Stock Market to Fall AT LEAST Another 40%!

Stock-Markets / Stocks Bear Market Feb 09, 2009 - 11:54 AM GMT Martin Weiss writes: With the U.S. economy now reeling from the fastest job collapse since the Great Depression …

Martin Weiss writes: With the U.S. economy now reeling from the fastest job collapse since the Great Depression …

With the Treasury Secretary ready to introduce yet another bank bailout plan this week …

And as we suffer through the uncontrollable bust of the largest-ever speculative bubble of all time …

You don't need a Ph.D. in economics to recognize that there's much more pain to come.

But how much pain? And precisely how FAR can the stock market decline? Not many people can provide that answer with precision.

But of all the analysts I know in the world today, one of those who provides the most reasoned — and most well-documented — answer is, not surprisingly, far away from Wall Street.

He is Claus Vogt, writing from Berlin.

Claus is the co-editor of Sicheres Geld , the German-language edition of our Safe Money Report .

He also edits the German edition of our International ETF Trader . And unlike nearly all his peers in Germany, Claus delivered overall gains in the high double digits last year, even as global markets tumbled.

Perhaps most impressive, thanks largely to Claus' input, the bank he advises was one of the very few in Europe that actually made good money for their clients last year.

The key to his success: The ability to watch the U.S. economy from afar, track it closely, and forecast it accurately.

A case in point: Well before the U.S. housing bubble burst, Claus Vogt and co-author Roland Leuschel wrote the book, Das Greenspan Dossier , in which they predicted:

“When the U.S. real estate bubble bursts, it will not only trigger a recession and a stock market crash, but it will jeopardize the whole financial system, especially Fannie Mae and Freddie Mac, the two U.S. — mortgage giants taking center stage in this huge bubble.”

Amazingly, in that one short paragraph, they captured the full range of events unfolding today — a scenario that almost every Wall Street or Washington expert missed by a mile.

That's why I have asked Claus to contribute more regularly to Money and Markets . That's also why I have asked him to tell us how far the U.S. stock averages are likely to fall — and why.

The report below is his answer.

Why U.S. Stocks Could Fall AT LEAST Another 40%

|

by Claus Vogt

Every major fundamental indicator relied upon by stock market analysts is unanimously pointing to a stock price plunge of at least another 40% from current levels. That would take …

- The S&P 500 down to the 500 level …

- The Dow Jones Industrials to below 5000, and …

- The Nasdaq to the low 900s.

Don't be surprised. To understand why, you need only step back from the trees and see the obvious chain of cause and effect:

You know that the major factor behind the current business cycle was — and is — a worldwide housing bubble and bust.

You also know that the bubble was driven by the speculative surge in mortgages and equity loans.

What you may not know is that, according to former Fed Chairman Alan Greenspan, that bubble accounted for 50% to 70% of GDP growth in recent years.

So it should come as no surprise that as soon as the mortgages and equity loans dried up, consumption and GDP growth began to take a huge hit.

Worse, the real estate bubble distorted the entire structure of the U.S. economy:

- It created grossly misplaced investments — second homes nobody really needed, massive numbers of people drawn into the real estate business as brokers and lenders, plus a whole new industry built around mortgage-backed securities.

- It created broad instability — too much consumption, too little savings, too many imports of goods from China and elsewhere — not to mention a huge current account deficit.

- It fostered unsound risk-taking by the financial sector — from Bear Stearns to Lehman Brothers, from Washington Mutual to Citibank, from Merrill Lynch to the hedge fund industry. And …

- The end result was one of the largest, most unstable and most risky economic environments of modern times.

But now, with the bursting of the bubble,

The U.S. faces the monumental task of bringing this highly distorted economy back into alignment and putting the country back on a sound footing.

Investments that are not viable must be abandoned or aborted. A new equilibrium must be found. New price levels for stocks and all assets must be reached.

The two words commonly associated with this natural process? Recession and depression!

But you ask: Why so severe? And why must stocks fall so far?

For the simplest answer, consider the rule of thumb that has almost always held true concerning speculative bubbles: The bigger the bubble, the greater the distortions; and the greater the distortions, the graver the inevitable correction.

This rule alone leads me to expect a long, severe decline in the economy and the stock market; and this basic reasoning, in itself, supports my forecast for a 40%-or-more plus additional plunge in the broad stock market averages. But let's also take a look at the rest of my supporting arguments …

Argument #1 U.S. Home Prices Continue to Fall

Consider the facts:

- Despite the unprecedented home price declines to date, the median price of an American home (compared to the median income a family earns) is still 15% above its average level of recent decades. In other words, homes are still overpriced by 15% or more.

- If you take the bubble years of 2002 — 2006 out of the equation, as any reasonable analyst would, then U.S. home prices are actually 20% out of whack.

- But that assumes the median income of U.S. households will not go down. If you factor in declines in income, home prices can fall even further.

- Moreover, once a bubble has burst, price corrections don't typically stop at some average statistical level; they overshoot to the downside.

Bottom line: You can expect home prices to continue to tumble. And you can expect all the ugly financial consequences of falling home prices to stay with us in the coming quarters — huge losses and bankruptcies in the banking sector.

Argument #2 The Current Crisis Is GLOBAL, Hitting The Whole World Simultaneously And Providing No Outside Support To Offset U.S. Domestic Weakness

In 1990, when Japan's real estate bubble burst, the rest of the world was booming, helping Japan's export industry.

Unfortunately we don't have that kind of a cushion today. Quite the contrary, instead of relief from exports to other countries, the U.S. export sector is getting slammed by falling overseas demand. And a rising dollar will only make U.S. goods more expensive abroad, depressing demand and aggravating this problem.

Additionally, as usual in bad times, there are already strong hints of protectionism emerging around the word; the same kind of beggar-thy-neighbour policies that aggravated the Great Depression are gaining traction globally.

Argument #3 Based on Earnings, Stocks Are Still FAR From Cheap

Let's start with the most widely followed fundamental indicator: P/E or the price/earnings ratio.

Right now the trailing 12-month P/E of the S&P 500 is 18. In other words, the average stock in the index is selling for 18 times its earnings of the past year.

That, in itself, is a very high multiple. It means that, on average, investors will have to wait a full 18 years before the investment they make in a company is matched by the accumulated earnings of the period (assuming the company can maintain its current level of profits).

Yes, 18 times earnings is much lower than it was in 1999 or 2000. But historically, 18 is still very high — even considering today's low interest rates.

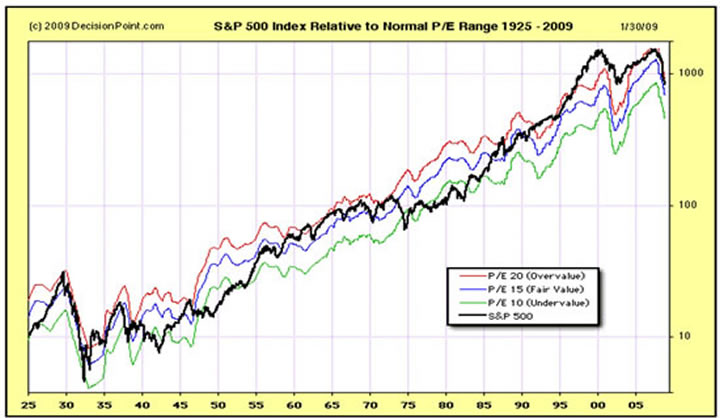

See for yourself by taking a look at the following graph going all the way back to 1925. In this graph …

Source: www.decisionpoint.com

- The black line shows the S&P 500 Index …

- The red line shows how the S&P would have behaved if it had a constant P/E of 20, a level considered overvalued, and …

- The green line shows how it would have behaved if it had a P/E of 10, which is borderline undervalued.

For 70 long years, from 1925 to 1995, the S&P rarely reached the overvalued level and even more rarely exceeded it. In contrast, this graph makes it very clear that the period between 1995 and 2008 is an extreme aberration in terms of this all-important stock market fundamental. It leaves no doubt that …

In the long history of the U.S. stock market, stocks have almost always been much more moderately priced. But in the current period, stocks have been, and remain, broadly overpriced.

That alone argues for lower stock prices. But the argument is even stronger when you look at these two-decade spans:

- The 1930s and 1940s, plus

- The 1970s and 1980s

These two periods included secular (long-term) bear markets. And as you can see, during those periods, the S&P 500 often fell to levels corresponding to a P/E of less than 10.

That was especially true when the cyclical downturns in the market were accompanied by severe recessions, similar to what we're already experiencing today. Indeed …

The P/E of the S&P 500 dropped to 7 during the recession of the mid-1970s — and it did it again in the recession of the early 1980s.

Even if the economic contraction could somehow be less severe this time … even assuming no decline in corporate earnings … and even if the P/E only declines from its current level of 18 to about 10 … that alone would take the S&P 500 Index to my target level of 500 or lower!

Thus …

- If the P/E of the average S&P stock were to plunge to 7 again, the market would fall to much lower levels, and …

- If you factor in falling corporate earnings, it could fall STILL further.

So you can see that 500 for the S&P Index is not just a reasonable target. It's actually a conservative target, erring on the side of predicting fewer adverse consequences than may actually be the case.

Argument #4 Based on Dividend Yields, U.S. Stocks Are Equally Overvalued

The dividend yield of the S&P 500 stocks — how much you can earn in dividends per dollar invested — draws an equally bleak picture:

- After being extremely depressed during the recent bubble years, the dividend yield of the S&P 500 has recovered somewhat to 3.39%. But despite this improvement, history tells us that the current level still signals a highly overvalued market.

- Solid, long-term buying opportunities don't come until you can get a dividend yield of 6% or more. But to reach that level, the dividend yield on S&P stocks needs to rise by 2.61 percentage points (3.39 + 2.61 = 6.00).

- Assuming no further dividend cuts or cancellations, to get those extra 2.61 points in yield, the price of the average S&P 500 stock would have to fall by 43.5%. (A stock selling for, say, $100 today and yielding 3.39% would have to fall to $56.50 to yield 6.00% — a stock price decline of 43.5%.)

In sum, the message from this fundamental indicator fully supports the conclusion I reached based on the P/E ratio: The market would have to fall by AT LEAST 40% or so — and that's assuming there are no further dividend cuts . But with dividend cuts inevitable, stocks will have to fall even further to match the 6% yield that might make them attractive again.

Argument #5 Earnings Are Falling, and Doing So Conspicuously!

Earnings and earnings estimates are already down substantially since 2007, with no sign of let-up.

The following chart shows you the S&P 500 along with the GAAP-based earnings for its component stocks.

As you can see, the earnings are already down from $85 at the top of the cycle to $46 in the fourth quarter of last year. And earnings estimates for the first quarter 2009 are nearly 10% lower, at $42.

The dire situation we're in today: Companies' lack of pricing power — and a recession that leaves hardly any sector unscathed — virtually guarantees further declines in earnings, making the current market valuations even further out of line.

Source: www.decisionpoint.com

Argument #6 Earnings Will STAY Depressed Longer Than Usual!

Among S&P 500 companies, profit margins reached an all-time high during this cycle, meaning that they must now fall back to a more normal level. This is what has happened in every major recession, and it's what almost inevitably will happen this time as well.

Specifically …

- In 1966, profit margins hit a high of 6% and then fell back to 3.5% in 1970.

- In 1978, they rallied back up to 6% and then came all the way down to 2% by 1986.

- In 1997, they rose again to 5.5% and fell back to below 3% in 2002. And now …

- In 2006, propelled by the big debt and high leverage of the recent bubble, they reached a record high of more than 8%.

But now, having started on a downward path again, it's highly improbable that profit margins will recover anytime soon.

Argument #7 Debt and Leverage Are Gone!

The facts here are even more shocking:

- At the top of this cycle, the profits of the financial sector reached up to 30% of all S&P 500 earnings — thanks to psychedelic leveraging and drunken risk-taking.

- Now, nearly all the extreme leverage in the financial sector — and nearly all the leverage financial institutions were providing other industries through 2007 — is no more.

Without a doubt, the forced sobering of the banking industry will have a long-lasting impact, and there is no way we can expect an early comeback of the old greedy days of Wall Street.

Argument #8 The Undeniable History of Speculative Bubbles

Throughout history, after the bursting of every speculative bubble, prices almost invariably revert back to the level corresponding to the beginning of the bubble. In other words …

Whatever boost the bubble gives to prices and values … the ensuing bust inevitably takes it ALL back.

This held true for the global stock market bubble that burst in 1929 and for the Japanese stock and real estate bubbles that burst in the early 1990s. And if you go all the way back to the South Sea bubble, which burst in 1720, you will see this very same pattern.

So our task is simple: To identify the price level of the S&P 500 at the juncture when this entire moon shot was first launched.

And based on objective measures like the S&P's dividend yield or P/E ratio, we know quite well where and when that was:

The U.S. stock market bubble began in 1995, when the S&P 500 broke above the 500 level … and it reached its climax in 2000, when the P/E ratio of U.S. stocks reached nosebleed levels of 38 on the S&P 500 and more than 200 on the Nasdaq.

Plus, there can now be little doubt that …

Ever since 2000, the U.S. stock market has been in a protracted bear market!

To be sure, after the first two years of the bear market in 2000-2002, the Fed engineered a real estate bubble, which, in turn, produced a parallel stock market rally that prevailed during most of the middle years of this decade.

But now we can look back at the entire mid-decade rally and see it for what it really was: A mere interlude in a nine-year bear market (so far!) that began at the turn of the millennium.

So, looking back at history and looking ahead, it would not be unusual in the least to see the S&P 500 fall all the way back to the original starting level of approximately 500 for the S&P, validating and revalidating my forecast.

Will This Bear Market and Recession EVER End?

Of course it will, eventually. And when it does, incredible bargain opportunities will abound. But to make sure you can buy them, you must do two things:

(1) Keep your assets intact and …

(2) Wait patiently for that day.

Wait for the damage of the bust to play itself out. Wait for P/E ratios to come back down to their lower range, corresponding to deep recessions of the past. Wait for at least 6% dividend yields. Then, start thinking about investing in a recovery.

Plus, there's one more thing you can do: Starting right now, you can grow your assets significantly DURING the decline.

Later this month, I will show you precisely how I'm planning to accomplish each of those goals with a new million-dollar contrarian portfolio I am managing.

I will make the trek from Berlin to Palm Beach, join Martin in an online video seminar, and lay it all out for you piece by piece, step by step.

Stand by for the invitation via email. And in the meantime, I look forward to getting your personal and direct input into how you think a dream portfolio should be handled in these tough times.

Best wishes from Berlin,

Claus

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.