Stocks Bear Market Rally Gathers Strength

Stock-Markets / Stocks Bear Market Feb 08, 2009 - 04:45 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Down! The very-long-term cycles have taken over and if they make their lows when

expected, the bear market which started in October 2007 should continue until 2012-2014. This would imply

that much lower prices lie ahead.

SPX: Intermediate trend - The lows appear to have been tested successfully. Bullish indications suggest another up-wave is starting. It needs to be confirmed by a further advance.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which determines the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview:

Are the bulls, after a short set-back, regaining dominance? There has been a lot of speculation about whether or not we were about to make a new low or simply re-test the November 2008 low. Technical evidence is beginning to support the latter. Most indices did not make a new low in the January decline and they are now showing evidence of wanting to resume their up-trend. After showing some positive divergence, all my momentum indicators are again moving up, even those of the two which did make a new low-- the banking index and the financial index. Some of the better patterns include the housing index and the AMEX securities broker/dealer index. But the best of all, is the one which is, historically, the leader of the pack: the NASDAQ 100 index which is already challenging its January 6 high!

This is impressive collective behavior by all the indices, and it cannot be ignored. By the same token, these are the signs of an incipient uptrend which will need to be confirmed over the next few days and weeks. The market may be motivated by the potentially bullish news reports which will take place next week, and traders may "sell on the news" and abort the advance before it gets under way. However, you could also make a strong case that they bought on the bad news when they totally ignored the worst jobs report in recent history on Friday, rallying the Dow Industrials 200+ points, when it normally should have tanked on such news.

If an uptrend does develop, we should remember that we are in a long-term bear market which is nowhere near its lows, and that this will only be a secondary reaction and not a move in the primary trend. With this caveat, let's dissect the technicals and see what they say.

What's ahead?

Chart Pattern and Momentum

Instead of analyzing only the SPX this time, I want to compare its performance to two other indices: the Nasdaq 100, and the Dow Financial index -- the "good", the "less-good", and the "ugly"!

All three indices are shown in the same time period, the last phase of the decline into the11/21/08 low which is represented by a blue trend line and a channel. All three indices broke above their blue trend line in early December. The NDX and SPX moved sideways and broke out of their channels with the "Santa Claus rally", in late December, but sold off again in early January. The financial index never did break out of its channel. The decline ended with the NDX and SPX successfully remaining above their lows, while the DJUSFN broke its low by a smidgen.

The decline ended on 1/21 and was retested successfully in early Feb. Since then, all three have been trying to get back into an uptrend. Will they succeed?

The NDX is the most successful so far, already challenging its early January high and leaving the others behind. This is the way it should be! Since the NDX is a recognized market leader, it should pull the others along behind it. It could break out to a new high on Monday!

There is another small down-channel spanning the January-February price move which has already been overcome by the NDX, while the other two are knocking at the door. Note also that the DJUSFN is, at the same time, attempting to get out of a longer-term channel which is somewhat different than the channels of the other two indexes'.

From a technical standpoint, there is every reason to believe that the indices will succeed in getting back in an uptrend. Why? Because there is glaring positive divergence showing in the indicators, even in those of the financial index which made a new low.

I also want to show the Dow Industrial index, which has all the technical characteristics of the indices shown above, but which is the one that describes most clearly another potentially bullish feature: a reverse Head & Shoulder pattern.

I have expanded the chart of the Dow to show how the black channel -- which I consider only a medium channel -- fits within a larger channel (green lines) which is probably the first phase of the bear market. As you can see (if this analysis is correct), there is a long way to go before we get back into a bull market once again -- about 4 years!

The potential H&S pattern is clearly visible on this chart, and is confirmed by the volume pattern. All we need now is an expansion of the volume as the index goes through its neckline. That could be a little bit of a challenge! On all the indices, I have also drawn what looks like the beginning of a potential pitchfork. If this is correct, you can see that the Dow will hit the median line of the pitchfork at about the same time as the neckline. Can it go through? We'll see, but many so-called H&S patterns end in failure.

Finally, let's take a look at the hourly SPX chart (above), to show the status of the indicators. They are moving up, but the one which tracks momentum (middle) is overbought and, like the short-term sentiment indicator which you will see shortly, suggests that a correction may be due.

A short-term pitchfork was also drawn on this chart, showing that the price is already at the top of the fork and should again find resistance at the blue parallel, where it was stopped at the previous top. But the bottom of the fork is far enough away to provide some room for a correction to relieve the overbought condition.

Cycles

If we are at the beginning of an uptrend, we have to conclude that the 18-mo cycle, which we expected to bottom in the middle of February has, instead, bottomed in early February. If it has, it would be another reason to expect a rally in the stock market, since it would be reinforced by the 7-yr and 6-yr which made their lows in the Fall of last year.

I am having a problem determining if the 6-wk cycle just bottomed and is expected again in early March, or if it will occur later this month. At times, it has a strong 3-wk mid-point, and may also have shifted by ½ phase.

I am expecting the next 20-week cycle low to be in early March.

The very long term cycles which should mark the low of the bear market are due in 2012-2014. This includes the 120-yr cycle and its major components. One of them, the 40-yr cycle accounts for the 1934 and 1974 market lows. Unless some miracle happens, this bear will be growling for some time to come.

Projections:

The projection which concerns us the most right now, is what will be the final low of intermediate wave 3. Assuming that we are in wave 5, it should conclude at about 785. If prices drop much below that, we will have to assume that our interpretation is incorrect and that we may be on our way to new lows. Should weakness resume in earnest and 741 be broken, the target would be about 650.

Breadth

The McClellan Summation Index (courtesy of StockCharts) has shown a strong pattern lately. One could interpret this as relative strength to the market and preparation for the rally which seems ready to take place.

The daily NYSE A/D MACD is moving up and about equal in strength to the momentum indicator.

The hourly A/D is in an uptrend and has yet to show negative divergence to price.

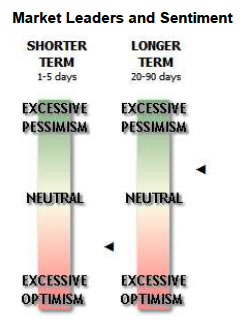

Market Leaders and Sentiment

Investor sentiment, as you can see on the graph above (courtesy of Sentimentrader), is bearish short-term and bullish longer-term. This would indicate that a short-term correction is nearby, but there is still room for higher prices in the longer term.

As mentioned before, the NDX is leading other market indices, and this is bullish. You saw this on the charts comparing both indices (above), but it is even more graphic on this relative strength chart (courtesy of StockCharts). It began to get stronger in early January and is still accelerating

Summary

There is evidence that the stock market indices have tested their November 2008 lows successfully, with the exception of the Banking and Financial indices. All of them show plenty of positive divergence at their second lows, which were reached at the beginning of last week, and they have since rallied, totally ignoring Friday's worst unemployment report in recent history.

This has all the markings of the beginning of a good stock market rally, but it will have to prove itself over the next few days by overcoming the January top, and keeping on going with good breadth and volume support.

The following are examples of unsolicited subscriber comments:

Awesome calls on the market lately. Thank you. D M

Your daily updates have taken my trading to the next level. D

… your service has been invaluable! It's like having a good technical analyst helping me in my trading. SH

I appreciate your spot on work more than you know! M

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

wra

09 Feb 09, 08:19 |

Stocks Overbought

The Market looks overbought in these charts. Stay away. |