S. mortgage paper ended up. And the governments there seem to be taking a “Grit your teeth and buckle down” approach to the credit crisis.

Nothing Illustrates This More Than the Way Gold is Behaving

|

Historically, the yellow metal has moved with the euro and opposite to the U.S. dollar. This relationship has reversed in recent months. Now, gold is closely tracking the U.S. dollar.

This shows that when Europeans get scared about their currency, they run for the safety of the two other global currencies — the U.S. dollar and gold.

And it's not just Europe. In January gold rose significantly against all major world currencies. In most currencies except in the U.S. dollar and the Japanese yen — the other “safety currency” — gold actually made an all-time-high.

Why are European investors so scared? Their currency is in serious trouble.

That fear crystallized in comments by mega-investor George Soros at the recent meeting of the world's movers and shakers in Davos, Switzerland. In an interview with Austria's Der Standard newspaper, Soros said that the euro may not survive unless the European Union presses for an international agreement on dealing with soured assets.

I've told you why Europeans should be scared about their currency. Now, let's look at …

Why Americans Should be Scared About the U.S. Dollar …

Let me give you four reasons:

- The U.S. federal budget deficit will reach at least $1.2 trillion in 2009, almost triple its level last year. And America will probably be running trillion-dollar deficits for the foreseeable future.

- The cost of the stimulus package is $838 billion. Some economists argue it must reach $1.3 trillion to have any significant impact on the U.S. economy's health. So, if this stimulus package doesn't work, there will probably be Stimulus Plan II.

- The stimulus package will raise the government's commitment to solving the financial crisis to $9.7 trillion. According to Bloomberg News, that's enough to pay off more than 90% of the nation's home mortgages.

- In January, the FOMC said in a statement: “The Committee is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets.” The Federal Reserve, Treasury Department and Federal Deposit Insurance Corporation have lent or spent almost $3 trillion over the past two years and pledged to provide up to $5.7 trillion more if needed.

For the record, I'm FOR stimulus spending. But shoveling more money into a banking system that's broken is like moving furniture into a burning house. The smart thing to do is put out the fire first.

And all this spending is putting the U.S. deeper and deeper into a hole — and raising the risk that the U.S. could eventually default on its debt.

|

Willem Buiter of the London School of Economics knows something about debtor nations who can't pay their bills. He said that the U.S. and Great Britain are fast approaching banana republic status. Buiter believes a currency collapse, a scenario that most would dismiss as impossible for the U.S. dollar, is becoming more likely as Washington opens up the rip cord on spending.

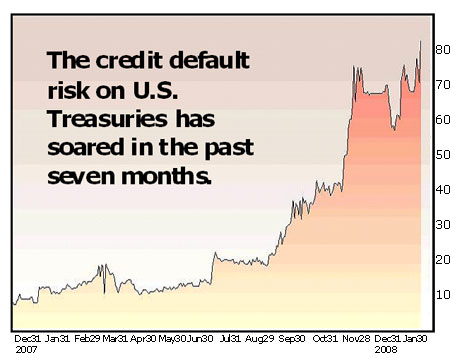

And it's just the credit default risk on 10-year U.S. Treasuries that we're seeing now. Until August, the credit default swap spread stayed below 20. It has now soared to over 82 — a huge move in a short amount of time.

Remember: This is a $30 trillion market. Even if just half of it goes bad, game over for the greenback!

Now if you've liked the bullish move in gold so far this year, hold on to your hat … because you haven't seen anything yet!

Forces That Could Thrust Gold Higher …

My near-term target on gold is now $1,060, up from $948 just a couple weeks ago. My next target: $1,185. It could be a rocky road getting there, but the potential this year is just enormous.

The increase in currency risk with the rising tide of investor fear is just one factor that makes gold look especially good over the next year, because gold is about wealth preservation — a refuge from fear.

What's more, there are at least three other forces that should drive gold a whole lot higher …

Force #1 — Average Joes and Janes are buying gold coins and bars:

Unlike many other commodities, gold (along with silver) has acted as an actual currency throughout history. If things get really bad — like, say, a Panic of 1837 scenario, where the currency markets literally implode and banks across the country close their doors — you can buy things with gold and silver.

That's why, although gold jewelry sales are tumbling quickly (sales of gold jewelry in the United States fell 29% last year), gold coins are hard to find unless you want to pay exorbitant premiums.

Force #2 — Investors are backing up the truck :

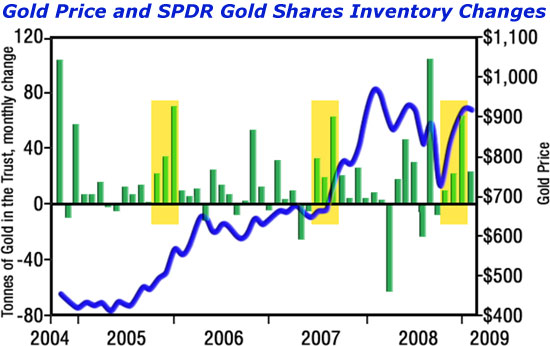

The inventory at the world's biggest gold ETF, the SPDR Gold Shares (GLD), is soaring and keeps making new highs, recently tipping the scales at 881.8 metric tonnes (28.4 million ounces). That may not be too surprising, but check out how this has impacted the price of gold in the past …

My chart shows the change in the GLD month to month. I've put gold rectangles around three periods. The first two, in 2005 and 2007, saw huge inflows to the GLD that marked the beginning of huge price appreciation in the price of gold. This is no coincidence — the big money flowing into the GLD is driving the gold price.

The third period I've marked with a yellow triangle is where we are now. Since December 1, the GLD increased its gold holdings by 109 metric tonnes, slightly less than the record three-month increase of 125 tonnes in January of 2006. Sure, gold is already well off its recent lows. But if history is any guide, we have months of gold price appreciation to go yet.

By the way, the GLD isn't the only gold ETF in the world — there are a bunch of them , and they're all adding to their gold holdings furiously.

Force #3 — Gold is still cheap relative to stocks:

Speaking of history, let's look at the ratio of gold to the S&P 500 …

This chart, using data taken from Sharelynx.com, shows the S&P 500 divided by the price of gold over the past 80 years. The ratio is now 0.95 — certainly lower than it was at when stocks peaked back in 2000. But it's still well above the lows made back in the 1930s-1940s and again in the late 1970s.

If this economic crisis is the next Great Depression or even worse than the Great Depression, I would expect the S&P 500/gold ratio could get back to its lows of the 1930s. That would imply that gold prices will triple, stocks will fall to a third of their present value, or some combination of the two. In either case, the easier path is for gold prices to go higher from here.

Why would this happen? Because the Fed refuses to put out the fire in financials. Indeed, it's burning through more money and taking buy-and-hold stock investors down along with it. Meanwhile, gold will shine as Washington opens up the firehoses of liquidity in an attempt to save the markets.

Three Steps You Should Consider Now …

I could give you a lot more reasons why I think gold will go higher over the next year and beyond. But now it's time for action. If you think I'm a worry-wart, you can stop reading. If you're as worried as I am …

Step #1 — Consider buying gold coins and silver coins:

|

| Gold and silver coins could be one way to protect yourself in case the dollar falls to pieces. |

Silver is subject to many of the same bullish forces as gold, and if things get really bad, it's easier to pay for essentials with lower-value silver coins than gold coins.

Step #2 — Consider investing in a gold or silver ETF:

While you won't have the physical metal in your possession, you are able to easily buy and sell these funds, and you can avoid storage costs in the bargain.

Step #3 — Make well-capitalized mining shares a part of your portfolio:

Consider including well-capitalized precious metals miners, like the kind I recommend in Red-Hot Global Small-Caps , as part of your portfolio. These stocks should become more valuable as the price of gold and silver go higher, because these miners are leveraged to the metals.

The fear trade is on, and gold should benefit. And even if you aren't worried, you shouldn't ignore the forces at work in the market. They could move our investment universe for years to come.

Join Me in Phoenix

I'll be attending and addressing the Cambridge House Resource Investment Conference and Silver Summit in Phoenix, Arizona on February 21 and 22. It should be educational, interesting and fun. If you're going to attend, I have a gift for you — a special code that should get you a discount.

The conference costs $25 at the door, but you can attend for free by signing up in advance at: http://www.cambridgehouse.ca/phoenix.html .

And if you want to attend the Silver Summit Reception and Dinner, use the code PHX09SB to get half off the cost of your ticket.

Yours for trading profits,

Sean

P.S. If you like what you're reading here, check out my Red Hot Energy and Gold blog .

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.