Yikes! We're caught in a liquidity trap. What the Heck is That?

Economics / Credit Crisis 2009 Jan 31, 2009 - 12:31 PM GMTBy: Joseph_Toronto

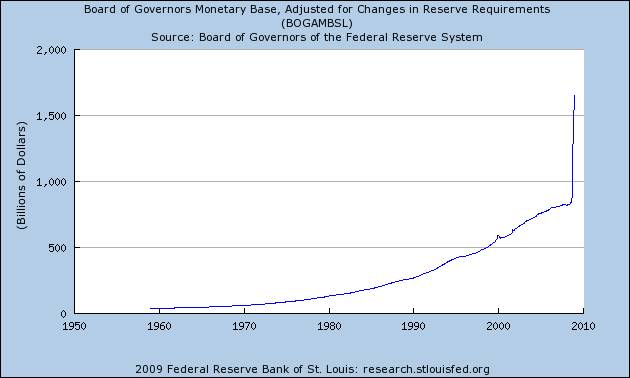

Since the Fed increased the monetary base by, oh, about a Trillion dollars, why aren't we having massive hyperinflation?

Since the Fed increased the monetary base by, oh, about a Trillion dollars, why aren't we having massive hyperinflation?

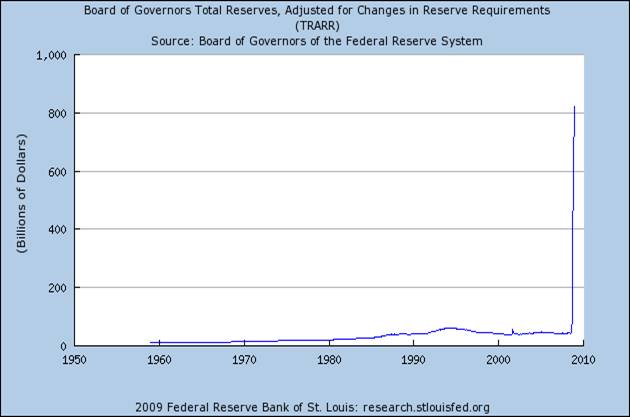

Well, It's because of the fact that banks have taken that Trillion (give or take) and put it in their excess reserves account at the Fed and are not loaning it out. The money never entered into circulation.

So, why didn't all those greenbacks get into circulation? Ah yes, it's because of the proverbial liquidity trap; a circumstance that occurs when economic conditions are so bad that even when the Fed pumps massive money and reduces interest rates to zero, that banks refuse to make any new loans fearing certain default by the borrower, and borrowers will not borrow any new loans fearing inability to pay them back. A liquidity trap is a phenomenon uniquely related to our system of injecting money into the economy only through bank loans.

We have no other means. Economists love to laugh about Fed Chairman Bernanke's comment about this nifty new technology called the printing press that, in an emergency would allow them to drop money from a helicopter (thereby obtaining the moniker Helicopter Ben). Sadly, It is just a joke. (Don't those economists just kill ya?) It seems like there's times called a tight money negative feedback loop where no one wants to borrow or lend creating even tighter money, when such a nifty technology really would come in very handy.

Very Best Regards,

Joseph Toronto

Joseph Toronto, has managed stock and bond portfolios for 26 years for some of the largest institutions in the west. He began in 1982 as a portfolio manager and analyst for the LDS Church Investment Trusts. In moving to the Trust Division of West One Bank he became senior investment officer and managed assets in excess of $100 million. Later, as the senior portfolio manager of Pacific American Investors, Inc. he managed stock and bond portfolios for high net-worth individuals nationwide. In 1993, Mr. Toronto founded Affiliated Investment Advisors, Inc., as a registered investment advisor for serious investors seeking professional management for superior safety and returns. Mr. Toronto is a Chartered Financial Analyst and is a member of the Salt Lake City Chapter of the Financial Analysts Society and the Association for Investment Management and Research. He has a Master's degree in investment securities and a B.A. degree with a dual major in finance and management.

Currently, Affiliated Investment Advisors, Inc. manages investment portfolios for retirement plans, profit sharing plans, individuals, IRA's and other trusts. We believe Affiliated offers professional portfolio management with superior investment returns while steadfastly safeguarding and protecting your capital. As a registered Investment Advisor, Affiliated's portfolio management services are “fee only” and takes no commissions or performance incentive. It is not a stock broker or financial planner and does not sell any investment or insurance fund or product. joe@aiadvisors.com

© 2009 Copyright Joseph Toronto - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.