Reuters Gold Forecast Poll 2009: Gold Expected to Outperform Other Asset Classes

Commodities / Gold & Silver 2009 Jan 26, 2009 - 11:47 AM GMTBy: Mark_OByrne

Reuters Precious Metals Poll 2009

Reuters Precious Metals Poll 2009

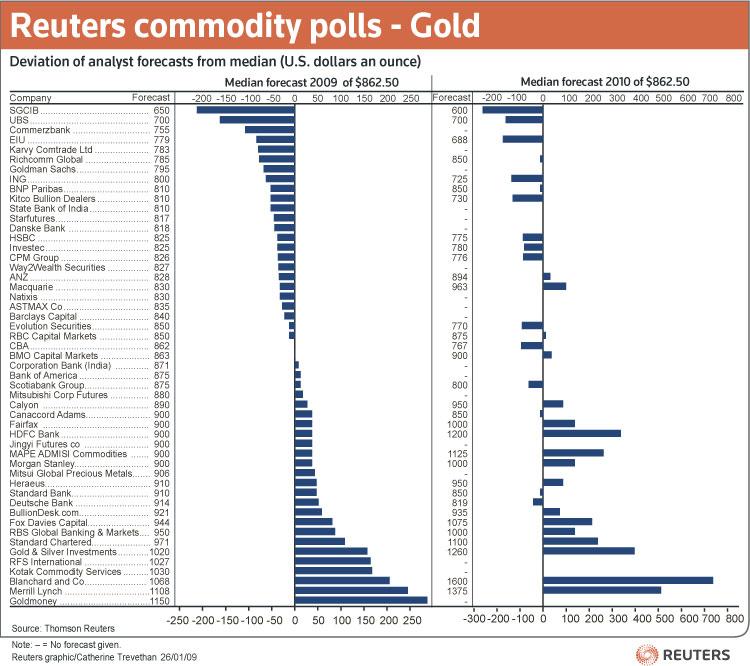

Reuters has released their Reuters Precious Metals Poll 2009 in which Gold and Silver Investments Limited has taken part. The survey of 56 precious metals analysts, traders and banks was carried out over the last three weeks. The Reuters poll finds that “gold prices are expected to hold firm this year as investors, looking for safety away from the mayhem in financial markets, pile into the precious metal used as a store of value.” The poll found however that “industrial precious metals prices will behave differently this year, reliant as they are on real economy demand.”

Bulls Versus Bears – Bearish Sentiment is Bullish from Contrarian Perspective

The Reuters poll has a larger sample (56) than the recent Bloomberg gold survey (20) and has more bearish respondents than those polled by Bloomberg. The bearish response of some half of the analysts is bullish from a contrarian perspective. As is the fact that the poll respondents believe gold prices would average $862.50 an ounce this year -- about $10 below the 2008 average price of $871.21 an ounce and more than 5% below today’s price of $905/oz.

It is worth remembering that many, if not most, of the respondents have been bearish in recent years despite gold rising every year since 2001.

Some of the most bearish participants are SGCIB, UBS, Commerzbank, the Economist Intelligence Unit (EIU), Kitco Bullion Dealers and Goldman Sachs.

Participants who are most bullish on gold, include Gold and Silver Investments Limited, Merrill Lynch and Goldmoney. With gold already up some 10% since the start of the year, their predictions are looking better than those of the bears. However, it is early days yet and a lot will happen between now and the end of 2009.

Best to Avoid Predictions in 2009

We would prefer not to get into the forecasting and predictions business as predictions and forecasts are fraught with uncertainty at the best of times and this is particularly the case in 2009 given the massive macroeconomic and geopolitical uncertainty and risk. As many have found to their cost in recent years it is nigh impossible to predict the future movement of any commodity, currency, equity indices, property market or any other asset class (particularly in the short term) as there are so many variables.

Having said that, in terms of accuracy Gold and Silver Investments have been far more accurate than most other commodity brokers, bullion dealers and banks in recent years.

Gold and Silver Investments were one of the few analysts to predict gold would rise above $1,000/oz in 2008 and we have called these markets right on a consistent basis and hopefully we can predict lines of probability. Continuing massive volatility and unpredictability in all markets is why we advise avoiding leverage as leveraged players will likely again have a very torrid time in 2009.

Gold and Silver Investments are the sixth most bullish on gold and the second most bullish on silver, after Merrill Lynch (see silver table on jpg hyperlink below) . We believe our estimates to be conservative as the average price of gold in 2008 was some $872/oz and thus an average price of some $1,020 is only some 20% above the 2008 average price. Similarly a high of $1,250 is only 21% above the 2008 high.

There is potential that prices rise far above these levels, particularly as the (Commodity Futures Trading Commission) CFTC is now investigating the massive concentrated short positions in the COMEX gold and silver markets – if these short positions get squeezed and some of the bullion banks are forced to buy back their huge short positions, prices could rise to levels that will surprise even the bulls.

Uncertain Macroeconomic Outlook

Many of the bears have been bearish for a number of years and have failed to realize that we are in a bull market. Given the deflationary headwinds assailing us early in 2009, they may be proved right this year as further massive deleveraging could affect the gold price.

However, we believe this to be unlikely given the massive macroeconomic and systemic risk and increasing monetary and geopolitical risk. And we believe that should the deflationary pressures continue throughout 2009, then most commodities and asset classes will again fall sharply in 2009 but gold will again outperform. As gold did in 2008 when it was up 6% in USD terms and by far more in most other currencies. Importantly, gold also rose during the last bout of sharp deflation in the Great Depression of the 1930s when Roosevelt revalued gold by some 70% and devalued the dollar by some 70%, from $20/oz to $35/oz.

Also there is the significant risk that deflation will gradually give way to virulent stagflation (especially in the US) if the dollar resumes its bear market and begins to fall sharply again.

All in all it promises to be a very uncertain and volatile year and it will be interesting to see how gold and silver actually perform.

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.