Davos Economists: Dumb and Dumber Save the Global Economy

Economics / Recession 2008 - 2010 Feb 05, 2009 - 12:20 PM GMTBy: Tim_Iacono

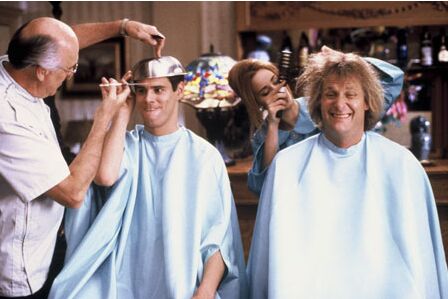

[The following conversation between two top U.S. economists was recently overheard at the World Economic Forum in Davos, Switzerland. For obvious reasons, their names have been withheld - they will be referred to here as Lloyd and Harry.]

[The following conversation between two top U.S. economists was recently overheard at the World Economic Forum in Davos, Switzerland. For obvious reasons, their names have been withheld - they will be referred to here as Lloyd and Harry.]

Two economists hatch a plan to save the global economy...

Lloyd: Harry, what are we going to do about deflation? We missed it by a whisker last month in the U.S., but you know next month's Consumer Price Index is going to show deflation and then people are going to stop spending money because they know they'll get lower prices if they just wait a little longer and that's going to just kill the economy...as if things aren't already bad enough.

That's what happened during the Great Depression and you know it will happen again if we allow deflation to take hold.

Harry: I know Lloyd, that's been keeping me up at night too. A lot of us our scratching our heads right about now. Macroeconomics used to be easy. Over the last twenty years, all you had to do was raise interest rates when the CPI went up and lower rates when the CPI went down, though that deflation scare in 2002-2003 was pretty frightening.

Lloyd: It's a good thing that we had Greenspan around at the time because he snuffed out that deflation like it was nobody's business. He had it down on the mat with those low interest rates and he wasn't going to let it up no matter what. That was really something!

Harry: Yes it was. You know all this criticism he's taken lately is really unfair. If he hadn't done what he did, we'd be six years into a deflationary spiral and people would be saying, "It's all Greenspan's fault for not doing enough to fight deflation".

Lloyd: Yeah, it really is unfair, but, what are we going to do about deflation this time Harry? Short-term rates are already at zero and the Federal Reserve and Treasury have already bought or guaranteed trillions of dollars worth of bank assets and, so far, quantitative easing just isn't working.

Harry: I don't know Lloyd, maybe if we can put our heads together we can come up with something, anything, to stop that deflation train that's barreling down the tracks.

Lloyd: You know, Merrill Lynch is predicting year-over-year inflation of minus 3.2 percent by summertime - I guess we'll all have to stop talking about in-flation and start saying de-flation when these new inflation numbers come out...or should I say, "when the de-flation numbers come out".

Lloyd: You know, Merrill Lynch is predicting year-over-year inflation of minus 3.2 percent by summertime - I guess we'll all have to stop talking about in-flation and start saying de-flation when these new inflation numbers come out...or should I say, "when the de-flation numbers come out".

Harry: And I hear Goldman Sachs just polled some money managers and found that 83 percent of them think de-flation, not in-flation, is now the biggest threat to the global economy. I just hate the sound of that...de-flation.

Lloyd: Hmmm... what to do...

Harry: Hmmm... is right.

Lloyd: Hey, I've got an idea. You know how some people still think that the price of gold is some sort of an indication of future inflation?

Harry: Uh-oh. Don't start any of your "crazy gold talk" again Lloyd. You've studied all the same textbooks as I have and you've got a PhD in economics just like I do yet, about once a year, you seem to get this wild hair up your derriere where you somehow think that the price of gold is relevant in what we do.

Lloyd: Just hear me out, Harry. I think I may be on to something that could really save our bacon here - you know, economists aren't all that popular these days because, except for Roubini, Shiller, and a couple of others, none of us saw this financial crisis coming.

Harry: Yeah, I really thought we were going to be OK with a zero savings rate in the U.S. back in 2005 because we were all so house-rich. I hear Bernanke's upside down on that place he bought in Washington back at the peak of the bubble when he was appointed Fed chair.

Lloyd: Don't distract me Harry.

Harry: Sorry.

Lloyd: Anyway, you and I both know that gold is irrelevant - why banks still keep the stuff is beyond me and, please, don't get me started on the Germans and their weird fascination with the stuff today, almost a hundred years after that Weimar episode.

But, a lot of the people in the world still think gold does matter, so if the gold price went higher, that might get enough people to start questioning the CPI numbers which, as we both know, are going to tell the real story this year - deflation.

Harry: You know, that's an interesting idea. It's inflation expectations that are important, so if enough people expect inflation because the price of gold is rising, maybe they'll be more likely to spend their money even if prices are falling.

Lloyd: Exactly. Back in the Great Depression, long before we had computers and our advanced economic models, they had the currency fixed to gold - $20 an ounce as I recall. When they revalued gold in 1933 to $35 an ounce, that's when things started to improve. To revalue gold, they had to print up lots and lots of new money and that's what really cured the deflation of the 1930s.

Harry: I've read about that...

Lloyd: You know, President Obama already thinks of himself as the new FDR, we could probably talk to Bernanke and Geithner and get him on board. If we could somehow push the price up to $1,500 or $2,000, then people would stop obsessing about deflation and go out and spend some money. You know adjusted for inflation, gold could go to about $2,500 and still not exceed its 1980 high, so it wouldn't really be extraordinary - we could still say that gold hasn't made any gains in 30 years.

Harry: Adjusting the price of gold for inflation? Lloyd, remember that you have a PhD in economics - don't embarrass yourself. Uh-oh! You've got that crazy look in your eye again Lloyd - I get the feeling that the next thing you're going to tell me is that the Federal Reserve, today, should print up money and buy gold.

Lloyd: Exactly!

Harry: Hmmm...

Lloyd: Look, people are scared to death with all these job losses and falling home prices so they're not borrowing and spending as they should. When deflation hits this spring, things will get even worse. If we could somehow convince them that we have in-flation instead of de-flation, despite what the government's data says, maybe that will help.

Harry: You know, that wouldn't cost much either. Let's see...100 tonnes of gold costs somewhere around $3 billion. If we went out and bought, say, 1,000 tonnes, that would be a good start and no one would notice an extra $30 billion on the Fed's balance sheet.

Lloyd: Yeah, that's just a drop in the bucket compared to all the other money that's being borrowed and printed to try to get us out of this mess.

Harry: Plus, the Fed would have the gold in their possession - they'd probably make money on the deal, unlike all the other stuff they've been buying lately.

Lloyd: It's just crazy enough that it might work. Huh?

Harry: Yes, it just might work, Lloyd.

Lloyd: I'm glad we had this talk - I think we really came up with something that might help.

Harry: You know, sometimes you really surprise me Lloyd - I don't know why everyone says you're so dumb.

Lloyd: Who says I'm dumb?

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.