2009: Dollar, Debts and Deficits to Eventually Drive Commodities Higher

Commodities / Investing 2009 Jan 22, 2009 - 04:57 AM GMTBy: HRA_Advisory

Happier New Year - 2008 will (hopefully) go down as the most difficult year investors ever have to face. While we certainly are not promising a rapid return to a true bull market we think there will be profit opportunities going forward, some of them substantial.

Happier New Year - 2008 will (hopefully) go down as the most difficult year investors ever have to face. While we certainly are not promising a rapid return to a true bull market we think there will be profit opportunities going forward, some of them substantial.

Great risks remain however and even in the rosiest scenarios this will be a traders market for months if not years to come. Any gains in the market will be hard won and made against the backdrop of economic stats that will continue to be awful. It will be important to harvest profits when you're able and building cash for use later to patiently buy longer term bargains. We will cover a number of sub sectors in this first issue of 2009 with some comments at the end on the mining sector as a whole.

(Reprinted from the January 2009 HRA Journal)

The title above is not a brave prediction, at least not in our opinion. Markets do tend to revert to the mean eventually and when you've just been through the worst year for equities in 70 years its pretty unlikely you will see a literal repeat. This year will be better. The question how quickly, how much better it actually gets and where the improvement will start. We'll touch on some of the factors discussed in the last issue before moving on to 2009.

Fear Factor Update

The last issue of 2008 discussed a number of technical indicators that would have to show improvement before the market started healing itself. While none of them are back to “normal” The improvement in several indicators during December was impressive.

The VIX “indecision” indicator dropped from 55 this time last month to about 35, before bouncing back over 40 in the past couple of sessions. This is still twice the value that prevailed before the credit markets fell apart but we would not expect to see this indicator get back to the sub 20 level for a long time. We'd like to see it get below 30 but anything under 40 shows there is at least some dissipation of market fear.

Treasury yields, the other fear indicator, continued to fall until the equity markets rallied after Christmas. The ten year yield (TNX) is currently about 50 basis points lower than early December. Since the Fed effectively took the funds rate to zero percent in the interim this is also an improvement.

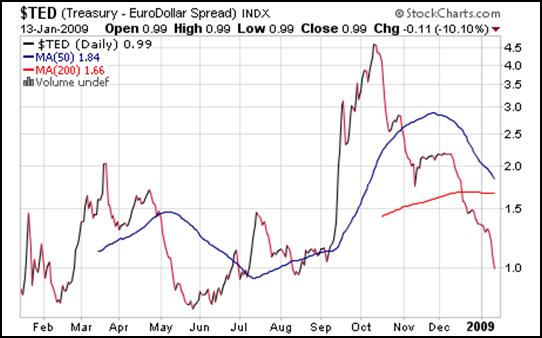

Of greater interest, the Treasury-Eurodollar, or “TED” spread has fallen most dramatically of all. A one year chart for the TED spread appears below. This risk measure topped out at 4.6% in the wake of the Lehman collapse but recently dropped back to the 1% level. While this is above historical norms it's the lowest reading since August and indicative of calmer traders and thawing credit markets.

Rate decreases have not been confined to sovereign debt; Fed purchases have succeeded in bringing mortgage rates below 5%. Of course, mortgages are actually only available to the sort of people who neither need nor want one these days but low rates may spur some refi activity that will free up a bit of badly needed household cash flow.

In short, fears remain but the improvements in the past month in the credit markets have been real and measurable. There is still a recession to get through but things are looking up.

The Year Ahead:

I. Dollars, Debts, and Deficits

For the next couple of quarters or at least until theres more supply/demand data, movements in most metal and other commodity prices will be tied to the value of US Dollar. The Dollar's value, in turn, will be determined by the extent of fiscal stimulus in the US and the strength of US economic stats relative to other economies, particularly the Eurozone. The Fed's move to zero rates in December brought the gap between US and European interest rates back to the levels last seen when the Dollar was wilting in the middle of this decade. That accelerated the pullback in the Dollar.

We don't expect a Fed Fund Rate increase for a long time, but market yields on Treasuries that have been the main beneficiary of fear buying will be much more volatile. Rates may have already made a bottom thanks to a partial return of risk appetite. There may be further yield increases as traders feel brave enough to chase other assets. Any upward move in yields will be strengthened by selling from those concerned increased supply will hurt bond prices.

Other central banks are continuing to slash rates, with England 's and Korea 's both cutting theirs to all time lows. The ECB has remained stubborn about lowering rates, though the market is pricing in a minimum 50 basis point cut at the next meeting. Falling prices are giving the ECB room to move though it might be concerned too deep a cut merely reinforces negative sentiment without accomplishing much else.

The best justification for an ECB rate cut would be to weaken the Euro. Its far from certain this would work in the longer term but the assumption the ECB will match US rate cuts has been hammering the Euro since the start of the year. US debt levels and monetary expansion to come may ultimately scuttle ECB attempts to push the value of the common currency down.

While Obama's stimulus plan is not fleshed out yet there have been enough leaks to estimate the Treasury will have to issue at least $1.5-2 trillion in debt by the end of October, plus funds for Obama's plans during that period. The size and number of debt auctions will have to be stepped up significantly to get that much paper off. We hope there will be enough willing buyers.

Politics will come into play here at several levels. While Obama won't want to fear monger, he won't underplay the seriousness of the situation for some time. He has the unenviable task of trying to clean up the mess and he'll want to make sure voters don't forget the trouble didn't start on his watch.

Even before the inauguration, the new administration is preparing Americans for the possibility of several years of trillion dollar federal deficits. Indeed, the Treasury just announced the current year deficit has hit a record and they have only counted the first three months! Expect plenty of dire talk about the economy as Obama pushes for rapid and bipartisan passage of new spending bills.

Through 2009, the US must balance the need for massive fiscal stimulus against the potential for a nasty turn in the bond market that could drive up interest rates at the worst possible time. It's not in anyone's interest for this to happen but as we all learned last year what you plan for and what you get are often two very different outcomes.

For many years US administrations have lectured BRIC countries about reducing “excess savings” and generating domestic demand. While the excess saving label seems laughable, the point about creating local demand to balance capital flows is well taken. It's easier to generate rapid growth in a low wage economy by simply selling to high wage economies. This is what most developing countries do but the world needs new consumers most of all. In fairness, BRIC countries have been increasing internal demand much more quickly in the past few years than they get credit for. The situation in the US makes it critical that this trend continue.

Warnings about a long deep recession from Washington may spur governments in Europe and Asia to increase their stimulus efforts. We've noted a disturbing level of complacency in many quarters about the way out of this recession. There seem to still be many who expect the US consumer to bail the world economy out. We don't see how that is possible. Other governments need to push policy that increases their own aggregate demand instead of waiting for the American middle class to do the heavy lifting.

We said before that the world was witnessing an end of empire scenario unfolding as developing nations rapidly increased their share of the world economy. Although “conventional wisdom” now shuns this concept we still consider it very much in play. Far from expecting the debt crisis to slow the process we think it will accelerate it. Those with short memories or little knowledge of history forget that as many empires ended with debt crises as with wars.

As the recession continues, cash rich developing countries will step up their own fiscal stimulus programs. The fact that many of these countries can now afford to without expanding external debt is one reason we are a little less bearish than some other analysts.

In past credit crises, the developing world was hit hardest because external funding vaporized. This time there are a number of export leaders like China and resource rich countries like Brazil that have built up reserves that can be used for internal stimulus. As these countries trade surpluses fade and they need to focus on domestic spending the demand for dollars should continue to decrease.

None of these countries is “out to get” the US $ and some, like China , don't want their own currency rising (which we think is a mistake) but the scale of treasury and US agency debt purchases these countries made in recent years simply isn't necessary now. The potential for falling offshore demand for US financial assets will a big problem for the Obama administration in 2009. Its one thing for Washington to promise big spending plans but quite another to deliver them in a way that isn't damaging to the economy in the long term. The US should be able to sell enough debt in the short term to cover spending increases but will probably have to ultimately monetize it rather than pay it off. The printing press will continue to run 24-7 in Washington for the foreseeable future.

Currencies trade in pairs and the lack of a real strong alternative currency has helped the Dollar trade better than it probably deserves for several years. The Fed's move to a zero interest rate policy and expected quantitative easing has added more downward pressure but the issue of where to move to when trading out of the Dollar remains.

Having the world's de facto reserve currency has allowed Americans to live through an era of extraordinary profligacy with near impunity. This era has come to an end and the ultimate consequences in terms of US growth and wealth could be large. A move to price international goods in other currencies and development of a new reserve currency (or more likely, basket of currencies) is still some time in the future. The US still has a financing window but we think diversification into other currencies (including precious metals) and assets by foreign government and investors is a trend that will not be reversed.

There is still a long way to go before the economic mess is behind us. The ability of the Obama team to generate positive consumer psychology and the willingness of the world's other growth centers to increase their domestic demand will be the major determinants of the length and depth of this recession. We still contend the trade and economic landscape will look much different in the future, and the old world financial centers will lose a lot of their power. We will go into that topic in more depth in the next Journal .

II. Precious Metals

Gold has gotten much mainstream press in the past month, from both bullish and bearish viewpoints. We are still bullish ourselves, though we base that on a “currency view” of gold. While we continue to expect buying from people who see gold as an asset of last resort we also recognize that the biggest demand sector is jewelry. Jewelry is a pro-cyclical luxury purchase, something that will not be high on most peoples list this year.

Falling jewelry demand will create some drag, but we think gold's currency status will continue to provide support and the potential for higher prices going forward. The (relative) stability of gold prices in recent sessions while the Euro was falling back hard is evidence of this increasing support. There has been a fairly steady increase in gold held by EFT funds even though prices have been highly volatile. In this economic back drop we do not expect much central bank selling, which has been a steady source of supply in the past. A move through $900 could generate renewed technical buying, particularly if major currencies renew their race to the bottom.

There has been enough optimism for Silver to tag along with percentage gains roughly the same as gold's. Silver appears to have more room to rally and shutdowns in the base metal space have been reducing supply. It still doesn't have the “currency cachet” of gold but if gold does move above $900 silver could see a larger percentage move as it plays catch up in a move back towards its 52 week high.

Platinum has seen similar percentage moves from its bottom though it and Palladium are a lot closer to their year lows than highs. They could both continue to shadow gold now that price lows have been put in. Platinum was expected to move into shortage this year but with the auto sector collapsing this may have gone by the wayside. Palladium has less investment and jewelry demand and more robust supply then platinum does. So it's harder to see upside in these metals until the economy really starts to turn. Note however that the first half of the year is historically the best time to own most precious metals. They should all have some buying support from chart traders in the next couple of months.

III. Base Metals

2008 was the worst year on record for base metals, as it was for anything so directly tied to manufacturing sectors that have been imploding worldwide.

As we discussed in the September 2008 Journal renewed balance in base metal markets will come as much from supply destruction as demand increases in the near term. Since that issue was released the shutdowns of mines and decreases in smelter capacity have continued across all base metal sectors. Nonetheless, the debt crisis has taken its toll, with all base metals falling to or below their estimated cash cost of production in Q4. Copper was the last metal to succumb but it too fell enough in October for plant shutdowns to start in earnest.

Even with mine shutdowns, there was an acceleration of warehouse stock build up for most metals, with the exception of tin and lead, both of which continue to have supply issues. In the second half of 2008, copper and zinc LME warehouse inventories increased by 176% and 74%, respectively. Nickel inventories were up by 65% in the past six months and lead inventories are down by about 50%.

Nickel inventories are in the mid range of those seen in the past ten years, but nickel has seen a large percentage decrease in supply in the past few months, with about 8% of world supply going off line, and probably quite a bit more when direct shipping operations are included. Some longer lived oxide and high grade sulphide operations would be cash flow positive at $5-6 per pound but most operations opened this cycle are not and there is little chance of new production starting at these prices. With little new supply coming we would expect to see warehouse stocks starting to be drawn down later in 2009 as infrastructure programs start to kick in.

The situation for zinc is more difficult short term, with a sizeable percentage of operations worldwide losing money. A very large number of zinc operations have gone offline in the past three months and more will follow shortly if prices do not continue to improve. The auto sector is an important end user for both zinc and lead though lead use is almost exclusively in batteries while zinc is used across a number of industries. China is the biggest producer and consumer, with large amounts being used in construction as well as galvanizing. Warehouse stocks continue to climb but we think they will level out soon. Note that zinc has a quite favorable longer term supply picture as some large mines start coming off line next year.

Copper held on the longest of the major base metals though it has seen a rapid price decline and climb in warehouse stocks in the past two months. Copper mine closures have been fewer but a number of world's largest producers have announced dramatic cuts in development budgets going forward. Many of the recently opened heap leach operations have cash costs near $2.00 so they will not operate long if the $1.50 price stays in effect for any length of time.

Although the price drops and effect on a number of base metal operations have been brutal, there are some important factors that need to be considered. One is that the prices for most base metals have not breached their lows from the beginning of this cycle and we think its unlikely they will.

Equally important, warehouse inventories for most base metals are nowhere near the heights they attained at the bottom of the last cycle. We recognize that this recession is not over and inventories will get higher before they start to fall, but they are currently at only about 20-30% of the levels they peaked at early in this decade. When the economic backdrop improves base metal prices could move up a lot faster than most people think.

Most producer groups still estimate supply increases in the 3% range for this year. This seems very optimistic to us, particularly since some of the “new supply sources” are already on the chopping block. Anyone who is not fully financed to production will not be in the near future.

With the exception of 2-3 large companies, the mining sector actually moved in the opposite direction to most other industries this cycle—they reduced the leverage in their balance sheets. There are few miners beholden to banks that must produce at a loss to service debts. That combined with a lack of new credit, means that operations that have costs exceeding current metal prices will not hang on for long. We will be quite surprised if actual increases in worldwide production for base metals exceed 1-2% this year and next.

The two biggest stimulus packages being proposed are both infrastructure focused, and should demand a lot of metal to complete. Official warehouse stocks in Shanghai have not been increasing and state governments have proposed purchased of 1 million tonnes of various metals. This is a stopgap measure but still supportive of prices.

We are still in the panic phase of this crisis. Buyers simply stopped buying in most industries and panicking managers throughout the supply chain from miners to smelters to large buyers dumped metal into the forward markets, using them as customers of last resort. Since we do not accept the “depression scenario” we expect this sort of selling to dry up. As fiscal stimulus starts to kick in late in 2009, there will be room for base metals to gain some traction. We do not expect miracles, but companies that can produce metals at a profit in this market are candidates for outside gains late this year and in 2010. They have to be viewed as long term trades but the patient and the brave should be able harvest large profits next year on good companies accumulated near their trading bottoms.

IV. Uranium and Oil

Uranium was one of the better performers outside of the precious metals and we expect that performance to continue. While we do not expect to see prices above $100 a pound any time soon, supply constraints are severe enough to allow for another $10-20 to be tacked onto uranium prices over the next 12-18 months. That should be more than enough to allow for renewed gains from successful explorers and developers. While the drop in oil prices may make the idea of increasing nuclear power generation less palatable in the G8 countries we don't think developing nations that are not self sufficient in fossil fuels will be as reticent.

Since we are not an oil and gas newsletter we don't find ourselves cheering on higher oil prices. Clearly, a $100/bbl drop in oil prices has been a huge boon for industrialized nations. As bad as the downturn is, it would have been much worse if oil prices had not fallen back.

OPEC is the only group with the vested interest and market share to affect prices with any speed. They do not have much of a track record of abiding by quotas when prices are low, so most observers are skeptical about oil prices rising in the near term.

While we agree with doubts about OPEC, many of the comments we have made about base metals apply here too. Development spending has collapsed and with oil trading below the average cost of production there is little prospect for new production. It's not needed at the moment, but this can change quickly. When it does, producers will again be behind the curve. The areas with the best potential for large production increases like the oil sands and new field offshore in Brazil are very high capital cost projects that simply will not get started again until the financing environment improves. It would be better for most of the world if oil prices stay below $50 for the next 24 months but we wouldn't bet on it happening.

V. Equities

We started this editorial with some reassurance that this year would be better than 2008. We believe that, but that doesn't mean we expect markets to shoot up tomorrow or to move in a comforting straight line. While we think most indices will end 2009 higher than 2008 it's likely to be quite a ride.

When we talked about the equity markets at more length in the November Journal we included a graph showing how each post WWII bear market evolved. We said then that particular attention should be paid to the graph for the 2001-2003 bear market. Given how things were unfolding we thought a double bottom was a real possibility again this time.

Most markets have had a nice bounce off their November lows, though they seem to be losing momentum again. The drops in most markets have been so severe that they have discounted an enormous amount of bad news. Unfortunately, we're not convinced they have discounted quite enough.

To use the S & P as an example, the current estimate of 2009 earnings is just over $40, which means the current level of about 900 is not that cheap. We would not expect the P/E ratio to bottom in the single digits since “risk free” returns are close to zero. We do however think actual earnings could come in even lower, at least in the first couple of quarters.

With demand destruction far and wide and high levels of pessimism on the part of both consumers and companies it seems no one will be spending until they get out of their funk. We are hoping a big stimulus package and stirring oratory from the Obama administration will help in that regard but that won't happen overnight. Fiscal stimulus does not work quickly even when it works.

Markets like this are also a time of management shake ups. New management usually wastes no time jettisoning products and concepts that didn't work and maximizing write offs to give them a lower bar to clear for future earnings. The best time to write things off is when your shareholders expect terrible earnings anyway. The combination of a sputtering economy and management tendency to clear the decks means earnings will stink for the next 2-3 quarters at least.

We think there is a good chance that November's lows will be tested by mid year. There will simply be too many earnings disappointments for the bulls to pull the market higher on their own and lagging indicators like employment will continue to be scary. Funds will be afraid to over commit and skeptics will want hard evidence of profit growth before re-entering the market. The rally leading up to this retest could be fairly large in percentage terms so it's worth playing but you have to harvest profits when you can then be willing to let the market come to you.

Unless this turns into a depression—and we do not believe that scenario—summer doldrums should present another buying opportunity. We don't think those that are afraid of the market right now will be the ultimate winners. It's a good time to be looking for buys; you just need to be willing to trade them.

The stock market is a leading indicator. You will not see full page ads telling you a bottom is in. The market will simply turn one day this year and not look back. We do think the bottom will be in this year if we didn't already see it in November. As we head toward the end of the year, the earnings comparisons will look better since they will be getting stacked against horrendous Q3 and Q4 2008 numbers.

Strange as it may seem, we expect the junior market to out perform the senior ones, at least in percentage terms. That is based more on the pounding that has already occurred than anything else. While there are many that have turned their backs on resource stocks the strong volumes in the past month and the number of stocks getting stronger bids now point to some continued interest. The chart below gives some interesting perspective. It charts new highs minus new lows for the Venture exchange. After a horrible pounding this measure is back where it was early last summer. While it's not at bullish levels by any means its indicating the worse of the bleeding is over.

We expect precious metals will have a better year than most asset classes. That will generate buying in producers that are not ahead of themselves price wise. It's also filtering down to developers and even a few larger explorers. The same can be said for base metal stocks although we think gains there will come later and be confined to producers once traders see warehouse stocks falling.

A number of explorers with real discoveries have seen pretty strong price recovery already. It's important that a company has a project that can generate truly superior results and its imperative the company have enough funds to carry it at least through 2009. Companies that meet those criteria are seeing renewed buying lately.

We think there will be more room for gains on a very select list of explorers. Everyone realizes this will be a very tough period to raise money. Shareholders will not want to see anyone squandering money but efficient, results driven exploration should get some traction, especially for precious metals.

Mining sector managers are just as freaked out by the market collapse as anyone else. We get the sense many management groups plan to spend 2009 hiding under their desks. In fairness, many have no choice in the matter due to funding constraints. Those that do however may find their shareholders do not appreciate them literally doing nothing.

Smart news flow that doesn't empty the treasury will still be better than no news flow. Winning explorers should be able to get attention in a market with little competing news. Bad as the market may feel at the moment, we are out looking - very selectively—for tomorrow's winners. Those companies will still have their day in the sun.

By David Coffin and Eric Coffin

http://www.hraadvisory.com

David Coffin and Eric Coffin are the editors of the HRA Journal, HRA Dispatch and HRA Special Delivery; a family of publications that are focused on metals exploration, development and production companies. Combined mining industry and market experience of over 50 years has made them among the most trusted independent analysts in the sector since they began publication of The Hard Rock Analyst in 1995. They were among the first to draw attention to the current commodities super cycle and the disastrous effects of massive forward gold hedging backed up by low grade mining in the 1990's. They have generated one of the best track records in the business thanks to decades of experience and contacts throughout the industry that help them get the story to their readers first. Please visit their website at www.hraadvisory.com for more information.

You can add yourself to our free mailing list here in order to receive articles of interest like this and occasional special reports and trial issues of the HRA publications.

© 2009 Copyright HRA Advisory - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

HRA Advisory Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.