Stock Markets Begin Week With Tentative Gain

Stock-Markets / Financial Markets 2009 Jan 27, 2009 - 04:07 AM GMTBy: PaddyPowerTrader

On a very back day for US employment, there was 71,400 job cuts announced. Still equity indices managed to eek out some meagre gains with the blockbuster Pfizer/Wyeth merger, a bullish statement from Barclays, solid earnings from the ever dependable McDonalds and better than expected existing home sales numbers bringing some relief. So a day when investors chose to see the glass as half full. I remain highly sceptical, particularly of tech stocks .

On a very back day for US employment, there was 71,400 job cuts announced. Still equity indices managed to eek out some meagre gains with the blockbuster Pfizer/Wyeth merger, a bullish statement from Barclays, solid earnings from the ever dependable McDonalds and better than expected existing home sales numbers bringing some relief. So a day when investors chose to see the glass as half full. I remain highly sceptical, particularly of tech stocks .

Today's Market Moving Stories

- Overnight the Nikkei rallied over 5% on a new $16.7bn Japanese government plan to buy stakes in troubled firms via direct purchases of preferred or common stock. Shipping and exporter stocks led the way, benefiting from a weaker Yen.

- “And please Sir can I have some more” from the shameless Freddie Marx and Fannie Engels with news the Fannie Mae and Freddie Mac are to seek a further $16bn and $35bn from the TARP. Hang ‘em high and Chris Dodd and Phil Gramm with them.

- I wrote recently of Société Générale's equity guru Albert Edwards rather bleak forecast for China. His theory was that China would start to implode with the current regime responding with a Mercantalist style devaluation of the Yuan leading to a trade war with the US. The result being that a recession turns into a depression. Well footage like this will spark fears that he could just be right (again).

- Irish government bonds also got some much needed bid on news that Blackrock was buying Spanish and Greek debt after what they regarded as ridiculously (high) spreads over Germany. But JP Morgan has recommended buying protection against a Greek sovereign default via the CDS (credit default swap) market. I have said it before and will say it the again that the ECB should come in and take these trades and smash JP Morgan and other charlatans peddling these weapons of Euro spread destruction. But of course the ECB, forever in denial, would rather talk more hawkish guff and end up tripped up by events everyone bar themselves seems capable of foreseeing. Rip up the textbook lads and do the right thing before we end up with deflation and depression in the Eurozone. Even a dog learns if you kick it often enough.

- Location, location, location. While you may be trying to offload that second home in Muff or Termonfeckin (actual places), spare a thought for those who live in ….

Equities

- A bit of rest bite for Irish bank shares yesterday with AIB and Bank of Ireland up 33% and 36% bouyed by a strong performance by their UK counterparts.

- Equities in the news this morning include Siemens who are up 5% after surprising the market with better than expected results and more importantly sticking to their 2009 guidance (brave call).

- Nordic phone company Telenor have pulled their rights issue saying that their plan to buy India's Unitech Wireless will now be funded via scrapping dividends and more debt.

- Dutch phone company KPN is also up over 5% this morning after reaffirming their 2009 and 2010 targets.

- British Land is off after being cut to a sell at Goldman Sach's on weakness in the CRE market.

- A busy morning for Goldman Sach's analysts as they have also cut Irish cider maker C&C to a sell due to loss of market share to Heineken in the tough UK market.

Data And Earning Today

One of the very few numbers with clout out today is the German IFO survey of business sentiment of 7,000 executives. The consensus forecast is for it to sink to a 26 year low of 81.0. It has actually just come in confounding expectations with a rise to 83.0. Mmmm not good news for those hoping for a February rate cut from the ECB. EUR/USD up to a 1 month high of 1.333 on the news.

From across the Atlantic we get the Case-Shiller home price index at 14.00 (-18.4 expected), consumer confidence at 15.00 (39.0) and the Richmond Fed manufacturing Index (-50).

Earnings highlights today are Verizon (expected EPS $0.61), DuPont, U.S. Steel ($0.75), Yahoo $0.13), Sun Micro (-$0.08) and Bristol-Myers Squibb ($0.41).

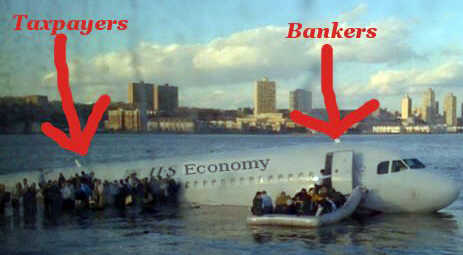

And Finally… Bankers First

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.