Real Deflation Spells Economic Doom

Economics / Deflation Jan 25, 2009 - 02:37 PM GMT

Asha Bangalore (Northern Trust): Home building activity posts new low

Asha Bangalore (Northern Trust): Home building activity posts new low

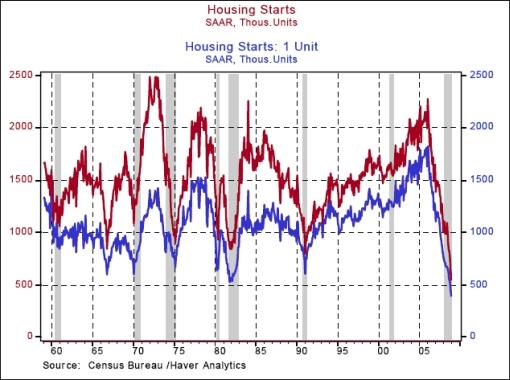

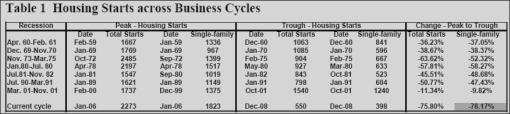

“Starts of new homes fell 15.5% in December to an annual rate of 550,000. The annual average of new homes started in 2008 is 902,000, the lowest on record. Starts of new single-family homes dropped 13.5% to an annual rate of 398,000, the lowest on record.

“The peak-to-trough decline in housing starts, both total and single-family, is the largest on record since record keeping began for these series in 1959 (see table 1). The duration of the weakness in home construction (peak was in January 2006) is also the longest on record.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , January 22, 2009.

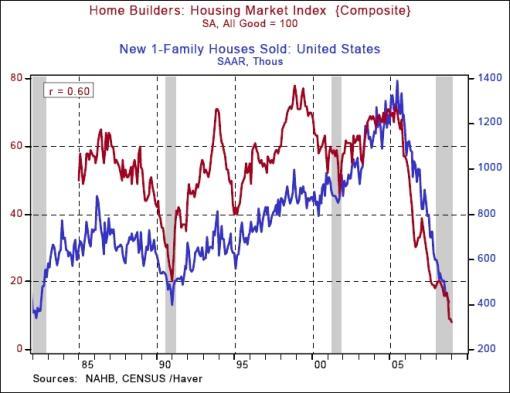

Asha Bangalore (Northern Trust): Housing Market Index spells more gloom

“The Housing Market Index (HMI) of the National Association of Home Builders fell to 8.0 in January 2009 from 9.0 in December 2008. Before the onset of the current recession, the record low for the HMI was 20.0 during the 1990-91 recession. The question now is: What is the low for the HMI? The answer is unknown, but we can say that the severity of the housing market situation grows in leaps and bounds everyday.

“The HMI is strongly correlated with sales of new single-family homes. Based on this historical relationship, it appears that a pickup in new sales in the near term is unlikely.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , January 21, 2009.

Shadowstats: Decline in retail sales worst since World War II

“Annual real retail sales fell by 9.09% in December, versus a 9.11% contraction in November, the steepest annual declines since 1952. On a three-month moving-average basis the December and November declines were 8.88% and 7.87%, respectively. The December annual moving-average decline was the deepest in the history of the two most recent retail series, making the results the worst of the post-World War II era. The annualized real contraction for fourth-quarter 2008 retail sales was 17.1%.”

Source: Shadowstats , January 2009.

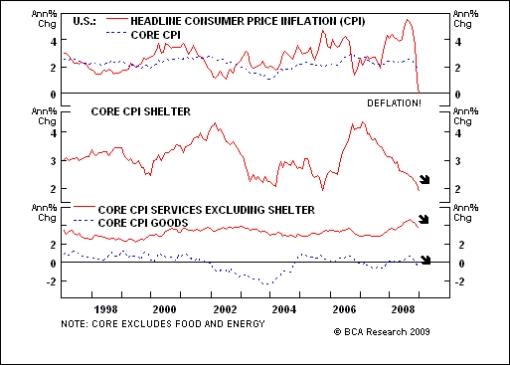

BCA Research: US deflation - this time it's for real

“Annual US headline CPI dipped to zero in December. Core CPI is still positive (1.7% annual growth), albeit is falling steadily.

“The decline in headline inflation is due largely to sharply falling energy (and food) prices. Underlying inflation moves with the business cycle, though it lags economic growth by several quarters. The economy decelerated steadily last year before imploding in the autumn. Thus, core CPI is on track to fall further as economic slack builds. Already, retail prices are falling.

“The current deflationary threat is much more serious than the previous episode in 2002, given the speed and magnitude of the credit and economic crunch. Thus, policymakers will need to work hard to anchor inflation expectations in positive territory, and ensure that a deflationary mindset among consumers and businesses does not set in.”

Source: BCA Research , January 19, 2009.

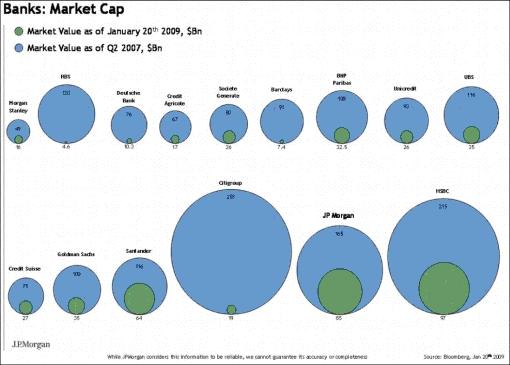

Paul Kedrosky (Infectious Greed): Banks are just a circle of their former selves

“Nice graphic of how the major banks are just a fraction of their former selves, at least as measured by market value.”

Source: Paul Kedrosky, Infectious Greed , January 21, 2009

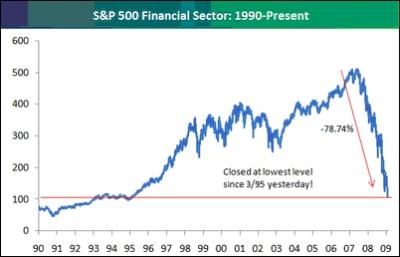

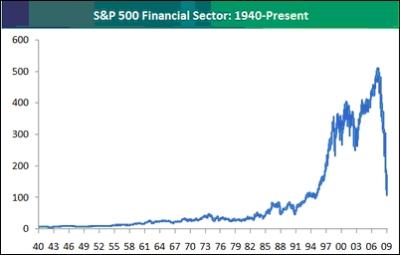

Bespoke: Long-term charts of the financial sector

“A look at long-term charts of the S&P 500 Financial sector is downright depressing. The first chart below dates back to 1990, and as shown, the sector closed at its lowest level since March 1995 yesterday. The sector is now down 79% from its highs in 2007. A chart of the sector all the way back to 1940 shows just how much the sector has fallen in such a short period of time.”

Source: Bespoke , January 21, 2009.

Eoin Treacy (Fullermoney): Will bank indices be leading indicators?

“The downward breaks experienced by a number of Western banking indices over the last week are significant and suggest we can expect further moves by the respective governments to shore up their financial sectors. This relative weakness poses a headwind for their wider markets.

“When bank indices began to underperform in 2007, they had an incredibly large weighting in most country indices. The performance of bank shares was important both in terms of their high relative weightings and because of their status as lead indicators. However, bank sectors are now a considerably smaller weighting in most indices. This lessens the intrinsic importance of the banks sector to the performance of the wider market, but the psychological impact is undiminished.

“The performance of bank sectors is a major drag on sentiment. Dividends are being eliminated and a process of nationalisation is underway in a number of Western countries. However, one should not forget that many other companies will not need government support, will not eliminate their dividend and as such are likely to be relative performers in this environment.

“In addition, an interesting dichotomy exists between markets where banks are underperforming and where they are outperforming. Bank indices in the USA (S&P500 Banks, Philadelphia Banks, Regional Banks), Europe (DJ Euro Stoxx Banks), the UK, France, Germany, Norway, Finland, Sweden, Italy and Ireland all made new lows in the last week. Internationally, the Chinese bank index is closest to the upper side of its range. No other bank index, I know of, is showing such relative strength. All Asian bank indices remain within their ranges. The marked underperformance of the USA and much of Europe is a clear indication that this is where the bulk of financial risk is focused.”

Source: Eoin Treacy, Fullermoney , January 20, 2009.

Brian Belski (Banc of America Securities-Merrill Lynch): Liquidity is key

“US equity investors should concentrate on companies, industries and sectors that have the means to fund themselves, says Brian Belski, strategist at Banc of America Securities-Merrill Lynch.

“He notes that areas in the market exhibiting strength recently have been dominated by low-quality companies with higher debt levels. But he says fundamental conditions do not support a move to low quality. ‘If 2008 taught us anything, attempts to get ahead of an eventual stock market and economic recovery were premature and misguided.'

“He acknowledges that credit market conditions have improved but is not convinced the worst is over. ‘Remember, even though credit spreads have narrowed, they still remain considerably above the peaks exhibited during prior credit cycles which we believe is a consequence of the loss of confidence both from investors and lenders.

“‘This is particularly troubling to us because we expect US corporate bond issuance to decline in 2009, yet a significant amount of bonds are expected to mature for S&P 500 companies. As a result, areas within the market that rely on leverage to fund operations are likely to struggle in the coming year and the trajectory of corporate bankruptcy filings over the past several years certainly appears to support this notion. Therefore, investors should continue to focus on areas demonstrating strong liquidity in the form of high cash balances and free cash flow.'”

Source: Brian Belski, Banc of America Securities-Merrill Lynch (via Financial Times ), January 20, 2009.

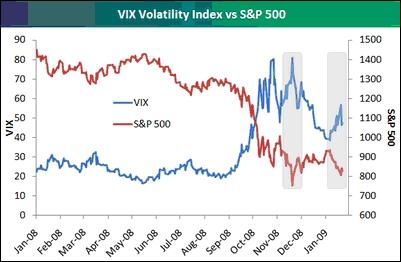

Bespoke: Volatility Index shows more complacency

“Below we highlight a chart of the VIX volatility index along with the S&P 500. One difference between the current decline and the declines in October and November is that the VIX has not spiked nearly as much. Many think of the VIX as an indication of fear in the market, and whether it's good or bad, there seems to be more complacency during the most recent downturn.”

Source: Bespoke , January 23, 2008.

Bloomberg: Roubini, Edwards predict slump in S&P 500 on China

“Stocks will retreat around the world because of shrinking demand from China as growth in the third- biggest economy slows, said Nouriel Roubini, the New York University professor who predicted last year's financial crisis.

“Global equities will fall 20% this year from current levels as China, which contributed 19.5% to total growth in 2007, contends with its slowest expansion in seven years, he said. Wall Street strategists predict the Standard & Poor's 500 Index, down 8.4% so far, will rise 17% in 2009.

“Roubini, an economics professor at NYU's Stern School of Business, said China already is in a ‘recession' despite government data showing a 6.8% fourth-quarter growth rate, as power output declines and manufacturing shrinks.

“‘Demand is falling in China, they're over-invested in capacity and there's a global supply glut,' Roubini said in a telephone interview. ‘It has very, very important implications.'

“Roubini's view is shared by Societe Generale global strategist Albert Edwards, who was correct in forecasting in March that a US contraction would spur a bear market in equities. Edwards says the China slowdown will reduce earnings at industrial, energy and raw-materials companies, sparking a selloff in emerging and developed-market stocks that may send the S&P 500 down 40% to 500.

“‘People should be thinking really hard about this rather than sticking their heads in the sand,' said Edwards, a London-based strategist and member of the top-ranked global investment strategy team in Thomson Extel's surveys the past three years. ‘We're just pointing out when the emperor doesn't have any clothes on.'”

Source: Michael Patterson and Adam Haigh, Bloomberg , January 23 2009.

Bloomberg: Mobius to invest more in China, emerging markets

“Mark Mobius, who oversees about $26 billion in emerging-market stocks at Templeton Asset Management, said he plans to buy more shares of consumer and commodities companies in emerging markets.

“‘Valuations are attractive,' Mobius, Templeton's executive chairman, said at a briefing in Kuala Lumpur today. ‘We feel that this year would be a year of recovery of the stock markets in the emerging markets.'

“Mobius said rising income in China, India and other parts of Asia will spur spending on consumer goods, while commodity prices are now ‘too low'. The two nations, Brazil, South Africa and Turkey offer best investment opportunities, he said.

“‘There is an incredible build-up of foreign reserves in the emerging markets, and the increase in money supply is quite dramatic,' the executive chairman said. ‘We've seen a very big increase of money coming into markets.'

“The emerging-markets gauge trades at 8.2 times its companies' reported earnings, 36% cheaper than its average valuation last year, according to data compiled by Bloomberg. The developed measure trades for 10.8 times profit.

“The US economy and other economies will rebound in 2010, said Mobius, whose biggest holdings are in Asia.”

Source: Soraya Permatasari, Bloomberg , January 17, 2009.

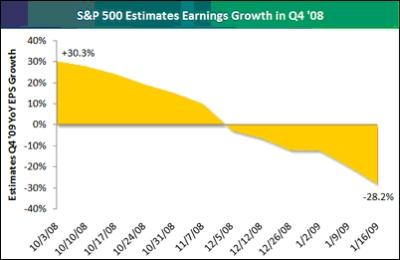

Bespoke: S&P 500 Q4 ‘08 earnings now expected to fall 28.2%

“At the start of the fourth quarter, analysts were expecting S&P 500 earnings to grow by 30% versus Q4 ‘07. While this seems outlandish now, remember that growth in Q4 ‘07 was extremely poor as well, and analysts thought many companies would begin to turn the corner by Q4 ‘08. As we all know, the economy pretty much came to a halt last October. As a result, analysts quickly began to cut growth estimates for the fourth quarter after it became apparent that things weren't going to get better anytime soon.

“Fast forward a few months, and now analysts are expecting those same Q4 ‘08 earnings to be 28% weaker than the fourth quarter of 2007. With the direction that these estimates have been heading, when all is said and done, it's likely that this number will get even worse.”

Source: Bespoke , January 21 2009.

Bespoke: Pick your poison - stocks or bonds

“While we all know that investing in stocks has been painful, some readers may be surprised to learn that Treasuries haven't provided a much better alternative. While the S&P 500 is down 8% so far this year, long-term Treasuries (as measured by the US Long Bond future) are down almost 6%. With the recent break below their 50-day moving average, bonds are hardly looking like a ‘safe' alternative in the current environment.”

Source: Bespoke , January 22, 2009.

Financial Times: Barclays Capital's Larry Kantor says keep assets liquid

“The situation in many markets and economies is so tenuous now because we don't know what the policies are going to be. The next month or two are critical. Investors should keep an ‘arsenal of liquid assets to deploy', at some point it is possible that there could be a very big upswing in the economy and in equities, which investors should be ready for.

“In the meantime, debt of strong companies appears to be a good investment, especially as the Federal Reserve is considering buying corporate debt, together with other assets it is already buying, such as commercial real-estate backed bonds.”

Source: Financial Times , January 18, 2009.

Bloomberg: “Time to sell” Treasuries, biggest Korean fund says

“A rally that sent US Treasuries to their best year since 1995 is coming to an end, South Korea's National Pension Service, the country's biggest investor, said.

“US government efforts to combat the recession will prompt the Federal Reserve to raise interest rates this year, said Kim Heeseok, who oversees $160 billion as head of global investments for the service in Seoul. The decline would snap a surge that sent the securities up 14% last year, according to Merrill Lynch & Co.'s US Treasury Master index, as investors sought the relative safety of debt.

“‘It's time to sell US Treasuries,' said Kim, who took over as head of investments at the start of the year. ‘The stimulus plan may cause inflation. The US will raise the benchmark interest rate.'”

Source: Wes Goodman, Bloomberg , January 19, 2009.

John Hussman (Hussman Funds): The case for TIPS

“The way to think about the relationship between TIPS yields and straight Treasury yields is that the nominal yield on a security is equal to the ‘real' yield plus expected inflation. At present, we have extraordinarily depressed nominal yields, but relatively high real yields, which means that the inflation rate implied in TIPS is extraordinarily low. Indeed, in order for TIPS to achieve the same total return as straight Treasuries over the next decade, we would need to observe a slight but sustained deflation over that period.

“My impression is that we are not near the point where there is any real risk of inflation, and we may very well observe negative near-term inflation rates (which is why it is important to be careful with TIPS that trade at a substantial premium to par, since the apparently high ‘real' yields on near-term TIPS can be eroded by deflation). TIPS can't mature at less than par, but if there is a deflation, the accrued inflation adjustment on these securities can be whittled down.

“Suffice it to say that we are holding TIPS not because we anticipate a near-term resurgence of inflation, but because the real, inflation-adjusted yields available over the next decade are quite high on a historical basis, and will adequately provide for the maintenance and growth of purchasing power over time, regardless of the near-term course of consumer prices.”

Source: John Hussman, Hussman Funds , January 19, 2009.

Steve Barrow (Standard Bank): Dollar honeymoon won't last

“The arrival of a new US president often sees an initial rise in the dollar - although the honeymoon does not always last long and it is doubtful whether this time will be different, says Steve Barrow, currency strategist at Standard Bank.

“He says it is possible that the market might buy into new hope offered by an incoming president.

“‘There's little doubt that Barack Obama campaigned on a pledge to bring new hope to the American people. It is also possible that the Democrats' strong position in Congress will give Mr Obama more scope to impose his will than President Bush did.'

“But Mr Barrow doubts any early dollar strength in Mr Obama's presidency will last. He says the US budget deficit is set to balloon due to the recession and likely $775 billion stimulus plan and notes that the last president to oversee such huge deficit expansion was Ronald Reagan in 1980-1988.

“‘Dollar strength at the start of Mr Reagan's term gave way to a downtrend that lasted until 1995. The Reagan camp initiated this weakness with dollar sales in 1985. We doubt Mr Obama will do the same, but in one respect, the new president will be seeking a weaker dollar.

“‘The Chinese renminbi remains a thorn in the side of the US trade balance. Mr Obama has vowed to continue the fight for flexibility - and hence strength - in the renminbi as initiated by President Bush. In order to see the dollar weaken against the renminbi, the dollar may have to fall elsewhere.'”

Source: Steve Barrow, Standard Bank (via Financial Times ), January 19, 2009.

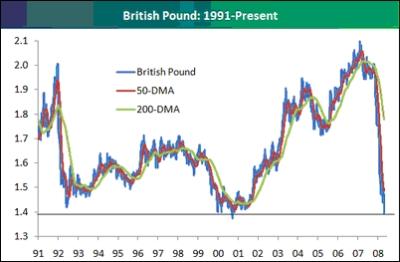

Jim Rogers: Sterling in peril

“The pound is a currency with no underpinning and should fall against the dollar and the euro, says Jim Rogers, chairman of Rogers Holdings and co-founder of the Quantum Fund with George Soros.

“He says his view reflects the UK's dire economic situation: ‘It's simple, the UK has nothing to sell.'

“Mr Rogers says the two main pillars of support for sterling have been North Sea oil and the strength of the UK financial services sector, in particular, the City of London's role.

“But Mr Rogers says just as North Sea oil is running out, so London's standing as a major financial centre is set to suffer.

“‘I don't think there is a sound UK bank now, at least, if there is one I don't know about it,' he says.

“‘The City of London is finished, the financial centre of the world is moving east. All the money is in Asia. Why would it go back to the West? You don't need London,' says Mr Rogers.

“Mr Rogers thinks the pound is more vulnerable than the dollar or the euro. He says the UK housing market is arguably in a worse state than that of the US, given pockets of strength in the US and prices that are sliding across the board in the UK.

“Meanwhile, he says, the UK is in worse shape economically than the eurozone, where most countries are not big debtors and do not run huge trade deficits. ‘If the UK discovers more North Sea oil, I might change this view,' he says. ‘But I don't see that happening.'”

Source: Jim Rogers (via Financial Times ), January 21, 2009.

Bespoke: British pound crumbles

“The US dollar is clearly back in rally mode after suffering a setback in December. As shown in the first chart below, the Dollar Index has now broken well above its 50-day moving average and appears to be heading back to its November highs. Unfortunately, rallies in the dollar have recently coincided with declines in riskier assets like equities.

“But the bigger news in currencies is the dramatic fall that the British pound has recently experienced. Today the pound is suffering another big drop, and as shown in the first chart below, the currency broke below recent support levels as well as the $1.40 mark. And the bottom chart shows just how much the pound has fallen in such a short period of time. In late 2007, the pound was trading at record highs versus the US dollar. Now it is trading very close to its lowest level since 1991. Anyone in the US that has the money to go to England can stay there on the cheapest tab in decades.”

Source: Bespoke , January 20, 2009.

Eoin Treacy (Fullermoney): Testing times for euro

“All countries in the Eurozone are now seeing their government bond spreads widen relative to German yields. This is an indication that all countries took part in the access to abundant credit made possible by the launch of the Euro and are now suffering the consequences.

“Some are being more affected than others. Spreads for Spain, Greece, Italy and Ireland have expanded most. These were some of the countries where borrowing costs had fallen most in order to join the Euro and where most use was made of the ability to access cheap credit. Without the single currency they would never have been able to borrow at such low rates, but they are now constricted by being unable to devalue their currencies in order to help them through the crisis.

“This is the first real test for the single currency. If it can survive the credit / solvency crisis without seeing some countries dropping out or its efficacy being called into question; then it stands a good chance of surviving for the longer-term as a viable entity. This may well depend on how long the crisis drags on.

“Spreads of more than 250 basis points over Bunds, for Greek government bonds are not encouraging for its long-term participation. Investors will no doubt remember there were significant questions about the Greek government's financial probity in the figures submitted to the European Commission prior to its entry into the single currency. Time will tell, but it will be a worthwhile exercise to monitor these spreads going forward.

“It is also interesting to see that in the UK, where control of interest rates is maintained by the BOE, that the brunt of the country's risk reassessment has been borne by the pound rather than government bonds. The spread over Bunds has been in a volatile downtrend since late 2005 and tested parity recently. The government bond spread has been contracting in line with the pound's decline against the Euro; both appear to have turned around the same time.”

Source: Eoin Treacy, Fullermoney , January 19, 2009.

CEP News: Treasury Secretary Geithner takes hardline stance on China

“In tune with the ‘change' mantra heard throughout the US Presidential campaign, the Obama administration signalled a new stance on China. But given the economic climate, analysts question the strategy of adopting a hardline position with the biggest purchaser of US debt.

“In comments to the Senate Finance Committee released Thursday, newly-confirmed Treasury Secretary Timothy Geithner said, ‘President Obama - backed by the conclusions of a broad range of economists - believes that China is manipulating its currency.' He added later that Obama will aggressively push the Asian country to change its policies on foreign exchange.

“‘The comments from the new administration suggest a more robust position on China than the former administration,' said Shaun Osborne, chief currency strategist at TD Securities. ‘It remains to be seen what China's response will be, but the US is in a very delicate position at the moment.'

“In September, China overtook Japan as the largest foreign holder of US debt, but that appetite may shrink as China's growth has slowed dramatically in the global recession.”

Source: Patrick McGee, CEP News , January 22, 2009.

John Authers (Financial Times): Currency interventions looming

“Unprecendented shifts in forex markets last year is fueling rumors of currency interventions in the coming weeks.”

Click here for the article.

Source: John Authers, Financial Times , January 22, 2009.

US Global Investors: Rosenberg - the case for gold

“Gold was, of course, one of the investment world's few bright spots in 2008, and after a slow start in 2009, it began a rally that climbed above $900 an ounce on Friday. This is gold's highest price since early October.

“David Rosenberg at Merrill Lynch sent out a short but useful research note Friday titled ‘The Case for Gold' that explains that gold's value is enhanced by declining bullion supply and increasing money supply.

“‘It's the only currency not going up in supply. Pretty simple. South African gold output declined 14% last year in the steepest decline since 1901. US production was down 2%. The leading producer in terms of growth last year was China at +3% (and global central bank selling activity dropped 42% in 2008 to 279+ tons, the lowest since 1996).

“‘Meanwhile, money supply is up more than 10% YoY in the USA (M2); +16% in Australia (M3); almost 11% in Germany (M2); 18% in the UK (M2); almost 9% in Italy (M2); 13% in Canada (M2); 14% in Korea (M2); 18% in India (M2); 12% in Singapore; and 18% in China (M2).

“‘Outside of gold, the only country where money is not being poured into the financial system as if it was water from the tap is Japan, where trends in the monetary aggregates are flat-to-negative. Be that as it may, and in view of all the problems in the US banking sector, we think the dollar is unlikely to lose its reserve currency status any time soon … Confidence in the ability of European governments to service their sovereign debt is being called into question in the debt markets (‘in the land of the blind …' ).'”

Source: US Global Investors - Weekly Investor Alert , January 23, 2009.

Richard Russell (Dow Theory Letters): Gold - very bullish action

“During the great gold bull markets of the 1970s to 1980, gold topped out at a price of 850 per ounce. For months now, gold has been ‘testing' the 850 level, first rallying above 850 and then sliding below 850. Currently, February gold is trading at 891. I consider this to be very bullish action. The current gold action is taking place in the second phase of the new gold bull market. The second phase has seen many hedge funds and a small segments of the public become interested in gold.

“I believe the third speculative phase of the current gold bull market lies ahead. This is the phase where the public jumps wholesale into the market. It's the phase where I expect to see a much higher, even frenzied, gold price. This final phase of the gold bull market will be accompanied by international doubt regarding the value and viability of fiat currency.

“Fiat money is being created in great quantities by almost every central bank in the world. Imagine, the foolishness of trying to ward off insolvency by creating ever-larger quantities of paper money. The worse off the economies of the world, the more fiat currency will be created.”

Source: Richard Russell, Dow Theory Letters , January 23, 2009.

Financial Times: UK move to boost cash supply

“Britain paved the way towards unconventional monetary policy in Europe on Monday when the government gave the Bank of England authority to create money and buy a variety of private sector assets.

“Although there is no sign the Bank's monetary policy committee wants to introduce US-style quantitative easing immediately, it now has the power to buy assets ranging from corporate bonds to asset-backed securities with newly created money.

“The policy, if introduced, seeks to ease the flow of finance to companies, driving down company borrowing costs and boosting the supply of cash in the economy. The Federal Reserve prefers the term ‘credit easing' to describe similar moves.

“The decision comes as part of a package designed to ease pressure on lending in the UK economy and put a brake on deepening recession. On Monday, the European Commission said Britain had one of the most exposed economies in the world to the global recession, predicting its economy would contract by 2.8% this year with stagnation continuing in 2010.

“Other elements of the package were heavily trailed. An insurance scheme stands at its heart, designed to restore some certainty to banks' finances by providing cover against catastrophic losses. This will be implemented from February on a case-by-case basis.

“From April, the government will provide guarantees to wrap around simple asset-backed securities issued by banks containing high-quality mortgage and corporate assets. Subject to state aid approval from the European Commission, it is also planning to extend its current guarantee of short-term funding for banks to the end of the year.

“For the first time since the crisis began, the Bank of England will also explicitly accept corporate credit risk when it begins a $74 billion programme of asset purchases from the private sector in return for government paper in February.”

Source: Chris Giles, Financial Times , January 19, 2009.

Financial Times: UK tries to break recessionary dynamic

“The government on Monday launched its second bank rescue package, injecting billions of pounds more of the taxpayer's money into saving Britain's banks. Chris Giles, FT's economics editor, tells Daniel Garrahan that the new bank rescue package is designed to rescue the economy as well as the banks.”

Source: Financial Times , January 19, 2009.

BCA Research: Last chance for UK banks

“Measures by UK authorities to shore up the banking system brings the prospect of full scale nationalization one step closer if they fail to re-ignite lending.

“The BoE's ability to purchase assets outright will effectively help in recapitalizing the banking system and should also provide a valuable fillip to the corporate debt market. For now, the Treasury has stopped short of setting up a ‘bad bank' to coral all the poor quality assets, probably for fear of what this might mean for the UK's beleaguered public finances in the event of default. Based on current government estimates the deficit will stay above 3% of GDP until the middle of the next decade.

“Bottom line: At this stage, policymakers are limiting their actions to ‘quality assets'. However, it is probable that the next step is a ‘bad bank' and full scale nationalization, given that output is forecast to fall this year at the fastest pace since 1946 and lending is likely to stay weak for a prolonged period.”

Source: BCA Research , January 21, 2009.

James Pressler (Northern Trust): Japan - no sale!

“Two items of significance regarding the Japanese market hit the wire this morning - the end-year trade balance and the Bank of Japan (BoJ) policy meeting announcement. With the overnight call rate already down to 0.10%, another rate cut would hardly be a news-maker, but the state of Japan's exports usually makes the front page. And unfortunately, the news was not good.

“Nobody expected the export market to make a miraculous turnaround, but some hope existed for less erosion in overseas sales or fewer imports, thereby supporting net exports. Neither occurred. December imports contracted by 21.5% on the year and were up by 7.9% for 2008 as a whole, but exports fared much worse, posting respective changes of -35.0% and -3.4%. This dragged the annual trade balance down to $20.4 billion, a level not seen since 1983 and a far cry from the 2007 tally of $92.1 billion.

“We have said it before and we will say it again - our official forecast for Q4 GDP in Japan is ‘abysmal'.”

Source: James Pressler, Northern Trust - Daily Global Commentary , January 22, 2009.

Societe Generale: Japanese exports fall 35%

“Strikingly, Japanese exports to the US were down some 37% yoy. But we cannot highlight strongly enough how truly mindboggling Japan's collapse in exports to China are. Last July they were expanding at a 16% yoy pace. Now they are contracting at a 35% yoy rate! This is a phenomenon throughout the region. Hence despite the notoriously manipulated Chinese GDP data showing a shocking slowdown in GDP growth to 6.8% yoy. I would eat my hat if the Chinese economy was doing anything other than contracting right now.”

Source: Societe Generale , January 2009.

Nouriel Roubini (RGE Monitor): China - why 0% growth is the new size 6.8%

“The Chinese came out today with their 6.8% estimate of Q4 2008 growth. China publishes its quarterly GDP figure on a year over year basis, differently from the US and most other countries that publish their GDP growth figure on a quarter on quarter annualized seasonally adjusted (SAAR) basis.

“When growth is slowing down sharply the Chinese way to measure GDP is highly misleading as quarter on quarter growth may be negative while the year over year figure is positive and high because of the momentum of the previous quarters' positive growth.

“Indeed if one were to convert the 6.8% y-o-y figure in the more standard quarter over quarter annualized figure Chinese growth in Q4 would be close to zero if not negative.

“Other data confirm that China was in a borderline recession in Q4 and that it may be in an outright recession in Q1: production of electricity plunged 7.9% in y-o-y basis; the Chinese PMI has been below 50 and close to 40 for five months now.

“And with manufacturing being about 40% of GDP , manufacturing is certainly in a sharp recession (negative growth) and the overall economy may be close to a recession

“So the 6.8% growth was actually a 0% growth - or possibly negative growth - in Q4; and the Q1 figures look even worse. So China is in a recession regardless of what the highly massaged official numbers claim.”

Source: Nouriel Roubini, RGE Monitor , January 22, 2009.

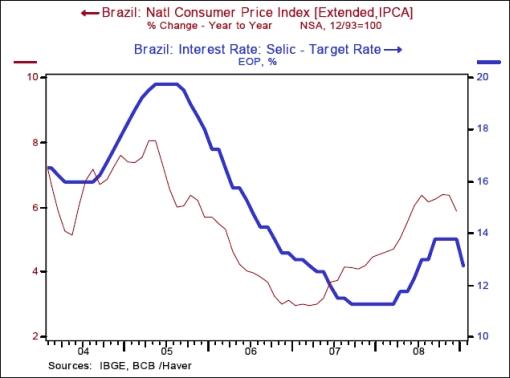

Bryan Crowe (Northern Trust): Brazil - 100 is the new 75

“In a surprise to the majority of forecasters, Brazil's central bank lowered its benchmark rate by a larger-than-expected 100bps on Wednesday after an official vote of 5-3 (the three voted for a 75 bp cut), bringing the overnight Selic rate down to 12.75%. This move was justified after a subdued inflation reading for December, but the committee's main reason for the move was a significant deterioration in domestic conditions.”

Source: Bryan Crowe, Northern Trust - Daily Global Commentary , January 22, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.