US Economic Growth Slowing To Stall Speed

Economics / UK Economy Apr 28, 2007 - 11:13 AM GMTBy: Paul_L_Kasriel

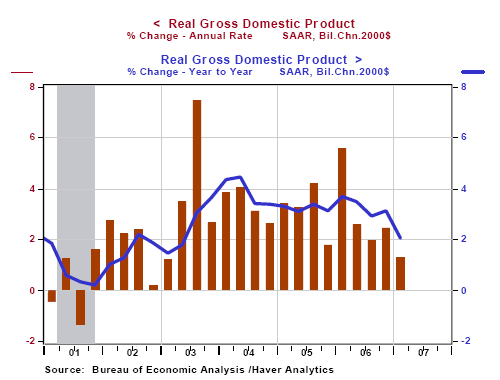

Real gross domestic product of the U.S. economy grew at an annual rate of only 1.3% in the first quarter of 2007, the slowest pace in four years. On a year-to-year basis, real GDP increased 2.1% in the first quarter, the smallest gain since the second quarter of 2003.

The U.S. economy is essentially stalling out with the downside risks of economic growth today being larger than at the March FOMC meeting.

Chart 1

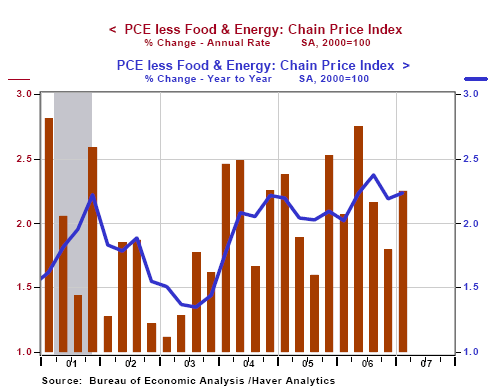

At the same time, core inflation is not entirely contained, which is typical late in the economic cycle inasmuch as inflation is a lagging indicator. The personal consumption expenditure price index excluding food and energy advanced 2.24% on a year-to-year basis in the first quarter, which is a small pickup in core inflation after a deceleration in the fourth quarter (2.19% in Q4 vs. 3.7% in Q3). On a monthly basis, we expect the year-over-year rate of increase in the core PCE price index to moderate with next week's release of the March data.

According to the Bureau of Economic Analysis, a part of the increase in the price index was from a pay hike of federal civilian and military personnel, which is treated as an increase in the price of employee services purchased by the government. Excluding the impact of this event, the gain in the core price index was most likely less troubling. Moreover, the absence of a similar increase in the next quarter will work to hold down the advance of the core price index.

Chart 2

The downside risks to output growth are increasing. There is evidence that the recession in housing is starting to metastasize to the consumer spending sector. To wit, CPI-adjusted retail sales fell 0.5% month-to-month in March and their growth slowed sharply in the first quarter vs. the fourth quarter (1.9% vs. 11.1%). Moreover, officials from both GM and Ford have indicated that April motor vehicle sales are coming in very weak due to problems in the housing market.

The FOMC surely is aware that inflation is a lagging indicator. In addition, the FOMC is aware that the rising rent of shelter - both explicit and implicit rents - has played an important role in driving up core consumer inflation. But with today's release of yet another record-high vacancy rate for potentially owner-occupied houses and condos, rent increases are likely to moderate as condo flippers-turned-"investors" will be desperate to rent their units. A weak April employment rate could be the catalyst for the FOMC to drop its implicit tightening bias and "go neutral" at the May 9 meeting. Regardless, we continue to expect the FOMC to begin cutting the fed funds rate at the August 7 meeting.

In the first quarter, the 3.8% increase in consumer spending, a pathetic rebound in equipment and software spending (1.9% increase vs. a 4.8% drop in 2006:Q4), a 2.2% gain in outlays on structures and a 0.9% increase in government spending provided the lift the real GDP. Partly offsetting these gains were declines in residential investment expenditures (-17.0% vs. -19.8% in 2006:Q4) and exports (-1.2%), a reduction in inventory accumulation ($14.8 billion vs. $22.4 billion), and wider trade deficit. Real final sales slowed to 1.6% annualized growth in the first quarter vs. 3.7% in the fourth quarter.

Going forward, we expect a modest rebound in real GDP growth to about a 2% annual rate in the second quarter. A sharp narrowing in the trade deficit because of strong export growth and a surge in national defense spending are the factors we expect to be responsible for this rebound, offsetting weaker private domestic spending. Without FOMC interest rate cuts commencing early in the second half of this year, we would not expect real economic growth to accelerate meaningfully.

REAL GROSS DOMESTIC PRODUCT - ADVANCE ESTIMATE 2007:Q1

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.