Peter Schiff Was Wrong

Stock-Markets / Financial Crash Jan 26, 2009 - 07:33 AM GMTBy: Mike_Shedlock

There are numerous YouTube videos, articles, and references to Peter Schiff being "right" rapidly circulating the globe. While Schiff was indeed correct about the US imploding, most of the praise heaped on Schiff is simply unwarranted, and I can prove it.

There are numerous YouTube videos, articles, and references to Peter Schiff being "right" rapidly circulating the globe. While Schiff was indeed correct about the US imploding, most of the praise heaped on Schiff is simply unwarranted, and I can prove it.

First, let's start with a look at the claim being made. Peter Schiff concludes many of his articles, books, etc. with the following statement.

Mr. Schiff is one of the few non-biased investment advisors (not committed solely to the short side of the market) to have correctly called the current bear market before it began and to have positioned his clients accordingly .

Highlight in red is mine.

I would like to see some proof of that statement. Specifically I would like to see the average returns posted by EuroPacific clients for 2008.

I have talked with many who claim they have invested with Schiff and are down anywhere from 40% to 70% in 2008. There are many other such claims on the internet. They are entirely believable for the simple reason Schiff's investment thesis was flat out wrong.

I have an actual portfolio statement from one of Schiff's clients at the end to discuss, for now let's discuss the main points of Schiff's thesis.

Schiff's Overall Thesis

- US Equity Markets Will Crash.

- US Dollar Will Go To Zero (Hyperinflation).

- Decoupling (The rest of the world would be immune to a US slowdown.

- Buy foreign equities and commodities and hold them with no exit strategy.

Schiff was correct about point number 1 above. The US equity markets crashed. That was a very good call. Unfortunately, his investment thesis centered on shorting the dollar in a hyperinflation bet, and buying foreign equities rather than shorting US equities.

Furthermore, Schiff made no allowances for being wrong and had no exit strategy whatsoever.

What happened in 2008 was that foreign equities sold off much harder than US equities, and a strengthening US dollar compounded the situation.

In other words, Schiff failed where it matters most: Peter Schiff did not protect his client's assets. Let's take a look how, and more importantly why, starting with charts of various foreign indices.

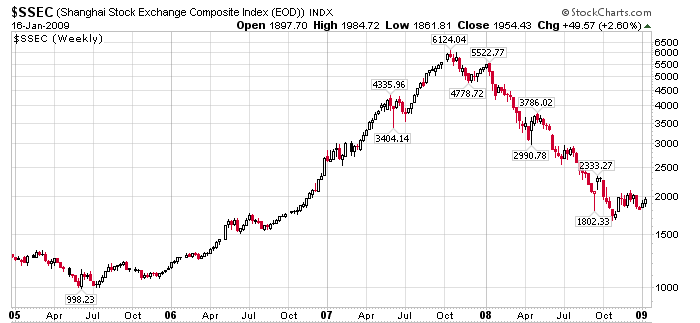

$SSEC Shanghai Stock Exchange Weekly

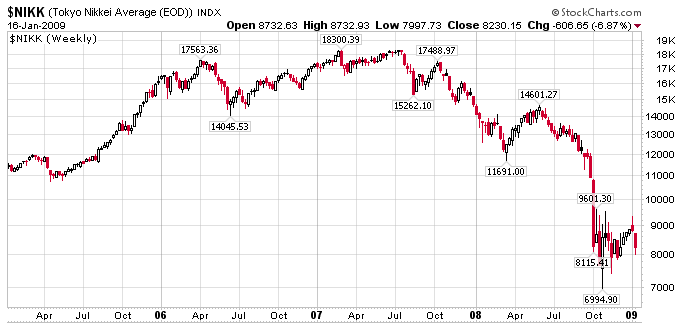

$NIKK Tokyo Nikkei Weekly Chart

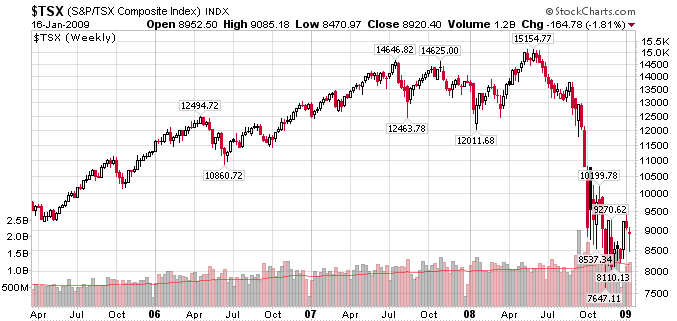

$TSX - Canada TSX Weekly Chart

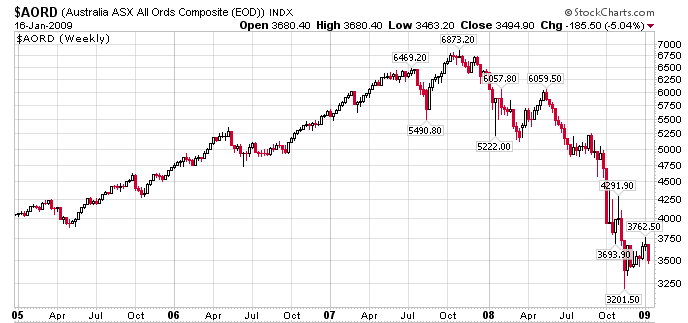

$AORD Australia ASX Weekly Chart

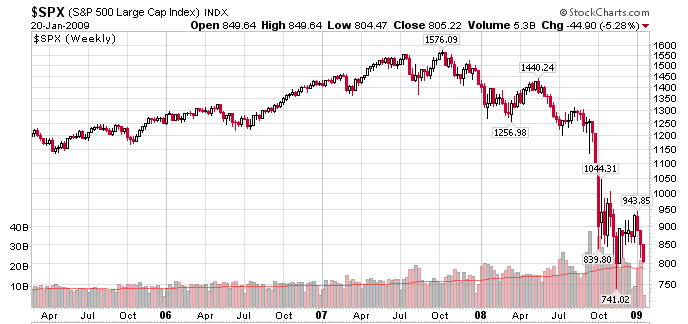

$SPX S&P 500 Weekly

2008 Equities Bloodbath

2008 was a global equities bloodbath. Clearly there was no decoupling. The Shanghai index (China), Nikkei (Japan), TSX (Canada), AORD (Australia), and virtually every world equity index collapsed along with the S&P 500, the DOW, and Nasdaq in the US.

Many, if indeed not most, foreign equity markets did worse than the US indices. The Shanghai index fell from 6124 to 1665, a whopping 72.8% decline top to bottom.

Let's investigate why this happened, starting with the decoupling thesis itself.

Global Decoupling Thesis

Please consider this excerpt from the Little Book of Bull Moves in Bear Markets, page 41:

" I'm rather fond of the word decoupling, in fact, because it fits two of my favorite analogies. The first is that America is no longer the engine of economic growth but the caboose. [The second] When China divorces us, the Chinese will keep 100% of their property and their factories, use their products themselves, and enjoy a dramatically improved lifestyle. "

I mentioned decoupling many times previously but declared it officially dead on January 22, 2008 in Global Decoupling Myth Shattered In Equity Selloff . There are some interesting charts on currencies in that post as well.

Here is a snip from Tail Wags Dog Theory Blows Up written November 1, 2008.

Tail Wags Dog Theory Blows Up

At every peak there are always ridiculous predictions. In the dotcom bust, it was all about the "gorilla game", the "new economy" and "click counts". When the Shanghai Stock Index rose from 998 to 6124 in about two years, we heard the same sort of thing about growth in China. Instead of click counts, the theory in vogue was called decoupling. China was supposed to be the 800 lb gorilla with insatiable demand for commodities and perpetual growth for the next decade.

That decoupling theory was based on the belief that the US no longer mattered, that China demand was self-sustaining, that China could grow forever with no problems, etc. Such beliefs eventually became a religion.

The tail does not wag the dog no matter how many people think otherwise.

Let's explore decoupling by looking at manufacturing, employment, and capital flows.

Global Manufacturing Contracts

Please consider US Manufacturing Orders at 60 Year Low, China Contracts 5th Straight Month .

- China's manufacturing contracted for a fifth month.

- European Manufacturing Contracts At Fastest Pace On Record.

- Russian Manufacturing PMI Shrank the Most on Record.

- U.S. Manufacturing Shrinks as Orders Hit 60-Year Low.

That's not decoupling, that's a worldwide recession.

Millions of Chinese Struggle to Find Jobs

In the wake of a global slowdown, Chinese export shrink, civil unrest is a worry, and unemployment is rising as noted in Xinhua says there will be more unemployment and social revolts in 2009 .

State council adviser Chen Quansheng, warns that unemployment is much more serious than portrayed by the official statistics. According to Chen, so far at least 670,000 small industries have been closed, leaving 6.7 million people unemployed, but this number refers only to registered workers. But there are millions of people working in the underground economy, coming from the countryside, who are being fired and are forced to return to their villages without any unemployment benefits.

The academy of social sciences is also warning about the worrisome number of firings. In 2009, the government will have to create work for at least 33 million people, including migrants, young people seeking their first jobs, and new graduates.

The odds of China finding work for 33 million workers without printing vast amounts of money are slim.

Hot Money Outflows Exacerbate Chinese Problems

Inquiring minds are reading Monetary conditions might exacerbate the Chinese adjustment by Prof. Michael Pettis.

Synopsis: Chinese monetary policy has locked the country into a dangerously pro-cyclical trap. Hot money flowed into China and pushed the economy into overheating. Those inflows have reversed sharply, perhaps by as much as $100bn last quarter, equivalent to around 8% of Q4 GDP. These outflows are causing a credit contraction and an even sharper economic slowdown at exactly the worst possible moment.

One Tail Cannot Wag Six Dogs

Those hot money inflows were all part of the global credit boom that is now unwinding. Much of China's boom centered on exports. Now that the US consumer has thrown in the towel, a key question arises:

Can China expand enough to make up for the contraction in US and European demand given that the two economies are more than six times the size of China?

The answer to that last question is an emphatic no. One tail cannot wag six dogs.

Here is another way to look at it. The US is the world's largest economy. Housing had already weakened but commercial real estate had not. US retail stores and malls were being built at an unsustainable blowoff pace and those stores were crammed with goods coming from China and Japan.

The decoupling theory was that loss of the US consumer would not matter to the commodity producers like Canada and Australia or the manufacturers like China and Japan. How could any economist have thought that? Many did. Schiff was one of them.

Peter Schiff on 2009-2010 USA Hyperinflation

Here is a partial transcript of a Schiff Audio On US Hyperinflation

The whole idea is to get out of the US Dollar. It is on the verge of collapse. The people who don't get out of the US dollar are going to be completely broke and that is obvious. Look at what Ben Bernanke did. Interest rates are zero. Money is free.

Bernanke is going to run up printing presses as fast as he can. This is pure inflation Latin American style. This is hyperinflation; this is Zimbabwe; this is the identical monetary policy of the Weimar Republic.

I am just as convinced that people who have their money in US dollars are going to be just as broke as people who have their money with Madoff.

I do not know how much time you have. With the dollar dropping 5% a week at this point, could it snap back? But what if it keeps falling? What if it's down 5% next week? And 5% the week after that? And then what if it drops 10%? and another 10%? At some point a year from now the dollar could be dropping 5% a day.

The inflation rate in Zimbabwe is over 100 million percent a year.

Hyperinflation or Hyperventilation?

Schiff asks " But what if it keeps falling? What if it's down 5% next week? And 5% the week after that? And then what if it drops 10%? .... "

That was quite some rant, enough to scare many who listened. Schiff is indeed very charismatic.

He never bothers to ask, "What if it doesn't?" The answer was not so pretty for his clients. The simple fact of the matter is Schiff was wrong where it mattered.

Schiff has been ranting about hyperinflation for years. The dollar is substantially higher now than it was at the start of 2005. His explanation for the recent rally is there is no "real demand" for dollars, it's just deleveraging.

I agree that deleveraging is indeed happening.

But why is deleveraging happening? The answer is everyone herded into anti-dollar plays based on decoupling and hyperinflation theories that did not pan out. Those trades are now being forcibly unwound. The bulk of the carnage is likely over but the losses have been immense.

Unlike Schiff, I called for this US dollar rally.

- August 8 : Trichet Puts Spotlight on the Euro, Dollar

- August 9 : Marc Faber - Bullish On The US$, Bearish On Commodities

- August 11 : Currency Intervention And Other Conspiracies

- August 18 : Steve Saville On The US Dollar And Gold

- September 4 : Telling Action In Euro, Dollar As ECB Holds Rates

- September 15 : US Dollar Rally Not Over Yet

- October 2 : U.S. Dollar Bulls Still Right, Here's Why

On November 9th, I went neutral on the dollar as the US dollar index came close to hitting my target.

In 2001-2002 the US$ index peaked at 121. Since then there was a massive flight out of US dollars into anything else. That flight continued into 2008 even though the fundamentals were changing.

The fundamentals of China and the commodity producers were simply not very good once the US consumer threw in the towel.

Schiff simply did not see this coming.

US the Next Zimbabwe?

Schiff continually compares the US to Zimbabwe. Such comparisons are silly. Please consider Zimbabwe to launch 100 trillion dollar note .

Zimbabwe's central bank will issue a 100 trillion Zimbabwe dollar banknote, worth about $33 (22 pounds) on the black market, to try to ease desperate cash shortages, state-run media said Friday.

Prices are doubling every day and food and fuel are in short supply. A cholera epidemic has killed more than 2,000 people and a deadlock between President Robert Mugabe and the opposition over power sharing has dampened hopes of ending the crisis.

Hyperinflation has forced the central bank to keep issuing new banknotes which quickly become almost worthless. There is an official exchange rate, but most Zimbabweans resort to the informal market for currency transactions.

Does that sound like anything that is happening or is going to happen in the US? I think not.

However, let's assume for a moment that hyperinflation is going to happen. Where then could one get the most bangs for their buck to take advantage? The answer to that question is in real estate, where one can buy on 5% down. Nowhere else can one easily get such leverage.

Note that there has never been hyperinflation in history where real property declined in value. Therefore, if Schiff really believes in hyperinflation, he ought to be suggesting that his clients buy houses.

However, Schiff thinks housing prices will continue to crash. So do I. And if they do, you can kiss hyperinflation theories goodbye.

EuroPacific Thoughts on the Financial Crisis

I do not expect every advisor at every company to think alike, but I did find these Thoughts on the Financial Crisis by Andre Sharon, Consulting Research Analyst for Euro Pacific Capital rather interesting.

What Now?

Only three possible outcomes:

1. We inflate to the level of the debt, i.e. we "fulfill" debt obligations, but in mini-dollars

2. We take the hit, cleanse the system of excesses and move on. Result: deflation, bankruptcies, high unemployment, etc...

3. We disinflate veeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeery slowly, like Japan. Won't happen: the American psyche won't take 16-odd years of no growth. Different cultural mindset: you can't prick a balloon slowly here.

My guess: combination of 1 and 2. I would hope for a bias towards 2. Terrible for many, but healthier for the system long-term. Schumpeter's concept of creative destruction trumps Keynes, in my book. That's life, and progress, with all its faults and flaws.

My pick is a combination of 2 and 3 (2 is not by choice but rather by force) for reasons explained in Brink of Debt Disaster .

But what I find interesting is that a Europacific advisor believes that Keyensian economics can be trumped (I do as well, Japan proved it), but also that Andre Sharon at least in part is calling for " Result: deflation, bankruptcies, high unemployment, etc... "

I would advise Schiff to toss his hyperinflation theories out the window and listen more to his research analyst. However, Schiff cannot and will not change because he has two books calling for hyperinflation .

On the other hand, I can change. I called for deflation and it is here right now. I do not have to wait for it. The only debate is how long it lasts.

At the appropriate time, I expect to transition my stance towards a stagnant slow growth period in which there will be inflation but not by a lot. In such a scenario, the US would hop in and out of recessions for up to a decade, much like Japan.

Time will tell whose model is correct. I reserve the right to change my model. It's too late for Schiff to change his. The damage has already been done.

Closer Look At Currency Fundamentals

The US economy is clearly in shambles. However, when the US dollar index crashed to 70 the dollar was priced as if the US alone was in trouble. That was hardly the case. Europe, China, Australia, Canada, the UK, are in shambles as well.

On August 8 2008, Trichet Put the Spotlight on the Euro, Dollar by saying economic growth in Europe would be "particularly weak". That was a clear signal all was not well in the Eurozone. Most, including Schiff ignored the signal.

Although the US had a massive housing bubble, so did Spain, Ireland, and other parts of Europe. Also note that European banks invested in US mortgage debt.

Finally, European banks invested heavily in Latin America and the Baltic states. The US did not make those mistakes.

The credit crunch now threatens the sacrosanct

On January 19 2008, New Europe reported The credit crunch now threatens the sacrosanct .

Last October, the ECB signed a currency swap agreement with the Swiss National Bank. The obvious purpose was to support the solvency of the Swiss Franc. The reason why the franc needed support was that the country's banks had undertaken huge obligations in foreign currencies, which exceed the Swiss national income, probably by many times. Who knows how many? Last week this agreement was renewed and extended in volume.

The case is similar with Iceland. That tiny country was one of the richest and most reliable in the world, a kind of small Switzerland. But Iceland's banks were found at the beginning of credit crisis to have huge obligations in foreign currency. When the banks started to go insolvent the government of Iceland stepped in and nationalised them.

In the case of Switzerland - along with the ECB - came the American central bank, the Fed, to support the solvency of the franc with foreign swap agreements. Who on earth wants the Swiss banks to fail? In short, nothing has been settled in the credit crunch crisis and the entire world continues to support those who created the problems in the first place.

Think the Swiss Franc is a safe haven? I don't.

So what about the Euro? Here are a few headlines to ponder.

Germany Faces Worst Post-War Economic Decline

Synopsis:

Germany is facing its biggest economic downturn since the Second World War with Chancellor Angela Merkel's government saying Wednesday it expects Europe's largest economy to contract by 2.25 per cent this year.Germany's Economics Minister Michael Glos and Finance Minister Peer Steinbrueck released the latest data on Wednesday, revising their prior 2009 forecast down sharply from last October's prediction of 0.2 percent growth.Since then, German exports have declined precipitously and are expected to be down 8.9 percent for the year.

Berlin Sees No Limits to Economic Intervention

Synopsis:

As part of her efforts to combat the economic crisis, German Chancellor Angela Merkel is increasing the state's influence in the market, buying holdings in banks and bailing out individual industries and companies.Is Germany turning into a planned economy? Only a few weeks ago, Chancellor Angela Merkel spoke out against "arbitrary, unfocussed economic stimulus programs" and large-scale government intervention in the real economy.

Trichet Vision Unravels as Italy, Spain Debt Shunned

On January 16, 2009 Bloomberg reported Trichet Vision Unravels as Italy, Spain Debt Shunned

European Central Bank President Jean-Claude Trichet's vision of economies converging behind the shield of a shared currency may be unraveling.

The gap between the interest rates Spain, Italy, Greece and Portugal must pay investors to borrow for 10 years and the rate charged to Germany has ballooned to the widest since before they joined the euro. The difference may grow further as Europe's worst recession since World War II hurts budgets and credit ratings across the region.

Diverging bond yields hurt Trichet's argument that the ECB's inflation-fighting mandate ushered in an era of stability for nations that once suffered rampant price growth.

They also make it tougher for the ECB, which cut its key rate to a record yesterday, to set one benchmark for all 16 euro nations. That may delay recovery as governments try to fund stimulus plans.

Monetary union has left half of Europe trapped in depression

Ambrose Evans-Pritchard at The Telegraph is writing Monetary union has left half of Europe trapped in depression .

Events are moving fast in Europe. The worst riots since the fall of Communism have swept the Baltics and the south Balkans. An incipient crisis is taking shape in the Club Med bond markets. S&P has cut Greek debt to near junk. Spanish, Portuguese, and Irish bonds are on negative watch.

Dublin has nationalised Anglo Irish Bank with its half-built folly on North Wall Quay and €73bn (£65bn) of liabilities, moving a step nearer the line where markets probe the solvency of the Irish state.

A great ring of EU states stretching from Eastern Europe down across Mare Nostrum to the Celtic fringe are either in a 1930s depression already or soon will be. Greece's social fabric is unravelling before the pain begins, which bodes ill.

Each is a victim of ill-judged economic policies foisted upon them by elites in thrall to Europe's monetary project – either in EMU or preparing to join – and each is trapped.

In Lithuania, riot police fired rubber-bullets on a trade union march. Dogs chased stragglers into the Vilnia river. A demonstration outside Bulgaria's parliament in Sofia turned violent on Wednesday.

Latvia's property group Balsts says Riga flat prices have fallen 56pc since mid-2007. The economy contracted 18pc annualised over the last six months. Leaked documents reveal – despite a blizzard of lies by EU and Latvian officials – that the International Monetary Fund called for devaluation as part of a €7.5bn joint rescue for Latvia. This was blocked by Brussels – purportedly because mortgage debt in euros and Swiss francs precluded that option.

Spain lost a million jobs in 2008. Madrid is bracing for 16pc unemployment by year's end.

Private economists fear 25pc before it is over. Spain's wage inflation has priced the workforce out of Europe's markets. EMU logic is wage deflation for year after year. With Spain's high debt levels, this is impossible.

Italy's treasury awaits each bond auction with dread, wondering if can offload €200bn of debt this year. Spreads reached a fresh post-EMU high of 149 last week. The debt compound noose is tightening around Rome's throat. Italian journalists have begun to talk of Europe's "Tequila Crisis" – a new twist.

On page 157 of Little Book of Bull Moves in Bear Markets, Peter Schiff writes " The Euro could possibly replace the United States dollar as the world's reserve currency . "

I suggest a breakup of the Eurozone has a greater chance than that. While I agree that US dollar hegemony will end eventually, ideas that the Euro will replace the US dollar as the world's reserve currency are farfetched.

Looking far ahead, there may not be any one reserve currency per se. Ideally we will return to a gold standard but at the moment that does not seem particularly likely either.

So what about Australia? Can it decouple?

Australia is one of Peter Schiff's favorite countries for investing. Please consider Aussies hit by 50yr record wealth decline .

CommSec equities economist Savanth Sebastian says that is the worst fall in records dating back to 1960.

"It's no doubt that it will have a big impact on consumer spending going forward adding further downward pressure after we saw those job losses in terms of full-time employment," he said.

"So it suggests that for the Reserve Bank and for the government further stimulus will need to be on the agenda."

That additional "stimulus" is the same thing Schiff rails about in the US every time he speaks. The whole world is stimulating now.

Australia Won't Hesitate To Stimulate

Australia Treasurer Wayne Swan says Australia's government won't hesitate to stimulate the economy further should the need arise amid the global recession.

“We will not hesitate to take whatever further action is necessary to support growth and jobs,” Swan, 54, said in speech notes received via e-mail. “Major financial institutions, some of which have withstood world wars and the Great Depression, have either collapsed or been bailed out.”

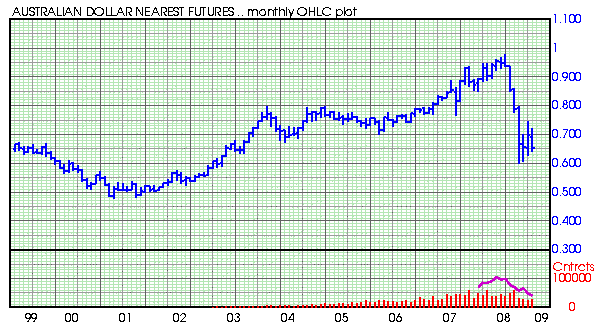

Australian Dollar Monthly Chart

The Australian dollar is one of Schiff's favorites. " While other countries are creating inflation, Australia's central bank is raising interest rates to keep inflation in check. " page 161

Australia May Cut Interest Rate Below 2%

Former Reserve Bank Governor Fraser suggests Australia May Cut Interest Rate Below 2% .

Fraser, Reserve Bank of Australia chief during the nation's last recession in 1991, said policy makers may reduce the overnight cash rate target to less than 2 percent from 4.25 percent now. The bank's board gathers for the first time this year on Feb. 3.

“This recession will be deeper and longer than the last recession in 1991,” Fraser said in a phone interview today from his home near Canberra. “The Reserve Bank could go below 2 percent; they will go as low as they need to and a further stimulus from the government will be required.”

Australia started reducing rates at the fastest rate ever in 2008, culminating with a surprise cut of 100 basis points in December. More rate cuts are coming.

One of the biggest drivers for currencies is relative differentials in interest rates, as well as expectations of future increases in interest rates differentials. The Fed is not cutting any more so future rates cuts in Australia may increase the unwinding of various carry trades (borrowing in dollars or Yen, and investing in Australian dollars or Euros).

Peter Schiff did not see or simply ignored the ramifications of the unwinding of various carry trades. All gains in the Australian dollar have been wiped out since 2003.

US$ Trading Range Theory

China, the UK, the Eurozone, Canada, Australia, and Japan are all slashing interest rates. And every country above is printing like mad. Finally, European banks are in dire straits because of bad loans to the Baltic states and Latin America on top of bad investments in US mortgage backed securities.

Schiff simply ignores those problems, or worse yet is not even aware of them.

Given the severe stress everywhere, and given the race to zero interest rates by all, the odds favor a wide trading range rather than a collapse of the dollar. Hyperinflation is simply not in the cards, at least for the US. Ironically, China or Russia is at far greater risk.

What About Commodities?

The following is from a chapter in his book called "Hot Stuff" on page 105.

Schiff writes: " What I want you to take away from this chapter is the knowledge that there is extraordinary excitement in commodities, which are in the early stages of a historic secular bull market. " ...

$CRB Commodities Monthly Index

"There is extraordinary excitement in commodities ."

Indeed there was . However, the time to invest in anything is not when there is extraordinary excitement but rather when there is no excitement at all.

When there is no excitement, the likelihood of investing safely for a long period increases. The above chart shows what happens when you invest for the long haul during periods of high excitement.

The Little Book of Bull Moves in Bear Markets nailed the exact cyclical peak in the commodities boom. Ironically, the subtitle to his book is " How to Keep Your Portfolio Up When the Market Is Down ".

Peter Schiff was wrong about deflation.

There is no debate (at least there should not be a debate) that the US is in deflation. The conditions in the US are exactly what one would expect to see in deflation. The score is a perfect 15 out of 15. Please see Humpty Dumpty On Inflation for details.

I believe I know Schiff's rebuttal. He will talk about soaring money supply. Yes, money supply is indeed soaring, but destruction of bank balance sheets is happening faster. He will counter that it is money that matters, not credit.

History proves otherwise, but I willing to debate on the basis of money supply alone.

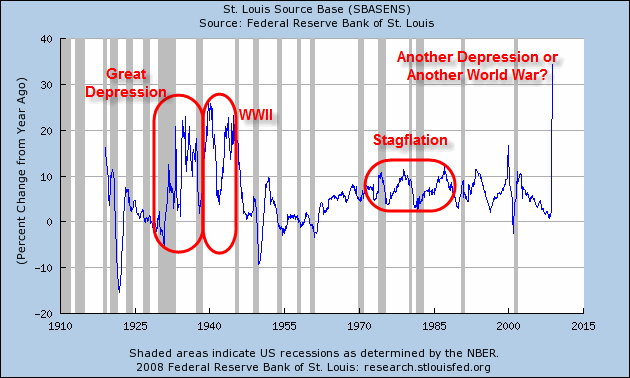

Base Money Percentage Change From A Year Ago

Using monetary expansion alone, one would conclude there was massive inflation during the great depression, starting in 1931!

Any definition that suggests that there was inflation in 1931 is silly. Some might counter, as one person recently did "It's not silly. When gold was confiscated by FDR and then revalued 70% higher in dollar terms, was this not inflation?"

My reply is "During the Great Depression, the purchasing power of the dollar went up vs. everything but gold. If the purchasing power of gold vs. the dollar is the sole judge of the inflation-deflation debate, then deflation ruled from 1980 to 2000, a ridiculous proposition."

It is important to pick definitions of inflation carefully. A definition based on money supply and credit successfully predicted interest rate trends, stock prices, the price of gold, housing, and numerous other things.

A definition of inflation based on the CPI failed miserably in predicting interest rates.

A definition based solely on an increase in money supply failed miserably in predicting interest rates, the recent strengthening of the US dollar, gold's decline from 850 to to 250 between 1980 and 2000, and numerous other things.

Soaring money supply simply is not proof "Big Inflation Is Coming" just as it was not proof that "Big Inflation" was coming in 1931. There cannot possibly be any other logical conclusion when confronted with the data.

Is Peter Schiff Early?

Some will claim that Schiff is simply "early". However, from the perspective of the Little Book of Bull Moves In Bear Markets, Schiff was 5 years too late.

To be fair, he was talking about commodities and foreign equities long before that, but as is often the case, such books come out at a time of "Peak Excitement". Schiff's book was the ultimate contrarian indicator.

Let's Return to Schiff's Investment Thesis.

Schiff's Investment Thesis

- US Dollar Will Go To Zero (Hyperinflation).

- Decoupling (The rest of the world would be immune to a US slowdown.

- Buy foreign equities and commodities and hold them with no exit strategy.

- Wrong about hyperinflation

- Wrong about the dollar

- Wrong about commodities except for gold

- Wrong about foreign currencies except for the Yen

- Wrong about foreign equities

- Wrong in timing

- Wrong in risk management

- Wrong in buy and hold thesis

- Wrong on decoupling

- Wrong on China

- Wrong on US treasuries

- Wrong on interest rates, both foreign and domestic

That's a lot of things to be wrong about, especially given all the "Peter Schiff Was Right" videos floating around everywhere. The one thing he was right about was the collapse of US equities and no part of his investment strategy sought to make a gain from that prediction.

Peter Schiff concludes many of his articles, books, etc. with the claim he saw this coming and " positioned his clients accordingly ".

Fortune Magazine bought into it the hype

Peter Schiff: Oh, he saw it coming

'Dr. Doom' became a star by predicting last year's market meltdown. And now his 2009 forecast is even scarier.

Schiff did not invest for doom; he invested for a bull market that did not exist. He was wrong where it mattered most, protecting client assets. For this amazing feat, people think of him as a star.

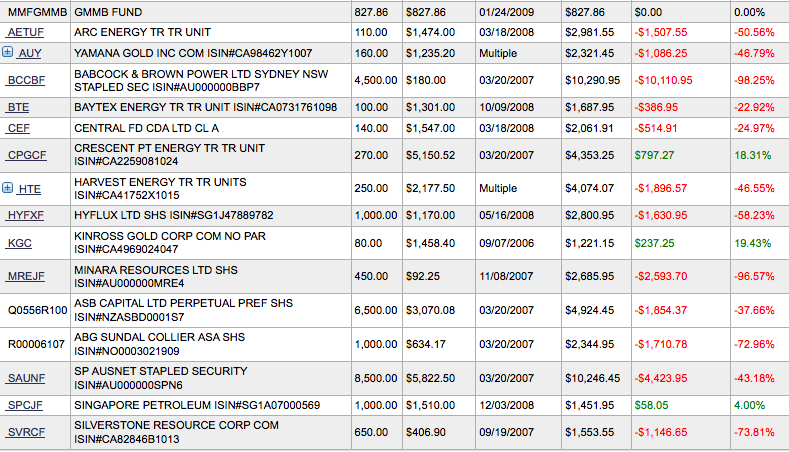

An Actual Schiff Portfolio

The above statement is from a person who claims to have additional portfolios invested with Schiff over the past 2 years. In total (not just this portfolio), my contact says he invested $70,000 and is now down to $27,000. That is a loss of 61%.

I have talked with another person who claims to be down 72%, and many others who claim 40% or more.

Schiff's entire invest thesis seems to boil down to "Buy and hold foreign stocks, foreign currencies, and commodities, come hell or high water, and hold on to them." Hell has arrived for those following Peter Schiff's philosophy.

Perhaps I have stumbled on the worst of Schiff's portfolios. There is one way to find out.

I challenge Schiff to post the average returns for his clients on a year-by-year basis, just as Sitka Pacific does. That is the only way to see just how right (or wrong) his investment thesis is.

Sitka Pacific vs. Europacific Philosophies

Rather than take a rigid position as to what the market "should do", Sitka Pacific Capital Management tries to position itself for what the market is doing. At times we may like a particular stock group, commodity, or currency, and at other times not.

We do not think this is a good time for buy and hold strategies for either foreign or domestic stocks or currencies. Moreover, we certainly do not think it was prudent to put 100% on foreign stocks and currencies, with virtually no exit strategy if wrong.

We do feel a long-term position in gold on a percentage of assets is a reasonable proposition.

Schiff's slogan is " Because There's A Bull Market Somewhere. TM " but for a year he failed to find one with the exception of physical gold. Ironically, one of his most hated asset classes (US treasuries), had one of their best years in history.

Sitka Pacific Strategies

The two key strategies at Sitka Pacific are called Hedged Growth (a long-short, primarily domestic strategy), and Absolute Return (a global strategy that can invest in domestic stocks, foreign stocks, gold, and currencies, hedged at times with inverse index ETFs).

Absolute Return may at times bear some resemble to Schiff's strategy but we are not dogmatic about it. If we do not like market action in stocks and commodities, we are on the sidelines and heavy in cash or treasuries.

Absolute Return had a 34% position in long dated treasury ETFs in 2008, now well less than half that after cashing out.

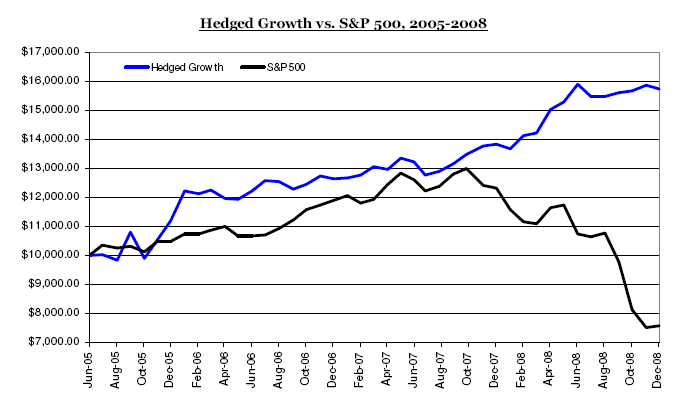

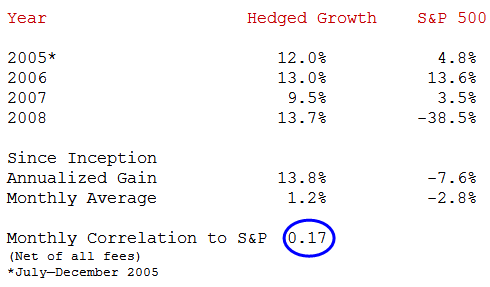

Chart of Hedged Growth Since Inception

Note the .17 correlation to the S&P 500 in Hedged Growth.

Correlations run from -1 (perfect inverse, think inverse ETF) to +1 (think buying every stock in the S&P). Zero is no correlation. A correlation of .17 is very low. What it means is the strategy is not dependent on market direction. Many hedge funds make that claim, but the average hedge fund got lost well over 20% in 2008.

Hedged Growth achieves its performance by picking a basket of stocks long and a basket of stocks short. Market direction, inflation-deflation debates, interest rates, etc., simply are not a concern for this strategy. The idea is to pick a winning basket of good stocks vs. poor stocks on a relative basis.

The most we ever put on a short position is 1.7%, and we only take a position in liquid issues. We never add to short positions. This is for risk management purposes.

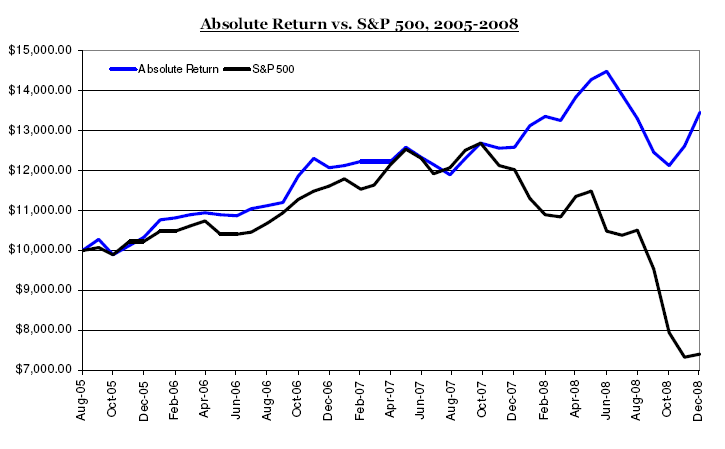

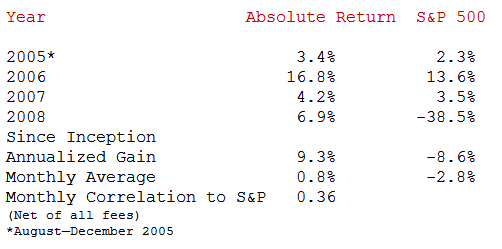

Absolute Return Since Inception

The chart shows a monthly correlation to the S&P at .36. That is a low number, which is a good thing.

The chart also shows we had a significant drawdown between June and October. That drawdown was based primarily on an expectation that gold and gold miners would diverge from the market on a seasonal trend. That seasonal pattern did not happen. We are not going to get everything correct, but no one else will either. We made much of that drawdown back in late November and December while hedged growth was flat.

One additional thing I would like point out is that none of our strategies was net short in 2008 . Our most cautious stance is market neutral. Thus, we were neutral to long the whole year, and our two key strategies finished solidly in the green even though the S&P finished down 38.5%.

90+% of Sitka Pacific accounts are either Hedged Growth or Absolute Return.

To lay everything out in the open, we also offer Commodities Focus (a portfolio of commodity related stocks and ETFs). Commodities Focus does not hedge and will tend to track a blend of energy stocks and mining stocks. It was down 34.5% on the year. Only 2% of our clients are in this strategy, approximately ½% by total asset value.

Commodities Focus is best suited for those who want anti-dollar plays for a hedge or for those with a very long time horizon as opposed to boomers headed into retirement with their nest egg.

We also offer Dividend Growth for IRA clients who cannot short. Dividend Growth is similar to Hedged Growth, except it may or may not hedge. When it does hedge, it uses inverse ETFs as opposed to shorts. Dividend Growth was down 4.6% for the year, a good achievement compared to the S&P 500 which was down 38.5%.

Gains Needed To Get Even

10% - 11%

50% - 100%

70% - 233%

If you are down 10% you need to gain 11% to get back to where you were, at 50% down you need a 100% gain to get back to even, and at 70% down you need a 233% gain to get even. This is why risk management and capital preservation is paramount.

Boomers significantly down hoping to get back to even may find it will take a decade or more. Those close to, or already in retirement, simply do not have a decade to make up for losses. That is the problem with buy and hold strategies.

Buy and hold was wrong nearly everywhere, but especially for those in or approaching retirement.

Client Letters

We post our client letters online, on a 2 month delayed basis. The letters come out sooner if you subscribe. Subscription is free. Interested parties may Register For Sitka Pacific Monthly Newsletters . Subscribe at the bottom of the linked-to page.

In the wake of various scandals, a certain question invariably comes up.

How Sitka Pacific differs from Madoff, hedge funds, and mutual funds.

- We are not a hedge fund.

- We offer managed accounts.

- The accounts are in investors names.

- Statements are from a brokerage house not us.

- We cannot manipulate earnings because we do not produce the statements.

- We have no access to investor funds.

- If someone sends us a check made out to us, we send it back. As a strict rule, we never handle client money.

- We have no exit penalties and no exit restrictions.

- Someone can close their account for any reason at any time and can even do it without telling us. If you do not like how we are trading your account, you can close it.

- We do not use leverage.

- We often have high cash positions.

- Clients can see every trade we make. This is unlike hedge funds where you typically cannot see anything, or mutual funds where all you see is a snapshot at the end of the month.

- We have trading rights to accounts; all other aspects of the account belong to the client.

- Your account is not commingled with any other account.

We are the very opposite of hedge funds or mutual funds.

High Risk, High Reward Strategies

Placing everything one has on anti-dollar bets is a type of high risk, high reward strategy. There is little room for error, especially if there are no risk management controls, which Schiff does not seem to have. " The whole idea is to get out of the US Dollar. It is on the verge of collapse. The people who don't get out of the US dollar are going to be completely broke and that is obvious. ...people who have their money in US dollars are going to be just as broke as people who have their money with Madoff. "

Such arguments can easily be construed as "fear tactics". Listen to the previously mentioned Schiff Audio On US Hyperinflation and make your own determination. While it is certainly prudent to have some diversification, it is not prudent, in my opinion, to bet the farm on a complete hyperinflationary collapse of the US dollar that did not occur and in my estimation won't, at least for a long time.

Undiversified, unhedged portfolios may succeed spectacularly. They also risk catastrophic loss. Many who rolled the dice on Schiff's philosophy came up snake eyes: a catastrophic loss that depending on the exact portfolio, may take a decade or longer to recover.

Where To In 2009?

The question as to where the market is headed comes up all the time. The truth is, no one really knows. However, we see no real value here. Fundamentally stocks are not cheap. Earnings are sinking, unemployment is rising, and this was the biggest debt bubble in history. Logic dictates the biggest bubble should be followed by the biggest crash.

To pick a range for a bottom something like 450-600 on the S&P 500 would seem about right. If so, that is quite a drop from here, and one would certainly want to be hedged if that happens.

However, if the market starts to behave like there is some value now, we will change our tune.

We strongly doubt the dollar will crash, but we will take notice if it breaks out of its trading range. We do like gold here but that can change. Commodities may have bottomed. We doubt stocks have. Foreign stocks may outperform but remember they were clobbered more in 2008.

We are not permabears or permabulls, nor do we daytrade. We review and reposition our strategies monthly, but if something noticeable happens mid-month, we try to react to it.

Unlike Schiff, we attempt to position our clients for what the market is actually doing, not what we think it ought to be doing. The distinction is paramount, especially when such thinking just might be wrong.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.