Gold Price Manipulation Further Forensic Examination

Commodities / Market Regulation Jan 27, 2009 - 02:10 PM GMTBy: Rob_Kirby

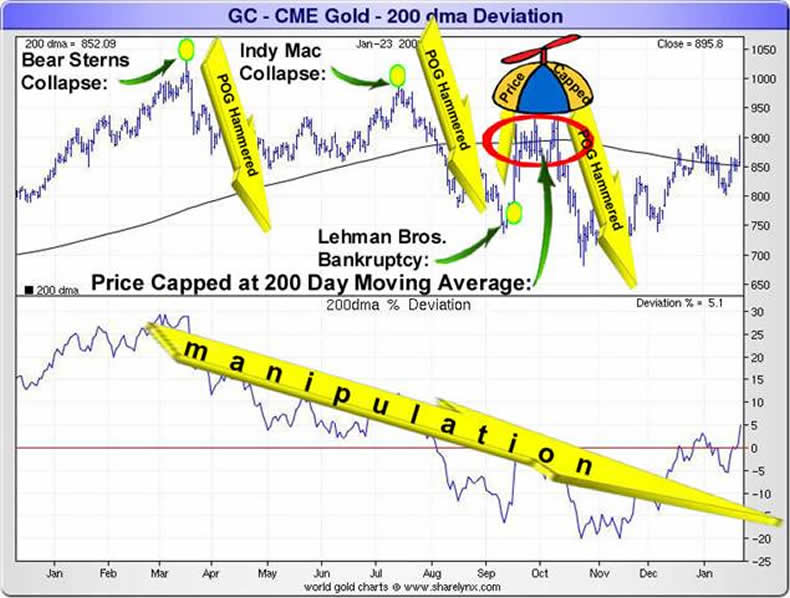

Borrowing from the axiom that, “a picture is worth a thousand words,” today we are going to view the incredulity of recent macro-economic events with the aid of charts and graphs. First up is a chart of the price of gold [POG] over the past year with a few “milestones” pasted in for good measure:

Borrowing from the axiom that, “a picture is worth a thousand words,” today we are going to view the incredulity of recent macro-economic events with the aid of charts and graphs. First up is a chart of the price of gold [POG] over the past year with a few “milestones” pasted in for good measure:

It saddens me to point out that – collectively - the milestones on the chart above are all indicative or symptomatic of systemic financial collapse. It saddens me even more knowing that the price of gold has acted counter-intuitively – getting hammered – each and every time these unfolding events should have propelled it higher.

How It's Done

The manipulation / capping of the gold price is largely accomplished by appointees of the U.S. Treasury / Federal Reserve selling staggering amounts of gold futures on exchanges, like N.Y.'s COMEX, to suppress the price:

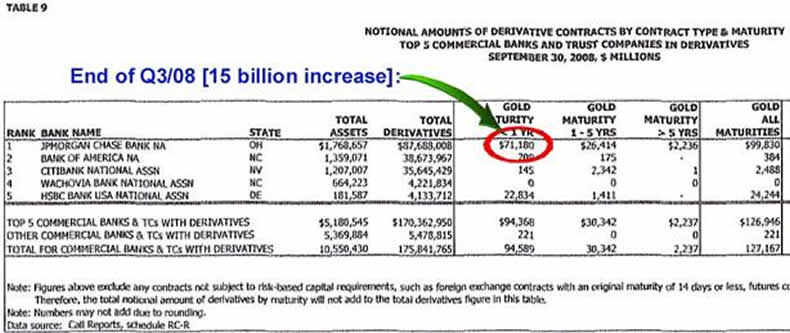

The table above is excerpted from the Quarterly Derivative Fact Sheet compiled and published by the U.S. Office of the Comptroller of the Currency. It shows that J.P. Morgan Chase has/had roughly 100 billion worth of gold derivatives [predominantly “short” gold futures] on their books as of Sept. 30, 2008.

Gold price suppression is not simply a “paper game” where relentless amounts of price suppressive “futures” can be sold forever; the price suppression scheme also requires that the price riggers expend some physical gold too – to make the ponzi-esque selling of futures “believable.” The physical gold which is mobilized to accomplish this is typically sovereign gold that is “leased” from Central Banks.

Leasing is preferred to outright sales because you can only outright sell something “once” – and it is gone. By leasing, the physical gold leaves the vault to be sold in the open market but Central Banks replace the missing physical gold with an I.O.U - for accounting purposes – and claim that they still posses the same amount of physical bullion! So, by leasing gold instead of “outright sales,” Central Banks can and do double count [cheat] – a la Enron – their gold stocks! [Don't try this at home or you'll end up in jail.]

The Unintended Consequences

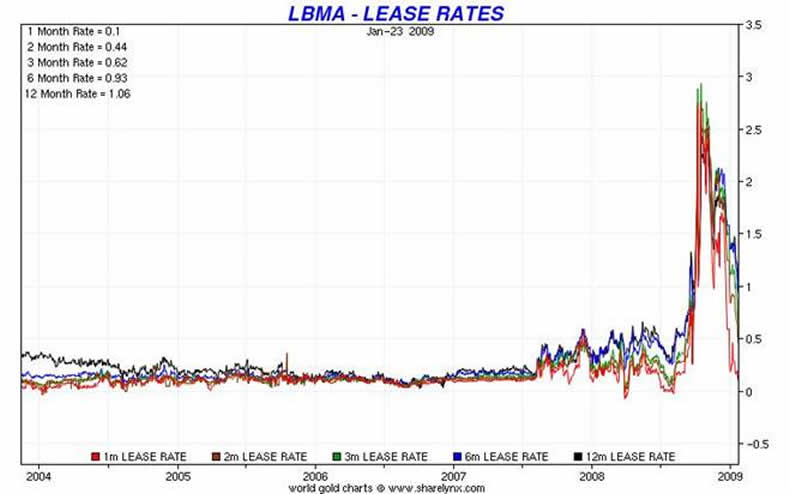

The problem with cheating, besides being not nice, is that gold leasing, as it is practiced, still depletes physical caches of gold bullion. Logically and intuitively, if you practiced this thievery long enough it would lead to a bifurcated market where the price of the physical commodity would “decouple” and trade at a premium to the suppressed paper price. This is EXACTLY what has happened in the gold [and silver] market today! The premium being paid has expanded and it is growing in the price to acquire physical ounces. This decoupling of physical from futures pricing is reflected in the increased cost to lease precious metal over time. Demonstrably, even the crooks at Central Banks are less willing to “lend” their bullion – because they KNOW it's unlikely they will be repaid:

Folks would do well to remember that once physical bullion is no longer available to “back up” the fraudulently derived futures price, the nominal cost of obtaining physical precious metal will skyrocket.

Got physical gold yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.