U.S. Dollar Trades Within Tight Trading Range

Currencies / Forex Trading Feb 03, 2009 - 04:39 AM GMTBy: ForexPros

It is a mixed start for the USD this morning as the Chinese markets are back after the extended Lunar New Year celebrations; the Greenback is better against EURO, GBP, CHF and CAD but softer against JPY to start the month. Although trading was light to start Asia, technical follow-on buying from Friday saw the majors start losing ground steadily into early Europe; below-expectations UK CBI data helped pressure GBP into early lows around the 1.4230 area with traders saying a failure at the key support area of 1.4250 to extend losses.

It is a mixed start for the USD this morning as the Chinese markets are back after the extended Lunar New Year celebrations; the Greenback is better against EURO, GBP, CHF and CAD but softer against JPY to start the month. Although trading was light to start Asia, technical follow-on buying from Friday saw the majors start losing ground steadily into early Europe; below-expectations UK CBI data helped pressure GBP into early lows around the 1.4230 area with traders saying a failure at the key support area of 1.4250 to extend losses.

GBP making lows in early New York at 1.4093 with noted sellers active on the GBP crosses.

EURO is also weaker after posting early highs in Asia at 1:2800 before turning lower to find stops under the 1.2750 area; low prints at 1.2707 found buyers at the technical level of 1.2720 and the rate is firm into early New York around the 1.2760 area. Traders expect support at 1.2720 to offer at least a slight bounce and note that both EURO and GBP are on or near technical support and have corrected recent strength to long-term fib defense areas suggesting that long-timeframe traders may be interested on the buy side soon. Aggressive traders can buy EURO under the 1.2750 area in my view.

USD/CHF is firmer to start the week, high prints in Asia at 1.1689—again at technical resistance. Traders note that offers extend above the 1.1700 area into the 1.1750 area and suggest that the upside may be limited for the week. Low prints at 1.1599 continue to be above the 1.1580 area where large stops are likely building.

USD/CAD high prints at 1.2405 were also at near-term resistance between 1.2380 and 1.2420; aggressive traders can look to sell the rate above the 1.2400 area in my view. Lows at 1.2257 overnight make for a larger range than most pairs suggesting more volatility in this pair near-term so be nimble on positions.

USD/JPY continued to trade in a tight range ahead of New York, high prints at 90.02 were offered as has been the case the past several sessions; traders saying that as long as 90.50/60 area holds on a closing basis the rate will likely remain stuck. Low prints at 88.80 are right on technical support with bids said to be layered into the 88.50 area suggesting more coiling action is likely.

In my view, the majors are starting the week inside range and driven by technical areas; news from the US today and tomorrow is light and traders note the Greenback appears to be drifting more so than being actively accumulated. Expect S/R to hold near-term and the majors to remain range bound within existing highs and lows. I don’t expect the USD to make a break out one way or the other for a few days.

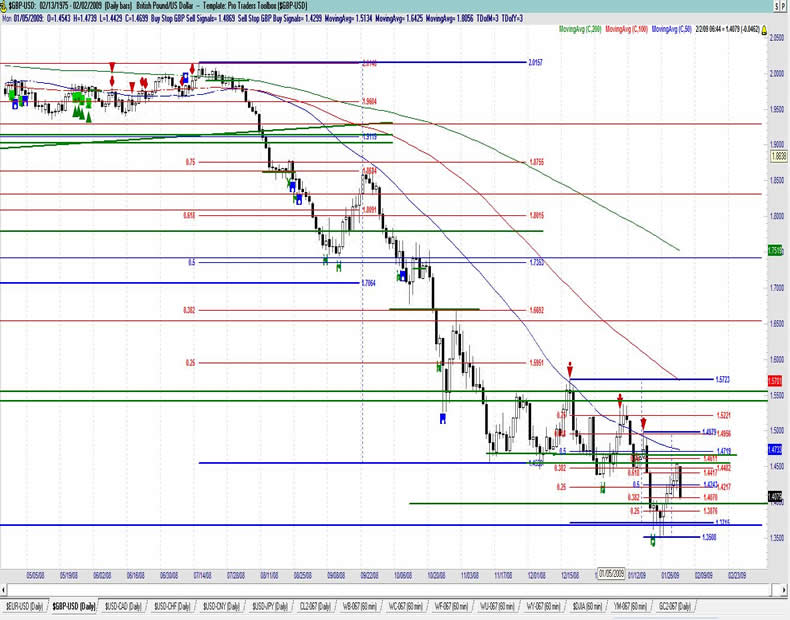

GBP/USD Daily

Resistance 3: 1.4250, Resistance 2: 1.4180, Resistance 1: 1.4100

Latest New York: 1.4077, Support 1: 1.3980, Support 2: 1.3920, Support 3: 1.3880

Comments

Rate drops back after an up week last week; likely a correction and a buying opportunity as the 23 year lows are very likely to hold. Last week’s Blanchflower comments help underscore the rate on dips but that support didn’t show this morning. Possibly unwinding of GBP crosses pressuring the rate above the 1.4300 handle. Light stops seen on the move under 1.4250 with likely active selling dropping into new lows at this writing. Two-way action continues suggesting that shorts are aggressively adding and longs are trying to find a bottom. Short-squeeze taking a break; need sharp rally after this dip to argue for continued upside. Rate trading on technical’s now. Signs of the bottom may be showing up as “smart” buyers reported in GBP last week. Spillover from EURO likely but modest. Look for two-way action into this bottom. A short-covering rally is increasingly likely now. Late sellers likely in or hurting.

Data due Tuesday: All times EASTERN (-5 GMT)

4:30am GBP Construction PMI

EUR/USD Daily

Resistance 3: 1.2920, Resistance 2: 1.2850, Resistance 1: 1.2820

Latest New York: 1.2756, Support 1: 1.2700/10, Support 2: 1.2650, Support 3: 1.2620

Comments

Rate follows GBP lower, cross-spreaders likely pressure as crosses are unwound during the day. One-way action overnight in light volume as stops get triggered under 1.2750 area and below but sellers run out on support at the 1.2700 handle. Major resistance is now back at 1.3030 area and a close back above there argues for another test of the 1.3300 area weekly highs. Downside bias may be running out as rate is now on solid support numbers around the 1.2700/20 area. Pullback argues the squeeze is over. Bulls are still attempting to find a bottom. 50 bar MA failed now likely to offer resistance and a close above suggests the bottom will be in. Technical levels around the 1.3300 area now likely to offer resistance so expect two-way action and consolidation. Aggressive traders can look to buy the next dip.

Data due Tuesday: All times EASTERN (-5 GMT)

2:00am EUR German Retail Sales m/m

5:00am EUR PPI m/m

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.