Volatility Plagues Forex Markets Ahead of Interest Rate Decisions

Currencies / Forex Trading Feb 05, 2009 - 04:45 AM GMTBy: ForexPros

Continued volatility plagued the majors the past 24 hours as the USD continued to consolidate gains earned overnight although signs of topping continue. Overnight news as well as US data this morning failed to extend US gains past early highs seen in New York after the release of ADP private payrolls estimates. Showing another large drop projecting a dip in NFP on Friday, ADP came in at -553K. Although a negative number it was seen as an improvement over December’s numbers; USD got a slight boost on the news but GBP and EURO reversed;

Continued volatility plagued the majors the past 24 hours as the USD continued to consolidate gains earned overnight although signs of topping continue. Overnight news as well as US data this morning failed to extend US gains past early highs seen in New York after the release of ADP private payrolls estimates. Showing another large drop projecting a dip in NFP on Friday, ADP came in at -553K. Although a negative number it was seen as an improvement over December’s numbers; USD got a slight boost on the news but GBP and EURO reversed;

EURO making New York highs above the 1.2900 handle at 1.2930 area and GBP making a daily high at 1.4580. Both pairs settled back on the day but did not make lows although EURO dropped all the way back to the 1.2820 area before regaining the 1.2870 area late in the day. High volatility found stops both ways in EURO and GBP as both rates suffered large swings in thinner volumes through the day but held firm into the close. Low prints in EURO at 1.2812 and in GBP at 1.4323 were on technical support suggesting that yesterday’s rally has more to go after both rates held support. Cross-spreaders in both pairs added to the volatility with main interest in Yen.

USD/JPY dropped to a low print at 88.81 but rallied later in the day for new highs at 89.79 before finishing mid range around the 89.30 area; dips are being bought and rallies sold suggesting more coiling before a large move in one direction; traders continue to suggest that a short-covering rally is due. USD/CHF rallied off overnight lows for a high print at 1.1639 before dropping back under the 1.1600 handle; the rate has to close below the 1.1580 area to suggest another selling wick and lower potential in my view.

USD/CAD fell to a low print at 1.2224 as the other pairs rallied to their highs but recovered one full handle to finish around the 1.2320 area into the close. Traders note that CAD demand related to M&A activity may have been behind the move after the London fix. In my view, today’s volatility in the majors is to be expected as the USD continues to sketch out a top. I think the

USD/JPY languishing around the 88.10/20 area before rallying to new highs intraday suggests that late shorts are getting nervous. Today’s drop in equities had no impact on the rate which also suggests that the rate is about ready to rally. Look for the USD to continue sideways with a lower bias into the next two days of data with the main focus NFP on Friday. BOE and ECB meetings with rate announcements due tomorrow with no changes expected but rhetoric to be closely watched during the press conferences.

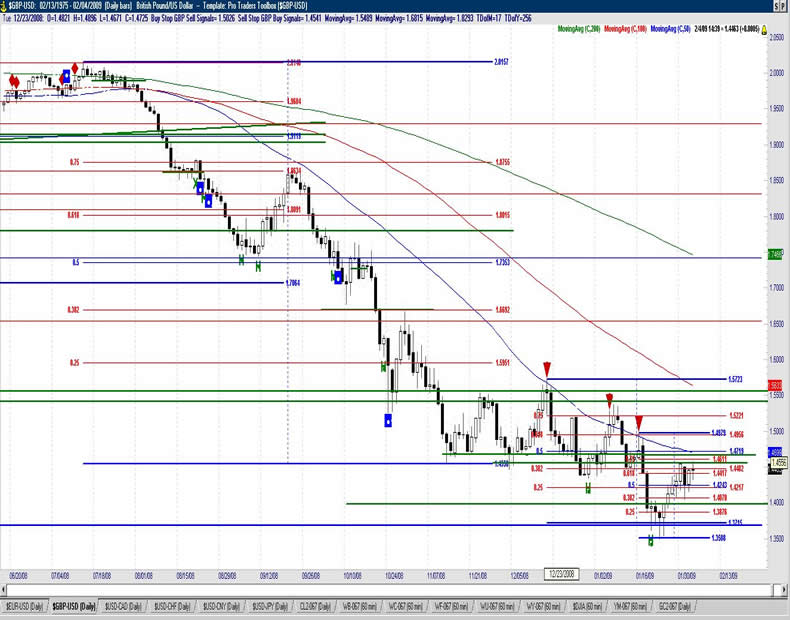

GBP/USD Daily

Resistance 3: 1.4650,

Resistance 2: 1.4620,

Resistance 1: 1.4580

Latest New York: 1.4460,

Support 1: 1.4320,

Support 2: 1.4250/60,

Support 3: 1.4200

Comments

Rate reverses overnight but not as much as other pairs; cross-spreaders on the offer. Traders note stops and active buying above the 1.4320 area and the rate recovers the 1.4400 handle into New York. Any correction a buying opportunity now as the rate begins to squeeze shorts. 23 year lows are very likely to hold on any break. Light stops seen on the move under 1.4380 with likely active selling dropping into lows overnight but the rate recovers in New York suggesting the bulls are in control. Two-way action continues suggesting that shorts are aggressively adding and longs are trying to find a bottom. Rate trading on technical’s now. Spillover from EURO likely but modest. A short-covering rally is increasingly likely now. Late sellers likely in or hurting.

Data due Thursday: All times EASTERN (-5 GMT)

5th-6th GBP Halifax HPI m/m

Tentative GBP MPC Rate Statement

7:00am GBP Official Bank Rate

EUR USD Daily

Resistance 3: 1.320/30,

Resistance 2: 1.3150,

Resistance 1: 1.3080

Latest New York: 1.2854,

Support 1: 1.2820,

Support 2: 1.2750,

Support 3: 1.2700

Comments

Rate drops hard on liquidation, stops, and new selling as aggressive sellers try to cap above key 1.3030 area; drop sees large names on the bid suggesting the dip is a buy op. Aggressive traders can ADD to open longs under the 1.2850 area. Follows GBP in two-way action and rally in GBP took EURO with it for highs in New York at 1.2930 area. Cross-spreaders likely pressure as crosses are unwound. Two-way action overnight in light volume as stops get triggered under 1.2850 area and below but sellers run out on support at the 1.2800 handle again. Close back above 1.3030 argues for another test of the 1.3300 area weekly highs. Bulls are still attempting to find a bottom. 50 bar MA failed now likely to offer resistance and a close above suggests the bottom will be in. Technical levels around the 1.3300 area now likely to offer resistance so expect two-way action and consolidation.

Data due Thursday: All times EASTERN (-5 GMT)

5:00am EUR Italian Prelim CPI m/m

6:00am EUR German Factory Orders m/m

7:45am EUR Minimum Bid Rate

8:30am EUR ECB Press Conference

Join us for the Afternoon US Dollar Wrap-Up daily at 3:15 pm Central/Chicago time (GMT -6)

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.