Gold, the Markets and India: A return to Tradition?

Commodities / Gold & Silver Apr 27, 2007 - 01:28 PM GMTBy: Bob_Kirtley

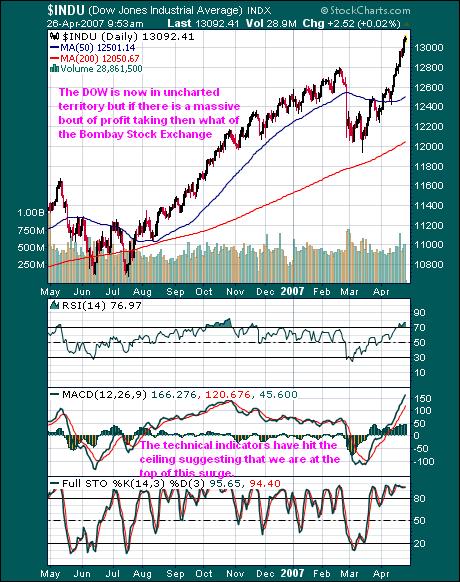

As the United States stock market goes through the 13000 level and India 's Bombay Stock Exchange heads towards 14500 and possibly new highs we ponder the ramifications for demand for gold in India .

As the United States stock market goes through the 13000 level and India 's Bombay Stock Exchange heads towards 14500 and possibly new highs we ponder the ramifications for demand for gold in India .

India is generally recognised as the words largest gold market but will the demand for gold continue to grow? Well according to Suresh Hundia, president of the Bombay Bullion Association, it will, as he informed Reuters last week that India 's gold imports could rise marginally this year to 600 tonnes from last year's 585 tonnes. However there are other factors to be considered before we take this as a given.

Firstly India's stock market is following a similar pattern to that of the United States in that it has risen considerably and is now about to test new highs as we can see from the chart of the ‘India Bombay Stock Exchange Index' below:

Stocks provide an alternative investment from gold in the eyes of the Indian investor. This country is going through its own version of an industrial revolution so its population are becoming wealthier and that wealth is seeking a home. Traditionally gold and jewellery would be the place to invest but this is a new generation looking to be worldlier.

Stocks are not the only competitor that gold has to face in India there is also the Indian currency. The Rupee has rose to 41.85 against the dollar and now stands at a nine year high against the dollar, which is impressive progress although it has been aided by a declining dollar. Still the Rupee on deposit generates around a 10% return, which will attract some of this new wealth.

So we have established that there at least two major competitors for gold, we will leave to one side the many other asset classes offering homes to investment cash for now.

Okay, so lets rewind to a short while ago to when we experienced a little wobble emanating from the Chinese stock market. All the world stock markets sold off. This tells us that investors are not that confident in our stock markets and consider them to be fragile; hence they have one finger on the sell button.

In our opinion the Bull Market in industrial stocks is showing us a climax before the rout. The rout will start when a major US car manufacturer seeks protection from bankruptcy precipitating a bout of uncertainty in the market place and raising questions as to the wisdom of holding stocks in general. This u-turn in the markets will be more than just a wobble and will have a worldwide impact.

What will this large nation of 1,027,015,247 people do then, as they seek cover and protection for their own newfound wealth? You got it in one, they will return to the centuries old, tried and trusted store of wealth, which is gold.

You can almost hear their elder statesmen saying I warned you!

Should this shake out happen you could either sit through it or run for cover? The team here are of the opinion that it could well present us with one last buying opportunity before Gold really takes off and we intend to be fully invested in gold stocks before this happens in order to take full advantage of the next leg up.

For ideas on which gold stocks to invest in, subscribe to the Gold Prices newsletter at www.gold-prices.biz completely free of charge.

By Bob Kirtley

www.gold-prices.biz

Bob Kirtley spent many years working on Oil projects including some in Alberta, such as the tar sands installations in Fort McMurray. He lived and worked in many different countries, as that is the nature of the construction business. Planning and cost control are key to a projects success and he tries to apply those disciplines on a daily basis when dealing with investments. His training in such areas as SWOT and Risk analysis can be applied from time to time. His qualifications include being chartered in the United Kingdom, which is similar to that of a Professional Engineer in Canada, along with a Masters Degree in Project Management from South Bank University, London, England.

He has been working for a number of years on a full time basis representing a group of investors in England.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.