Dow Jones Industrial Averages Index Price Anomaly

Stock-Markets / Market Manipulation Jan 27, 2009 - 03:50 AM GMTBy: David_Urban

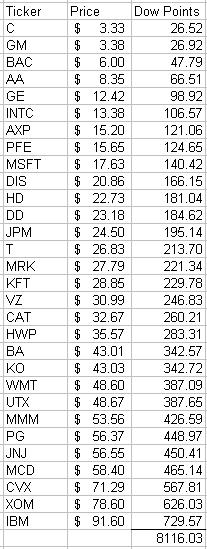

Over the last week, a number of articles were written about the distortions in the Dow Jones Industrial Average (DJIA). Because of the collapse of the financial sector the DJIA, a price-weighted index, has become distorted. In a price-weighted index, each stock price is divided by a divisor to determine its price makeup within the index. Normally this is not a major problem but as of the closing bell on Monday, January 26th, four stocks trade below $10 per share and nine stocks trade below $20 per share. This interesting anomaly deserves a closer look.

Over the last week, a number of articles were written about the distortions in the Dow Jones Industrial Average (DJIA). Because of the collapse of the financial sector the DJIA, a price-weighted index, has become distorted. In a price-weighted index, each stock price is divided by a divisor to determine its price makeup within the index. Normally this is not a major problem but as of the closing bell on Monday, January 26th, four stocks trade below $10 per share and nine stocks trade below $20 per share. This interesting anomaly deserves a closer look.

If all four stocks below $10 opened on Tuesday at 0, the DJIA would only see a loss of approximately 167.74 points or 2.08%. In fact, if all nine stocks trading under $20 were to open at 0, the DJIA would only see a loss of approximately 759.36 points or 9.4%. The price weighting of 30% of the DJIA stocks are make up less than 10% of the Indexes value.

If all four stocks below $10 opened on Tuesday at 0, the DJIA would only see a loss of approximately 167.74 points or 2.08%. In fact, if all nine stocks trading under $20 were to open at 0, the DJIA would only see a loss of approximately 759.36 points or 9.4%. The price weighting of 30% of the DJIA stocks are make up less than 10% of the Indexes value.

As a point of comparison, the largest five stocks account for slightly more than 35% of the Index value.

After going over the data, it appears as though we may be at a bottom for the market barring a total collapse of an Index name. Given the fact that most of the economic and earnings bad news has been written into the stock market a significant bottom may be at hand barring any unforeseen events.

While there is still approximately 7-10% downside risk to retest the November lows it is worth considering a long investment at this time. In order for us to break below the November lows, we would have to see a serious collapse by one of the larger weighted names, in this case, Exxon, IBM, Chevron, McDonalds, or Johnson and Johnson.

However, this is not to say that we are at the beginning of another bull market cycle. That is a number of years away for the major indices as the charts of financial companies are similar to those found when asset bubbles pop throughout history. When bubbles do pop, it takes decades for prices to recover to previous levels, if they do at all. This is not an index market for investors and will not be an index market for investors for some time into the future. This is a sideways market and will remain that way for years.

The argument has been made that there is no need in changing the makeup of the index because of the current conditions, but there are high quality companies that would not cause the DJIA to lose its luster. Wells Fargo, JP Morgan Chase, US Bancorp, and Goldman Sachs come to mind as financial sector candidates to replace Citigroup and Bank of America. Toyota could replace General Motors as they recently surpassed General Motors as the world's number one automaker by sales. Alcoa could be replaced with Freeport-McMoran and provide a greater diversification in the Basic Materials sector. In each case, a comparable company can be found to replace a languishing stock in the DJIA.

Toyota would be especially controversial, but with Ford trading under $2 and GM the recipient of a government bailout Toyota would be the logical choice. Not only are they the largest automotive company by sales, but they also have a significant amount of production located in the United States.

It was not long ago that Intel and Microsoft were added to the DJIA. This marks the addition of NASDAQ and technology stocks into the DJIA. Toyota would be an extension into foreign firms with ADR's but have significant manufacturing operations located within the United States .

A rotation of stocks may not be the best move for public relations purposes but it is never good for a stock to be dropped from the DJIA. A rotation of stocks would correct the price anomaly in the Index at the present time and provide for a more price-balanced index for investors.

By David Urban

http://blog.myspace.com/global112

Communications are intended solely for informational purposes. Statements made should not be construed as an endorsement, either expressed or implied. This article and the author is not responsible for typographic errors or other inaccuracies in the content. This article may not be reproduced without credit or permission from the author. We believe the information contained herein to be accurate and reliable. However, errors may occasionally occur. Therefore, all information and materials are provided "AS IS" without any warranty of any kind. Past results are not indicative of future results.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN THE STOCK, BOND, AND DERIVATIVE MARKETS. WHEN CONSIDERING ANY TYPE OF INVESTMENT, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Before making any type of investment, one should consult with an investment professional to consider whether the investment is appropriate for the individuals risk profile. This is not intended to be investment advice or a solicitation to purchase any of the securities listed here. I will not be held liable or responsible for any losses or damages, monetary or otherwise that result from the content of this article.

David Urban Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.