Economic Stimulus Spending Breakdown Shows Repeating the Mistakes of Japan

Economics / Economic Stimulus Feb 09, 2009 - 06:59 AM GMTBy: Mike_Shedlock

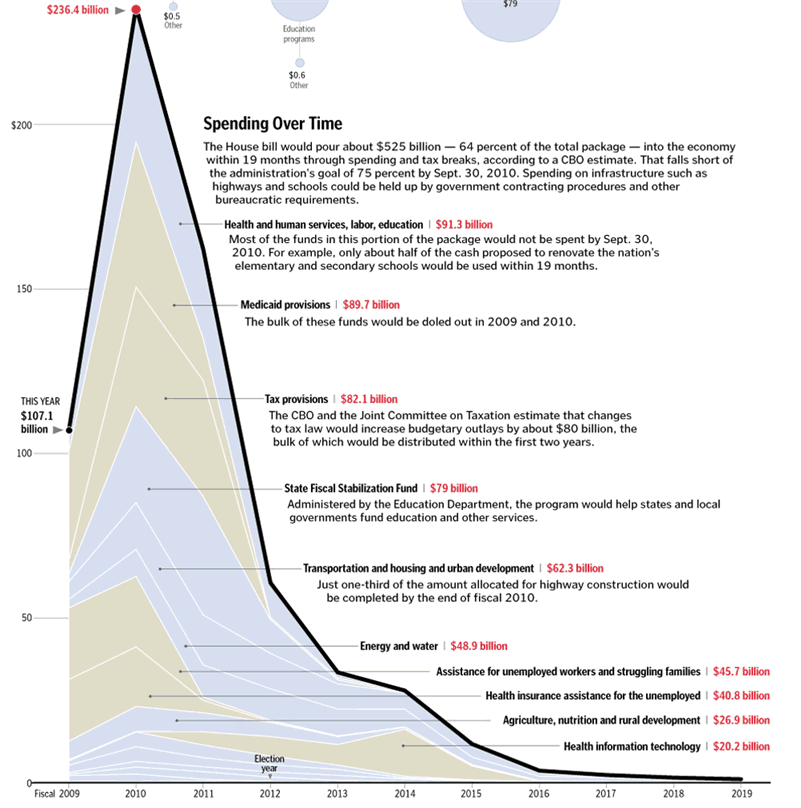

The Washington Post is Taking Apart the $819 billion Stimulus Package with a couple of graphs that show how and when the stimulus money will be spent. Here is one of the graphs.

The Washington Post is Taking Apart the $819 billion Stimulus Package with a couple of graphs that show how and when the stimulus money will be spent. Here is one of the graphs.

Click on first link for an additional chart.

The chart depicts the Obama shotgun approach of spraying bullets in multiple directions hoping that something, somewhere hits a target. Furthermore, notice the state stabilization fund, assistance for the struggling families, and health insurance assistance for the unemployed is not even earmarked as stimulus but something closer to riot prevention.

More importantly, none of this spending can possibly stimulate anything. Take for example $62.3 billion for transportation or the $91.3 billion to renovate schools. What happens after the schools are renovated and the potholes are filled? Where will the jobs come from? Do the schools even need to be renovated?

Taxpayers will eventually have to pick up the tab, either via taxes or a weaker US dollar.

Repeating The Mistakes Of Japan

The New York Times is looking at Japan's Big-Works Stimulus Lesson .

Japan's rural areas have been paved over and filled in with roads, dams and other big infrastructure projects, the legacy of trillions of dollars spent to lift the economy from a severe downturn caused by the bursting of a real estate bubble in the late 1980s. During those nearly two decades, Japan accumulated the largest public debt in the developed world — totaling 180 percent of its $5.5 trillion economy — while failing to generate a convincing recovery.

Now, as the Obama administration embarks on a similar path, proposing to spend more than $820 billion to stimulate the sagging American economy, many economists are taking a fresh look at Japan's troubled experience. While Japan is not exactly comparable to the United States — especially as a late developer with a history of heavy state investment in infrastructure — economists say it can still offer important lessons about the pitfalls, and chances for success, of a stimulus package in an advanced economy.

In a nutshell, Japan's experience suggests that infrastructure spending, while a blunt instrument, can help revive a developed economy, say many economists and one very important American official: Treasury Secretary Timothy F. Geithner, who was a young financial attaché in Japan during the collapse and subsequent doldrums. One lesson Mr. Geithner has said he took away from that experience is that spending must come in quick, massive doses, and be continued until recovery takes firm root.

Between 1991 and 1995, Japan spent some $2.1 trillion on public works, in an economy roughly half as large as that of the United States, according to the Cabinet Office. “Stimulus worked in Japan when it was tried,” said David Weinstein, a professor of Japanese economics at Columbia University. “Japan's lesson is that, if anything, the current U.S. stimulus will not be enough.”

Most Japanese economists have tended to take a bleaker view of their nation's track record, saying that Japan spent more than enough money, but wasted too much of it on roads to nowhere and other unneeded projects.

Dr. Ihori of the University of Tokyo did a survey of public works in the 1990s, concluding that the spending created almost no additional economic growth. Instead of spreading beneficial ripple effects across the economy, he found that the spending actually led to declines in business investment by driving out private investors. He also said job creation was too narrowly focused in the construction industry in rural areas to give much benefit to the overall economy.

He agreed with other critics that the 1990s stimulus failed because too much of it went to roads and bridges, overbuilding this already heavily developed nation. Critics also said decisions on how to spend the money were made behind closed doors by bureaucrats, politicians and the construction industry, and often reflected political considerations more than economic.

In Hamada, residents say the city's most visible “hakomono,” the Japanese equivalent of “white elephant,” was its own bridge to nowhere, the $70 million Marine Bridge, whose 1,006-foot span sat almost completely devoid of traffic on a recent morning. Built in 1999, the bridge links the city to a small, sparsely populated island already connected by a shorter bridge.

“Roads and bridges are attractive, but they create jobs only during construction,” said Shunji Nakamura, chief of the city's industrial policy section. “You need projects with good jobs that will last through a bad economy.”

Rather than acknowledge the complete failure is Japan's stimulus that has left Japan with the largest public debt in the developed world — totaling 180 percent of its $5.5 trillion economy, Treasury Secretary Timothy Geithner and professor of Japanese economics at Columbia University have come to the ridiculous conclusion that Japan did not spend enough.

Neither appears intelligent enough to ask a simple question: What happens when the stimulus ends?

On the Edge

Paul Krugman thinks the economy is On the Edge .

A not-so-funny thing happened on the way to economic recovery. Over the last two weeks, what should have been a deadly serious debate about how to save an economy in desperate straits turned, instead, into hackneyed political theater, with Republicans spouting all the old clichés about wasteful government spending and the wonders of tax cuts.

Consumers, their wealth decimated and their optimism shattered by collapsing home prices and a sliding stock market, have cut back their spending and sharply increased their saving — a good thing in the long run, but a huge blow to the economy right now .

My Comment : The above paragraph in red is the paradox of thrift, an idea that is easily refuted by application of common sense. Please consider Keynesian Claptrap From PIMCO and Something For Nothing vs. Paradox of Deleveraging if you are not up to speed on the complete silliness of the paradox of thrift.

It's no wonder, then, that most economic forecasts warn that in the absence of government action we're headed for a deep, prolonged slump. Some private analysts predict double-digit unemployment. The Congressional Budget Office is slightly more sanguine, but its director, nonetheless, recently warned that “absent a change in fiscal policy ... the shortfall in the nation's output relative to potential levels will be the largest — in duration and depth — since the Depression of the 1930s.”

Worst of all is the possibility that the economy will, as it did in the '30s, end up stuck in a prolonged deflationary trap.

We're already closer to outright deflation than at any point since the Great Depression. In particular, the private sector is experiencing widespread wage cuts for the first time since the 1930s, and there will be much more of that if the economy continues to weaken.

And deflationary traps can go on for a long time. Japan experienced a “lost decade” of deflation and stagnation in the 1990s — and the only thing that let Japan escape from its trap was a global boom that boosted the nation's exports. Who will rescue America from a similar trap now that the whole world is slumping at the same time?

My Comment : The idea of a deflationary trap is in and of itself complete nonsense. Deflation is actually a natural state of affairs. As productivity increases, standard of living rises and prices fall. Absent government intervention, productivity would actually increase the amount of goods produced, causing prices to drop. Falling prices are a good thing not a bad one.

Fed and government policies rob taxpayers by promoting policies of inflation. Look at what accompanies rising prices: rising property taxes, rising sales taxes, and rising income taxes. Is that a good thing. The answer is no, especially when wages fail to keep up, which is exactly what happened.

Who benefits from inflation? The answer is government, banks, and already wealthy because they are first in line to receive money. Everyone else is screwed. Inflation is theft from the middle and lower classes for the benefit of government and the wealthy.

Over time, the government and the Fed so distort the economic picture, that a mentality sets depicted in the often heard phrase for a few years' back "Better get that house now, before it's too late".

The problem is not falling prices, the problem was the excess of debt that led to massive speculation and ever escalating prices. Krugman continues to put the cart before the horse in this regard. Indeed, Krugman Is Still Wrong After All These Years .

It is impossible for government to spend one's way to prosperity. Proof can be found in the failed practices of Russian and Chinese central planners over the years, and more recently the failed policies of Japan.

The ultimate irony of the "Conscience of a Liberal" tag is that Paul Krugman is openly supporting policies that continue to destroy middle class America, while pretending otherwise.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.