Investor Flight to Safety as Global Recession Fears Intensify

Stock-Markets / Recession 2008 - 2010 Jan 25, 2009 - 08:26 AM GMT

Fears about the intensity of the global recession and renewed skepticism regarding the beleaguered financial sector fueled a flight to safety during the past holiday-shortened trading week. President Obama's inauguration offered only a brief respite from the dreadful economic and earnings data and pounding of the stock markets.

Fears about the intensity of the global recession and renewed skepticism regarding the beleaguered financial sector fueled a flight to safety during the past holiday-shortened trading week. President Obama's inauguration offered only a brief respite from the dreadful economic and earnings data and pounding of the stock markets.

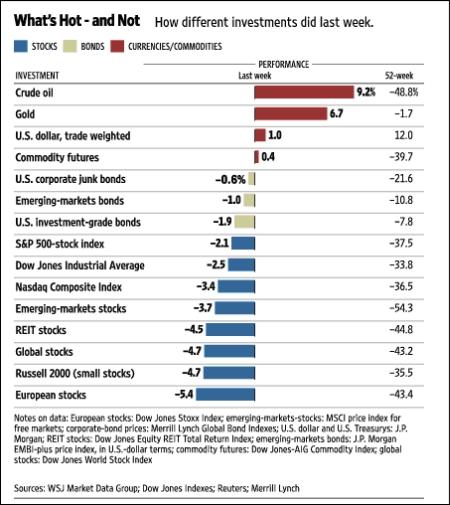

As investors piled into the perceived safety of gold (+6.9%), the US dollar (+1.8% in the case of the US Dollar Index) and the Japanese yen (+2.1% against the US dollar), global stock markets recorded a third straight week of losses. West Texas Intermediate Crude (+9.2%) also ended higher, joining a broader rally in commodities (+2.1% in the case of the Reuters/Jeffries CRB Index).

The MSCI World Index and the MSCI Emerging Markets Index declined by 4.7% (YTD -10.3%) and 5.7% (YTD -10.5%) respectively. Bucking the downtrend, the Shanghai Composite Index rose by 1.9% over the week and, with a gain of 9.3%, is also the best-performing global stock market since the start of 2009.

Elsewhere, the yields of long-dated government bonds in the US, UK and Eurozone rose sharply as large issuances of sovereign debt looms. For example, the yield of the US ten-year Treasury Note jumped by 28 basis points to 2.62% and that of the 30-year Treasury Bond by 40 basis points to 3.32% - the highest weekly points rise since April 1987. On the other hand, short-dated yields in a number of European countries declined as a result of expectations of further rate cuts.

The UK was a case in point with the two-year Gilt declining by 12 basis points to 1.0% on doubts about the government's new rescue plan for the banking system and a deterioration in the country's public finances. The pound crumbled to a 23-year low against the greenback and an all-time low against the yen.

The financial turmoil and the various actions by central banks reminded me of a quote from 1867 by Karl Marx: “Owners of capital will stimulate the working class to buy more and more expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks, which will have to be nationalized, and the State will have to take the road which will eventually lead to communism.”

“TARP has been an abject failure,” said Thomas Barrack Jr, billionaire and founder of Colony Capital, in BusinessWeek . “I compare the situation to a fire on a Savannah plain: Let it rip and burn, and the market will rejuvenate so much faster - try to control or impede it, and there will be more and longer suffering before renewal. Japan experienced two decades of economic paralysis by experimenting with fire control of a similar unproductive sort.”

And here is Peter Schiff's ( Euro Pacific Capital ) prescription for how the US can dig itself out of the current mess, as reported by Fortune Magazine : “Shrink the government radically, cancel all bailouts immediately, take plenty of tough medicine, and let the free market do its job - however harsh it may be for, say, autoworkers in the meantime.”

According to Sheila Bair of the FDIC, as reported by The Wall Street Journal , there will soon be a new government banking agency, the Aggregator Bank, to buy troubled assets from financial institutions. For a bit of fun, I tried to register this domain last week. Alas, another aspirant banker pipped me to the post. His reselling price? $100,000! Needless to say, I swiftly terminated the negotiations.

Next, a tag cloud of my week's reading. This is a way of visualizing word frequencies at a glance. Key words such as “bank”, “government”, “economy”, “market”, “financial”, debt” and “crisis” topped the list.

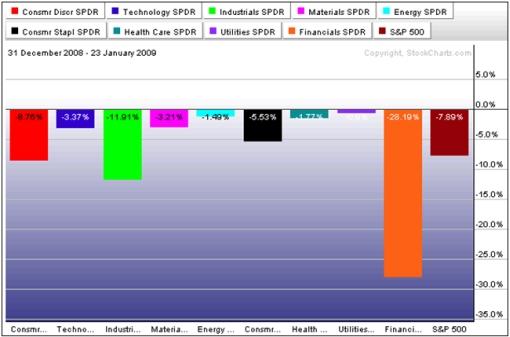

The graph below shows the performance of various S&P sector SPDRs for the year to date. With Financials having declined by 28.2%, the market's weakness was quite strongly concentrated in one sector. In addition to Financials, only Industrials (-11.9%) and Consumer Discretionary (-8.8%) have underperformed the S&P 500 Index (-7.9%) since the beginning of the year.

“During prior declines during this bear, losses were broad based and once they become more concentrated (as they are now), it's a sign that the market is beginning to separate the eventual winners from the losers,” said Bespoke .

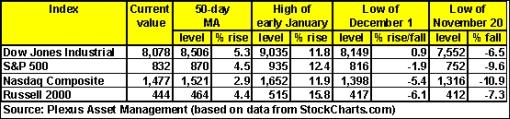

Considering the outlook for the stock market, Richard Russell, 84-year-old author of the Dow Theory Letters , said: “Recently, the Transports broke below their November 20 bear market low. The Industrials have refused (so far) to confirm the Transports. Will the Industrials break down and confirm?

“No one can possibly know. But the longer the time elapses that the Industrials refuse to confirm, the more hopeful the situation. As a rule, the closer in time the two Averages, Transports and Industrials, break through preceding levels, the more authoritative the signal. The Transports broke to new lows on January 20. The longer Industrials hold above their November 20 low of 7,552, the better the odds that they will not confirm.”

Key resistance and support levels for the major US indices are shown in the table below. The immediate upside target is the 50-day moving average, followed by the early January highs. On the downside, the December 1 and all-important November 20 lows must hold in order to prevent considerable technical damage.

A number of global stock markets - Germany, France, Belgium, Finland, Ireland and Venezuela - have actually already broken below their November 20 lows. Although a retest of the lows is often a feature of base formation development, it can also be a harbinger of the resumption of a downtrend.

Donning his customary bearish outfit, Albert Edwards of Société Générale , a favorite market strategist among Investment Postcards' readers, said: “After increasing our equity exposure at the end of October we believe that the market is set to quickly slide sharply towards our 500 target for the S&P 500.

“While economic data in developed economies increasingly reflect depression rather than a deep recession, the real surprise in 2009 may lie elsewhere. It is becoming clear that the Chinese economy is imploding and this raises the possibility of regime change. To prevent this, the authorities would likely devalue the yuan. A subsequent trade war could see a re-run of the Great Depression.”

According to Jeffrey Hirsch ( Stock Trader's Almanac ), the December Low Indicator says that should the Dow Jones Industrial Index close below its December low anytime during the first quarter, it is frequently an excellent warning sign. This came to pass on Tuesday when the Dow closed below its December low of 8,149 (recorded on December 1).

Also of concern to Hirsch is the January Barometer , stating “As January goes, so goes the year”. Every down January since 1950 has been followed by a new or continuing bear market or a flat year. On Friday the S&P 500 closed at 832, 7.9% lower than the December 31 close.

From across the pond David Fuller ( Fullermoney ) commented that one could not rule out an overcorrection by the S&P 500 to 600 (as suggested by Jeremy Grantham in his latest quarterly newsletter ), “although the downside move to date is still quite overstretched relative to the 200-day moving average. Fundamentals will not determine the actual low, in my opinion, whether already seen or pending. That will be determined by sentiment and liquidity, as always. Currently, sentiment is diabolical but liquidity is increasingly abundant.

“From an investment perspective, my preferred strategy would be to nibble on high-quality equities with decent and well-covered yields.”

On the back of the bullion price increasing by 6.9%, the Gold Bugs Index (+10.6%) was one of the top-performing industry groups for the week. The venerable Richard Russell said: “The [gold] market always does what it's supposed to, but never when. Is it ‘when time' for gold? It looks like the long erratic correction in gold is over.

“Gold is pushing up consistently now - the first upside target is to better the 900 level which will take gold above the two preceding peaks. If gold can move above the 900 level (we're close), I think there is a good chance it will test the highs. Up until now, gold's progress has been halted, every advance corrected. Gold appears to advance more easily now and the gold stocks are going along with the bullion.”

According to US Global Investors - Weekly Investor Alert , David Rosenberg of Merrill Lynch on Friday sent out a research note titled “The case for gold”, explaining that gold's value is enhanced by declining bullion supply and increasing money supply.

James Montier of Société Générale added: “Gold kind of scares me because very often the people involved with it seem to be slightly insane. My other problem is I don't know how to value it. That said, I can certainly see why gold could be considered somewhat of an insurance policy, if not an investment in its own right. Any kind of systemic economic turmoil is likely to drive gold prices higher.”

For more discussion about the direction of stock markets, also see my post “ Video-o-rama: Wishing you well, Mr O “.

Economy

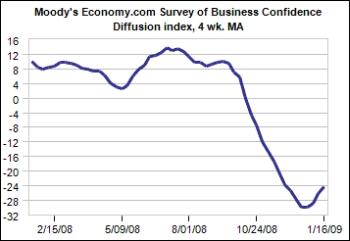

“Global businesses remain darkly pessimistic. Sentiment was at its worst in mid-December, but has improved only marginally since then,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . “European and South American businesses are most worried, followed by North America; Asian companies are negative but less so. Pricing power has collapsed, suggesting that deflation is increasingly likely.”

The latest US economic reports also indicate that the intensity of the economic downturn shows no sign of letting up. Homebuilding descended to an unprecedented post-war low, the National Association of Home Builders (NAHB) housing market index again reached a new low, and the ABC/Washington Post Consumer Confidence Index remained near its all-time lows. Interestingly, no president has entered office with such a poor level of consumer confidence since the beginning of the Survey in 1985.

Regarding the meeting of the Federal Open Market Committee (FOMC) on January 27 and 28, Asha Bangalore ( Northern Trust ) said: “The policy statement will be the first following the zero interest rate policy adopted at the last meeting. The explicit hint about the Fed's future course of action in the December 16, 2008 policy statement read as follows:

‘The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. In particular, the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.'

“We will be paying close attention to whether the Fed will retain or rephrase this part of the policy statement. With regard to the Fed's views about economic growth and inflation … we do not expect radical modifications of the entire policy statement.”

Elsewhere in the world, evidence mounted that the recession was spreading and deepening.

• The UK's real GDP contracted by 1.5% in the fourth quarter, following a 0.6% decline in the third quarter. The data confirmed the first UK recession since 1991.

• China's real GDP declined by 6.8% year on year in the fourth quarter. However, when recalculating China's growth rate on a quarter-on-quarter annualized basis, like most other countries do, commentators are of the opinion that the Chinese economy might already be contracting.

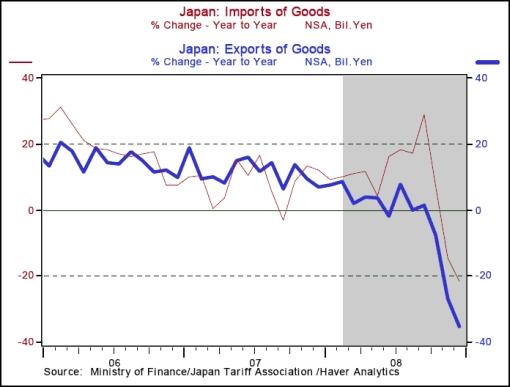

• Japan recorded a fifth consecutive monthly trade deficit in December, marking the worst year for exports on record. Exports contracted by 35% year on year, compared with a 16% expansion as recently as July.

Summarizing the economic situation, Nouriel Roubini ( RGE Monitor ) said: “The US economy is, at best, halfway through a recession that began in December 2007 and will prove the longest and most severe of the post-war period. Credit losses of close to $3 trillion are leaving the US banking and financial system insolvent. And the credit crunch will persist as households, financial firms and corporations with high debt ratios and solvency problems undergo a sharp deleveraging process.

“Worse, all of the world's advanced economies are in recession. Many emerging markets, including China, face the threat of a hard landing. Some fear that these conditions will produce a dangerous spike in inflation, but the greater risk is for a kind of global ‘stag-deflation'. We're likely to see vulnerable European markets (Hungary, Romania and Bulgaria), key Latin American markets (Argentina, Venezuela, Ecuador and Mexico), Asian countries (Pakistan, Indonesia and South Korea), and countries like Russia, Ukraine and the Baltic states facing severe financial pressure.

“The world's first global recession is just getting started.”

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Jan 21 | 10:35 AM | Crude Inventories | 01/16 | - | NA | NA | NA |

| Jan 22 | 8:30 AM | Building Permits | Dec | 549K | 610K | 600K | 615K |

| Jan 22 | 8:30 AM | Housing Starts | Dec | 550K | 605K | 605K | 651K |

| Jan 22 | 8:30 AM | Initial Claims | 01/17 | 589K | 540K | 543K | 527K |

| Jan 22 | 11:00 AM | Crude Inventories | 1/16 | 6.10M | NA | NA | 1.14M |

Source: Yahoo Finance , January 23, 2009.

In addition to the interest rate announcement by the FOMC (Wednesday, January 28), the US economic highlights for the week, courtesy of Northern Trust , include the following:

1. Leading Indicators (January 26): Consensus : -0.3% versus -0.4% in November.

2. Existing Sales (January 26): Consensus : 4.40 million versus 4.49 million in November.

3. New Home Sales (January 29): Consensus : 400,000 versus 407,000 in November.

4. Durable Goods Orders (January 29): Consensus : -2.0% versus -1.5% in November.

5. Real GDP (January 30): Northern Trust: -4.5% Consensus : -5.4% versus -0.5 in Q3.

6. Other reports : Consumer Confidence (January 27); Consumer Sentiment Index and Employment Cost Index (January 30).

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , January 23, 2009.

Bernard Baruch said: “If you get all the facts, your judgment can be right; if you don't get all the facts, it can't be right.” Hopefully the “Words from the Wise” reviews offer assistance to Investment Postcards ‘ readers in compiling the facts.

That's the way it looks from Cape Town.

Bespoke: Interesting prediction market contracts

“Prediction market website Intrade has some interesting finance-related contracts trading at the moment, and below we highlight charts of them. The first contract is whether Apple CEO Steve Jobs will depart as CEO by the end of 2009. As shown, the contract peaked when the company announced Mr. Jobs' leave of absence earlier this month, but it has since declined a bit to its current level of 60% (traders are putting the odds at 60%).

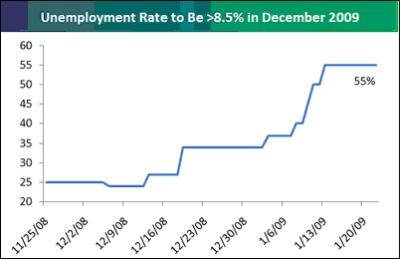

“The second contract is whether the unemployment rate in the US will be higher than 8.5% by December 2009. The unemployment rate is currently at 7.2%, and the odds for it to be higher than 8.5% by year end are at 55%.

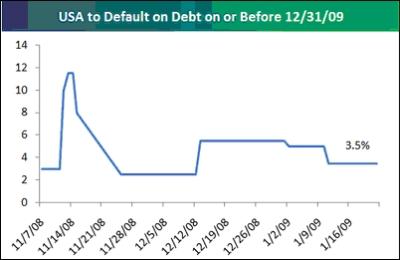

“Intrade also has a contract on whether the US will default on its debt on or before 12/31/09. Traders are currently putting the odds of this occurring at 3.5% on Intrade, which seems low, but is actually pretty high considering what the implications would be if this happened.

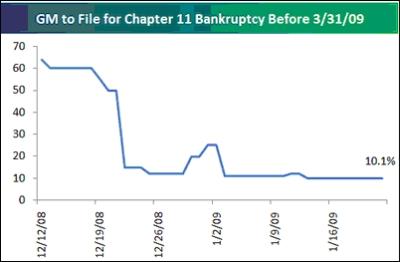

“And back in early December, Intrade traders were putting the odds of a GM bankruptcy before the end of Q1 ‘09 at greater than 60%. After government intervention for the automakers happened a few weeks later, those odds dropped sharply and now stand at just 10%.

“Liquidity in these markets is low, so making big bets is hard to do, but analyzing these contracts gives some unique insight into what some people think will or will not happen in the near future.”

Source: Bespoke , January 22, 2009.

CNBC: Barack Obama will help the economy, but don't expect miracles

Click here for the article.

Source: CNBC , January 18, 2009.

Reuters: Soros - US stimulus not enough, TARP bailout misused

“The stimulus plan the US government is currently considering is necessary to help American citizens, but it will likely not reverse the country's economic decline, hedge fund manager and billionaire philanthropist George Soros said on Monday.

“‘It is not enough to turn the situation around,' Soros told the US Conference of Mayors about the $850 billion proposal to increase spending and cut taxes.

“The plan, which was introduced in the US House of Representatives last week and will likely be passed by next month, will help state and local governments balance their budgets and preserve important social services, Soros said.

“At the same time, the $700 billion financial bailout known as TARP for Troubled Assets Relief Program had been carried out in a ‘haphazard and capricious way' and ‘without proper planning', he said.

“‘Unfortunately it was misused and the way it was done has poisoned the well. It has created tremendous ill will toward putting up more money,' Soros said.”

Source: Lisa Lambert, Reuters , January 19, 2009.

Casey's Charts: What the banks did with the latest bailout

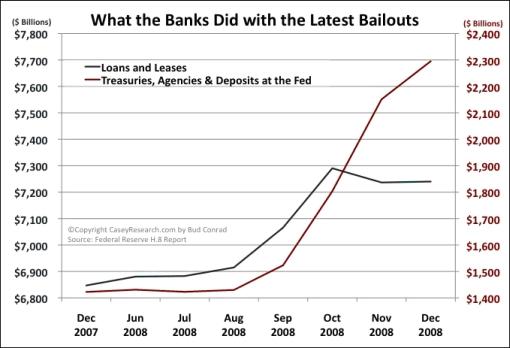

“The red line in the graph below shows that, since August, banks have built their cash position in the form of Treasuries, agencies and deposits at the Fed by $865 billion, while their loans and leases have increased by only $325 billion.

“In other words, rather than lending the billions of dollars received from the Treasury's Troubled Asset Relief Program (TARP), as was originally intended, the recipient banks have squirreled away the bailout funds in order to shore up their balance sheets.

“Concurrently, the Federal Reserve is exchanging its excess reserves for toxic waste from the financial institutions.

“The combined affect is a ‘circular bailout' with the Treasury borrowing … in order to lend money to banks … that then lend it back by purchasing more Treasuries. Of course, the expense of this entire bailout scheme ultimately falls onto the back of the tax-paying public.”

Source: Casey's Charts , January 20, 2009.

Reuters: US and UK on brink of debt disaster

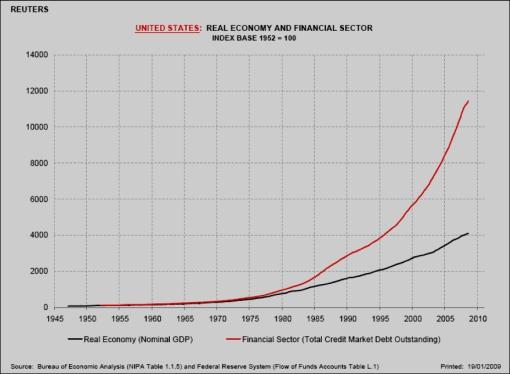

“The United States and the United Kingdom stand on the brink of the largest debt crisis in history. While both governments experiment with quantitative easing, bad banks to absorb non-performing loans, and state guarantees to restart bank lending, the only real way out is some combination of widespread corporate default, debt write-downs and inflation to reduce the burden of debt.

“To understand the scale of the problem, and why it leaves so few options for policymakers, take a look at the chart below which shows the growth in the real economy (measured by nominal GDP) and the financial sector (measured by total credit market instruments outstanding) since 1952.

“The solution must be some combination of policies to reduce the level of debt or raise nominal GDP. The simplest way to reduce debt is through bankruptcy, in which some or all of debts are deemed unrecoverable and are simply extinguished, ceasing to exist.

“But widespread bankruptcies are probably socially and politically unacceptable. The alternative is some mechanism for refinancing debt on terms which are more favorable to borrowers (replacing short term debt at higher rates with longer-dated paper at lower ones).

“The remaining option is to tolerate, even encourage, a faster rate of inflation to improve debt-service capacity. Even more than debt nationalization, inflation is the ultimate way to spread the costs of debt workout across the widest possible section of the population.”

Source: John Kemp, Reuters , January 21, 2009.

Financial Times: Winter bites in EU but with some bright spots

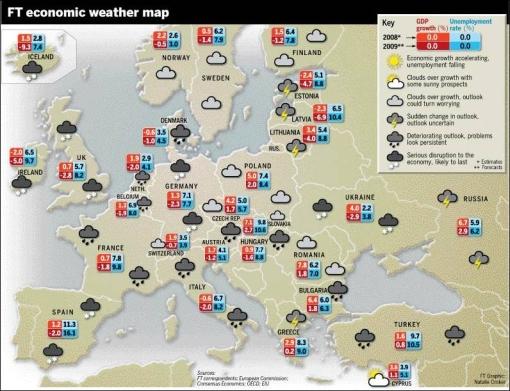

“Wintry conditions are gripping Europe's economies as the biting winds caused by financial market storms lead to deep and protracted recessions, but regional variations are still distinguishable.

“The latest Financial Times economic weather map for Europe shows a further substantial deterioration since it was last published in October, when the devastating impact on the global economy of the collapse of Lehman Brothers, the investment bank, was only just becoming apparent.

“European industrial production collapsed in November, data this month have shown, and business confidence surveys suggest the bottom of the recession - set to be among the worst since the second world war - has not yet been reached.”

Source: Ralph Atkins and Ben Hall, Financial Times , January 19, 2009.

CNBC: Buffett & Brokaw

“Insight on the financial and economic turmoil, with Warren Buffett, Tom Brokaw, NBC News special correspondent, and CNBC's Erin Burnett and Mark Haines.”

Source: CNBC , January 19, 2009.

RGE Monitor: Estimated $3.6 trillion loan and securities losses in US

“Nouriel Roubini and Elisa Parisi-Capone of RGE Monitor released new estimates for expected loan losses and writedowns on US originated securitizations.

“Loan losses on a total of $12.37 trillion unsecuritized loans are expected to reach $1.6 trillion. Of these, US banks and brokers are expected to incur $1.1 trillion.

“Mark-to-market writedowns based on derivatives prices and cash bond indices on a further $10.84 trillion in securities reached about $2 trillion. About 40% of these securities (and losses) are held abroad according to flow-of-funds data. US banks and broker dealers are assumed to incur a share of 30-35%, or $600-700 billion in securities writedowns.

“Total loan losses and securities writedowns on US originated assets are expected to reach about $3.6 trillion. The US banking sector is exposed to half of this figure, or $1.8 trillion (i.e. $1.1 trillion loan losses + $700 billion writedowns.)

“FDIC-insured banks' capitalization is $1.3 trillion as of Q3 2008; investment banks had $110 billion in equity capital as of Q3 2008. Past recapitalization via TARP 1 funds of $230 billion and private capital of $200 billion still leaves the US banking system borderline insolvent if our loss estimates materialize.

“In order to restore safe lending, additional private and/or public capital in the order of $1 - 1.4 trillion is needed. This magnitude calls for a comprehensive solution along the lines of a ‘bad bank' as proposed by policy makers or an outright restructuring through a new RTC.

“Back in September, Nouriel Roubini proposed a solution for the banking crisis that also addresses the root causes of the financial turmoil in the housing and the household sectors. The HOME (Home Owners' Mortgage Enterprise) program combines a RTC to deal with toxic assets, a HOLC to reduce homeowers' debt, and a RFC to recapitalize viable banks.”

Source: RGE Monitor , January 22, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Andrew

27 Jan 09, 09:48 |

Marx quote

The Karl Marx quote you cite is fake. Nice try though. |