Sterling Sinks as Britain Teeters on Brink of Bankruptcy

Currencies / British Pound Jan 22, 2009 - 08:48 AM GMTBy: Mike_Shedlock

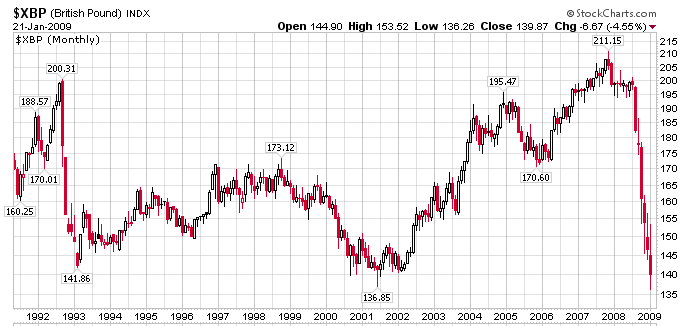

The British Pound has imploded on fears of bank nationalization and Prime Minister Gordon Brown's plan to give the Bank of England unprecedented powers to buy securities. This chart paints the not so pretty picture.

The British Pound has imploded on fears of bank nationalization and Prime Minister Gordon Brown's plan to give the Bank of England unprecedented powers to buy securities. This chart paints the not so pretty picture.

British Pound vs. US$ Monthly Chart

That is not a surprise to me.

January 22, 2008: Global Decoupling Myth Shattered In Equity Selloff .

Kiss goodbye the idea that the UK would decouple from the US credit crunch.

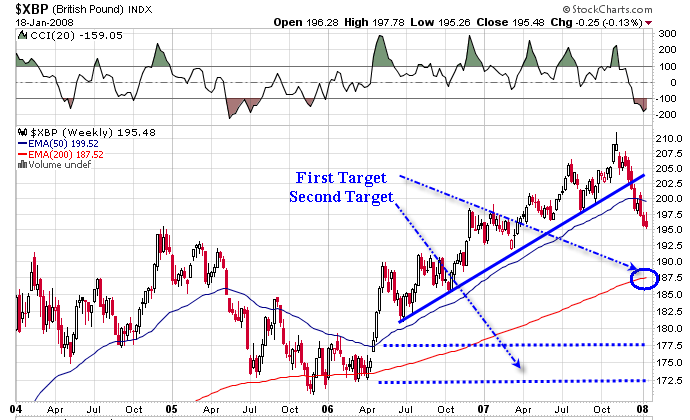

British Pound vs. US$ Weekly

The technical picture of the British Pound is weak. There has been a major trendline break, the 50EMA seems to be rolling over, and there is a big cross under the 50EMA. A pullback to the 200EMA seems likely. There is a good chance the entire runup from the April 2006 low is retraced.

We got that retrace and then some. Dollar bulls were right much of 2008, especially against the Pound. The UK is one country hell bent on outdueling Bernanke and the US in foolish activity.

Pound At Lowest Level Versus Dollar Since 1985

Bloomberg is reporting Pound Falls to Lowest Versus Dollar Since 1985 on Bank Concern .

The pound fell to its weakest level against the dollar since Margaret Thatcher was U.K. prime minister and dropped to a record against the yen for a second day on speculation the government will nationalize banks.

“The U.K.'s imploding,” said Jonathan Gencher, Toronto- based director of currency sales at BMO Capital Markets, a unit of Canada's fourth-largest bank. “You have all the concern about the financial sector and which banks are going to be nationalized. You have expectations that the Bank of England is going to be moving toward zero interest rates. That's weighing on the pound.”

Sterling dropped as much as 2.2 percent to $1.3622, the lowest level since September 1985, before trading at $1.3740 at 1:43 p.m. in New York, Against the yen, the pound fell 2.8 percent to 121.59 after reaching the all-time low of 119.42. The pound fell 1.1 percent to 93.61 pence against the euro.

The Bank of England will lower its benchmark rate by a half-percentage point to 1 percent at its Feb. 5 meeting, according to the median forecast of 28 economists surveyed by Bloomberg News.

Bank of England May Start Buying Assets

In news that rightfully should sink the pound, King Says BOE May Start Buying Assets Within Weeks

Bank of England Governor Mervyn King said officials may start buying assets in the next weeks to loosen credit markets as the lowest interest rates since 1694 fail to avert a “marked” recession.

The U.K. central bank may acquire securities such as corporate bonds and commercial paper to bolster lending to companies and consumers as banks rebuild balance sheets damaged by the global financial crisis, King said today. He said interest-rate reductions to the current 1.5 percent won't prevent a contraction in the first half of the year.

“Despite those big cuts, there remains a risk that inflation will fall below 2 percent,” the target rate, King said in a speech in Nottingham, England. “It is sensible for the Monetary Policy Committee to prepare for the possibility -- and I stress that we are not there yet -- that it may need to move beyond the conventional instrument” of the bank's benchmark interest rate.

King backed Prime Minister Gordon Brown's plan to give the Bank of England unprecedented powers to buy securities, unveiled yesterday along with a 100-billion pound ($140 billion) bailout for banks. Those tools may later be expanded to fight deflation as the British economy faces a recession this year that may be the worst since the aftermath of World War II.

“The bank is almost ready, but very willing, to engage in unconventional monetary policy techniques,” Philip Shaw, chief economist at Investec Securities in London, said in an interview. “There is still some room for interest rates to come down. But there's a good chance they'll use this facility.”

Notice how the big fear is that inflation will fall below 2 percent. How stupid can you get? The fear ought to have been about asset bubbles, speculation, and inflation, not low prices.

Britain On Edge Of Bankruptcy

Inquiring minds are reading how Gordon Brown brings Britain to the edge of bankruptcy

Iain Martin says the Prime Minister hasn't 'saved the world' and now faces disgrace in the history books.

They don't know what they're doing, do they? With every step taken by the Government as it tries frantically to prop up the British banking system, this central truth becomes ever more obvious.

The Government's bail-out of the banks in October with £37 billion of taxpayers' money was supposed to have "saved the world", according to the PM, but now it is clear that it has not even saved the banks. Our money kept the show on the road for only three months.

It is finally dawning on the Government that the liabilities of the British banks grew to be so vast in the boom years that they now eclipse the entire economy. Unfortunately, the Treasury is pledged to honour those liabilities because it has guaranteed not to let a British bank go down. RBS has liabilities of £1.8 trillion, three times annual UK government spending, against assets of £1.9 trillion. But after the events of the past year, I wager most taxpayers will believe the true picture is worse.

And they come piled on top of the rocketing national debt, charitably put at £630 billion, or 43 per cent of GDP. The true figure is much higher because the Government has used off-balance sheet accounting to hide commitments such as PFI projects.

The PM and the Chancellor , both looking a year older every day, tell us that for their next trick they will buy more bank shares, create a giant insurance scheme for bad debt, pledge to honour liabilities without limit, cross their fingers and hope it all works. The phrase "bottomless pit" springs to mind for a reason: that is what they have designed.

Gordon Brown's nightmare, in which we are all trapped, is going to get much worse.

Iain Martin is thinking clearly. Unfortunately no one in the UK with any authority is. This is a known quirk of the Fiscal Insanity Virus , now rapidly spreading the globe.

FIV always seems to strike those with the power to do the most damage. Prime Minister Gordon Brown, Bank of England Governor Mervyn King, and the Chancellor of the Exchequer Alistair Darling, all seem to be in the late stages of FIV.

Hope of recovery is slim.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.