Stock Market Up Again Despite Grim Economic Data

Stock-Markets / Financial Markets 2009 Jan 28, 2009 - 03:31 AM GMTBy: PaddyPowerTrader

Stubborn stocks ground out a few more hard yards in the face of more grim economic news. They drew some cheer from better than expected results from American Express (albeit still very weak). That the market can drag itself higher in the face of the current headwinds (job losses, poor earnings and guidance and dire real economy data) reinforces the importance of expectations and the significant pessimism currently built into market pricing.

Stubborn stocks ground out a few more hard yards in the face of more grim economic news. They drew some cheer from better than expected results from American Express (albeit still very weak). That the market can drag itself higher in the face of the current headwinds (job losses, poor earnings and guidance and dire real economy data) reinforces the importance of expectations and the significant pessimism currently built into market pricing.

Today's Market Moving Stories

- President Obama is set to announce the creation of a ‘ bad bank ' as part of his financial rescue plan early next week. Bloomberg says that the FDIC would run the operation . The problem of course with a ‘bad bank' solution remains what price they would pay for these “toxic” assets. The fear is that the taxpayer gets fleeced as banks have thus far failed to write down these assets fully or find a free market clearing price for them.

- Germany is thinking about raiding the gold reserves of the Bundesbank to finance their get out of economic jail card. Germany currently holds the 2nd largest amount of gold reserves of any central bank, valued at €75bn.

- The Irish Government gave some clarity on The Dept of Finance's website regarding the treatment of Anglo Irish's bonds. Essentially the decision remains with Anglo's board. The other Irish banks are benefiting from this positive statement with AIB up 22%, Bank of Ireland rising 9% and Irish Life and Permanent up 7%.

- While Davos must be duller this year minus Bono and Mrs Brad Pitt, they do have Dr Doom Nouriel Roubini on this European tour (a sign of the times when celebrity economists are feted like rock stars). His latest prophecy is a 20% further fall in equities and US unemployment to hit 6m.

- Looks like Citigroup are still going through with plans to buy a $50 million jet . Good to see the boys still looking after themselves. No going steerage for them.

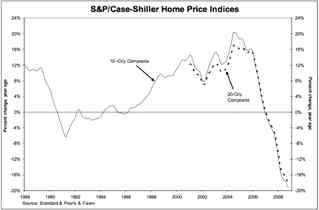

In case you missed yesterday's woeful data, American consumer confidence fell to an all time low because the Case-Shiller index of house prices in 20 major US cities is still falling at an accelerated rate. That's 28 down months in a row, quite a losing streak. They may take years to reach a bottom.

In case you missed yesterday's woeful data, American consumer confidence fell to an all time low because the Case-Shiller index of house prices in 20 major US cities is still falling at an accelerated rate. That's 28 down months in a row, quite a losing streak. They may take years to reach a bottom.

- And it's not just our American friends who are hurting. Bloomberg reports that U.K. commercial property prices may fall as much as 25% this year as banks curb lending to investors, according to Moody's. By the end of the year, valuations in Britain may have dropped as much as 45% from their peak before the credit crisis started in 2007. Moody's went on to say that French real estate may fall as much as 20%, with a 15% decline in Germany.

Austerity Programme For Ireland

The Irish prime minister Brian Cowen promised to deliver €2bn in spending cuts within seven days but warned that the cuts alone will not be enough to reduce the budget deficit. A total adjustment of €16.5bn is needed. The Irish Independent reports that he gave the strongest indication to date that a range of taxes will have to be increased to bridge the gap between spending and income. The tax hikes are likely to come in a number of budgets over the next five years as part of a lengthy stabilisation programme.

John McHale suggests that instead of relying on debt markets, the government should use the opportunity to switch towards an unfunded state pension system : “Under this system, benefits are linked to earlier contributions. For a given contribution rate, contributions receive a “notional” rate of return equal to the growth rate of the wage bill. But the system is unfunded, so that the revenues are made available to the government today.” Why is this good idea? The government receives a sizable inflow of funds at its disposal now; there would be no need for an imminent tax increase that could weaken the economy even further; a state pension reduces the risk exposure of workers under current private pension schemes and could lift the spirits of households about their future income in times where they might need some assurance.

Equities

- GE is close to losing its much coveted triple A (AAA) credit rating.

- SAP is up strongly this European morning after reporting improving profits (and the now customary 3k layoffs!)

- A profit warning from Tate and Lyle is weighing on their shares.

- Novaratis is also under pressure after warning on the outlook for 2009.

- BSkyB posted some encouraging results that beat the street.

- Meanwhile the awful news flow from Japan continues with news that Canon's Q4 net income fell a staggering 91% and Sumitomo Mitsui's profits collapsed 99% !

- Drinks giant Diageo, who have some cash to spend, are said to be in talks with India's biggest liquor maker United Spirit with a view to taking a stake.

- Rio Tinto is mulling a rights issue to reduce debt (curious timing?)

Data And Earnings Today

The two-day FOMC meeting will reach a conclusion this evening. Fed funds cannot be cut further so it is left to the contents of the accompanying statement to possibly excite the market. The economic gloom has not lifted since the December meeting so any market sensitive news will stem from any Quantitative Easing (QE) details. The market is doubtful there will be any QE details at this stage, so the buzz that usually precedes the FOMC announcement may be lacking this around.

The German preliminary CPI number will be out this afternoon with the annual inflation rate widely expected by market commentators to stay at 1.1% for both the national and EU harmonised measures. However, any undershoot of expectation for the annual figure will raise concerns that the ECB's confidence, displayed by policymakers of late, is misplaced with regards avoiding deflation.

Earnings highlights today from AT&T (expected EPS $0.65), Boeing (0.78), Pfizer ($0.60) , Wells Fargo (0.33), Boston Scientific ($0.14), Qualcomm ($0.47), Tyco ($0.30) and Starbucks ($0.17).

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.